RSI Indicatora in Forex Trading

Introduction

Dear Freinds,

Forex trading main RSI indicator ko use kar k work karna ho ga so why hum munfa kama saky gy. Awar pir ye k forex aik best business hain hum ess mai agar indicator ko ignore kary gy to hamara account baned ho jy ga hum is mai apne marze sy time tbale bna kar kam kar sakty hain.moreover, hum ess mai part time be kam kar sakty hain hum ess mai full time be kam kar sakty hain. Awar hum ess main agar lalachi ban ky kam kary gy to harma account band ho jy ga hum is mai apny boss ap he hty hain hum is mai apne marze sy tim table baana kar kam kar sakty hain hum is mai raat ma be km kar sakty hain hum is mai din mai be kam kar sakty hain forex bahoot he acha business hain. Awar hum ko ess main RSI indicaters kay uses btanay ha or who ya ha k forex main agar app ksi bi pair ko choose karty h trade karnay kay lyia to app ko is ma indicaters ki bot hi zroorat hoti hain. Q k ya asy alamty ishary ha jo app ki trde ma madad karty ha ya app ko trade karnay ma 85%tak success daty ha kyu kay ya app ko trade ma profit or loss hasil kar skaty ha or app ko ya guide karty ha kay app marke ma kis waqqat trade kray or kis waqat is ko leave kar day or ya app ko trade ma graph ki movement kay bary ma btaty ha kay kis waqat graph up hota hain awar Forex trading Mein kam karte waqt aapke pass bahut Sare tools hote hain aur bahut Sare indicators hote hain Jiska istemal Karke aap trading Mein accha profit Hasil kar sakte hain ismein Ek indicator aur RSI indicator bhi Hota Hai Jisko trading ke dauran aap istemal kar sakte hain ya aapko market trial ke Jisko trading ke dauran aap istemal kar sakte hain ya aapko market Trend k bare mein batata hai aur aapko ismein acchi entries mil sakti hain aapko buyzone aur sellzone ke bare mein batata Hai Jab aap ismein kam karte hain to aapko ismein istemal karne ke liye moving average ka bee jaiza lety hian.

How to Uses?

Freinds,

Pir ye k Rsi indicator ko use kar k kam karna h ga pher he hum kam kar k hum munfa kama saky gy. Awar forex aik legal busnss hain hum ess mai bagher balance account bana kar be kam kr sakty hain. hum ess main raat mai be kam kar sakty hai hum is mai din mai be kam kar sakty hain hum is mai agar indicator ko ignore kar ddety hain to hamara account block kar deya jyga forex aik online business hain hum ess mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hamy market mai kamyan hony ky liye strugle py focue karna ho ag per he hum kam kar k pasia Forex trading Mein jitne bhi indicator istemal ho rahe Hote Hain vah Humko bahut acche tarike se indicate karte hain awar Market ki movement ke bare main bahut acchi details provide karte hain aur Ham Ko nuksan Hone se bacha lete hain aur Hamare fayde ke liye kam karte hain unme se ek indicator Awar bhi hai jo aapko bahut hi acche tarike se a brief karta hai is ko learn karne ke liye aap internet per videos aur lectures Sun sakte hain jisse aapko bahut ziada madad Milegi aur aapane jo question kiya hai ki aapke pass Kitna balance Hona chahie is indicator ko istemal karne ke liye to usmein Koi limit Nahin Hai Jab Bhi aap Koi trade Lagate Hain RSI sub say best hsi kiyu kay es mai kam karna kafi asan hota hai aur es mai ap acha kam kar saktye hain ager ap rsi ksy barye mai jan jatye hain tu ap ka ksm hsi kay ap apnye kam mai dil laga kay kam karain aur hamesha rsi pay kam karain es mai kafi faidye hain simple sa hai indicator jis ko har koi asani kay ssth seekh sakta hai aur jan sakta hsi tu ap nay kam karna hai tu ap rsi mai expert ban jaye tu ap ki trading kafi better ho jatye hai jub kay rsi ssy hat kay kam kartye hain tu ap kay kam mai faraq par jata hai kiyu kay kafi asan kam ho jata hai rsi oay ap asani kay sath kamyabo ki taraf jatye hain tu ap acha kam karain mahnet kay sath kam karain aur RSI hamesha yad kr k hum kar skaty hain.

