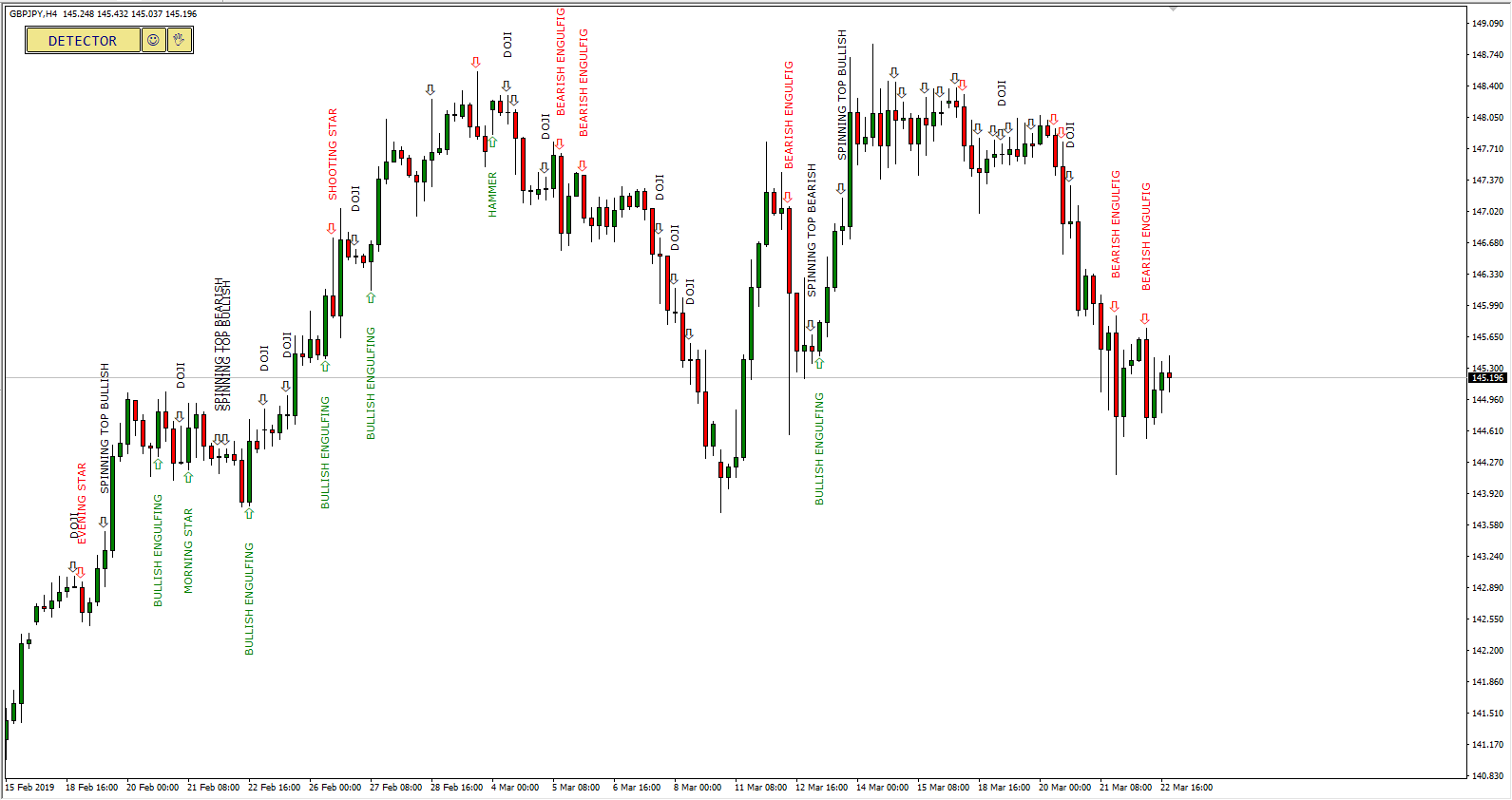

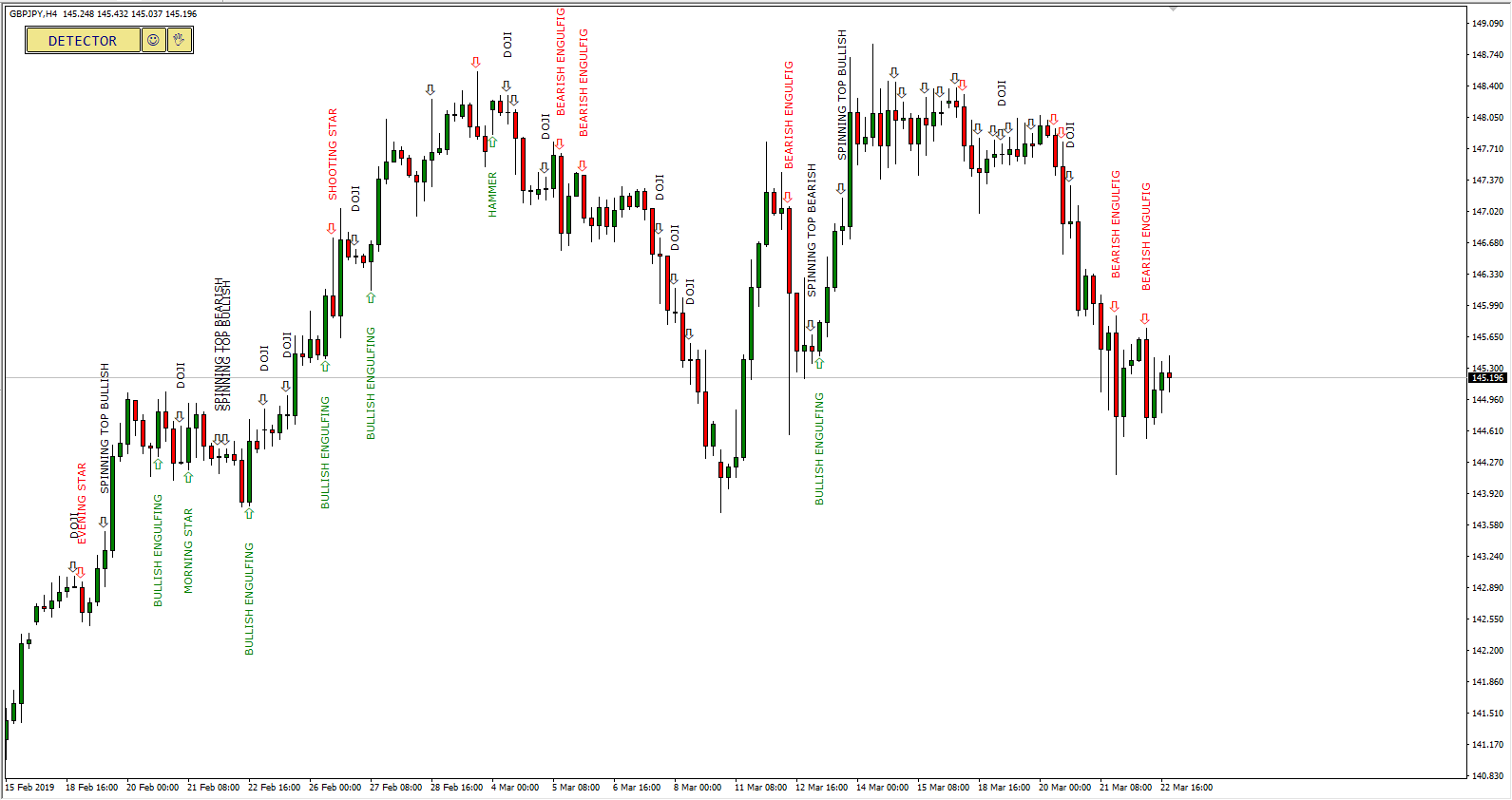

Forex trading mein candlestick patterns ka istemal karna, market ke behavior ko samajhne ka ek mahatva purna tareeka hai. Candlestick patterns traders ko market mein hone wale price changes, trends, aur reversals ke bare mein malumat pradan karte hain. Is post mein hum dekheinge ke kis tarah se master candlestick behavior ko samajh kar forex trading mein fayda uthaya ja sakta hai.

Candlestick Basics:

Candlestick, price action ko represent karne ka ek visual tareeka hai. Har candlestick chart par, har candle ek specific time frame ko darust karta hai, jaise ke 1 din, 1 ghanta, ya 15 minutes. Har candle ka ek open, close, high, aur low price hota hai.

