Assalamualaikum!

Dear friend Kya hal hain umeed krta hon k ap sab kheriat sy hon gy our forex market mn acha kam kr rhe hon gy dosto aj ka hmara topic bhot he important h aj hm butterfly candlestick chart pattern k bary mn discuss krien gy.

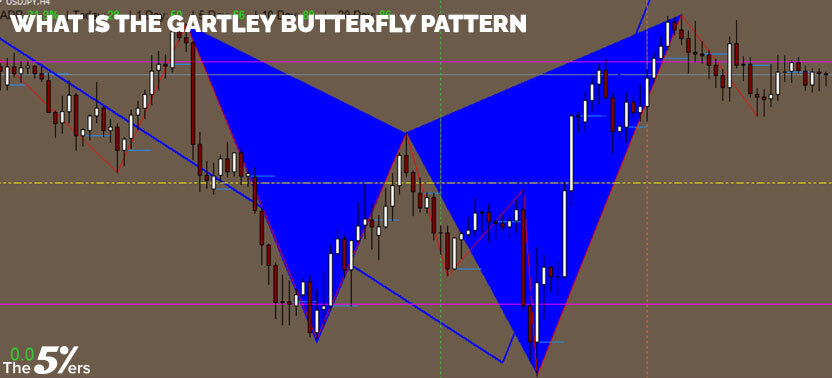

What is Butterfly candlestick chart pattern?

Butterfly candlestick pattern ek technical analysis concept hai jo stock market aur financial markets mein istemal hota hai. Ye pattern traders ko market trends ko samajhne aur trading decisions lene mein madadgar hota hai. Butterfly pattern ko samajhne ke liye, apko candlestick charts ka istemal karna hoga, jo market ki price movements ko graphically darust dikhate hain.Butterfly candlestick pattern ek specific reversal pattern hai, jiska mukhya uddeshya market ke trend mein hone wale changes ko pesh karna hai. Is pattern mein, chand candlesticks ek khas tarah se arrange hoti hain.

Pattern ko pehchanne ke liye, neeche diye gaye kuch steps ko follow kiya jata hai:

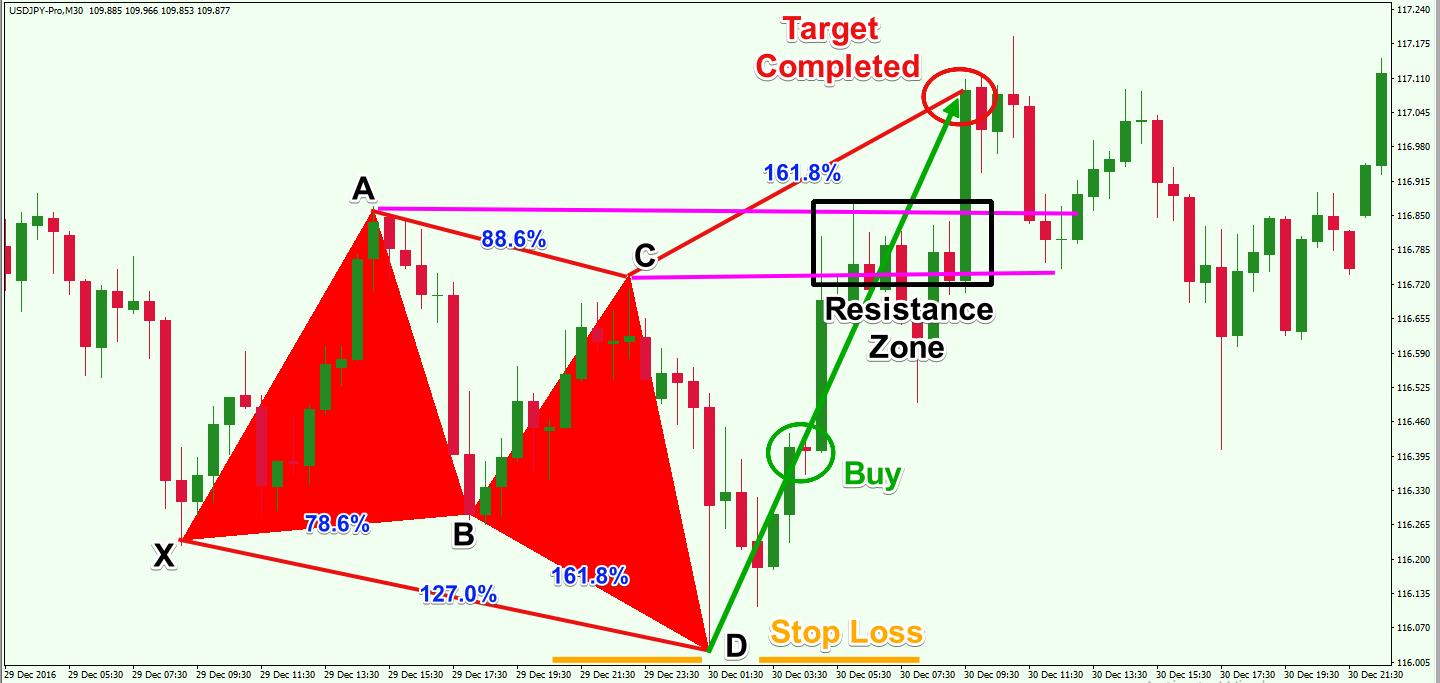

Pehla Step (Starting Point):

Butterfly pattern ka pehla step hota hai "X-A" leg, jahan se pattern ki shuruaat hoti hai. Is mein price uptrend mein hoti hai.

Dusra Step (Price Reversal):

X-A leg ke baad, market mein price mein ek reversal hota hai aur ye "A-B" leg ke roop mein dikhta hai. Is leg mein price down movement dikhata hai.

Tisra Step (Retracement):

Iske baad, market mein thoda sa retracement hota hai, jo "B-C" leg ke roop mein hota hai. Yahan par price phir se kuch had tak upar ja sakti hai.

Choutha Step (Final Reversal):

Butterfly pattern ka antim step hota hai "C-D" leg, jahan par price phir se down movement karta hai. Is leg mein price reversal hoti hai aur overall trend change hota hai.Pattern ko pehchanne ke liye, neeche diye gaye kuch steps ko follow kiya jata hai:

Butterfly pattern ko samajhne ke liye, main aapko uski components aur unke matlab ke bare mein batata hoon:

Swing High (SH):

Swing high ek point hai jahan price ek uptrend ke dauran highest level tak pahunchti hai.

Swing Low (SL):

Swing low ek point hai jahan price ek downtrend ke dauran lowest level tak pahunchti hai.