Conclusion

Freinds,

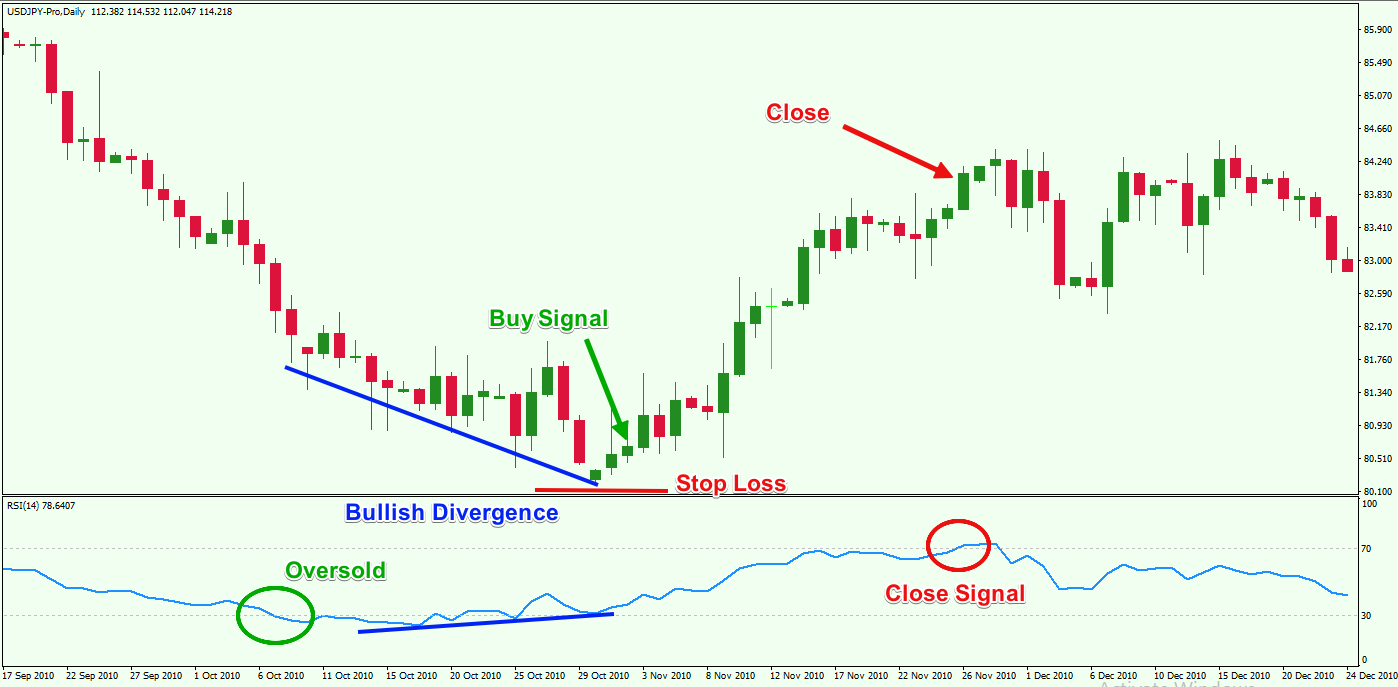

Last mi ye k RSI relative strength index indicator trading market ki reverse condition aur prediction ke bare mein hamen maloom from karta hai agar rsi ki reading above 70 ho to yeh overbought yehni ky market bahot zeyda buying zone ma hai aor reverse ho skti hai is ko show krta hai aur agar relative strength index indicator ye reading show Karen ke 30 below bande mein main indicator chala jaaye to ess ka matlab hota hain. Awar market over fail ho chuki hai aur kisi bhi waqt reverse treend shuru ho sakta hai if indicator ko use karte hue aap log short term trading jisko hedging trading strategy bhi kaha ja sakta hai aur sath mein aap scalping trading strategy use karke achcha instant profit le sakte ho relative strength index indicator ko use karna bahoot asan hai trading market mein aapko different information required hoti hai jaisa cake support and resistance ka bhi maloom hona chahie aapko aur aapko candlestick awar RSI indicator best indicator ha jis sy hum ache trading kar sakty han is main 2 levels han aik jahan sy hum sell kar sakty hain awar dosra jess sy hum buy kar k ache earning kar sakty han is ley humy chae ha ziada sy ziada ache trading k ley humy RSI indicator ko sahe time pe istamal karna ho ga RSI indicator bary time frame main best result data ha or choty time frame main usi k time frame k through result data hain. So why humy bary time frame ko tarjeeh dani chae ha or us main humy ziada tar trading karni chae ha is k ley humy behtar planning or strategy sy trading karni ho ge ta k hum log kamyab ho saken jtni ziada mehnat karny gy to hum utny he kamyab ho saken gy RSI indicator main 30 or 70 levels hain k jin sy hum apni trade open kar sakty han means jab bi RSI indicator ki value 30 ya is kam ho ge to wahan sy humy buy karna ho ga tab he hum ache earning kar saken gy or jab bi RSI indicator ki value 70 ya ess sy ziada ho to humy wahan sy sell karna chahiay.

Thanks

Introduction

Dear Freinds,

Forex trading main RSI indicator ko use kar k work karna ho ga so why hum munfa kama saky gy. Awar pir ye k forex aik best business hain hum ess mai agar indicator ko ignore kary gy to hamara account baned ho jy ga hum is mai apne marze sy time tbale bna kar kam kar sakty hain.moreover, hum ess mai part time be kam kar sakty hain hum ess mai full time be kam kar sakty hain. Awar hum ess main agar lalachi ban ky kam kary gy to harma account band ho jy ga hum is mai apny boss ap he hty hain hum is mai apne marze sy tim table baana kar kam kar sakty hain hum is mai raat ma be km kar sakty hain hum is mai din mai be kam kar sakty hain forex bahoot he acha business hain. Awar hum ko ess main RSI indicaters kay uses btanay ha or who ya ha k forex main agar app ksi bi pair ko choose karty h trade karnay kay lyia to app ko is ma indicaters ki bot hi zroorat hoti hain. Q k ya asy alamty ishary ha jo app ki trde ma madad karty ha ya app ko trade karnay ma 85%tak success daty ha kyu kay ya app ko trade ma profit or loss hasil kar skaty ha or app ko ya guide karty ha kay app marke ma kis waqqat trade kray or kis waqat is ko leave kar day or ya app ko trade ma graph ki movement kay bary ma btaty ha kay kis waqat graph up hota hain awar Forex trading Mein kam karte waqt aapke pass bahut Sare tools hote hain aur bahut Sare indicators hote hain Jiska istemal Karke aap trading Mein accha profit Hasil kar sakte hain ismein Ek indicator aur RSI indicator bhi Hota Hai Jisko trading ke dauran aap istemal kar sakte hain ya aapko market trial ke Jisko trading ke dauran aap istemal kar sakte hain ya aapko market Trend k bare mein batata hai aur aapko ismein acchi entries mil sakti hain aapko buyzone aur sellzone ke bare mein batata Hai Jab aap ismein kam karte hain to aapko ismein istemal karne ke liye moving average ka bee jaiza lety hian.

How to Uses?