Colors Ka Ahemiyat:

Har candle ka color bhi ahemiyat rakhta hai. Agar candle ki opening price closing price se upar hai, toh candle usually green ya white hota hai, jo ke bullish behavior ko darust karta hai. Jabki agar closing price opening price se neeche hai, toh candle red ya black hota hai, jo ke bearish behavior ko darust karta hai.

Master Candlestick Pattern:

Master candlestick pattern ek powerful pattern hai jo multiple candles ko include karta hai aur market ke behavior ko indicate karta hai. Is pattern mein ek bada candle hota hai, jo ke smaller candles ko surround karta hai.

Significance:

Master candlestick pattern ka mukhya uddeshya market mein hone wale trend changes ko predict karna hai. Yeh pattern traders ko indicate karta hai ke market mein ek potential reversal hone wala hai.

Master Candlestick Ka Tareeqa:

Large Candle Ki Pehchaan:

Master candlestick pattern ko identify karne ke liye sabse pehle aapko dekhna hoga ke kya market mein ek large candle bani hui hai. Yeh candle usually market mein significant volatility ko darust karta hai.

Small Candles Ka Group:

Master candle ke aas-paas ke kuch chhote candles hote hain, jo isse ghirte hain. Yeh candles large candle ki high aur low range ke andar rehte hain.

Breakout Aur Trend Change:

Agar master candle ke baad market mein breakout hota hai aur price range ko cross kiya jata hai, toh yeh ek potential trend change ya reversal ko indicate karta hai.

Master Candlestick Ka Istemal:

Trend Reversals:

Master candlestick pattern ka istemal karke traders ko market mein hone wale trend reversals ka pata chalta hai. Agar breakout upward hota hai, toh yeh bullish reversal ki sambhavna ko darust karta hai, jabki downward breakout bearish reversal ko indicate karta hai.

Entry Aur Exit Points:

Master candlestick pattern ko dekh kar traders apne entry aur exit points ko tay kar sakte hain. Breakout ke baad entry karna, aur trend reversal ke signs par exit karna, traders ko achhe results dene mein madad karta hai.

Master Candlestick Ka Tazurba:

Demo Trading Mein Practice:

Shuruwat mein, master candlestick pattern ko samajhne aur uska sahi istemal karne ke liye demo trading ka istemal karna behtar hai. Demo trading aapko real market conditions mein practice karne ka mauka deta hai.

Risk Management:

Master candlestick pattern ka istemal karte waqt risk management ka dhyan rakhna zaroori hai. Stop-loss orders ka istemal karna aur risk ko control mein rakhna, traders ke liye mahatva purna hai.

Case Study:

Maan lijiye, aapne ek master candlestick pattern identify kiya hai jismein ek bada candle hai jo chhote candles se surround kiya gaya hai. Agar iske baad market mein breakout hota hai aur price range ko cross karta hai, toh yeh bullish reversal ka indication ho sakta hai.

Confirmation:

Master candlestick pattern ko confirm karne ke liye, doosre technical indicators ka bhi istemal karna important hai. Volume analysis, trend lines, aur doosre patterns ki confirmation, traders ko sahi direction mein guide karte hain.

Master Candlestick Aur Time Frames:

Time Frame Ka Ahemiyat:

Master candlestick pattern ka istemal karte waqt time frame ka bhi dhyan rakhna zaroori hai. Chhote time frames par yeh pattern jyada effective hota hai intraday trading mein, jabki long-term time frames par iska istemal trend reversal ko predict karne mein madad karta hai.

Conclusion:

Master candlestick pattern ka sahi istemal karke traders market mein hone wale trend changes ko samajh sakte hain aur apne trading strategies ko improve kar sakte hain. Is pattern ko samajhne mein practice aur patience ka hona zaroori hai. Har trading decision ko dhyan se lena chahiye aur risk management ka tazurba hona bhi mahatva purna hai. Master candlestick pattern ke saath achhi tayari aur discipline ke saath, traders apne trading skills ko enhance karke market mein behtar results achieve kar sakte hain.

Candlestick Basics:

Candlestick, price action ko represent karne ka ek visual tareeka hai. Har candlestick chart par, har candle ek specific time frame ko darust karta hai, jaise ke 1 din, 1 ghanta, ya 15 minutes. Har candle ka ek open, close, high, aur low price hota hai.

Colors Ka Ahemiyat:

Har candle ka color bhi ahemiyat rakhta hai. Agar candle ki opening price closing price se upar hai, toh candle usually green ya white hota hai, jo ke bullish behavior ko darust karta hai. Jabki agar closing price opening price se neeche hai, toh candle red ya black hota hai, jo ke bearish behavior ko darust karta hai.

Master Candlestick Pattern:

Master candlestick pattern ek powerful pattern hai jo multiple candles ko include karta hai aur market ke behavior ko indicate karta hai. Is pattern mein ek bada candle hota hai, jo ke smaller candles ko surround karta hai.

Significance:

Master candlestick pattern ka mukhya uddeshya market mein hone wale trend changes ko predict karna hai. Yeh pattern traders ko indicate karta hai ke market mein ek potential reversal hone wala hai.

Master Candlestick Ka Tareeqa:

Large Candle Ki Pehchaan:

Master candlestick pattern ko identify karne ke liye sabse pehle aapko dekhna hoga ke kya market mein ek large candle bani hui hai. Yeh candle usually market mein significant volatility ko darust karta hai.

Small Candles Ka Group:

Master candle ke aas-paas ke kuch chhote candles hote hain, jo isse ghirte hain. Yeh candles large candle ki high aur low range ke andar rehte hain.

Breakout Aur Trend Change:

Agar master candle ke baad market mein breakout hota hai aur price range ko cross kiya jata hai, toh yeh ek potential trend change ya reversal ko indicate karta hai.

Master Candlestick Ka Istemal:

Trend Reversals:

Master candlestick pattern ka istemal karke traders ko market mein hone wale trend reversals ka pata chalta hai. Agar breakout upward hota hai, toh yeh bullish reversal ki sambhavna ko darust karta hai, jabki downward breakout bearish reversal ko indicate karta hai.

Entry Aur Exit Points:

Master candlestick pattern ko dekh kar traders apne entry aur exit points ko tay kar sakte hain. Breakout ke baad entry karna, aur trend reversal ke signs par exit karna, traders ko achhe results dene mein madad karta hai.

Master Candlestick Ka Tazurba:

Demo Trading Mein Practice:

Shuruwat mein, master candlestick pattern ko samajhne aur uska sahi istemal karne ke liye demo trading ka istemal karna behtar hai. Demo trading aapko real market conditions mein practice karne ka mauka deta hai.

Risk Management:

Master candlestick pattern ka istemal karte waqt risk management ka dhyan rakhna zaroori hai. Stop-loss orders ka istemal karna aur risk ko control mein rakhna, traders ke liye mahatva purna hai.

Case Study:

Maan lijiye, aapne ek master candlestick pattern identify kiya hai jismein ek bada candle hai jo chhote candles se surround kiya gaya hai. Agar iske baad market mein breakout hota hai aur price range ko cross karta hai, toh yeh bullish reversal ka indication ho sakta hai.

Confirmation:

Master candlestick pattern ko confirm karne ke liye, doosre technical indicators ka bhi istemal karna important hai. Volume analysis, trend lines, aur doosre patterns ki confirmation, traders ko sahi direction mein guide karte hain.

Master Candlestick Aur Time Frames:

Time Frame Ka Ahemiyat:

Master candlestick pattern ka istemal karte waqt time frame ka bhi dhyan rakhna zaroori hai. Chhote time frames par yeh pattern jyada effective hota hai intraday trading mein, jabki long-term time frames par iska istemal trend reversal ko predict karne mein madad karta hai.

Conclusion:

Master candlestick pattern ka sahi istemal karke traders market mein hone wale trend changes ko samajh sakte hain aur apne trading strategies ko improve kar sakte hain. Is pattern ko samajhne mein practice aur patience ka hona zaroori hai. Har trading decision ko dhyan se lena chahiye aur risk management ka tazurba hona bhi mahatva purna hai. Master candlestick pattern ke saath achhi tayari aur discipline ke saath, traders apne trading skills ko enhance karke market mein behtar results achieve kar sakte hain.