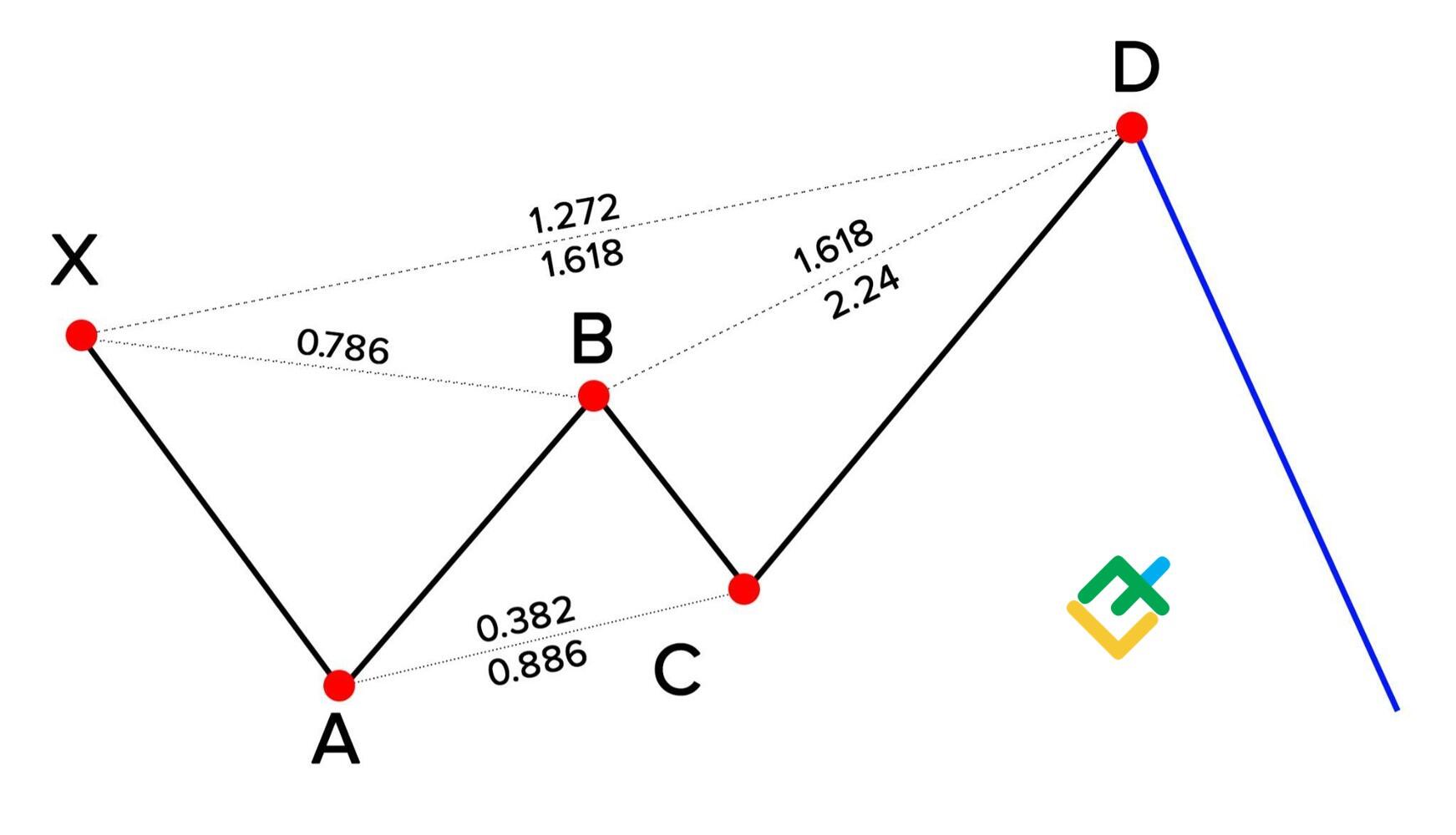

XA Leg:

XA leg butterfly pattern ka starting point hota hai. Yeh ek impulse move hota hai aur price ka ek significant swing hota hai. Is leg ko draw karne ke liye SH se SL tak line banayi jati hai.

AB Leg:

AB leg XA leg ke bad ka retracement move hota hai. Is leg mein price XA leg ki kuch had tak reverse hoti hai. Is leg ko draw karne ke liye SL se kisi resistance level tak line banayi jati hai.

BC Leg:

BC leg AB leg ka retracement move hota hai. Yeh leg AB leg ke levels ke bich mein rehta hai. Is leg ko draw karne ke liye AB leg ka Fibonacci retracement level 0.382 ya 0.618 ka use hota hai.

CD Leg:

CD leg butterfly pattern ka final leg hota hai. Yeh ek extension move hota hai, jahan price BC leg ke level se reverse hoti hai. Is leg ko draw karne ke liye BC leg ke high point tak line banayi jati hai.

Explanation:

