THREE BLACK CROWS CANDLESTICKS PATTERN

INTRODUCTION

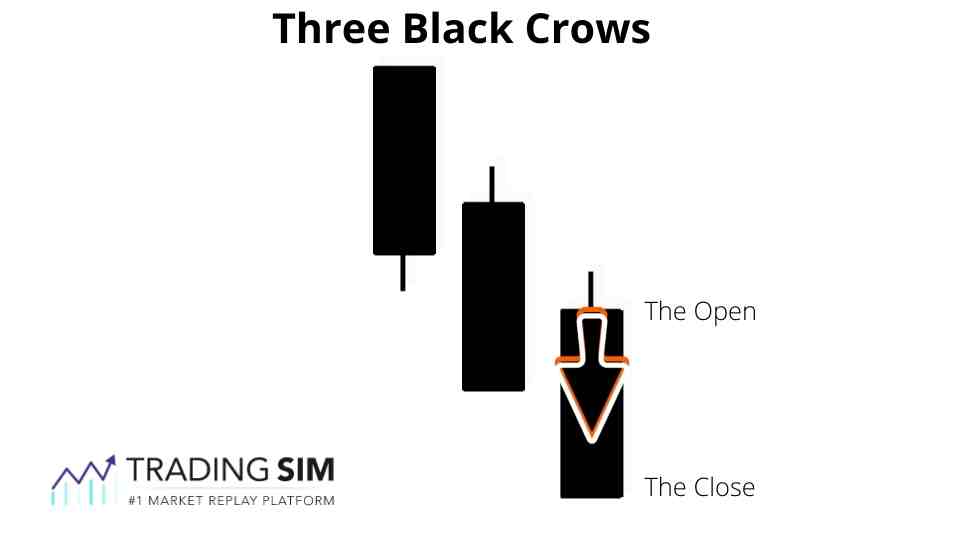

Ye pattern bearish reversal pattern hai jo market ki upward trend ko indicate karta hai. Ye pattern teen achay size ke bearish candlesticks se bana hota hai. Har candlestick ka opening price pehlay candlestick ke closing price se ooper hota hai. Har candlestick ka closing price pehlay candlestick ke closing price se nichay hota hai.

CONFIRMATION OF SIGNALS

Traders ko confirmatory signals ki zarurat hoti hai jaise ke volume ki izafa ya kisi aur technical indicator ki madad. Ye pattern aam tor par market analysis mein istemal kiya jata hai taa ke traders ko future price movement ka andaza lagaya ja sake. Kala Kauwa strategy Forex mein ek mashhoor trading strategy hai jisay candlestick patterns aur trend analysis ke zariye istemal kiya jata hai.

BEARISH AND BULLISH CANDLESTICKS

Is tareeqay mein, traders teen mukhtalif kisam ke candlestick patterns ka istemal karte hain jo bullish ya bearish trend ki tasdeeq karte hain. Ye patterns shaamil hote hain:

- Ek bearish candlestick pattern (pehla kauwa)

- Doji ya spinning top (dusra kauwa)

- Ek bullish candlestick pattern (teesra kauwa)

TRADING STRATEGY

Traders is strategy ko istemal karte hain jab wo trend reversal ka pata lagana chahte hain. Jab teeno kauwe ek sath dikhai de, to yeh ek mazboot signal hai ke market ka trend badalne wala hai. Traders is signal par amal kar ke positions lete hain.

TREND ANALYSIS OF THREE BLACK CROWS CANDLESTICKS PATTERN

Is tareeqe ko samajhne ke liye, traders ko candlestick patterns aur trend analysis ki acchi samajh honi chahiye. Demo account par practice karke aur experience hasil karke, traders is strategy ko behtar taur par istemal kar sakte hain.Ye pattern market ki bullish trend ki khatam hone ya reversal ki nishani hoti hai.

Jab ye pattern form hota hai, traders ko downward movement ki tawaqquh hoti hai.

INTRODUCTION

Ye pattern bearish reversal pattern hai jo market ki upward trend ko indicate karta hai. Ye pattern teen achay size ke bearish candlesticks se bana hota hai. Har candlestick ka opening price pehlay candlestick ke closing price se ooper hota hai. Har candlestick ka closing price pehlay candlestick ke closing price se nichay hota hai.

CONFIRMATION OF SIGNALS

Traders ko confirmatory signals ki zarurat hoti hai jaise ke volume ki izafa ya kisi aur technical indicator ki madad. Ye pattern aam tor par market analysis mein istemal kiya jata hai taa ke traders ko future price movement ka andaza lagaya ja sake. Kala Kauwa strategy Forex mein ek mashhoor trading strategy hai jisay candlestick patterns aur trend analysis ke zariye istemal kiya jata hai.

BEARISH AND BULLISH CANDLESTICKS

Is tareeqay mein, traders teen mukhtalif kisam ke candlestick patterns ka istemal karte hain jo bullish ya bearish trend ki tasdeeq karte hain. Ye patterns shaamil hote hain:

- Ek bearish candlestick pattern (pehla kauwa)

- Doji ya spinning top (dusra kauwa)

- Ek bullish candlestick pattern (teesra kauwa)

TRADING STRATEGY

Traders is strategy ko istemal karte hain jab wo trend reversal ka pata lagana chahte hain. Jab teeno kauwe ek sath dikhai de, to yeh ek mazboot signal hai ke market ka trend badalne wala hai. Traders is signal par amal kar ke positions lete hain.

TREND ANALYSIS OF THREE BLACK CROWS CANDLESTICKS PATTERN

Is tareeqe ko samajhne ke liye, traders ko candlestick patterns aur trend analysis ki acchi samajh honi chahiye. Demo account par practice karke aur experience hasil karke, traders is strategy ko behtar taur par istemal kar sakte hain.Ye pattern market ki bullish trend ki khatam hone ya reversal ki nishani hoti hai.

Jab ye pattern form hota hai, traders ko downward movement ki tawaqquh hoti hai.

تبصرہ

Расширенный режим Обычный режим