Elliott Wave Theory ek technical analysis ka old tareeqa hai jo financial markets mein aane wale daamoun ki future tehqiqat ke liye istemal hota hai, jese ke stocks, forex, aur commodities, isay tarikhii daamoun par base kia gaya hai. 1930s mein Ralph Nelson Elliott ne tajrubaat kiye aur yeh theory yeh sarahna karti hai ke market ki harkatein kisi nahi tarteeb mein hoti hain jo ke market mein mojood logon ki psychology, jazbat, aur crowd behavior ko numaya karti hain. Elliott Wave Theory ki bunyad yeh hai ke market ke daamoun ki harkatein itefaqi nahi hoti balkeh insano ki psychology, jazbat, aur crowd behavior ki natural tarteeb ko follow karti hain. Elliott Wave Theory yeh shayari hai ke market mein harkatein ta'arufi cycles mein hoti hain, aur in patterns ko samajhna traders aur investors ko inform kiya ja sakta hai.

Principles of Elliott Wave Theory

Is theory ki bunyad yeh hai ke market ke daamoun ki harkatein itefaqi nahi hoti balkeh insano ki psychology, jazbat, aur crowd behavior ki natural tarteeb ko follow karti hain. Elliott ke mutabiq, market trends paanch chhotay waves mein hoti hain, jo ke impulsive waves aur corrective waves mein taqseem kiye ja sakte hain.

