Forex trading ke duniya mein, technical tajaweez karne mein tijarat karne walon ko malumat hasil karne mein ahem kirdar ada karta hai. Ek sab se mashhoor aur wasee istemal hone wala takneeky daleel hai moving average (MA). Moving average ek hissi makhraj hai jo maayenat amal ko had muddat mein ek darja ke darmiyan ek miyari maayenat se hawaala dete hain. Moving average ribbon, moving average ka ek tabdeel shakhsiyat hai jo market ke trend ki taqat ka ek tasweeri tasawwur banane ke liye mukhtalif timeframes ka istemal karta hai. Is dalil ko Bollinger Bands MA ribbon ya Multiple Timeframe Moving Average (MTMA) ribbon ke naam se bhi jana jata hai. Is maqale mein, hum forex mein moving average ribbon, is ke faide, is ka istemal kaise kiya jata hai, aur is istemaal se istemaal hone wale kuch tajaweezat ko tafseel se explore karenge.

Moving Average Ribbon Explanation

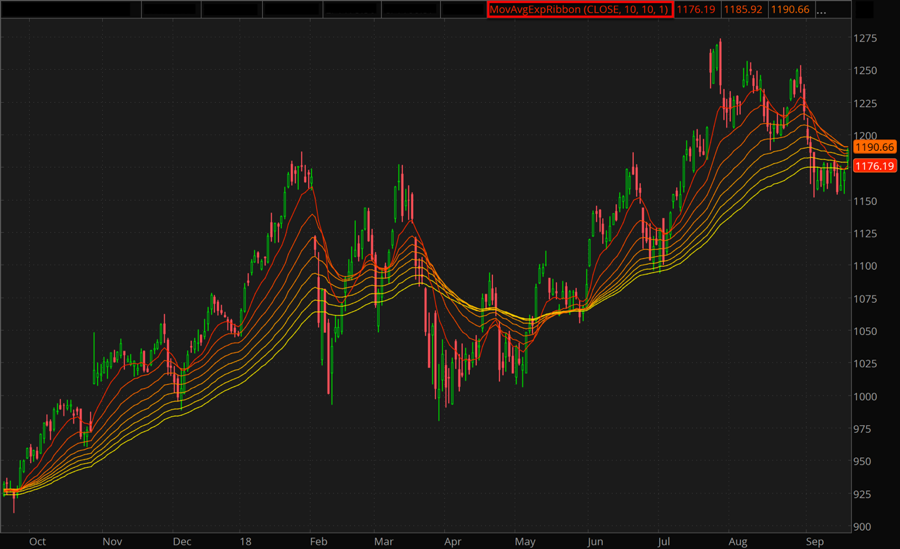

Moving average ribbon mukhtalif moving averages ko ek akele chart par darust karte hue tasweer hai. Ribbon kayi lineon se mushtamil hoti hai, har ek mukhtalif timeframes ki moving average ko darust karti hai. Ribbon mein istemal hone wale timeframes tajaweez karne wale trader ki pasandidgi par mabni ho sakti hain, lekin aam taur par istemal hone wale timeframes mein 21 din, 55 din aur 200 din ke MAs shamil hain. Ribbon ke rang bhi maqsoos hote hain, har line aik mukhtalif rang ko darust karti hai. Istemal hone wale rang tajaweez karne wale trader par mabni ho sakte hain, lekin aam taur par, chhote arsay ke MAs ko sabz ya neela rang mein darust kiya jata hai, jabke lambay arsay ke MAs ko surk ya siyah rang mein darust kiya jata hai.

Benefits of Using the Moving Average Ribbon

Identifying Trend Strength: Moving average ribbon tajaweez karne wale traders ko trend ki taqat ko pata lagane mein madad karta hai, yeh dikhata hai ke kitne timeframes ek dosre ke sath mutabiq hain. Jab tamam MAs qareeb hote hain aur ek hi taraf ishara kartay hain, to yeh ek mazboot trend ko dikhata hai. Umge ke agar MAs phaile hue hote hain aur mukhtalif raaste mein ishara kartay hain, to yeh kamzor trend ya mukhtalif raaste ka ishara karti hai.

Confirming Price Action: Ribbon traders ko bhi keemat amal ko tasdeeq karne mein madad karti hai, yeh dikhata hai ke keemat MAs ke oper ya neeche hai. Jab tamam MAs ke oper keemat ho, to yeh ek uptrend ko dikhata hai, jabke jab tamam MAs ke neeche keemat ho, to yeh ek downtrend ko dikhata hai. Agar keemat do ya do se zyada MAs ke darmiyan ho, to yeh ek range-bound market ko dikhata hai.

Identifying Support and Resistance Levels: Ribbon traders ko potential support aur resistance levels ki pehchan karne mein bhi madad karti hai, yeh dikhata hai ke MAs ek dosre ke sath ya keemat amal ke sath kahan milte hain. Jab keemat MAs ya do MAs ke darmiyan se takraati hain, to yeh potential support ya resistance levels ko dikhata hai.

Providing Entry and Exit Points: Trend ki taqat, keemat amal ko tasdeeq karna, aur support aur resistance levels ko pehchan karke traders apne tajaweez ke liye dakhli aur kharij nuktay moumkin karne ke liye moving average ribbon ka istemal kar sakte hain. Misal ke tor par, agar keemat tamam MAs ke oper chhut jati hai ek uptrend mein, to yeh ek mumkin kharid ishara ho sakta hai. Umge ke agar keemat tamam MAs ke neeche chhut jati hai ek downtrend mein, to yeh ek mumkin bech ishara ho sakta hai.

Uses the Moving Average Ribbon

Moving Average Ribbon Explanation

Moving average ribbon mukhtalif moving averages ko ek akele chart par darust karte hue tasweer hai. Ribbon kayi lineon se mushtamil hoti hai, har ek mukhtalif timeframes ki moving average ko darust karti hai. Ribbon mein istemal hone wale timeframes tajaweez karne wale trader ki pasandidgi par mabni ho sakti hain, lekin aam taur par istemal hone wale timeframes mein 21 din, 55 din aur 200 din ke MAs shamil hain. Ribbon ke rang bhi maqsoos hote hain, har line aik mukhtalif rang ko darust karti hai. Istemal hone wale rang tajaweez karne wale trader par mabni ho sakte hain, lekin aam taur par, chhote arsay ke MAs ko sabz ya neela rang mein darust kiya jata hai, jabke lambay arsay ke MAs ko surk ya siyah rang mein darust kiya jata hai.

Benefits of Using the Moving Average Ribbon

Identifying Trend Strength: Moving average ribbon tajaweez karne wale traders ko trend ki taqat ko pata lagane mein madad karta hai, yeh dikhata hai ke kitne timeframes ek dosre ke sath mutabiq hain. Jab tamam MAs qareeb hote hain aur ek hi taraf ishara kartay hain, to yeh ek mazboot trend ko dikhata hai. Umge ke agar MAs phaile hue hote hain aur mukhtalif raaste mein ishara kartay hain, to yeh kamzor trend ya mukhtalif raaste ka ishara karti hai.

Confirming Price Action: Ribbon traders ko bhi keemat amal ko tasdeeq karne mein madad karti hai, yeh dikhata hai ke keemat MAs ke oper ya neeche hai. Jab tamam MAs ke oper keemat ho, to yeh ek uptrend ko dikhata hai, jabke jab tamam MAs ke neeche keemat ho, to yeh ek downtrend ko dikhata hai. Agar keemat do ya do se zyada MAs ke darmiyan ho, to yeh ek range-bound market ko dikhata hai.

Identifying Support and Resistance Levels: Ribbon traders ko potential support aur resistance levels ki pehchan karne mein bhi madad karti hai, yeh dikhata hai ke MAs ek dosre ke sath ya keemat amal ke sath kahan milte hain. Jab keemat MAs ya do MAs ke darmiyan se takraati hain, to yeh potential support ya resistance levels ko dikhata hai.

Providing Entry and Exit Points: Trend ki taqat, keemat amal ko tasdeeq karna, aur support aur resistance levels ko pehchan karke traders apne tajaweez ke liye dakhli aur kharij nuktay moumkin karne ke liye moving average ribbon ka istemal kar sakte hain. Misal ke tor par, agar keemat tamam MAs ke oper chhut jati hai ek uptrend mein, to yeh ek mumkin kharid ishara ho sakta hai. Umge ke agar keemat tamam MAs ke neeche chhut jati hai ek downtrend mein, to yeh ek mumkin bech ishara ho sakta hai.

Uses the Moving Average Ribbon

- Choose Your Timeframes: Apne moving average ribbon mein istemal karne wale timeframes ko tay karen. Aam taur par istemal hone wale timeframes mein 21 din (short-term), 55 din (medium-term), aur 200 din (long-term) shamil hain. Aap apne pasandidgi aur trading strategy ke mutabiq zyada ya kam timeframes istemal kar sakte hain.

- Determine Your Colors: Apne har timeframe ke MA line ke liye apne rang tay karen. Aam taur par, chhote arsay ke MAs ko sabz ya neela rang mein darust kiya jata hai, jabke lambay arsay ke MAs ko surk ya siyah rang mein darust kiya jata hai. Ye traders ko apne chart par unke dekh rahe MA line ko jaldi pehchanne mein madad karta hai.

- Plot Your MAs: Apne chunay gaye timeframes ke MAs ko apne chart par darust karen, har line ke liye apne rang ko chun kar. Yeh yaad rakhen ke apne chart ki setting ko aise mojooda karen ke sab MAs ek sath dikh saken aur unhen aik martaba parhna asaan ho. Aapko apne chart ki zoom level ko adjust karna ya multiple charts ek saath istemal karna padh sakta hai takay aap apne MAs ko saaf se dekhen.

- Analyze Your Chart: Jab aap apne chart par apne moving average ribbon ko darust karenge, to usko tahlil karen ke trends, support aur resistance levels, aur dakhli aur kharij nuktay ke liye potential entry aur exit points ko kaise pehchan sakte hain. Yaad rahe ke koi bhi dalil mukammal nahi hoti aur ise dusri tajaweezat jaise ke bunyadi tajaweez aur keemat amal tahlil ke saath istemal karna chahiye, taake mulahizaat ke basis par faisle karne mein madad mile jo ke sirf aik tool ya methodology par tawajjuh dena se behtar hota hai.

:max_bytes(150000):strip_icc():format(webp)/MovingAverageRibbon-e47a05f1c0164817ad3411547ce72c35.png)

تبصرہ

Расширенный режим Обычный режим