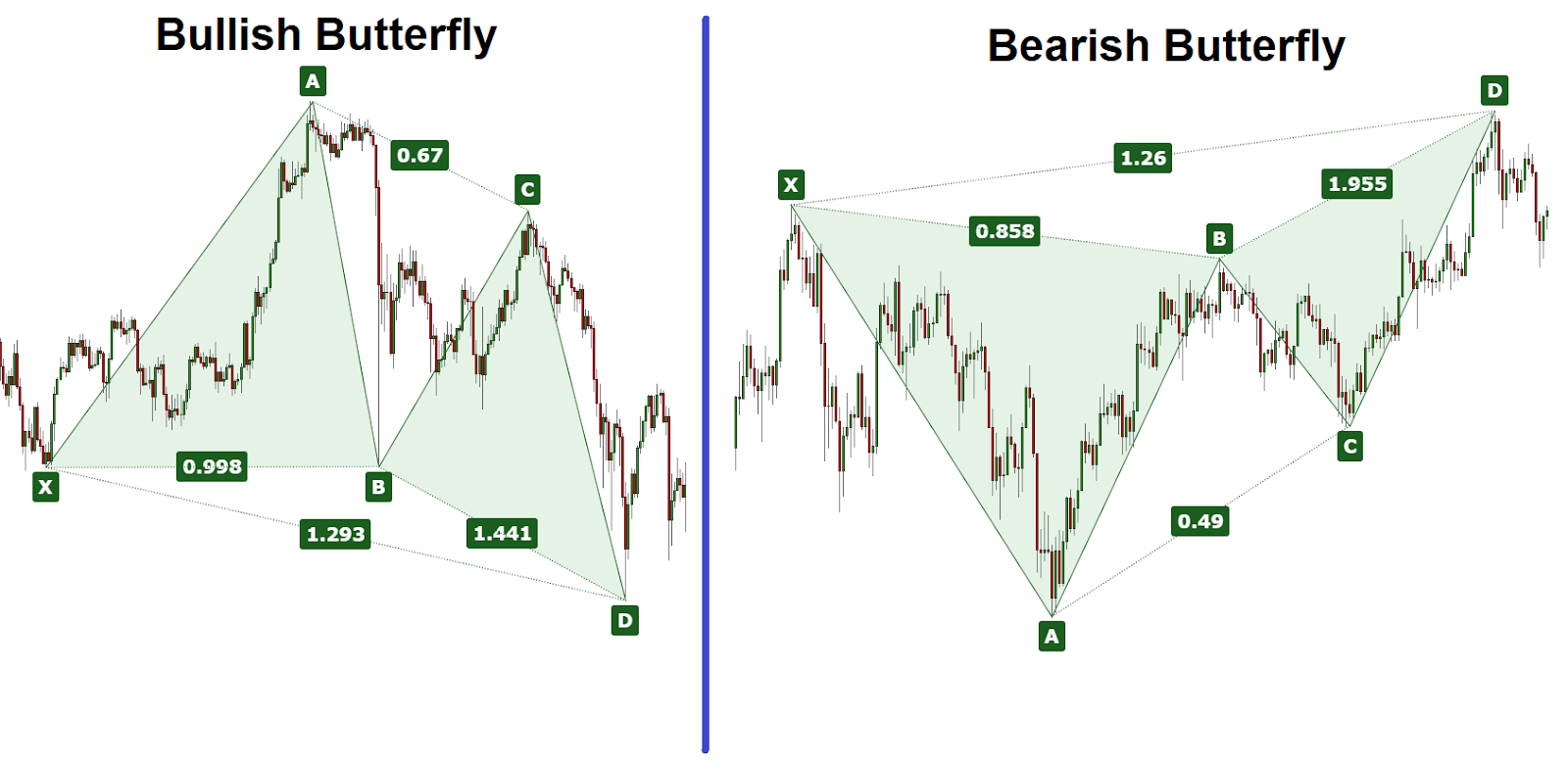

Butterfly pattern ke peechle logic yeh hai ki isse market mein trend reversal ko pesh kiya jata hai. Agar aap market mein uptrend dekh rahe hain aur butterfly pattern detect hota hai, to iska matlab hai ki market mein downtrend hone ke chances hain. Yadi aap market mein downtrend dekh rahe hain aur butterfly pattern detect hota hai, to iska matlab hai ki market mein uptrend hone ke chances hain.Is pattern ko trading decisions lene mein istemal kiya ja sakta hai. Agar aapko lagta hai ki butterfly pattern market mein hone wale trend reversal ko indicate kar raha hai, to aap apni trading strategy ko usi disha mein adjust kar sakte hain. Yani ki, agar aap uptrend mein hain aur butterfly pattern detect hota hai, to aap short positions le sakte hain ya existing long positions ko close kar sakte hain.Is pattern ki safalti ke liye, traders ko candlestick chart analysis ki acchi samajh honi chahiye aur is pattern ko dusre technical indicators ke saath milakar istemal karna chahiye. Iske alawa, risk management bhi mahatvapurn hai, taki trading losses ko kam kiya ja sake.Butterfly candlestick pattern ek powerful tool ho sakta hai, lekin yeh kisi bhi trading decision ko confirm nahi karta hai. Market mein risk hamesha hota hai, isliye traders ko hamesha savdhan rehna chahiye aur apni research aur analysis ko mazbut banaye rakhna chahiye.

Thanks for Attention.

Dear friend Kya hal hain umeed krta hon k ap sab kheriat sy hon gy our forex market mn acha kam kr rhe hon gy dosto aj ka hmara topic bhot he important h aj hm butterfly candlestick chart pattern k bary mn discuss krien gy.

What is Butterfly candlestick chart pattern?