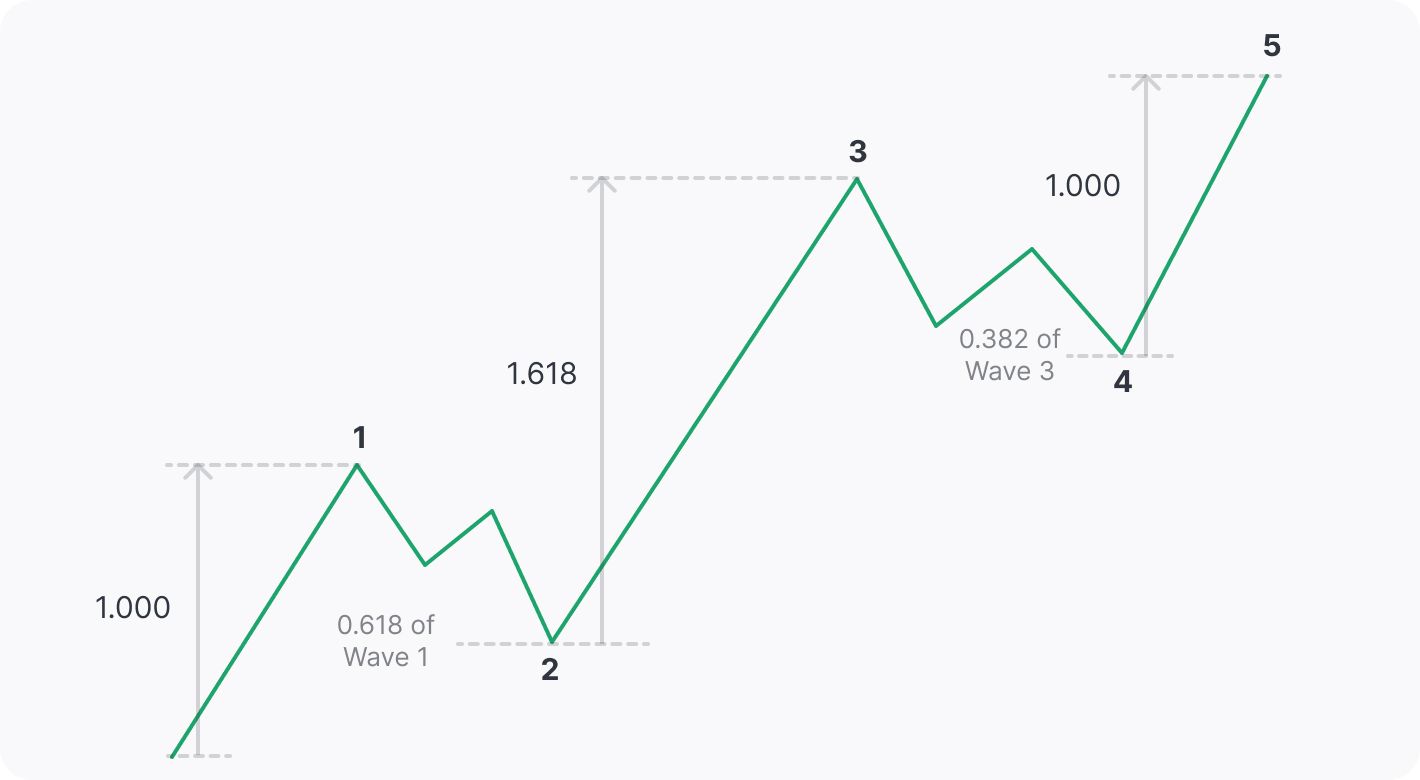

Impulsive Waves: Yeh waves prevailing trend ki taraf chalti hain aur paanch chhotay waves 1, 2, 3, 4, aur 5 se mil kar banti hain. In mein se waves 1, 3, aur 5 trend ki taraf chalti hain, jab ke waves 2 aur 4 pullbacks ke taur par kaam karti hain.

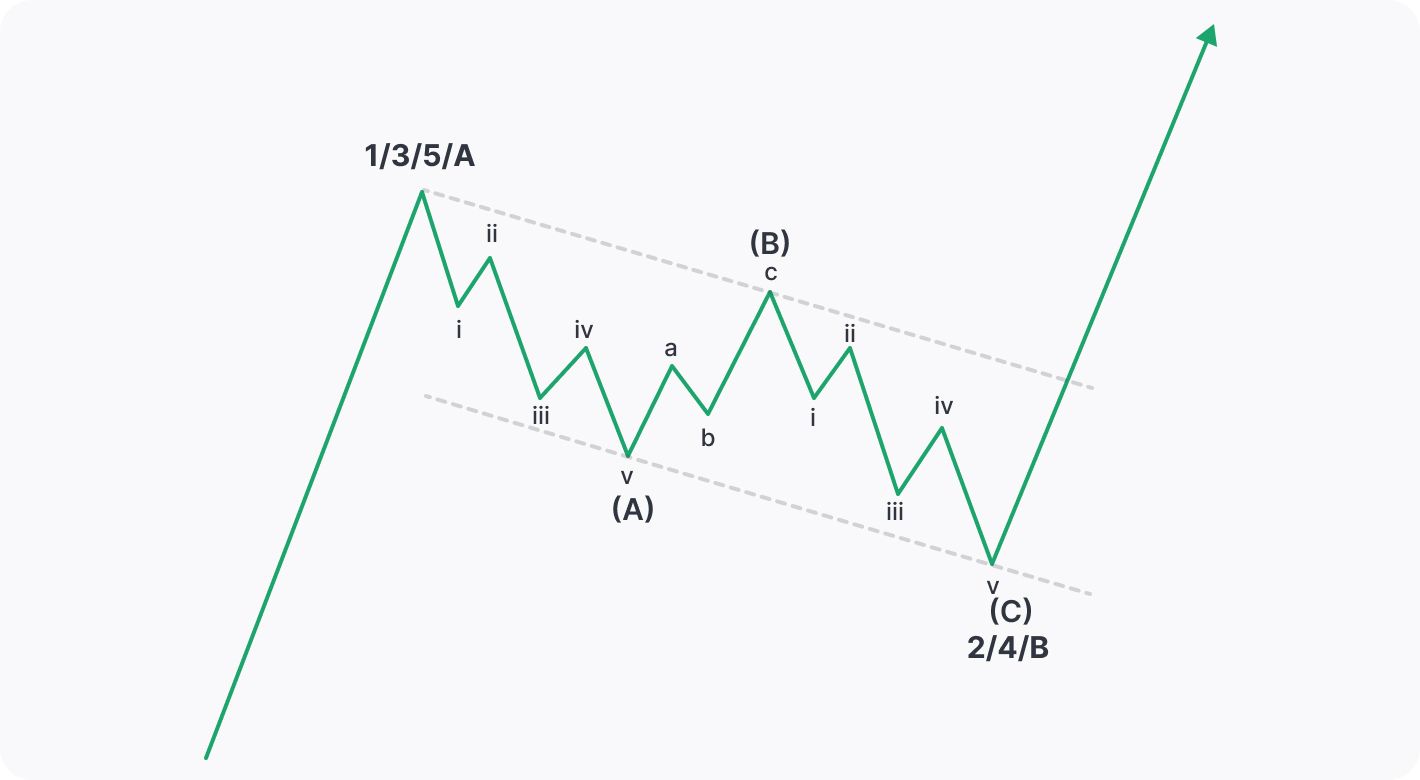

Corrective Waves: Yeh waves prevailing trend ke khilaaf chalti hain aur teen chhotay waves A, B, aur C se mil kar banti hain. Yeh waves temporary counter-trend movements ko represent karte hain jo ke larger trend ke dobara shuru hone se pehle aati hain.

Fibonacci Ratios

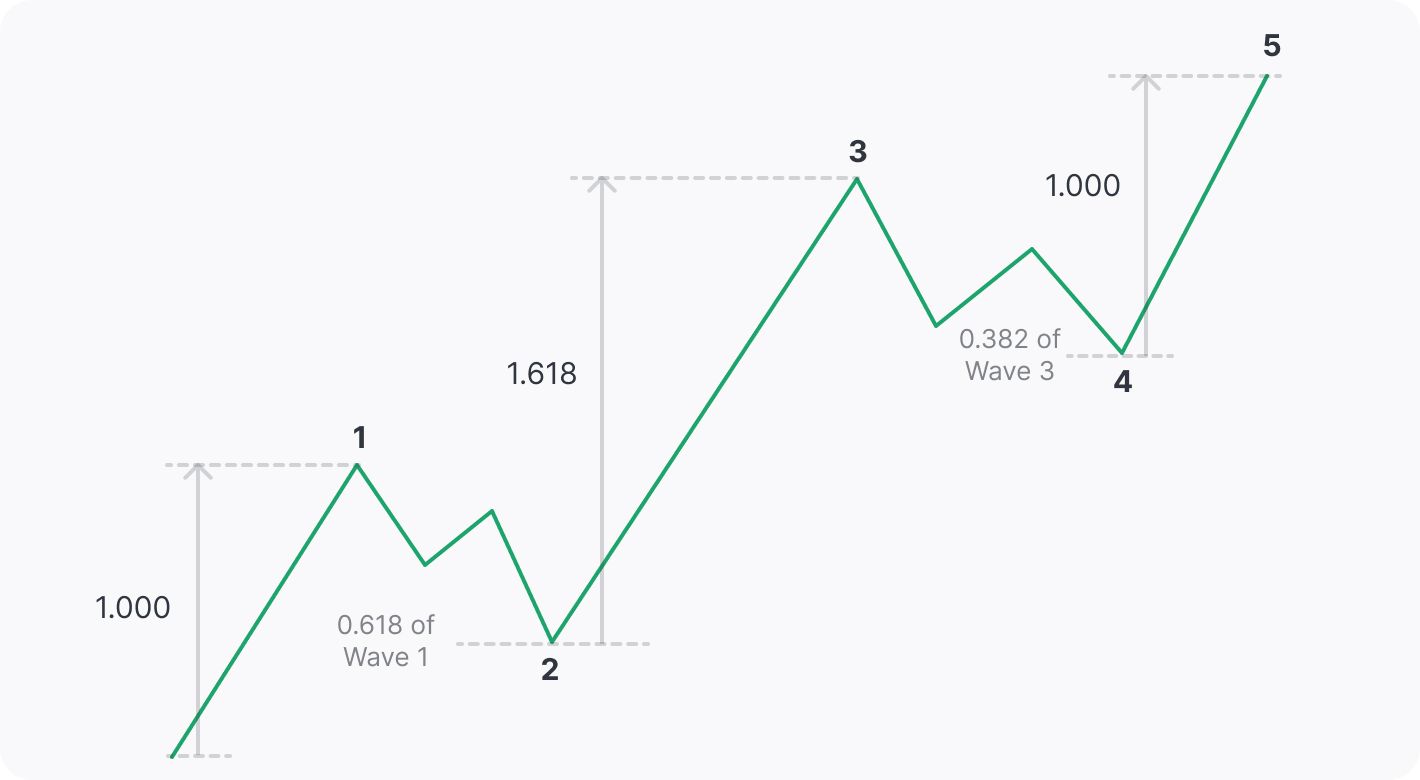

Elliott Wave Theory mein ek ahem hissa Fibonacci ratios ka istemal potential reversal aur extension levels ko identify karne ke liye hota hai. Elliott ne dekha ke yeh ratios natural phenomena mein bhi mojood hoti hain aur unka maali markets mein bhi ahem kirdar hota hai. Elliott Wave analysis mein istemal hone wale common Fibonacci ratios mein 0.618, 1.618, 2.618, aur 4.236 shamil hain.

Wave Patterns

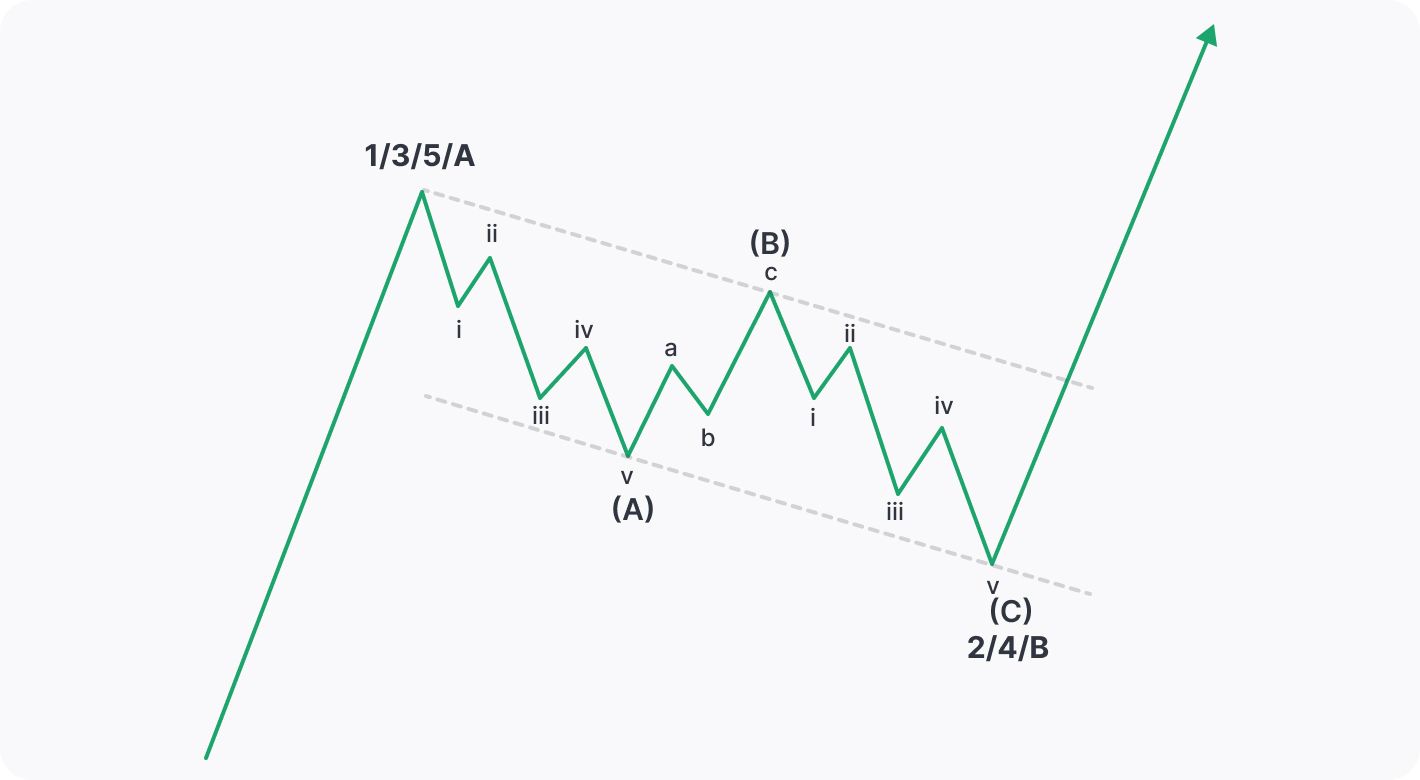

Elliott Wave Theory kai alag wave patterns identify karti hai, har ek pattern ke apne khaas rules aur guidelines hoti hain. Sab se basic pattern 5-3 wave pattern hai, jisme impulsive wave ko ek corrective wave follow karta hai. In patterns mein variations aur combinations hoti hain jo market ki harkaton ko nuqta nigah se analyze karne ki ejazat deti hain.

