Impulse Wave Pattern, Elliott Wave Theory ke andar ek bunyadi concept hai, jo ke tajaweez shuda tijarat karain market ko tajziya karne ke liye istemal hoti hain. Ralph Nelson Elliott ne 1930s mein is nazariye ko tashkeel di, jo ke ye kehta hai ke market ke qeemat ke harqatein dohrati hain, aur in patterns ko samajhna mumkin ane wale qeemati harqaton mein izafay ki taraf ishara kar sakta hai.

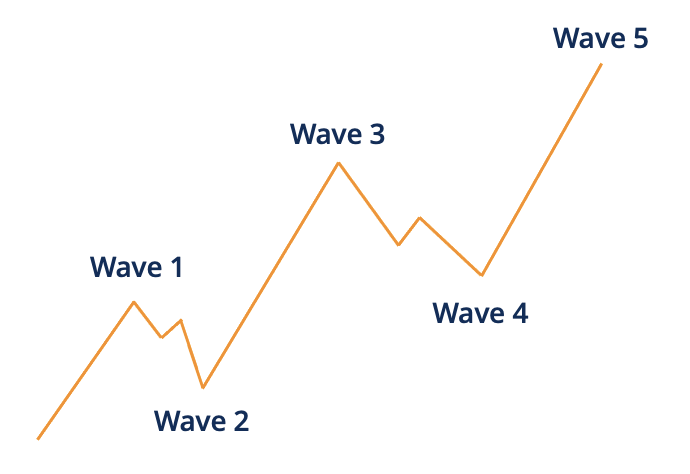

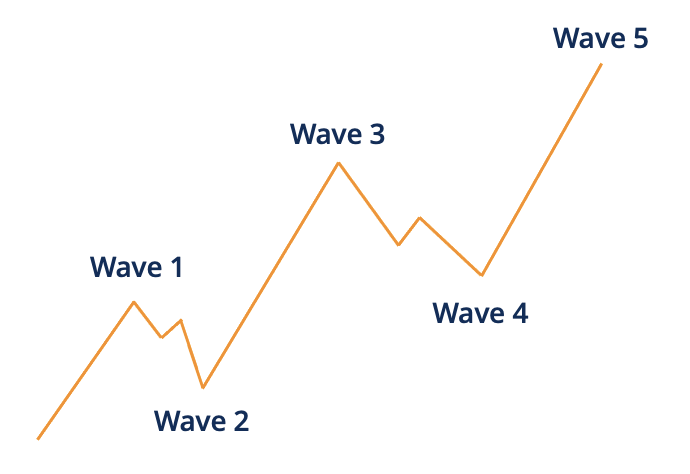

Impulse Wave, Elliott Wave Theory ke andar do directional price movements mein se ek hai, dosra Corrective Waves hai. Impulse Waves aam taur par mojooda trend ke rukh mein chalti hain aur panch wave ki structure ke zariye numayan hoti hain. Impulse Wave ke components ko tafseel se samajhte hain:

Wave 1:

Yeh yaad rakhna ahem hai ke Impulse Wave ke andar Waves 1, 3, aur 5 motive waves hain, jo ke trend ko chalane wale hain, jabke Waves 2 aur 4 corrective waves hain, jo ke zaroori pullbacks farahem karte hain.

Kuch ahem steps hain jo Impulse Wave Pattern ko pehchanne aur iske sath tijarat karne ke liye madadgar hain:

Impulse Wave, Elliott Wave Theory ke andar do directional price movements mein se ek hai, dosra Corrective Waves hai. Impulse Waves aam taur par mojooda trend ke rukh mein chalti hain aur panch wave ki structure ke zariye numayan hoti hain. Impulse Wave ke components ko tafseel se samajhte hain:

Wave 1:

- Impulse ke pehle wave mein aksar ek naya trend paida hota hai.

- Aam taur par yeh dheere se shuru hota hai aur ise amm taur par baray market mein pehchana nahi jata.

- Ibtidaai harkat ke baad, a correctional wave aksar hoti hai, jo ke Wave 1 ke hisse ko dobara kar leti hai.

- Yeh wave tijaratkarain ko ek behtar keemat par trend mein shamil hone ka mouqa deti hai.

- Wave 3 aksar sequence mein sab se zyada taqatwar aur taaqatwar wave hota hai.

- Is mein taqatwar lihaz aur trend ke rukh mein mazeed tezi hoti hai.

- Wave 3 ki taqatwar harkat ke baad, ek correctional wave aati hai, jo ke overbought ya oversold shirait ko durust karti hai.

- Wave 4 aam taur par Wave 2 se zyada kamzor hota hai.

- Sequence mein aakhri wave, Wave 5, trend ke rukh mein aakhri dhakka hota hai.

- Yeh maujooda trend mein aakhri dhakka hai aur ek mumkin reversal se pehle hota hai.

Yeh yaad rakhna ahem hai ke Impulse Wave ke andar Waves 1, 3, aur 5 motive waves hain, jo ke trend ko chalane wale hain, jabke Waves 2 aur 4 corrective waves hain, jo ke zaroori pullbacks farahem karte hain.

Kuch ahem steps hain jo Impulse Wave Pattern ko pehchanne aur iske sath tijarat karne ke liye madadgar hain:

- Wave Extensions: Kabhi kabhi, Wave 3 lamba ho sakta hai, jiski wajah se trend mein izafay ki taraf ishara hota hai. Tijaratkar aksar apne tijarat ke rujhan ko durust karne ke liye extension ki nishandahi karte hain.

- Wave Ratios: Elliott Wave Theory mein Fibonacci ratios bhi shamil hain, jo ke mukhtalif waves ke darmiyan talluqat ko napne mein madad karte hain. Ye ratios tijaratkarain ko mukhtalif reversal ya continuation points ko pehchane mein madad karte hain.

- Overlap Rule: Impulse Wave ke andar, Wave 4 ko Wave 1 ke price territory mein overlap nahi karna chahiye. Ye rule impulse aur corrective waves ko farq karne mein madad karta hai.

- Volume Analysis: Impulse Wave ko barhne wale trading volume ke sath tasdeeq kar ke trend ki taqat ko mazeed tasdeeq karne ke liye ahem hai.

تبصرہ

Расширенный режим Обычный режим