Limitations of triple top candlestick pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

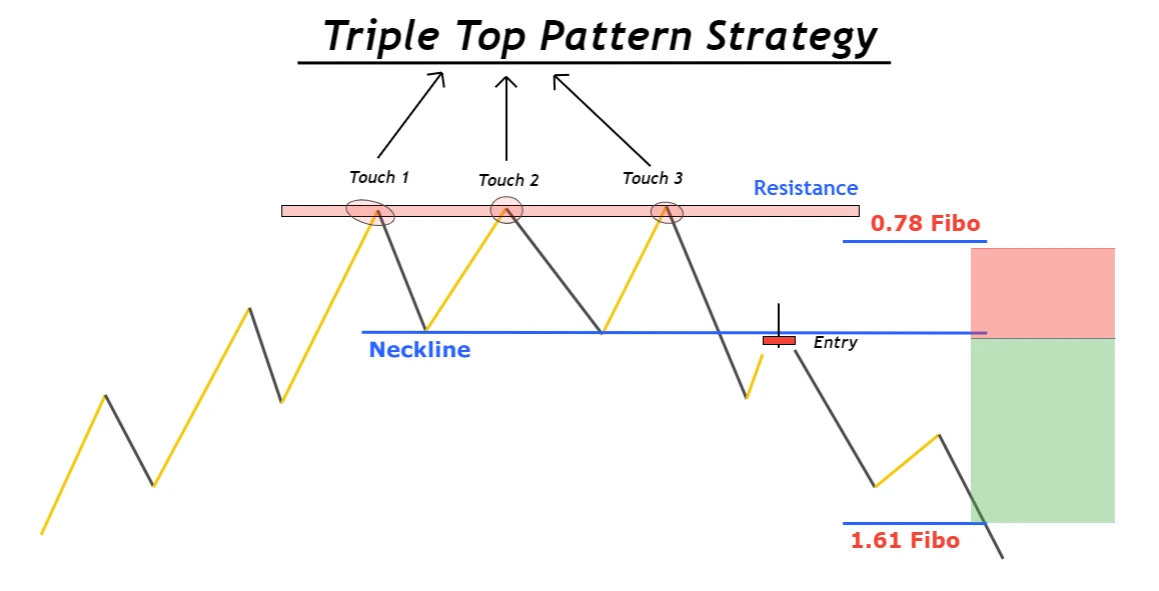

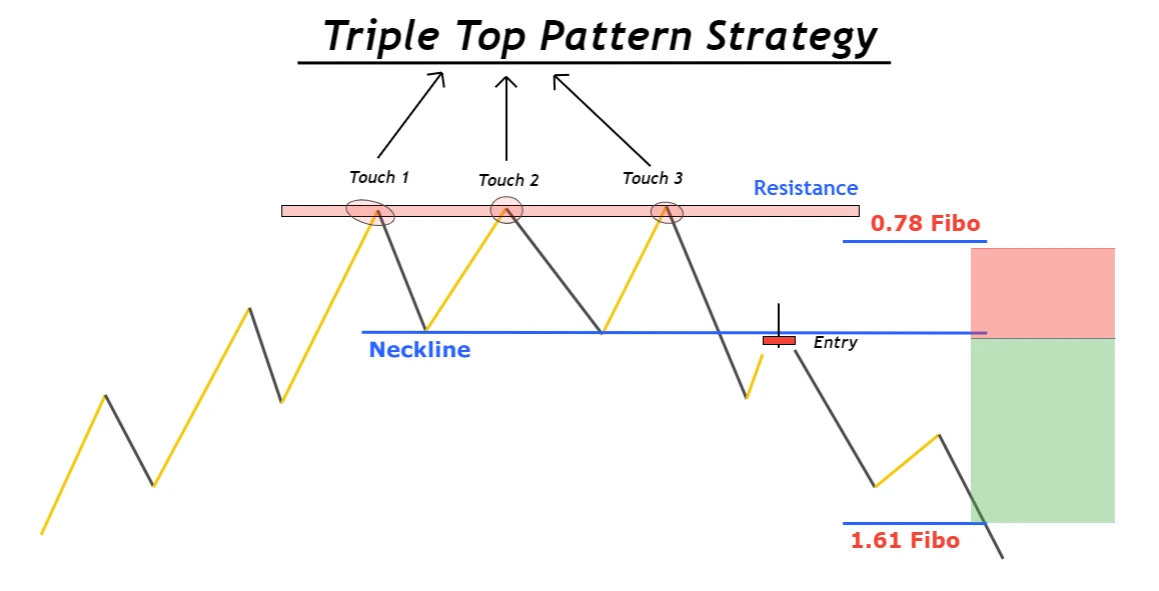

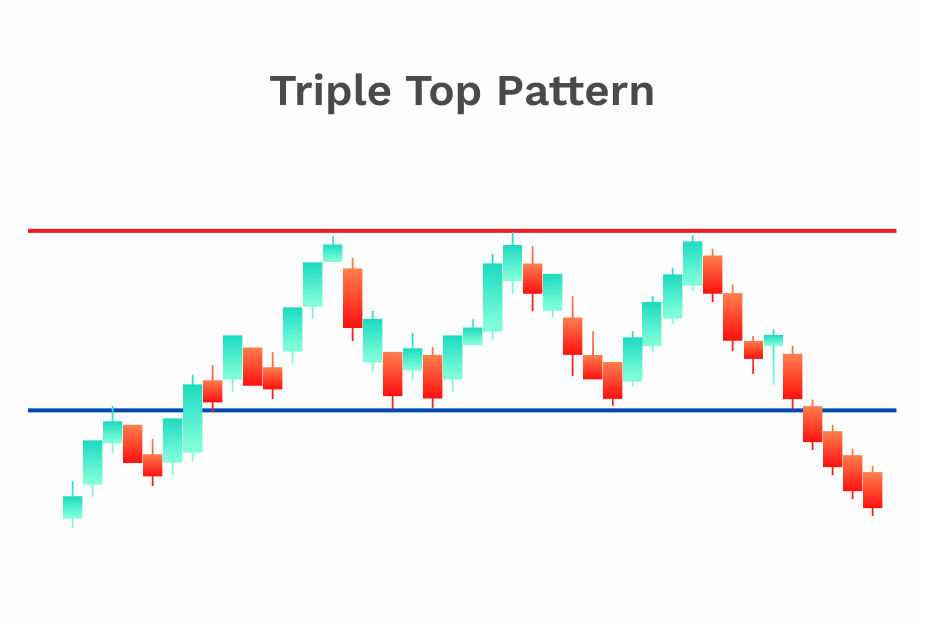

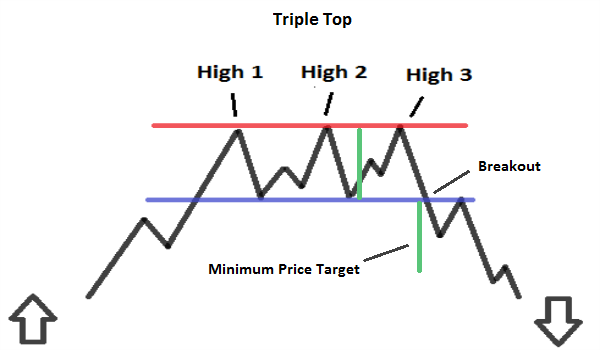

LIMITATIONS OF USING TRIPLR TOP CANDLESTICK PATTERNIntroduction Triple top pattern trading mein istemal hony wala aik famous technical analysis ka pattern hai jo market mein price reversals ko identify karne ke liye istemal hoti hai. Lekin, triple top pattern ke bhi kuch limitations hain jo traders ko samajhna zaroori hai. In limitations ko samajh kar traders apni trading strategies ko improve kar sakte hain aur nuksan se bach sakte hain. Limitations False Signals: Triple top pattern kabhi-kabhi jhoothi signals de sakti hai. Yani ke ye pattern dikhai dene par price reversal hona expected hota hai, lekin ye hamesha sahi nahi hota. Iska matlab hai ke agar aap sirf triple top pattern par bharosa karenge to kabhi-kabhi aapko nuksan ho sakta hai. Lambhi Mudad: Triple top pattern ko pehchanne mein waqt lag sakta hai. Is pattern ke formation mein lambe arsey lag sakte hain, aur is waqt mein market ki kai aur cheezein bhi ho sakti hain. Isi doran trader ko nuksan ka khatra ho sakta hai. Volume Analysis Ki Zarurat: Triple top pattern ko samajhne ke liye volume analysis bhi ki zarurat hoti hai. Agar volume analysis nahi ki jati, to false signals ka khatra badh jata hai. Lekin volume data access na ho to iski samjhna mushkil ho jati hai. Market Conditions: Triple top pattern sirf specific market conditions mein effective hota hai. Aisa nahi hai ke ye har samay kaam karega. Market mein volatility, liquidity, aur overall conditions par iska asar hota hai. Risk Management: Triple top pattern ki pehchan ke baad bhi, risk management ka hona bahut zaroori hai. Agar aap apni trades ko control nahi karenge to nuksan ho sakta hai. Is pattern ko samajh kar bhi, trader ko stop-loss aur take-profit levels ka theek se istemal karna chahiye. Market Sentiment: Triple top pattern sirf price action ko dekhta hai, lekin market sentiment ko nazar andaz karta hai. Market sentiment bhi price movement ko influence karta hai, isliye traders ko