Explained.

Forex trading involves the buying and selling of currencies to make a profit. Traders use various techniques and strategies to predict the movement of currency prices. One of the popular trading techniques is the Counterattack Line Pattern. Let's understand this technique in detail.

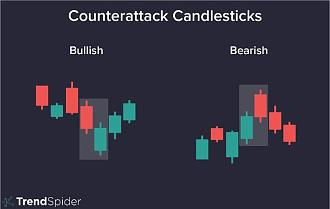

The Counterattack Line Pattern is a candlestick pattern that signals a reversal of the current trend. It is formed by two candlesticks, one bullish and one bearish, that have the same opening price. The bullish candlestick opens higher than the previous day's close and closes lower than its opening price. The bearish candlestick opens lower than the previous day's close and closes higher than its opening price.

How to identify the Counterattack Line Pattern?

To identify the Counterattack Line Pattern, traders need to look for two consecutive candlesticks with the same opening price. The first candlestick should be bullish, and the second candlestick should be bearish. Both candlesticks should have long shadows and small bodies.

How to trade using the Counterattack Line Pattern?

Traders can use the Counterattack Line Pattern to trade in two ways: as a reversal signal or as a confirmation signal.

As a reversal signal: When the Counterattack Line Pattern appears after a prolonged uptrend or downtrend, it signals a reversal of the trend. Traders can take a short position when the pattern appears after an uptrend or a long position when it appears after a downtrend.

As a confirmation signal: When the Counterattack Line Pattern appears after a consolidation phase, it confirms the direction of the trend. Traders can take a long position when the pattern appears after a bullish consolidation phase or a short position when it appears after a bearish consolidation phase.

Conclusion

The Counterattack Line Pattern is a popular trading technique used by forex traders to predict the reversal or continuation of the trend. Traders need to identify the pattern correctly and use it as a reversal or confirmation signal to make a profit in the forex market.

Forex trading involves the buying and selling of currencies to make a profit. Traders use various techniques and strategies to predict the movement of currency prices. One of the popular trading techniques is the Counterattack Line Pattern. Let's understand this technique in detail.

The Counterattack Line Pattern is a candlestick pattern that signals a reversal of the current trend. It is formed by two candlesticks, one bullish and one bearish, that have the same opening price. The bullish candlestick opens higher than the previous day's close and closes lower than its opening price. The bearish candlestick opens lower than the previous day's close and closes higher than its opening price.

How to identify the Counterattack Line Pattern?

To identify the Counterattack Line Pattern, traders need to look for two consecutive candlesticks with the same opening price. The first candlestick should be bullish, and the second candlestick should be bearish. Both candlesticks should have long shadows and small bodies.

How to trade using the Counterattack Line Pattern?

Traders can use the Counterattack Line Pattern to trade in two ways: as a reversal signal or as a confirmation signal.

As a reversal signal: When the Counterattack Line Pattern appears after a prolonged uptrend or downtrend, it signals a reversal of the trend. Traders can take a short position when the pattern appears after an uptrend or a long position when it appears after a downtrend.

As a confirmation signal: When the Counterattack Line Pattern appears after a consolidation phase, it confirms the direction of the trend. Traders can take a long position when the pattern appears after a bullish consolidation phase or a short position when it appears after a bearish consolidation phase.

Conclusion

The Counterattack Line Pattern is a popular trading technique used by forex traders to predict the reversal or continuation of the trend. Traders need to identify the pattern correctly and use it as a reversal or confirmation signal to make a profit in the forex market.