Butterfly candlestick pattern ek technical analysis concept hai jo stock market aur financial markets mein istemal hota hai. Ye pattern traders ko market trends ko samajhne aur trading decisions lene mein madadgar hota hai. Butterfly pattern ko samajhne ke liye, apko candlestick charts ka istemal karna hoga, jo market ki price movements ko graphically darust dikhate hain.Butterfly candlestick pattern ek specific reversal pattern hai, jiska mukhya uddeshya market ke trend mein hone wale changes ko pesh karna hai. Is pattern mein, chand candlesticks ek khas tarah se arrange hoti hain.

Pattern ko pehchanne ke liye, neeche diye gaye kuch steps ko follow kiya jata hai:

Pehla Step (Starting Point):

Butterfly pattern ka pehla step hota hai "X-A" leg, jahan se pattern ki shuruaat hoti hai. Is mein price uptrend mein hoti hai.

Dusra Step (Price Reversal):

X-A leg ke baad, market mein price mein ek reversal hota hai aur ye "A-B" leg ke roop mein dikhta hai. Is leg mein price down movement dikhata hai.

Tisra Step (Retracement):

Iske baad, market mein thoda sa retracement hota hai, jo "B-C" leg ke roop mein hota hai. Yahan par price phir se kuch had tak upar ja sakti hai.

Choutha Step (Final Reversal):

Butterfly pattern ka antim step hota hai "C-D" leg, jahan par price phir se down movement karta hai. Is leg mein price reversal hoti hai aur overall trend change hota hai.Pattern ko pehchanne ke liye, neeche diye gaye kuch steps ko follow kiya jata hai:

Butterfly pattern ko samajhne ke liye, main aapko uski components aur unke matlab ke bare mein batata hoon:

Swing High (SH):

Swing high ek point hai jahan price ek uptrend ke dauran highest level tak pahunchti hai.

Swing Low (SL):

Swing low ek point hai jahan price ek downtrend ke dauran lowest level tak pahunchti hai.

XA Leg:

XA leg butterfly pattern ka starting point hota hai. Yeh ek impulse move hota hai aur price ka ek significant swing hota hai. Is leg ko draw karne ke liye SH se SL tak line banayi jati hai.

AB Leg:

AB leg XA leg ke bad ka retracement move hota hai. Is leg mein price XA leg ki kuch had tak reverse hoti hai. Is leg ko draw karne ke liye SL se kisi resistance level tak line banayi jati hai.

BC Leg:

BC leg AB leg ka retracement move hota hai. Yeh leg AB leg ke levels ke bich mein rehta hai. Is leg ko draw karne ke liye AB leg ka Fibonacci retracement level 0.382 ya 0.618 ka use hota hai.

CD Leg:

CD leg butterfly pattern ka final leg hota hai. Yeh ek extension move hota hai, jahan price BC leg ke level se reverse hoti hai. Is leg ko draw karne ke liye BC leg ke high point tak line banayi jati hai.

Explanation:

Butterfly pattern ke peechle logic yeh hai ki isse market mein trend reversal ko pesh kiya jata hai. Agar aap market mein uptrend dekh rahe hain aur butterfly pattern detect hota hai, to iska matlab hai ki market mein downtrend hone ke chances hain. Yadi aap market mein downtrend dekh rahe hain aur butterfly pattern detect hota hai, to iska matlab hai ki market mein uptrend hone ke chances hain.Is pattern ko trading decisions lene mein istemal kiya ja sakta hai. Agar aapko lagta hai ki butterfly pattern market mein hone wale trend reversal ko indicate kar raha hai, to aap apni trading strategy ko usi disha mein adjust kar sakte hain. Yani ki, agar aap uptrend mein hain aur butterfly pattern detect hota hai, to aap short positions le sakte hain ya existing long positions ko close kar sakte hain.Is pattern ki safalti ke liye, traders ko candlestick chart analysis ki acchi samajh honi chahiye aur is pattern ko dusre technical indicators ke saath milakar istemal karna chahiye. Iske alawa, risk management bhi mahatvapurn hai, taki trading losses ko kam kiya ja sake.Butterfly candlestick pattern ek powerful tool ho sakta hai, lekin yeh kisi bhi trading decision ko confirm nahi karta hai. Market mein risk hamesha hota hai, isliye traders ko hamesha savdhan rehna chahiye aur apni research aur analysis ko mazbut banaye rakhna chahiye.

Thanks for Attention.

تبصرہ

Расширенный режим Обычный режим