is factor ko bhi consider karna chahiye. Over-Trading: Triple top pattern ki khoj mein traders over-trading kar sakte hain. Yani ke woh har choti si movement ko triple top pattern ke hisab se interpret karke trade kar sakte hain, jo ki nuksan de sakta hai. Confirmation Ki Zarurat: Triple top pattern ki pehchan karne ke baad, traders ko confirmation ki bhi zarurat hoti hai. Iska matlab hai ke doosri technical indicators aur analysis tools ka bhi istemal karna chahiye. Market News: Market mein unexpected news events bhi hote hain jo pattern ko affect kar sakte hain. Triple top pattern sirf historical price data par based hota hai, lekin market mein naye developments bhi important hote hain. Summary In limitations ko samajh kar, traders ko alert rehna chahiye aur aik comprehensive trading strategy banani chahiye jo sirf triple top pattern par hi depend nahi karti. Market mein hone wale changes ko bhi consider karna zaroori hai aur risk management ko bhi priority deni chahiye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hanging man candle Hanging Man Flame Hanging man candle uss waqat banti hai, punch bullish pattern k dowran security open sharpen ke baad numaya peak standard nechay chali jati hai, lekin clamor k ahtetam standard costs bullish close ho jate hen, iss prosses mein anay wali candle aik lambi nechay saye (lower shadow) ke sath murabba lollypop ki tarah dikhaye deti hai. Mandarjabala candle agar bullish pattern ya excessive cost region principal banta hai, to iss ko hanging man candle kehte hen, jo k negative candle ki hososeyat rakhti hai aur negative pattern inversion ka sabab bhi banti hai. Hanging man light ka taluq umbrella family se hai, jiss fundamental candle ki potential gain standard little genuine body hoti hai, punch k lower standard aik long shadow hota hai. Candle k genuine body k upper side standard shadow ka nahi hona chaheye, lekin aik little wick satisfactory hai. Candle ki Arrangement Hanging man candle aik signle candle design hai, jiss ka design bullish ya exorbitant costs region principal ziada moasar hota hai. Ye candle baqi umbrella aur backwards umbrealla candles ki tarah pattern inversion ka sabab banti hai. Costs primary candle