Freinds,

Pir ye k Rsi indicator ko use kar k kam karna h ga pher he hum kam kar k hum munfa kama saky gy. Awar forex aik legal busnss hain hum ess mai bagher balance account bana kar be kam kr sakty hain. hum ess main raat mai be kam kar sakty hai hum is mai din mai be kam kar sakty hain hum is mai agar indicator ko ignore kar ddety hain to hamara account block kar deya jyga forex aik online business hain hum ess mai part time be kam kar sakty hain hum is mai full time be kam kar sakty hain hamy market mai kamyan hony ky liye strugle py focue karna ho ag per he hum kam kar k pasia Forex trading Mein jitne bhi indicator istemal ho rahe Hote Hain vah Humko bahut acche tarike se indicate karte hain awar Market ki movement ke bare main bahut acchi details provide karte hain aur Ham Ko nuksan Hone se bacha lete hain aur Hamare fayde ke liye kam karte hain unme se ek indicator Awar bhi hai jo aapko bahut hi acche tarike se a brief karta hai is ko learn karne ke liye aap internet per videos aur lectures Sun sakte hain jisse aapko bahut ziada madad Milegi aur aapane jo question kiya hai ki aapke pass Kitna balance Hona chahie is indicator ko istemal karne ke liye to usmein Koi limit Nahin Hai Jab Bhi aap Koi trade Lagate Hain RSI sub say best hsi kiyu kay es mai kam karna kafi asan hota hai aur es mai ap acha kam kar saktye hain ager ap rsi ksy barye mai jan jatye hain tu ap ka ksm hsi kay ap apnye kam mai dil laga kay kam karain aur hamesha rsi pay kam karain es mai kafi faidye hain simple sa hai indicator jis ko har koi asani kay ssth seekh sakta hai aur jan sakta hsi tu ap nay kam karna hai tu ap rsi mai expert ban jaye tu ap ki trading kafi better ho jatye hai jub kay rsi ssy hat kay kam kartye hain tu ap kay kam mai faraq par jata hai kiyu kay kafi asan kam ho jata hai rsi oay ap asani kay sath kamyabo ki taraf jatye hain tu ap acha kam karain mahnet kay sath kam karain aur RSI hamesha yad kr k hum kar skaty hain.

Conclusion

Freinds,

Last mi ye k RSI relative strength index indicator trading market ki reverse condition aur prediction ke bare mein hamen maloom from karta hai agar rsi ki reading above 70 ho to yeh overbought yehni ky market bahot zeyda buying zone ma hai aor reverse ho skti hai is ko show krta hai aur agar relative strength index indicator ye reading show Karen ke 30 below bande mein main indicator chala jaaye to ess ka matlab hota hain. Awar market over fail ho chuki hai aur kisi bhi waqt reverse treend shuru ho sakta hai if indicator ko use karte hue aap log short term trading jisko hedging trading strategy bhi kaha ja sakta hai aur sath mein aap scalping trading strategy use karke achcha instant profit le sakte ho relative strength index indicator ko use karna bahoot asan hai trading market mein aapko different information required hoti hai jaisa cake support and resistance ka bhi maloom hona chahie aapko aur aapko candlestick awar RSI indicator best indicator ha jis sy hum ache trading kar sakty han is main 2 levels han aik jahan sy hum sell kar sakty hain awar dosra jess sy hum buy kar k ache earning kar sakty han is ley humy chae ha ziada sy ziada ache trading k ley humy RSI indicator ko sahe time pe istamal karna ho ga RSI indicator bary time frame main best result data ha or choty time frame main usi k time frame k through result data hain. So why humy bary time frame ko tarjeeh dani chae ha or us main humy ziada tar trading karni chae ha is k ley humy behtar planning or strategy sy trading karni ho ge ta k hum log kamyab ho saken jtni ziada mehnat karny gy to hum utny he kamyab ho saken gy RSI indicator main 30 or 70 levels hain k jin sy hum apni trade open kar sakty han means jab bi RSI indicator ki value 30 ya is kam ho ge to wahan sy humy buy karna ho ga tab he hum ache earning kar saken gy or jab bi RSI indicator ki value 70 ya ess sy ziada ho to humy wahan sy sell karna chahiay.

Thanks

تبصرہ

Расширенный режим Обычный режим