Tweezer Top Candlestick Pattern:

Tweezer Top ek bearish reversal candlestick pattern hai, jo aksar market me upar ki taraf rally ke baad aata hai. Yeh pattern do candles se milke banta hai, jo aksar same high level par hoti hain. Is pattern ka hona market mein price reversal ka indication deta hai, jo aksar upar se neeche ki taraf jata hai.

Introduction:

Tweezer Top ek technical analysis tool hai jo price action ko samajhne ke liye use hota hai. Yeh pattern tab banta hai jab do consecutive candlesticks ka high price almost same hota hai, lekin agla candle ek bearish candle hota hai jo market me downward pressure dikhata hai. Yeh pattern aksar bull market ke end par hota hai, jab buyers apni strength lose kar rahe hote hain aur sellers market mein enter kar rahe hote hain.

Examples:

1. Example 1:

Ek stock ka price upar ja raha tha, aur do consecutive candles (ek long bullish aur doosri bearish) bana kar dono ka high almost same tha. Agle din stock ka price significantly neeche aaya.

2. Example 2:

Ek currency pair ka price upar ja raha tha aur do candles ban gayi jisme dono candles ka high same tha. Iske baad market ne niche ki taraf momentum pakda aur price gir gaya.

Types of Tweezer Patterns:

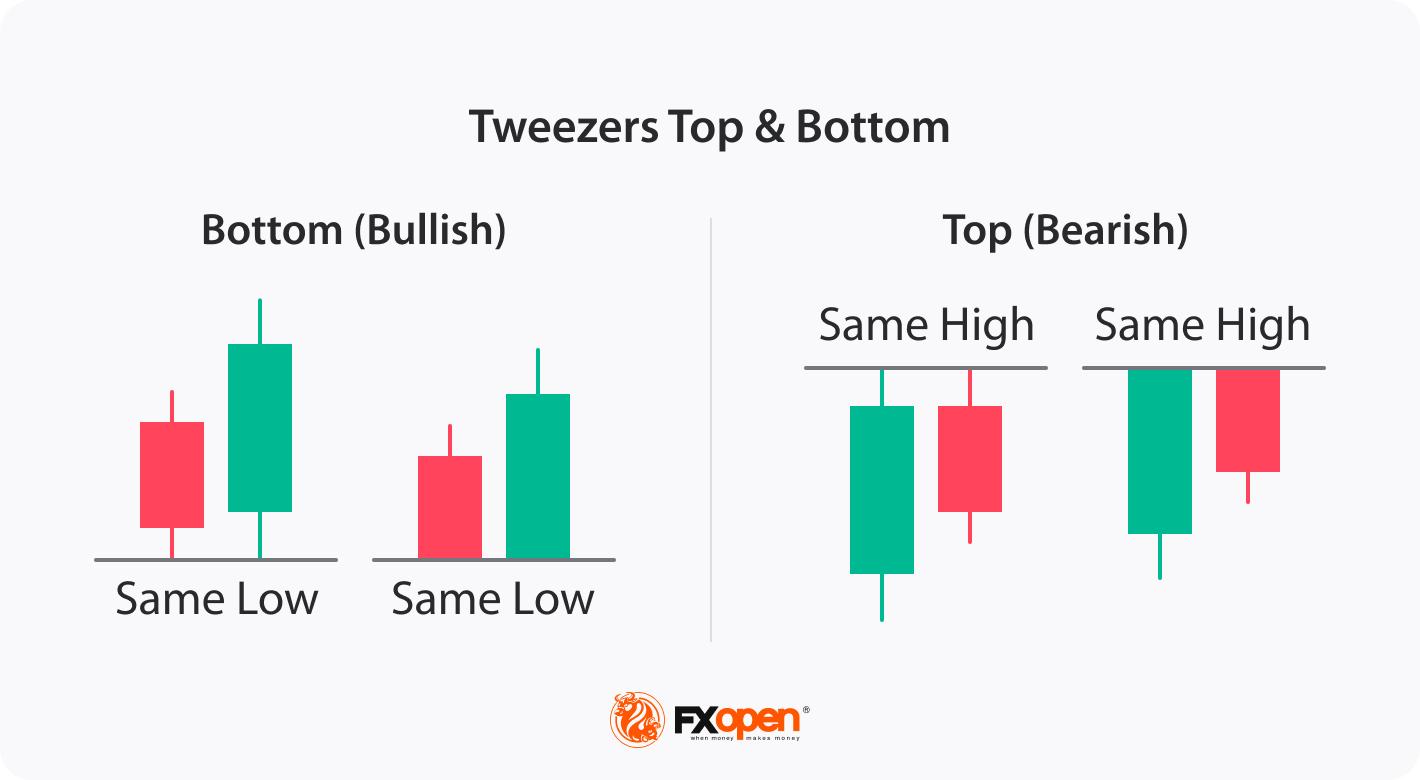

1. Tweezer Top:

Do candles jo same high level par hoti hain, aur doosra candle bearish hota hai. Yeh market mein reversal ka signal deta hai.