Practical Application

Traders aur analysts Elliott Wave Theory ko trading decisions banane ke liye istemal karte hain taake wo market mein entry aur exit points identify kar sakein. Jab price chart ki analysis ki jati hai, practitioners recognizable wave patterns dhoondhte hain aur in patterns ki validity ko confirm karne ke liye Fibonacci retracement aur extension tools ka istemal karte hain. Current wave count ko samajhne aur Fibonacci levels se milti julti targets ko samajhne ke zariye, traders defined risk aur reward ratios ke saath trading strategies develop kar sakte hain.

Challenges aur Criticisms

Jab ke Elliott Wave Theory ko aam tor par accept kia jata hai, iske kuch challenges aur criticisms bhi hain. Isme wave counting mein subjectivity ka masla hota hai. Alag analysts ek hi price data ko different taur par interpret kar sakte hain, jo ke alag wave counts aur predictions tak le jata hai. Iske ilawa, wave patterns ki complexity aur subjective judgment par bharosa karne ke liye is theory ko samajhna beginners ke liye mushkil ho sakta hai.

Principles of Elliott Wave Theory

Is theory ki bunyad yeh hai ke market ke daamoun ki harkatein itefaqi nahi hoti balkeh insano ki psychology, jazbat, aur crowd behavior ki natural tarteeb ko follow karti hain. Elliott ke mutabiq, market trends paanch chhotay waves mein hoti hain, jo ke impulsive waves aur corrective waves mein taqseem kiye ja sakte hain.

Impulsive Waves: Yeh waves prevailing trend ki taraf chalti hain aur paanch chhotay waves 1, 2, 3, 4, aur 5 se mil kar banti hain. In mein se waves 1, 3, aur 5 trend ki taraf chalti hain, jab ke waves 2 aur 4 pullbacks ke taur par kaam karti hain.

Corrective Waves: Yeh waves prevailing trend ke khilaaf chalti hain aur teen chhotay waves A, B, aur C se mil kar banti hain. Yeh waves temporary counter-trend movements ko represent karte hain jo ke larger trend ke dobara shuru hone se pehle aati hain.

Fibonacci Ratios

Elliott Wave Theory mein ek ahem hissa Fibonacci ratios ka istemal potential reversal aur extension levels ko identify karne ke liye hota hai. Elliott ne dekha ke yeh ratios natural phenomena mein bhi mojood hoti hain aur unka maali markets mein bhi ahem kirdar hota hai. Elliott Wave analysis mein istemal hone wale common Fibonacci ratios mein 0.618, 1.618, 2.618, aur 4.236 shamil hain.

Wave Patterns

Elliott Wave Theory kai alag wave patterns identify karti hai, har ek pattern ke apne khaas rules aur guidelines hoti hain. Sab se basic pattern 5-3 wave pattern hai, jisme impulsive wave ko ek corrective wave follow karta hai. In patterns mein variations aur combinations hoti hain jo market ki harkaton ko nuqta nigah se analyze karne ki ejazat deti hain.

Practical Application

Traders aur analysts Elliott Wave Theory ko trading decisions banane ke liye istemal karte hain taake wo market mein entry aur exit points identify kar sakein. Jab price chart ki analysis ki jati hai, practitioners recognizable wave patterns dhoondhte hain aur in patterns ki validity ko confirm karne ke liye Fibonacci retracement aur extension tools ka istemal karte hain. Current wave count ko samajhne aur Fibonacci levels se milti julti targets ko samajhne ke zariye, traders defined risk aur reward ratios ke saath trading strategies develop kar sakte hain.

Challenges aur Criticisms

Jab ke Elliott Wave Theory ko aam tor par accept kia jata hai, iske kuch challenges aur criticisms bhi hain. Isme wave counting mein subjectivity ka masla hota hai. Alag analysts ek hi price data ko different taur par interpret kar sakte hain, jo ke alag wave counts aur predictions tak le jata hai. Iske ilawa, wave patterns ki complexity aur subjective judgment par bharosa karne ke liye is theory ko samajhna beginners ke liye mushkil ho sakta hai.