Protecting Your Profit From Storms:

Forex trading me "protecting your profit from storms" ka matlab hai apne munafa ko nuksan se bachany ka tareeqa. Ap is tareeqe ko istemal kar sakty hain:

1.Stop Loss Orders: Ap apni trade me stop loss order laga kar apne nuksan ko had se kam kar sakty hain. Stop loss order ap ko predefined price level par apne trade ko band karny ka option deta hai agar market ap k favor me na ho.

2.Take Profit Orders: Take profit orders lagana bhi aik tareeqa hai apne munafa ko mehfooz rekhny ka. Is mein ap apni trade ko automate kar dety hain, jis se ap ko profit level par trade close ho jata hai.

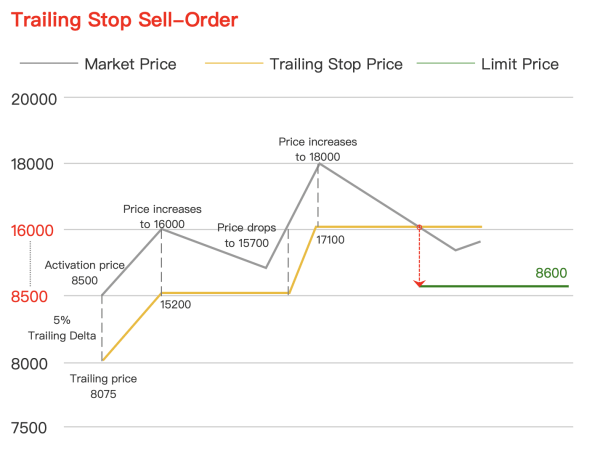

3.Trailing Stop Loss: Trailing stop loss order ap ki trade ke sath sath chalta rehta hai, jab market ap k favor me move karti hai, to yeh stop loss level bhi sath move karta hai, jis se ap ka profit mehfooz rehta hai agar market achanak change ho jaye.

4.Diversification: Apne portfolio ko diversify kar k bhi ap apne profits ko storms se bacha sakty hain. Alag-alag currencies aur instruments me invest kar k risk ko spread out kar sakty hain.

4.Diversification: Apne portfolio ko diversify kar k bhi ap apne profits ko storms se bacha sakty hain. Alag-alag currencies aur instruments me invest kar k risk ko spread out kar sakty hain.

Building-a-Diversified-Forex-Portfolio-with-the-Libyan-Dinar--The-Importance-of-Portfolio-Diversification-in-Forex-Trading.webp5.Risk Management: Har trade me risk ko manage karna zaroori hai. Apne trading account ka ek chhota hissa har trade me lagane se ap apne overall risk ko kam kar sakty hain, jis se ap k overall portfolio ko storms se bachane me madad milegi.

Yad rahe ke forex trading me risk hamesha hota hai, aur koi bhi strategy 100% guarantee nahi deti. Is liye hamesha apni research karein aur apne risk tolerance k hisab se trading karein.

Forex trading me "protecting your profit from storms" ka matlab hai apne munafa ko nuksan se bachany ka tareeqa. Ap is tareeqe ko istemal kar sakty hain:

1.Stop Loss Orders: Ap apni trade me stop loss order laga kar apne nuksan ko had se kam kar sakty hain. Stop loss order ap ko predefined price level par apne trade ko band karny ka option deta hai agar market ap k favor me na ho.

2.Take Profit Orders: Take profit orders lagana bhi aik tareeqa hai apne munafa ko mehfooz rekhny ka. Is mein ap apni trade ko automate kar dety hain, jis se ap ko profit level par trade close ho jata hai.

3.Trailing Stop Loss: Trailing stop loss order ap ki trade ke sath sath chalta rehta hai, jab market ap k favor me move karti hai, to yeh stop loss level bhi sath move karta hai, jis se ap ka profit mehfooz rehta hai agar market achanak change ho jaye.

Building-a-Diversified-Forex-Portfolio-with-the-Libyan-Dinar--The-Importance-of-Portfolio-Diversification-in-Forex-Trading.webp5.Risk Management: Har trade me risk ko manage karna zaroori hai. Apne trading account ka ek chhota hissa har trade me lagane se ap apne overall risk ko kam kar sakty hain, jis se ap k overall portfolio ko storms se bachane me madad milegi.

Yad rahe ke forex trading me risk hamesha hota hai, aur koi bhi strategy 100% guarantee nahi deti. Is liye hamesha apni research karein aur apne risk tolerance k hisab se trading karein.

تبصرہ

Расширенный режим Обычный режим