2. Tweezer Bottom:

Yeh bullish reversal pattern hota hai, jisme do candles hoti hain jo same low level par hoti hain, aur doosra candle bullish hota hai. Yeh signal deta hai ke market neeche se upar ki taraf move karega.

How Tweezer Top Works:

Tweezer Top kaam tab karta hai jab market mein ek strong uptrend hota hai aur phir sudden resistance milti hai, jise tweezer top pattern indicate karta hai. Do candles ka same high price market mein resistance ka signal hota hai, aur jab next candle bearish hota hai, to yeh reversal ka signal deta hai.

Trading Strategy:

1. Pattern Confirmation:

Tweezer Top ka trade tab confirm hota hai jab do candles ka high price same ho, aur agla candle bearish ho. Agar yeh pattern resistance level ke aas paas ho, to market mein reversal hone ka chance zyada hota hai.

2. Entry Point:

Tweezer Top pattern ke baad, aap entry lene ke liye wait kar sakte hain jab next candle open ho aur price neeche ki taraf break kare.

3. Stop Loss:

Tweezer Top pattern ke case mein, stop loss ko pattern ke high ke upar rakhna chahiye, jisse aap market ke against move hone se bach sakein.

4. Target:

Aap target ko market ke recent low ke level par rakh sakte hain, jaha tak price ne pehle support liya tha.

Conclusion:

Tweezer Top ek important candlestick pattern hai jo market mein reversal ka indication deta hai, khaas kar jab ek strong uptrend ke baad ho. Is pattern ko samajhna aur use karna, agar correctly apply kiya jaye, to traders ko profitable trades mil sakti hain. Lekin, har candlestick pattern ke saath confirmation signals aur market context ka dhyaan rakhna zaroori hota hai.

Tweezer Top ek bearish reversal candlestick pattern hai, jo aksar market me upar ki taraf rally ke baad aata hai. Yeh pattern do candles se milke banta hai, jo aksar same high level par hoti hain. Is pattern ka hona market mein price reversal ka indication deta hai, jo aksar upar se neeche ki taraf jata hai.

Introduction:

Tweezer Top ek technical analysis tool hai jo price action ko samajhne ke liye use hota hai. Yeh pattern tab banta hai jab do consecutive candlesticks ka high price almost same hota hai, lekin agla candle ek bearish candle hota hai jo market me downward pressure dikhata hai. Yeh pattern aksar bull market ke end par hota hai, jab buyers apni strength lose kar rahe hote hain aur sellers market mein enter kar rahe hote hain.

Examples:

1. Example 1:

Ek stock ka price upar ja raha tha, aur do consecutive candles (ek long bullish aur doosri bearish) bana kar dono ka high almost same tha. Agle din stock ka price significantly neeche aaya.

2. Example 2:

Ek currency pair ka price upar ja raha tha aur do candles ban gayi jisme dono candles ka high same tha. Iske baad market ne niche ki taraf momentum pakda aur price gir gaya.

Types of Tweezer Patterns:

1. Tweezer Top:

Do candles jo same high level par hoti hain, aur doosra candle bearish hota hai. Yeh market mein reversal ka signal deta hai.

2. Tweezer Bottom:

Yeh bullish reversal pattern hota hai, jisme do candles hoti hain jo same low level par hoti hain, aur doosra candle bullish hota hai. Yeh signal deta hai ke market neeche se upar ki taraf move karega.

How Tweezer Top Works:

Tweezer Top kaam tab karta hai jab market mein ek strong uptrend hota hai aur phir sudden resistance milti hai, jise tweezer top pattern indicate karta hai. Do candles ka same high price market mein resistance ka signal hota hai, aur jab next candle bearish hota hai, to yeh reversal ka signal deta hai.

Trading Strategy:

1. Pattern Confirmation:

Tweezer Top ka trade tab confirm hota hai jab do candles ka high price same ho, aur agla candle bearish ho. Agar yeh pattern resistance level ke aas paas ho, to market mein reversal hone ka chance zyada hota hai.

2. Entry Point:

Tweezer Top pattern ke baad, aap entry lene ke liye wait kar sakte hain jab next candle open ho aur price neeche ki taraf break kare.

3. Stop Loss:

Tweezer Top pattern ke case mein, stop loss ko pattern ke high ke upar rakhna chahiye, jisse aap market ke against move hone se bach sakein.

4. Target:

Aap target ko market ke recent low ke level par rakh sakte hain, jaha tak price ne pehle support liya tha.

Conclusion:

Tweezer Top ek important candlestick pattern hai jo market mein reversal ka indication deta hai, khaas kar jab ek strong uptrend ke baad ho. Is pattern ko samajhna aur use karna, agar correctly apply kiya jaye, to traders ko profitable trades mil sakti hain. Lekin, har candlestick pattern ke saath confirmation signals aur market context ka dhyaan rakhna zaroori hota hai.