INTRODUCTION TO HARMONIC PRICE CHART PATTERNS :

Harmonic Price Chart Patterns forex traders ki taraf se technical analysis mein istemal ki jane wale taqatwar tools hain jo market mein potential price reversals ko pehchankarne ke liye istemal hote hain. Ye patterns Fibonacci ratios par base karte hain aur price chart par geometric structures banate hain. Ye traders ko historical price patterns par aadharit hokar future market movements ki aashanka ko pehchanne mein madad karte hain. Sabse commonly used harmonic patterns Gartley, Butterfly, Bat, aur Crab patterns hain.

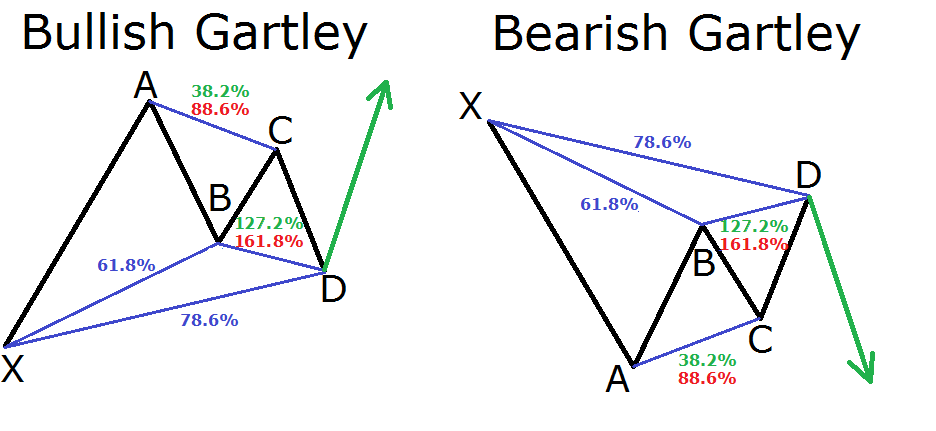

GATELEY PATTERN :

Gartley pattern ek aesa harmonic pattern hai jo sabse zyada pehchana jata hai aur jise traders trade karte hain. Ye pattern ek series of price swings aur retracements se bana hota hai jo ek distinct ABCD pattern create karte hain. Pattern ek initial price swing se shuru hota hai, phir us swing ka retracement hota hai. Retracement usually 61.8% Fibonacci level ke qareeb khatam hota hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek aur swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 78.6% Fibonacci level ke qareeb khatam hoti hai. Traders Gartley pattern ka istemal potential trend reversals ko pehchanne aur trades enter karne ke lie karte hain.

BUTTERFLY PATTERN :

Butterfly pattern ek aur popular harmonic pattern hai jo forex traders dwara istemal kiya jata hai. Ye Gartley pattern ki tarah hai lekin isme different Fibonacci ratio retracement levels hote hain. Pattern ek initial price swing se shuru hota hai, phir ek retracement hoti hai jiske qareeb usually 78.6% Fibonacci level tak khatam hoti hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek dusre swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 127.2% Fibonacci extension level ke qareeb khatam hoti hai. Traders Butterfly pattern ke formation par potential trend reversals ki talaash karte hain.

BAT PATTERN :

Bat pattern Gartley pattern ka ek variation hai aur isme distinct Fibonacci retracement aur extension levels hote hain. Pattern ek initial price swing se shuru hota hai, phir ek retracement hota hai jiske qareeb usually 88.6% Fibonacci level tak khatam hoti hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek dusre swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 161.8% Fibonacci extension level ke qareeb khatam hoti hai. Traders Bat pattern ka istemal potential trend reversals ko pehchanne mein karte hain, dusre harmonic patterns ki tarah.

CRAB PATTERN :

Crab pattern harmonic patterns ki zyada recent addition hai aur isme deep retracement levels ke liye mashoor hai. Pattern ek initial price swing se shuru hota hai, phir ek retracement hoti hai jiske qareeb usually 161.8% ya 224.6% Fibonacci level tak khatam hoti hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek dusre swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 361.8% ya 423.6% Fibonacci extension level ke qareeb khatam hoti hai. Traders Crab pattern ka istemal potential trend reversals ko pehchanne aur trades karte hain.

Harmonic Price Chart Patterns forex traders ki taraf se technical analysis mein istemal ki jane wale taqatwar tools hain jo market mein potential price reversals ko pehchankarne ke liye istemal hote hain. Ye patterns Fibonacci ratios par base karte hain aur price chart par geometric structures banate hain. Ye traders ko historical price patterns par aadharit hokar future market movements ki aashanka ko pehchanne mein madad karte hain. Sabse commonly used harmonic patterns Gartley, Butterfly, Bat, aur Crab patterns hain.

GATELEY PATTERN :

Gartley pattern ek aesa harmonic pattern hai jo sabse zyada pehchana jata hai aur jise traders trade karte hain. Ye pattern ek series of price swings aur retracements se bana hota hai jo ek distinct ABCD pattern create karte hain. Pattern ek initial price swing se shuru hota hai, phir us swing ka retracement hota hai. Retracement usually 61.8% Fibonacci level ke qareeb khatam hota hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek aur swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 78.6% Fibonacci level ke qareeb khatam hoti hai. Traders Gartley pattern ka istemal potential trend reversals ko pehchanne aur trades enter karne ke lie karte hain.

BUTTERFLY PATTERN :

Butterfly pattern ek aur popular harmonic pattern hai jo forex traders dwara istemal kiya jata hai. Ye Gartley pattern ki tarah hai lekin isme different Fibonacci ratio retracement levels hote hain. Pattern ek initial price swing se shuru hota hai, phir ek retracement hoti hai jiske qareeb usually 78.6% Fibonacci level tak khatam hoti hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek dusre swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 127.2% Fibonacci extension level ke qareeb khatam hoti hai. Traders Butterfly pattern ke formation par potential trend reversals ki talaash karte hain.

BAT PATTERN :

Bat pattern Gartley pattern ka ek variation hai aur isme distinct Fibonacci retracement aur extension levels hote hain. Pattern ek initial price swing se shuru hota hai, phir ek retracement hota hai jiske qareeb usually 88.6% Fibonacci level tak khatam hoti hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek dusre swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 161.8% Fibonacci extension level ke qareeb khatam hoti hai. Traders Bat pattern ka istemal potential trend reversals ko pehchanne mein karte hain, dusre harmonic patterns ki tarah.

CRAB PATTERN :

Crab pattern harmonic patterns ki zyada recent addition hai aur isme deep retracement levels ke liye mashoor hai. Pattern ek initial price swing se shuru hota hai, phir ek retracement hoti hai jiske qareeb usually 161.8% ya 224.6% Fibonacci level tak khatam hoti hai. Retracement ke baad price apni pichli taraf jari rakhti hai, ek dusre swing banati hai jo pichle swing ka high ko paar kar leti hai. Pattern complete hota hai jab price dusre swing se retraces karti hai aur initial swing ke 361.8% ya 423.6% Fibonacci extension level ke qareeb khatam hoti hai. Traders Crab pattern ka istemal potential trend reversals ko pehchanne aur trades karte hain.

تبصرہ

Расширенный режим Обычный режим