Double Top Pattern Forex.

Double Top Pattern Forex Strategy ka matlab hai keh aap kaise Double Top Pattern ki madad se Forex Trading kar sakte hain. Is strategy ko use kar ke aap Forex market mein successful ho sakte hain. Is strategy ko use karne ke liye aapko kuch headings ki zarurat hogi, jinhe hum neechay explain karein gay:

Double Top Pattern Results.

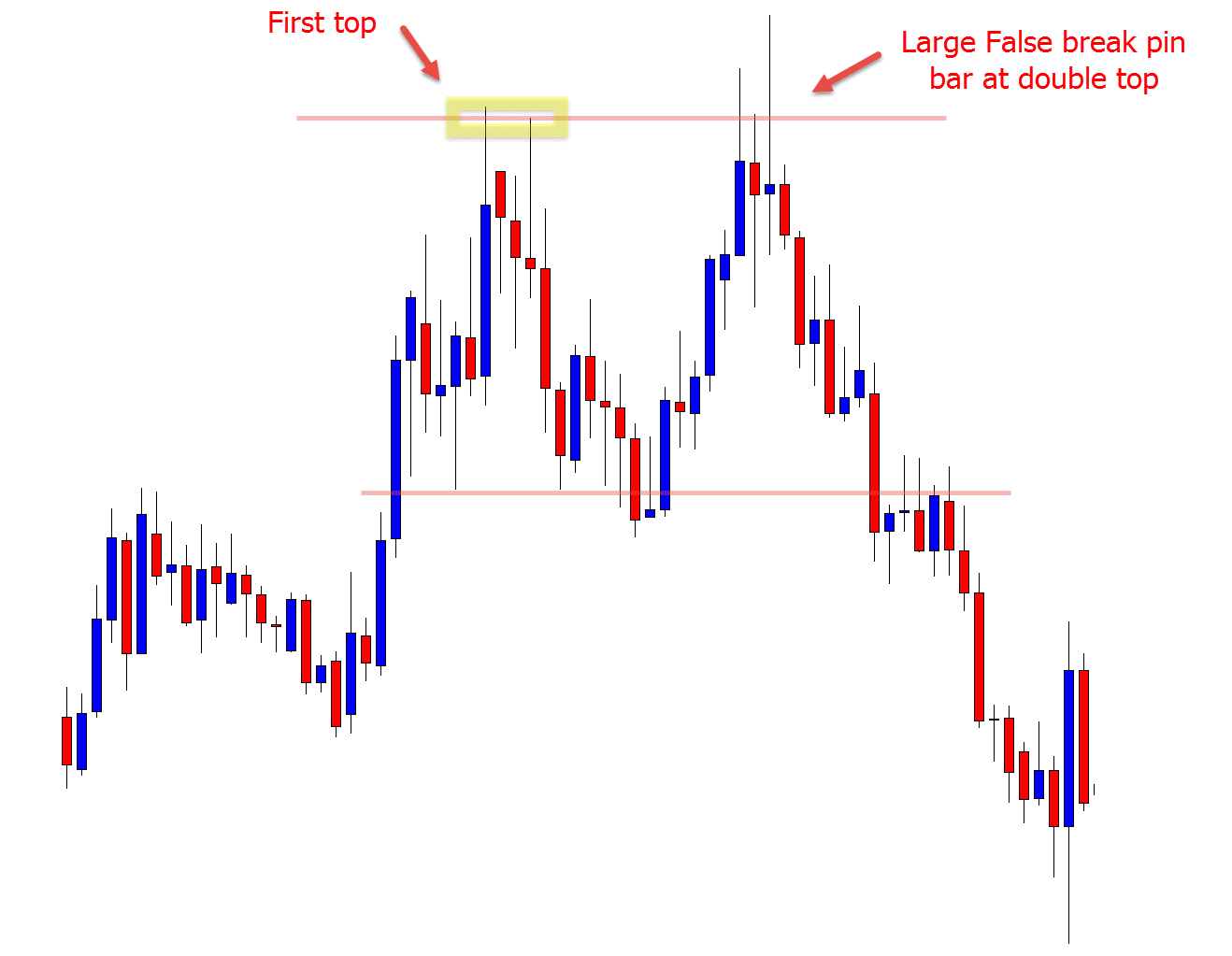

Double Top Pattern ek technical analysis tool hai, jo Forex market mein use kiya jata hai. Is pattern mein 2 peaks hotay hain, jo almost same level par hotay hain. Ye peaks aik trend line ki madad se connect kiye jatay hain.

Double Top Pattern Recognization.

Double Top Pattern recognize karna bohat hi asan hai. Agar aap ko kisi currency pair ki chart par 2 almost same level ke peaks nazar aatay hain, to yeh aapke liye Double Top Pattern hai.

Double Top Pattern Workings.

Double Top Pattern ka use karne ke liye aap ko apni trading platform par Double Top Pattern indicator add karna hoga. Is indicator ki madad se aap ko Double Top Pattern ki nishandehi ho jaye gi. Agar aap ko Double Top Pattern ki nishandehi ho jati hai, to aap us currency pair par sell order lagayein.

Double Top Pattern se trading karna bohat hi asan hai. Agar aap ko Double Top Pattern ki nishandehi ho jati hai, to aap sell order lagayein. Agar aap ka sell order execute ho jata hai, to aap stop loss aur take profit levels set kar lein. Stop loss level aap ko apne entry price se kuch pips neechay rakhna hoga aur take profit level aap ko apne stop loss level se kuch pips upar rakhna hoga.

Double Top Pattern Successful.

Double Top Pattern se profit kamane ke liye aap ko apne stop loss aur take profit levels ko sahi set karna hoga. Agar aap ka stop loss level hit ho jata hai, to aap ko loss ho jaye ga. Agar aap ka take profit level hit ho jata hai, to aap ko profit ho jaye ga. Double Top Pattern ki madad se aap Forex market mein profit kamane ke liye bohat hi asan tareeqa use kar sakte hain.

Double Top Pattern Forex Strategy ka matlab hai keh aap kaise Double Top Pattern ki madad se Forex Trading kar sakte hain. Is strategy ko use kar ke aap Forex market mein successful ho sakte hain. Is strategy ko use karne ke liye aapko kuch headings ki zarurat hogi, jinhe hum neechay explain karein gay:

Double Top Pattern Results.

Double Top Pattern ek technical analysis tool hai, jo Forex market mein use kiya jata hai. Is pattern mein 2 peaks hotay hain, jo almost same level par hotay hain. Ye peaks aik trend line ki madad se connect kiye jatay hain.

Double Top Pattern Recognization.

Double Top Pattern recognize karna bohat hi asan hai. Agar aap ko kisi currency pair ki chart par 2 almost same level ke peaks nazar aatay hain, to yeh aapke liye Double Top Pattern hai.

Double Top Pattern Workings.

Double Top Pattern ka use karne ke liye aap ko apni trading platform par Double Top Pattern indicator add karna hoga. Is indicator ki madad se aap ko Double Top Pattern ki nishandehi ho jaye gi. Agar aap ko Double Top Pattern ki nishandehi ho jati hai, to aap us currency pair par sell order lagayein.

Double Top Pattern se trading karna bohat hi asan hai. Agar aap ko Double Top Pattern ki nishandehi ho jati hai, to aap sell order lagayein. Agar aap ka sell order execute ho jata hai, to aap stop loss aur take profit levels set kar lein. Stop loss level aap ko apne entry price se kuch pips neechay rakhna hoga aur take profit level aap ko apne stop loss level se kuch pips upar rakhna hoga.

Double Top Pattern Successful.

Double Top Pattern se profit kamane ke liye aap ko apne stop loss aur take profit levels ko sahi set karna hoga. Agar aap ka stop loss level hit ho jata hai, to aap ko loss ho jaye ga. Agar aap ka take profit level hit ho jata hai, to aap ko profit ho jaye ga. Double Top Pattern ki madad se aap Forex market mein profit kamane ke liye bohat hi asan tareeqa use kar sakte hain.

تبصرہ

Расширенный режим Обычный режим