ki development darjazzel tarah se hoti hai: Hanging Man Light: Hanging man candle bullish pattern principal achanak ziada selling pressure ki waja se banti hai, jiss fundamental candle ki ziada tar hososeyat negative pattern ki hoti hai. Ye candle little genuine body principal hoti hai, jiss ka lower side standard aik long shadow hota hai. Candle ki genuine body bullish aur negative dono ho sakti hai, lekin ye candle negative flame greetings shumar hoti hai. Clarification Hanging man candle aik negative pattern inversion ka single candle patteren hai, jo iss baat ki nishandahi karti hai, k stock apni base level tak pahonch gaya hai, aur costs pattern tabdeel karne ki position mein hai. Hanging man flame khaas peak standard, yeh ishara karta hai, ke dealers market mein ziada dynamic ho chuke hen, jiss se wo costs ko akhari base level tak push karte hen. Lekin baad principal market fundamental purchasers ki pressure ya tadad primary izafa sharpen ki waja se costs racket k akhtetam tak wapis upper chali jati hai. Costs k aghaz primary selling aur baad fundamental purchasing pressure ki waja se light k lower side standard aik long shadow banta hai, jo k arzi tawar standard costs ka solidification time hota hai, jiss ka baad ye flame costs k negative pattern inversion ka zarya banta hai. Exchanging Costs graph k top region principal lollypop shakal ki banne wali aik single example light jiss k upper side standard aik little body hoti hai, aik hanging man flame hoti hai, jo costs ko mazeed bullish jane se rok kar pattern inversion ka sabab banti hai. Ye light market fundamental purchasers ka ikhtetam aur dealers ka costs ko up push karne ka ishara hota hai. Flame standard exchanging se pehle pattern affirmation k leye aik to costs ka top hona chaheye, hit k doara aik negative genuine body wali candle bhi honi chaheye. Lekin hanging man candle k baad bullish flame k banne se ye candle invalid ho jayegi. Ye single flame design sharpen ki waja se pattern ki affirmation CCI marker aur Stochastic oscillator se bhi ki ja sakti hai, jo k overbought zone primary hona chaheye. Stop Misfortune design k sab se upper side ya candle k genuine body k top se two pips above set karen. -

#4 Collapse

TRIPLE TOP PATTERNKI LIMITATION:-Ghalat Signals: Triple top candlestick pattern kabhi-kabhi ghalat signals bhi de sakta hai. Iska matlab hai ke jab ye pattern ban raha hota hai, toh price trend reverse hone ki bajaye woh phir se upar ya neeche ja sakta hai. Confirmatory Indicators: Is pattern ko samajhna aur us par rely karna mushkil ho sakta hai. Traders ko usually isko confirmatory indicators ke sath istemal karna parta hai jaise ke volume ya doosre technical indicators. Timeframe Dependence: Triple top pattern ka asar timeframe par bhi depend karta hai. Choti timeframe par ye pattern asar kar sakta hai, lekin lambe timeframe par zyada reliable ho sakta hai. Zaroorat-e-Waqt: Triple top pattern ko pehchan'ne aur samajhne mein waqt aur mahirana ilm ki zaroorat hoti hai. Isay sahi tariqe se samajhna trading skills ki zaroorat hai. Risk Management: Is pattern ke istemal ke sath risk management bhi ahem hai. Agar is pattern ke signals par pura bharosa karte hain, toh nuksan se bachne ke liye stop-loss orders ka istemal karna zaroori hota hai. Market Conditions: Triple top patterns ka asar market ki haliyat par bhi depend karta hai. Volatile market conditions mein ye pattern kam asar kar sakta hai kyunki prices mein tezi ya girawat aksar aise waqt par hoti hain. Overtrading Ka Khatra: Ye pattern traders ko overtrading karne ke liye majboor kar sakta hai. Kyunki ye pattern infrequent hota hai, isay dhundna traders ko jaldi-jaldi trades karnay par majboor kar sakta hai, jo ke nuksan de sakti hain. Trend Continuation: Kabhi-kabhi triple top patterns ke bajaye, ye bhi ho sakta hai ke trend continue ho aur price tops banata rahe. Isliye, is pattern ko samajhne se pehle trend analysis bhi zaroori hai. Risk-Reward Ratio: Triple top patterns ke signals par trade karne ke liye risk aur reward ka behtareen balance banana zaroori hota hai. Agar risk zyada hai aur reward kam hai, toh ye pattern trading ke liye munasib nahi ho sakta. Psychological Pressure: Jab traders triple top pattern dekhte hain, toh unpar psychological pressure hota hai, aur woh decision-making mein ghalati kar sakte hain. Isliye, is pattern ko samajh kar aur confidence ke sath istemal karna zaroori hai. Triple top candlestick pattern ek powerful tool ho sakta hai agar sahi tarike se samjha jaye aur doosre technical analysis tools ke sath istemal kiya jaye. Lekin, iski limitations ko bhi samajhna ahem hai taake traders apne trades ko behtar tarike se manage kar saken.

Triple top candlestick pattern ek powerful tool ho sakta hai agar sahi tarike se samjha jaye aur doosre technical analysis tools ke sath istemal kiya jaye. Lekin, iski limitations ko bhi samajhna ahem hai taake traders apne trades ko behtar tarike se manage kar saken.

-

#5 Collapse

Limitations of triple top candlestick pattern

HANGING man candle uss waqat banti hai, punch bullish pattern k dowran security open sharpen ke baad numaya peak standard nechay chali jati hai, lekin clamor k ahtetam standard costs bullish close ho jate hen, iss prosses mein anay wali candle aik lambi nechay saye (lower shadow) ke sath murabba lollypop ki tarah dikhaye deti hai. Mandarjabala candle agar bullish pattern ya excessive cost region principal banta hai, to iss ko hanging man candle kehte hen, jo k negative candle ki hososeyat rakhti hai aur negative pattern inversion ka sabab bhi banti hai. Hanging man light ka taluq umbrella family se hai, jiss fundamental candle ki potential gain standard little genuine body hoti hai, punch k lower standard aik long shadow hota hai. Candle k genuine body k upper side standard shadow ka nahi hona chaheye, lekin aik little wick satisfactory hai.Candle ki Arrangement pattern inversion ka single candle patteren hai, jo iss baat ki nishandahi karti hai, k stock apni base level tak pahonch gaya hai, aur costs pattern tabdeel karne ki position mein hai. Hanging man flame khaas peak standard, yeh ishara karta hai, ke dealers market mein ziada dynamic ho chuke hen, jiss se wo costs ko akhari base level tak push karte hen. Lekin baad principal market fundamental purchasers ki pressure ya tadad primary izafa sharpen ki waja se costs racket k akhtetam tak wapis upper chali jati hai. Costs k aghaz primary selling aur baad fundamental purchasing pressure ki waja se light k lower side standard aik long shadow banta hai, jo k arzi tawar standard costs ka solidification time hota hai, jiss ka baad ye flame costs k negative pattern inversion ka zarya banta hai.Triple top pattern ko pehchanne mein waqt lag sakta hai. Is pattern ke formation mein lambe arsey lag sakte hain, aur is waqt mein market ki kai aur cheezein bhi ho sakti hain. Isi doran trader ko nuksan ka khatra ho sakta hai.

Risk Management: HangingTriple top pattern ki pehchan ke baad bhi, risk management ka hona bahut zaroori hai. Agar aap apni trades ko control nahi karenge to nuksan ho sakta hai. Is pattern ko samajh kar bhi, trader ko stop-loss aur take-profit levels ka theek se istemal karna chahiye. man candle aik signle candle design hai, jiss ka design bullish ya exorbitant costs region principal ziada moasar hota hai. Ye candle baqi umbrella aur backwards umbrealla candles ki tarah pattern inversion ka sabab banti hai. Costs primary candle ki development darjazzel tarah se hoti hai: Hanging Man Light: Hanging man candle bullish pattern principal achanak ziada selling pressure ki waja se banti hai, jiss fundamental candle ki ziada tar hososeyat negative pattern ki hoti hai. Ye candle little genuine body principal hoti hai, jiss ka lower side standard aik long shadow hota hai. Candle ki genuine body bullish aur negative dono ho sakti haJab traders triple top pattern dekhte hain, toh unpar psychological pressure hota hai, aur woh decision-making mein ghalati kar sakte hain. Isliye, is pattern ko samajh kar aur confidence ke sath istemal karna zaroori hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Triple top candlestick patterns are used in technical analysis to identify potential reversal points in the price of an asset. These patterns typically consist of three consecutive peaks that reach a similar price level, and they can provide traders with insights into potential trend changes. However, like all technical patterns, triple tops have their limitations: Subjectivity: Identifying a triple top pattern can be somewhat subjective, as it requires traders to interpret price action and recognize when three peaks are forming at roughly the same level. Different traders may have slightly different interpretations of what constitutes a valid triple top. False Signals: Triple top patterns can sometimes appear, but the price may not reverse as expected. These false signals can lead to losses if traders rely solely on this pattern without considering other indicators and factors. Timing: Triple top patterns do not provide a clear indication of when the reversal will occur. Traders may see the pattern develop but not know when the price will start to decline. This uncertainty can lead to missed opportunities or entering trades too early. Confirmation Needed: To increase the reliability of triple top patterns, traders often look for confirmation signals, such as a break below the support level formed between the peaks. However, this confirmation may not always occur, and traders could be left waiting for a signal that never materializes. Market Conditions: Triple top patterns work best in trending markets. In choppy or sideways markets, they can be less reliable, as the price may continue to fluctuate within a range rather than reversing. Risk Management: Relying solely on triple top patterns for trading decisions can be risky. Traders should use proper risk management techniques, such as stop-loss orders, to limit potential losses when a trade based on this pattern does not work out as expected. Not Suitable for All Assets: Triple top patterns may not work well for all types of assets and timeframes. They are generally more effective in liquid markets with clear trends. In illiquid markets or on shorter timeframes, other patterns or strategies may be more suitable. In summary, while triple top candlestick patterns can be a useful tool for technical analysis, traders should be aware of their limitations and use them in conjunction with other indicators and analysis techniques to make informed trading decisions. Additionally, risk management is crucial when implementing any trading strategy based on chart patterns. -

#7 Collapse

What Is Triple Top Candlestick Pattern: Pattern Example ki pehchan ke baad bhi, risk the board ka hona bahut zaroori hai. Agar aap apni exchanges ko control nahi karenge to nuksan ho sakta hai. Is design ko samajh kar bhi, merchant ko stop-misfortune aur take-benefit levels ka theek se istemal karna chahiye. man candle aik signle light plan hai, jiss ka plan bullish ya over the top costs locale head ziada moasar hota hai. Ye light baqi umbrella aur in reverse umbrealla candles ki tarah design reversal ka sabab banti hai. Costs essential candle ki improvement darjazzel tarah se hoti hai: Hanging Man Light: Hanging man candle bullish example head achanak ziada selling pressure ki waja se banti hai, jiss crucial candle ki ziada tar hososeyat negative example ki hoti hai. Ye flame minimal veritable body head hoti hai, jiss ka lower side standard aik long shadow hota hai. Light ki real body bullish aur negative dono ho sakti haJab brokers triple top example dekhte hain Single light patteren hai, jo iss baat ki nishandahi karti hai, k stock apni base level tak pahonch gaya hai, aur costs design tabdeel karne ki position mein hai. Hanging man fire khaas top norm, yeh ishara karta hai, ke vendors market mein ziada dynamic ho chuke hen, jiss se wo costs ko akhari base level tak push karte hen. Lekin baad chief market central buyers ki pressure ya tadad essential izafa hone ki waja se costs racket k akhtetam tak wapis upper chali jati hai. Costs k aghaz essential selling aur baad principal buying pressure ki waja se light k lower side standard aik long shadow banta hai, jo k arzi tawar standard costs ka hardening time hota hai, jiss ka baad ye fire costs k negative example reversal ka zarya banta hai.Triple top example ko pehchanne mein waqt slack sakta hai. Is design ke arrangement mein lambe arsey slack sakte hain, Triple Top Chart Pattern Types: Triple top candle design ek useful asset ho sakta hai agar sahi tarike se samjha jaye aur doosre specialized investigation instruments ke sath istemal kiya jaye. Lekin, iski impediments ko bhi samajhna ahem hai taake brokers apne exchanges ko behtar tarike se oversee kar saken.Kabhi-kabhi triple top examples ke bajaye, ye bhi ho sakta hai ke pattern proceed with ho aur cost tops banata rahe. Isliye, is design ko samajhne se pehle pattern examination bhi zaroori hai. Triple top examples ke signals standard exchange karne ke liye risk aur reward ka behtareen balance banana zaroori hota hai. Agar risk zyada hai aur reward kam hai, toh ye design exchanging ke liye munasib nahi ho sakta brokers triple top example dekhte hain, toh unpar mental tension hota hai, aur woh decision-production mein ghalati kar sakte hain. Isliye, is design ko samajh kar aur certainty ke sath istemal karna zaroori hai.

Single light patteren hai, jo iss baat ki nishandahi karti hai, k stock apni base level tak pahonch gaya hai, aur costs design tabdeel karne ki position mein hai. Hanging man fire khaas top norm, yeh ishara karta hai, ke vendors market mein ziada dynamic ho chuke hen, jiss se wo costs ko akhari base level tak push karte hen. Lekin baad chief market central buyers ki pressure ya tadad essential izafa hone ki waja se costs racket k akhtetam tak wapis upper chali jati hai. Costs k aghaz essential selling aur baad principal buying pressure ki waja se light k lower side standard aik long shadow banta hai, jo k arzi tawar standard costs ka hardening time hota hai, jiss ka baad ye fire costs k negative example reversal ka zarya banta hai.Triple top example ko pehchanne mein waqt slack sakta hai. Is design ke arrangement mein lambe arsey slack sakte hain, Triple Top Chart Pattern Types: Triple top candle design ek useful asset ho sakta hai agar sahi tarike se samjha jaye aur doosre specialized investigation instruments ke sath istemal kiya jaye. Lekin, iski impediments ko bhi samajhna ahem hai taake brokers apne exchanges ko behtar tarike se oversee kar saken.Kabhi-kabhi triple top examples ke bajaye, ye bhi ho sakta hai ke pattern proceed with ho aur cost tops banata rahe. Isliye, is design ko samajhne se pehle pattern examination bhi zaroori hai. Triple top examples ke signals standard exchange karne ke liye risk aur reward ka behtareen balance banana zaroori hota hai. Agar risk zyada hai aur reward kam hai, toh ye design exchanging ke liye munasib nahi ho sakta brokers triple top example dekhte hain, toh unpar mental tension hota hai, aur woh decision-production mein ghalati kar sakte hain. Isliye, is design ko samajh kar aur certainty ke sath istemal karna zaroori hai.  Triple top example ka asar time period standard bhi depend karta hai. Choti time period standard ye design asar kar sakta hai, lekin lambe time span standard zyada dependable ho sakta hai.Triple top example ko pehchan'ne aur samajhne mein waqt aur mahirana ilm ki zaroorat hoti hai. Isay sahi tariqe se samajhna exchanging abilities ki zaroorat hai.Is design ke istemal ke sath risk the board bhi ahem hai. Agar is design ke signals standard pura bharosa karte hain, toh nuksan se bachne ke liye stop-misfortune orders ka istemal karna zaroori hota hai.Triple top examples ka asar market ki haliyat standard bhi depend karta hai. Unpredictable economic situations mein ye design kam asar kar sakta hai kyunki costs mein tezi ya girawat aksar aise waqt standard hoti hain.Ye design merchants ko overtrading karne ke liye majboor kar sakta hai. Kyunki ye design rare hota hai, isay dhundna merchants ko jaldi exchanges karnay standard majboor kar sakta hai, jo ke nuksan de sakti hain. Formation Of Triple Top Chart Pattern: Candle design kabhi ghalat signals bhi de sakta hai. Iska matlab hai ke poke ye design boycott raha hota hai, toh cost pattern invert sharpen ki bajaye woh phir se upar ya neeche ja sakta hai. Is design ko samajhna aur us standard depend karna mushkil ho sakta hai. Dealers ko normally isko corroborative pointers ke sath istemal karna parta hai jaise ke volume ya doosre specialized indicators.Market mein unforeseen news occasions bhi hote hain jo design ko influence kar sakte hain. Triple top example sirf authentic cost information standard based hota hai, lekin market mein naye advancements bhi significant hote hain.In impediments ko samajh kar, merchants ko alert rehna chahiye aur aik exhaustive exchanging methodology banani chahiye jo sirf triple top example standard greetings depend nahi karti. Market mein sharpen grain changes ko bhi consider karna zaroori hai aur risk the executives ko bhi need deni chahiye.

Triple top example ka asar time period standard bhi depend karta hai. Choti time period standard ye design asar kar sakta hai, lekin lambe time span standard zyada dependable ho sakta hai.Triple top example ko pehchan'ne aur samajhne mein waqt aur mahirana ilm ki zaroorat hoti hai. Isay sahi tariqe se samajhna exchanging abilities ki zaroorat hai.Is design ke istemal ke sath risk the board bhi ahem hai. Agar is design ke signals standard pura bharosa karte hain, toh nuksan se bachne ke liye stop-misfortune orders ka istemal karna zaroori hota hai.Triple top examples ka asar market ki haliyat standard bhi depend karta hai. Unpredictable economic situations mein ye design kam asar kar sakta hai kyunki costs mein tezi ya girawat aksar aise waqt standard hoti hain.Ye design merchants ko overtrading karne ke liye majboor kar sakta hai. Kyunki ye design rare hota hai, isay dhundna merchants ko jaldi exchanges karnay standard majboor kar sakta hai, jo ke nuksan de sakti hain. Formation Of Triple Top Chart Pattern: Candle design kabhi ghalat signals bhi de sakta hai. Iska matlab hai ke poke ye design boycott raha hota hai, toh cost pattern invert sharpen ki bajaye woh phir se upar ya neeche ja sakta hai. Is design ko samajhna aur us standard depend karna mushkil ho sakta hai. Dealers ko normally isko corroborative pointers ke sath istemal karna parta hai jaise ke volume ya doosre specialized indicators.Market mein unforeseen news occasions bhi hote hain jo design ko influence kar sakte hain. Triple top example sirf authentic cost information standard based hota hai, lekin market mein naye advancements bhi significant hote hain.In impediments ko samajh kar, merchants ko alert rehna chahiye aur aik exhaustive exchanging methodology banani chahiye jo sirf triple top example standard greetings depend nahi karti. Market mein sharpen grain changes ko bhi consider karna zaroori hai aur risk the executives ko bhi need deni chahiye.  Triple base inversion ek Bullish ka inversion design hai yah design with three se half year ki time span mein bante Hain jo bar diagram line paya jata hai obstruction ke upar Ek opening ke awful same 3 low hai bar ya line graph in accordance with triple rear inversion harm down se bilkul restrictive hai yionee PF jo negative aide wreck ko kisi bhi revers test ke sath switch karne ke liye ek present day pattern honi chahie lows bilkul barabar nahin honi chahie jisse average volume ki ranges kam hoti jaati hai opposition guide badalta hai.eh ek bullish inversion test hai, jiska matlab hota hai ki market opinion horrible se top notch mein badalne ka risk hota hai.Is test ko check karne ke liye purchasers candle outlines aur specialized pointers ka istemal karte hain. Triple rear example ek bullish inversion signal proposition karta hai, matlab ki stock ka cost phir se upar jaane ke conceivable outcomes badh jaate hain. Triple Top Chart Pattern Trading: Triple base aik aisa design ha jo ye show karta ha k market standard negative ka control ha jis sa ye downtrend mama move karti hai, jis mama pehli base ordinary cost second hoti hai, second mama energy gain kar k conceivable inversion ka ishara deti hai jb k third ye show krti hai k solid help face karni standard rahi hai, is design se pehly b market mama downtrend hota hai, is me three bottoms cost mama takreeban same hoti hain, is mama pattern line level b ho sakti hai, puray design me volume down hota rehta ha jo show karta ha k negative strength free kar rahi hai aur jb cost last opposition ko breakout karta ha to bullish volume increment hota ha,

Triple base inversion ek Bullish ka inversion design hai yah design with three se half year ki time span mein bante Hain jo bar diagram line paya jata hai obstruction ke upar Ek opening ke awful same 3 low hai bar ya line graph in accordance with triple rear inversion harm down se bilkul restrictive hai yionee PF jo negative aide wreck ko kisi bhi revers test ke sath switch karne ke liye ek present day pattern honi chahie lows bilkul barabar nahin honi chahie jisse average volume ki ranges kam hoti jaati hai opposition guide badalta hai.eh ek bullish inversion test hai, jiska matlab hota hai ki market opinion horrible se top notch mein badalne ka risk hota hai.Is test ko check karne ke liye purchasers candle outlines aur specialized pointers ka istemal karte hain. Triple rear example ek bullish inversion signal proposition karta hai, matlab ki stock ka cost phir se upar jaane ke conceivable outcomes badh jaate hain. Triple Top Chart Pattern Trading: Triple base aik aisa design ha jo ye show karta ha k market standard negative ka control ha jis sa ye downtrend mama move karti hai, jis mama pehli base ordinary cost second hoti hai, second mama energy gain kar k conceivable inversion ka ishara deti hai jb k third ye show krti hai k solid help face karni standard rahi hai, is design se pehly b market mama downtrend hota hai, is me three bottoms cost mama takreeban same hoti hain, is mama pattern line level b ho sakti hai, puray design me volume down hota rehta ha jo show karta ha k negative strength free kar rahi hai aur jb cost last opposition ko breakout karta ha to bullish volume increment hota ha,  Jab Bhi market main aesa design make hota hai jb market fundamental bar pattern development primary conservation Ho rehi hoti hai aur bar market again pattern ko follow kerna shuru ker deti hai to hit 3 bar conservation leny ky terrible market pattern ko follow kerty huwey aesi support ya opposition jis ko twice as of now contact ker chuki ho aur third time bhi wahan ponch jaey tou jo design creat hota hai woh tripple top ya tripplye base example creat hota hai tou same example ky complete hony per ham market ko isterha sy examination kerty hai ky punch market primary same impressive help ya obstruction break nehi ho rehi tou market a converse bearing primary kisi bhi time development start ker sakti hai lehaza hamain isky liay prepared rehna chahiay aur jesy hello there pattern inversion affirm ho hamain exchange bhi enter ker leni chahiye.

Jab Bhi market main aesa design make hota hai jb market fundamental bar pattern development primary conservation Ho rehi hoti hai aur bar market again pattern ko follow kerna shuru ker deti hai to hit 3 bar conservation leny ky terrible market pattern ko follow kerty huwey aesi support ya opposition jis ko twice as of now contact ker chuki ho aur third time bhi wahan ponch jaey tou jo design creat hota hai woh tripple top ya tripplye base example creat hota hai tou same example ky complete hony per ham market ko isterha sy examination kerty hai ky punch market primary same impressive help ya obstruction break nehi ho rehi tou market a converse bearing primary kisi bhi time development start ker sakti hai lehaza hamain isky liay prepared rehna chahiay aur jesy hello there pattern inversion affirm ho hamain exchange bhi enter ker leni chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

INTRUDUCTION OF TRIPLE TOP CANDLE STICK PATTREN: Asslamoalaikum dear sir I hope aap sab khariyat sy hoon gy Forex tradings Marketing main Triple top candle stick Pattren aesa Pattren Hei joke market Mei apni bhot sari type ky madnzar rakhty howy hein Triple top candle design ek useful asset ho sakta hai agar sahi tarike se samjha jaye aur doosre specialized investigation instruments ke sath istemal kiya jaye. Lekin, iski impediments ko bhi samajhna ahem hai taake brokers apne exchanges ko behtar tarike se oversee kar saken.Kabhi-kabhi triple top examples ke bajaye, ye bhi ho sakta hai ke pattern proceed with ho aur cost tops banata rahe. Isliye, is design ko samajhne se pehle pattern examination bhi zaroori hai. Triple top examples ke signals standard exchange karne ke liye risk aur reward ka behtareen balance banana zaroori hota hai. Agar risk zyada hai aur reward kam hai, toh ye design exchanging ke liye munasib nahi ho sakta brokers triple top example dekhte hain, toh unpar mental tension hota hai, aur woh decision-production mein ghalati kar sakte hain. Isliye, is design ko samajh kar aur certainty ke sath istemal karna chahta hein.EXPLAIN THE TRIPLE TOP CANDLE STICK PATTREN: Piyary members forex exchanging Market Mei yeh Pattren mukhtalif pannal par mushtamil hotaa hey our Triple top example ka asar time period standard bhi depend karta hai. Choti time period standard ye design asar kar sakta hai, lekin lambe time span standard zyada dependable ho sakta hai.Triple top example ko pehchan'ne aur samajhne mein waqt aur mahirana ilm ki zaroorat hoti hai. Isay sahi tariqe se samajhna exchanging abilities ki zaroorat hai.Is design ke istemal ke sath risk the board bhi ahem hai. Agar is design ke signals standard pura bharosa karte nuksan se bachne ke liye stop-misfortune orders ka istemal karna zaroori hota hai.Triple top examples ka asar market ki haliyat standard bhi depend karta hai. Unpredictable economic situations mein ye design kam asar kar sakta hai kyunki costs mein tezi ya girawat aksar aise waqt standard hoti hain.Ye design merchants ko overtrading karne ke liye majboor kar sakta hai. Kyunki ye design rare hota Hai our yeh Pattren jisay traders ko downtrend movemet ky liye bhot mashor Trendiness show karta Hai. CANDLE FORMATION: Dear friends Forex tradings Marketing main apna rujhaan rakhty howy ye Pattren ko samjhna bhot ziyada mehnat karni chaye hoti hey Triple base inversion ek Bullish ka inversion design hai yah design with three se half year ki time span mein bante Hain jo bar diagram line paya jata hai obstruction ke upar Ek opening ke awful same 3 low hai bar ya line graph in accordance with triple rear inversion harm down se bilkul restrictive hai yionee PF jo negative aide wreck ko kisi bhi revers test ke sath switch karne ke liye ek present day pattern honi chahie lows bilkul barabar nahin honi chahie jisse average volume ki ranges kam hoti jaati hai opposition guide badalta hai.eh ek bullish inversion test hai, jiska matlab hota hai ki market opinion horrible se top notch mein badalne ka risk hota hai.Is test ko check karne ke liye purchasers candle outlines aur specialized pointers ka istemal karte hain. Triple rear example ek bullish inversion signal proposition karta hai, matlab ki stock ka cost phir se upar jaane ke KY liye perfect timing ki zarort hotii Hei our Traders hazraat Tradings karty market ko follow karty hen our Forex Mei Tradings karty howy benifet hasil kar sakty hen TRADING WITH TRIPLE TOP CANDLE STICK PATTREN: Dear members forex exchanging Market Mei Pattren ko kabel istemaal bnaty hei our ye bhoot asaan Pattren ko itmal karny ky liye hard work karna zoriri hota Hai Triple base aik aisa design ha jo ye show karta ha k market standard negative ka control ha jis sa ye downtrend mama move karti hai, jis mama pehli base ordinary cost second hoti hai, second mama energy gain kar k conceivable inversion ka ishara deti hai jb k third ye show krti hai k solid help face karni standard rahi hai, is design se pehly b market mama downtrend hota hai, is me three bottoms cost mama takreeban same hoti hain, is mama pattern line level b ho sakti hai, puray design me volume down hota rehta ha jo show karta ha k negative strength free kar rahi hai aur jb cost last opposition ko breakout karta ha to bullish volume Mei izafa hota Hai our es sey ziyada mehnat karni hotyi hey.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:39 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим