What's the Hook Reversal Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Hook Reversal Pattern Hook Reversal Pattern ek technical analysis concept hai jise traders use karte hain market trends ko predict karne ke liye. Is pattern ka naam isliye hai kyunki yeh market trend ke reversal ko indicate karta hai. Jab market mein Hook Reversal Pattern dekha jata hai, toh yeh signal deta hai ki current trend khatam ho sakta hai aur naya trend shuru hone wala hai. Is pattern ko samajhne ke liye, traders ko price charts par dhyan dena hota hai. Hook Reversal Pattern ka ek common example hai jab price chart par ek downtrend ke baad ek chhota sa price drop hota hai, phir ek sudden uptrend start hota hai. Yeh indicate karta hai ki sellers ki dominance kam ho rahi hai aur buyers ka control badh raha hai. Is pattern ko identify karne ke liye, traders ko price movements ko closely observe karna padta hai. Hook Reversal Pattern ki pehchan karne mein experience aur technical analysis ki samajh hona zaroori hai. Yeh pattern market volatility ko capture karne mein madad karta hai aur traders ko potential trend reversal ke bare mein alert rakhta hai. Lekin hamesha yaad rahe ke kisi bhi pattern ko rely karne se pehle, thorough analysis aur risk management important hote hain. Hook Reversal Pattern ka istemaal karne ka kuch faiday hain. Pehle toh, yeh traders ko market trends ke possible changes ke baare mein agah karta hai. Iski madad se, wo anticipate kar sakte hain agar ek trend khatam ho raha hai aur naya shuru hone wala hai. Dusri baat, Hook Reversal Pattern market volatility ko capture karne mein madad karta hai. Jab yeh pattern dikhta hai, toh yeh indicate karta hai ki market mein sudden shifts ho sakti hain. Isse traders ko opportunities milte hain profits kamane ke liye, agar wo is change ko effectively capture kar sakein. Is pattern ka istemaal karke, traders risk management ko bhi improve kar sakte hain. Agar wo trend reversal ko sahi se identify karte hain, toh wo apne trades ko adjust kar sakte hain aur potential losses ko minimize kar sakte hain. Lekin yaad rahe ke har trading strategy ki tarah, Hook Reversal Pattern bhi puri research aur samajhdari ke saath istemaal hona chahiye. Market mein uncertainties hote hain, isliye prudent aur informed decisions lena crucial hai.Toh, Hook Reversal Pattern traders ke liye ek useful tool ho sakta hai trend changes ko anticipate karne mein, lekin prudent trading decisions ke liye thorough research aur market understanding bhi zaroori hai.

-

#3 Collapse

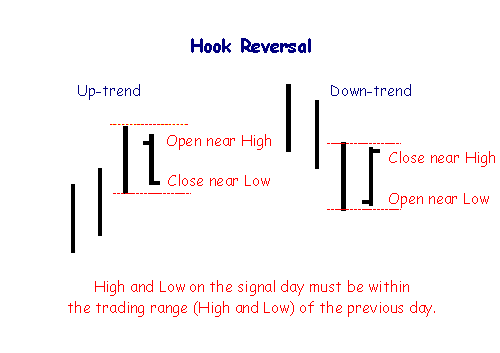

IDENTIFICATION OF HOOK REVERSAL PATTERN.Dear fellow friends yeh eik bahut hi importance pattern hay jo market ke andar ose time frame mein Banta Hai Jab market aik uptrend ki series banati Hai, yah downtrend ki series banati Hai Tou Jab woh apna yah trend braek kerti Hai Tou Uss key baad hook reversal candlestick pattern banta hai.ess market mein jo Hamen bahut hi zyada information provide karta hai aur Agar Ham is market mein jyada time active Hain To Ham is market sey ess pattern se bahut positive profit kama sakte hain.Jab Ham market Mein trading start kerty hain tou start karne se pahle Ham market se related jitne bhi important patterns hote hain unko carefully study kar ke apni trading per apply Karen.Ta kay mistake say bach sakein. FORMATION AND IDENTIFICATION OF HOOK REVERSAL PATTERN. market mein trading start kerty hi pattern ki identity bhout zaroori hota hy.yeh pattern hamein short term ya long term trade ka signal deta hay, Jis main first candle already continue market trend ki long body ka form hona bhout zarori ha. Aur ess kay baad "2nd candle ka 1st candle ki real body k ander he craete hona bhot zarori ha. 2nd candle hamein market kay related signal deta hay ky already chalta howa market trend mein buyer/seller entry li ha, but confrimation k liye hamein 3rd candle ka first candle k high ko break ker kay closing dena zarori ha aur trader ko 4th candle ager 3rd na breakout dia ha to open kerni chaheye.ess tarah ess pattern ki completion ho jaye ge.IMPORTANT TRADING FACTORS.Trading movements ki verification kay leye yeh pattern traders ka favourite pattern mana jata hy.yeh pattern trading kerty hoyuy bahot kam create hota hai specially jab trend change hony wala ho tou wahan sy hook pattern create hona lag jata hai tou wahan per ham new trend ko follow kerty huey trade open ker sakty hain. hook pattern candle stick pattern main hook shape main bhi create hota hai aur inverted hook ki shape main bhi create hota hai tou aesy main market ky trend ky reversal ki confirmation hoti hai tou ham new trend per trade open ker sakty hain.agar peak ya lowest point of reversal per trade op-en ker de jaye tu maximum profit milk jata hy. -

#4 Collapse

Hook Reversal candlestick Pattern: Hello!Dear forex friends Hook reversal candlestick pattern two candlestick per mushtamil hota hy isko analyse karna bohot asan hota hy is mein sabse pehly is downtrend aur uptrend Ka progress mein hona bohot zaruri hy dusre numbers per pattern per mushtamil hona zaruri hai aur teesra second candle ka first candle ke andar banna zaruri hota hay number aur chote numbers per second candle k higher low aur lower high hona chahiye ye market trend k colour ko red (down trend) ko green(uptrend) me tabdeel ker deta hy is mein dono candle k size me ziyada fraq ni hota,yeh green(uptrend) ko red(downtrend) mein tabdeel ker deta ha.Hook reversal pattern bullish aur bearish dono ho sakty hain. Lekin bullish and bearish hook reversal pattern similar hota hy Lekin pattern ki formation mein opposite hota hy. Types of hook reversal candlestick pattern: Bullish hook reversal candlestick pattern: Dear my sisters Bullish hook reversal candlestick pattern us waqat banta hay jab market downtrend ke andar move kar rahi ho aur vahan per jo bearish ki candles ka close hy to us sy thora upar ek bullish candles open ho yani ky inke close or open mein thora sa fark ho jo bullish candle bana hai yeh thoda sa upar ho previous bearish candle ke close se to fir uske baad is mein bullish candle ki aik series banti jaye upar ki taraf to us waqat hook reversal pattern banta hai aur is market mein agar hum buy ki trade lagate hain to hum kuch acha profit hasil ker sakte hain. Bearish Hook reversal candlesick pattern: Dear trading partners Bullish hook reversal candlestick pattern us waqat banta hy jab bullish candlestick ki aik series ban rahi ho aur market up trend ke andar ho to uske baad bullish candles jahan par close hui hy to us se thora niche bearish candle open ho jaati hai aur phir bearish candles ke open hone ke baad bearish candle uski ek series ban jaati hai aur market downtrend ke andar chale jaati hy To is waqat hum ko jo chart main pattern milta hai wo bearish hook reversal pattern hota Hain aur is se hum bohot hi zyada faida utha sakte hain agar hum is mein sell ki trade lagate hein to Humen aik acha profit ho sakta hai. -

#5 Collapse

Hook Reversal Pattern ek technical analysis tool hai jo stock market ya anya financial markets mein istemal hota hai. Is pattern ka upyog trend reversal points ko pehchanne ke liye kiya jata hai.Hook Reversal Pattern mein, price chart par ek "hook" jaisa pattern ban jata hai. Is pattern mein, stock price ya anya asset ka price pehle ek uptrend mein hota hai, phir ek sharp decline ya pullback hota hai, aur phir price wapas uptrend ki taraf move karta hai.Is pattern ki wajah se, traders ko ye signal milta hai ki trend reversal hone ki sambhavna hai. Agar price chart par Hook Reversal Pattern dikhta hai, toh traders iska istemal karke long positions ko exit kar sakte hain ya short positions par enter kar sakte hain.Yeh pattern technical analysis ka hissa hai aur traders ki taraf se istemal kiya jata hai, isliye agar aap iske bare mein aur gehri jankari chahte hain, toh aapko ek financial expert ya stock market analyst se sampark karna chahiye. What's the Hook Reversal Pattern Hook Reversal Pattern ek candlestick pattern hai, jisme ek specific candlestick formation ko dekha jata hai. Is pattern mein, ek uptrend ke baad price sharp decline karta hai aur ek "hook" ya "reversal" pattern banata hai.Hook Reversal Pattern ka mukhya characteristic hai ki ismein ek candlestick ki body, wicks aur shadows ki specific formation hoti hai. Is pattern mein, price chart par ek bullish (uptrend) candlestick followed by ek bearish (downtrend) candlestick hoti hai, jiska body pehle candlestick ki body se neeche tak extend hota hai. Dusri candlestick ki body pehli candlestick ki body se upar tak extend hoti hai. Is tarah se, hook jaisa pattern ban jata hai.Hook Reversal Pattern ki wajah se, traders ko potential trend reversal ka signal milta hai. Agar price chart par is pattern ka formation dikhta hai, toh traders iska istemal karke trading decisions le sakte hain. Agar uptrend mein hain, toh is pattern ke formation ke baad traders apne long positions ko exit kar sakte hain ya short positions par enter kar sakte hain.Is pattern ki sahi tashkhees ke liye, traders ko candlestick charting aur technical analysis ke basic concepts aur principles par bhi gahri samajh honi chahiye. Isliye, agar aap is pattern ka istemal karne mein interested hain, toh aapko candlestick patterns aur technical analysis ki puri samajh honi chahiye. -

#6 Collapse

Introduction of Hook Reversal Pattern Hook Reversal Pattern, yaani "Hook Ulatnay ka Pattern," ek technical analysis pattern hai jo financial markets mein istemal hota hai taake traders aur investors ko price trends aur market reversals ke baray mein agah kare. Is pattern ka maqsad hota hai ke market ki mukhtalif phases ko pehchan karne mein madad milti hai, taa ke aap sahi waqt par trade kar saken. Hook Reversal Pattern Key Features:

Hook Reversal Pattern Key Features: - Price Trends: Hook Reversal Pattern market trends ko analyze karne ke liye istemal hota hai. Ismein price movement ko dekha jata hai, jo traders ko market ke future direction ke baray mein sochne mein madadgar hota hai.

- Short-Term Indicator: Is pattern ka zyada tar istemal short-term trading ke liye hota hai. Yani, traders is pattern ko market ke short-term behavior ko predict karne ke liye istemal karte hain.

- Hook Shape: Hook Reversal Pattern ka naam is pattern ki characteristic "hook" shape se aaya hai. Ismein price ka sudden change hota hai jiska result hota hai ke price trend ko reverse hota hai.

- Bullish Hook Reversal: Yeh pattern market ke bearish (girawat) trend ke baad hota hai. Ismein price ka sudden upward movement hota hai, jo market mein bullish trend ki shuruaat darust karta hai.

- Bearish Hook Reversal:Is pattern mein market ke bullish (baraqat) trend ke baad price ka sudden downward movement hota hai, jo market ko bearish trend ki taraf le jata hai.

- Pattern Recognition: Sab se pehla kadam yeh hota hai ke traders ko market chart ko analyze karna hota hai taa ke woh Hook Reversal Pattern ko pehchan saken. Is pattern ko samajhne ke liye traders ko market price movement aur volume data ko dekhte hain.

- Confirmation:Jab traders Hook Reversal Pattern ko pehchan lete hain, to woh isko confirm karne ke liye doosri technical indicators aur tools ka istemal karte hain, jaise ke moving averages, RSI, aur MACD.

- Trade Entry: Agar pattern ko confirm kiya jata hai aur traders ko lagta hai ke market reverse hone wala hai, to woh trade entry points ko determine karte hain aur trade karte hain.

- Risk Management: Trading mein risk management bohat ahem hota hai. Traders apne trades ko control karne ke liye stop-loss orders aur take-profit orders ka istemal karte hain.

-

#7 Collapse

Introduction of Hook Reversal Pattern Hook Reversal Pattern, yaani "Hook Ulatnay ka Pattern," ek technical analysis pattern hai jo financial markets mein istemal hota hai taake traders aur investors ko price trends aur market reversals ke baray mein agah kare. Is pattern ka maqsad hota hai ke market ki mukhtalif phases ko pehchan karne mein madad milti hai, taa ke aap sahi waqt par trade kar saken. Hook Reversal Pattern Key Features:

Hook Reversal Pattern Key Features: - Price Trends: Hook Reversal Pattern market trends ko analyze karne ke liye istemal hota hai. Ismein price movement ko dekha jata hai, jo traders ko market ke future direction ke baray mein sochne mein madadgar hota hai.

- Short-Term Indicator: Is pattern ka zyada tar istemal short-term trading ke liye hota hai. Yani, traders is pattern ko market ke short-term behavior ko predict karne ke liye istemal karte hain.

- Hook Shape: Hook Reversal Pattern ka naam is pattern ki characteristic "hook" shape se aaya hai. Ismein price ka sudden change hota hai jiska result hota hai ke price trend ko reverse hota hai.

- Bullish Hook Reversal: Yeh pattern market ke bearish (girawat) trend ke baad hota hai. Ismein price ka sudden upward movement hota hai, jo market mein bullish trend ki shuruaat darust karta hai.

- Bearish Hook Reversal:Is pattern mein market ke bullish (baraqat) trend ke baad price ka sudden downward movement hota hai, jo market ko bearish trend ki taraf le jata hai.

- Pattern Recognition: Sab se pehla kadam yeh hota hai ke traders ko market chart ko analyze karna hota hai taa ke woh Hook Reversal Pattern ko pehchan saken. Is pattern ko samajhne ke liye traders ko market price movement aur volume data ko dekhte hain.

- Confirmation:Jab traders Hook Reversal Pattern ko pehchan lete hain, to woh isko confirm karne ke liye doosri technical indicators aur tools ka istemal karte hain, jaise ke moving averages, RSI, aur MACD.

- Trade Entry: Agar pattern ko confirm kiya jata hai aur traders ko lagta hai ke market reverse hone wala hai, to woh trade entry points ko determine karte hain aur trade karte hain.

- Risk Management: Trading mein risk management bohat ahem hota hai. Traders apne trades ko control karne ke liye stop-loss orders aur take-profit orders ka istemal karte hain.

-

#8 Collapse

What is hook reversal patterrn ye ek specialized examination instrument hai jo securities exchange ya anya monetary business sectors mein istemal hota hai. Is design ka upyog pattern inversion focuses ko pehchanne ke liye kiya jata hai.Hook Inversion Example mein, cost outline standard ek "snare" jaisa design boycott jata hai. Is design mein, stock cost ya anya resource ka cost pehle ek upturn mein hota hai, phir ek sharp decay ya pullback hota hai aur phir cost wapas upswing ki taraf move karta hai.Is design ki wajah se dealers ko ye signal milta hai ki pattern inversion sharpen ki sambhavna hai. Agar cost diagram standard Snare Inversion Example dikhta hai, toh brokers iska istemal karke long positions ko exit kar sakte hain ya short positions standard enter kar sakte hain.Yeh design specialized examination ka hissa hai aur dealers ki taraf se istemal kiya jata hai, isliye agar aap iske exposed mein aur gehri jankari chahte hai toh aapko ek monetary master ya financial exchange examiner se sampark karna chahiye. what is bullish reversal hook Bullish reversal hook candle design us waqat banta h jb market down trend ke andar move kar rahi ho aur vahan per jo negative ki candles ka close hy to us sy thora upar ek bullish candles open ho yani ky inke close or open mein thora sa fark ho jo bullish light bana hai yeh thoda sa upar ho past negative flame ke close se to fir uske baad is mein bullish candle ki aik series banti jaye upar ki taraf to us waqat snare inversion design banta hai aur is market mein agar murmur purchase ki exchange lagate hain to murmur kuch acha benefit hasil ker sakte hain. what is bearish reversal hook patternBullish reversal hook candle design us waqat banta h jb market down trend ke andar move kar rahi ho aur vahan per jo negative ki candles ka close hy to us sy thora upar ek bullish candles open ho yani ky inke close or open mein thora sa fark ho jo bullish light bana hai yeh thoda sa upar ho past negative flame ke close se to fir uske baad is mein bullish candle ki aik series banti jaye upar ki taraf to us waqat snare inversion design banta hai aur is market mein agar murmur purchase ki exchange lagate hain to murmur kuch acha benefit hasil ker sakte hain. how to behave trader during that trend Sab se pehla kadam yeh hota hai ke merchants ko market graph ko investigate karna hota hai taa ke woh Snare Inversion Example ko pehchan saken. Is design ko samajhne ke liye dealers ko market cost development aur volume information ko dekhte ha Hit brokers Snare Inversion Example ko pehchan lete hain, to woh isko affirm karne ke liye doosri specialized pointers aur instruments ka istemal karte hain, jaise ke moving midpoints, RSI, aur MACD. Agar design ko affirm kiya jata hai aur merchants ko lagta hai ke market invert sharpen wala hai, to woh exchange passage focuses ko decide karte hain aur exchange karte hain. Exchanging mein risk the executives bohat ahem hota hai. Brokers apne exchanges ko control karne ke liye stop-misfortune orders aur take-benefit orders ka istemal karte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

Snare Inversion Example Snare Inversion Example ek specialized investigation idea hai jise dealers use karte hain market patterns ko anticipate karne ke liye. Is design ka naam isliye hai kyunki yeh market pattern ke inversion ko demonstrate karta hai. Hit market mein Snare Inversion Example dekha jata hai, toh yeh signal deta hai ki latest thing khatam ho sakta hai aur naya pattern shuru sharpen wala hai. Is design ko samajhne ke liye, brokers ko cost outlines standard dhyan dena hota hai. Snare Inversion Example ka ek normal model hai hit cost outline standard ek downtrend ke baad ek chhota sa cost drop hota hai, phir ek abrupt upswing start hota hai. Yeh show karta hai ki dealers ki predominance kam ho rahi hai aur purchasers ka control badh raha hai. Is design ko distinguish karne ke liye, dealers ko cost developments ko intently notice karna padta hai. Snare Inversion Example ki pehchan karne mein experience aur specialized investigation ki samajh hona zaroori hai. Yeh design market unpredictability ko catch karne mein madad karta hai aur brokers ko potential pattern inversion ke uncovered mein alert rakhta hai. Lekin hamesha yaad rahe ke kisi bhi design ko depend karne se pehle, exhaustive investigation aur risk the executives significant hote hain. Snare Inversion Example ka istemaal karne ka kuch faiday hain. Pehle toh, yeh brokers ko market patterns ke potential changes ke baare mein agah karta hai. Iski madad se, wo expect kar sakte hain agar ek pattern khatam ho raha hai aur naya shuru sharpen wala hai. Dusri baat, Snare Inversion Example market instability ko catch karne mein madad karta hai. Punch yeh design dikhta hai, toh yeh demonstrate karta hai ki market mein abrupt movements ho sakti hain. Isse dealers ko open doors milte hain benefits kamane ke liye, agar wo is change ko actually catch kar sakein. Is design ka istemaal karke, dealers risk the board ko bhi improve kar sakte hain. Agar wo pattern inversion ko sahi se distinguish karte hain, toh wo apne exchanges ko change kar sakte hain aur potential misfortunes ko limit kar sakte hain. Lekin yaad rahe ke har exchanging procedure ki tarah, Snare Inversion Example bhi puri research aur samajhdari ke saath istemaal hona chahiye. Market mein vulnerabilities hote hain, isliye judicious aur informed choices lena significant hai.Toh, Snare Inversion Example merchants ke liye ek helpful instrument ho sakta hai pattern changes ko expect karne mein, lekin reasonable exchanging choices ke liye careful examination aur market understanding bhi zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:59 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим