Spinning Top Candlestick Pattern.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

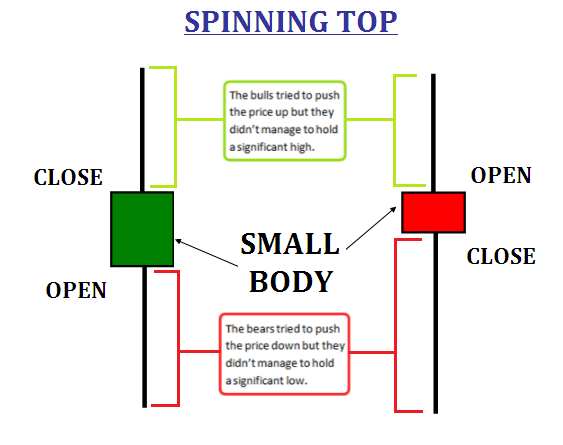

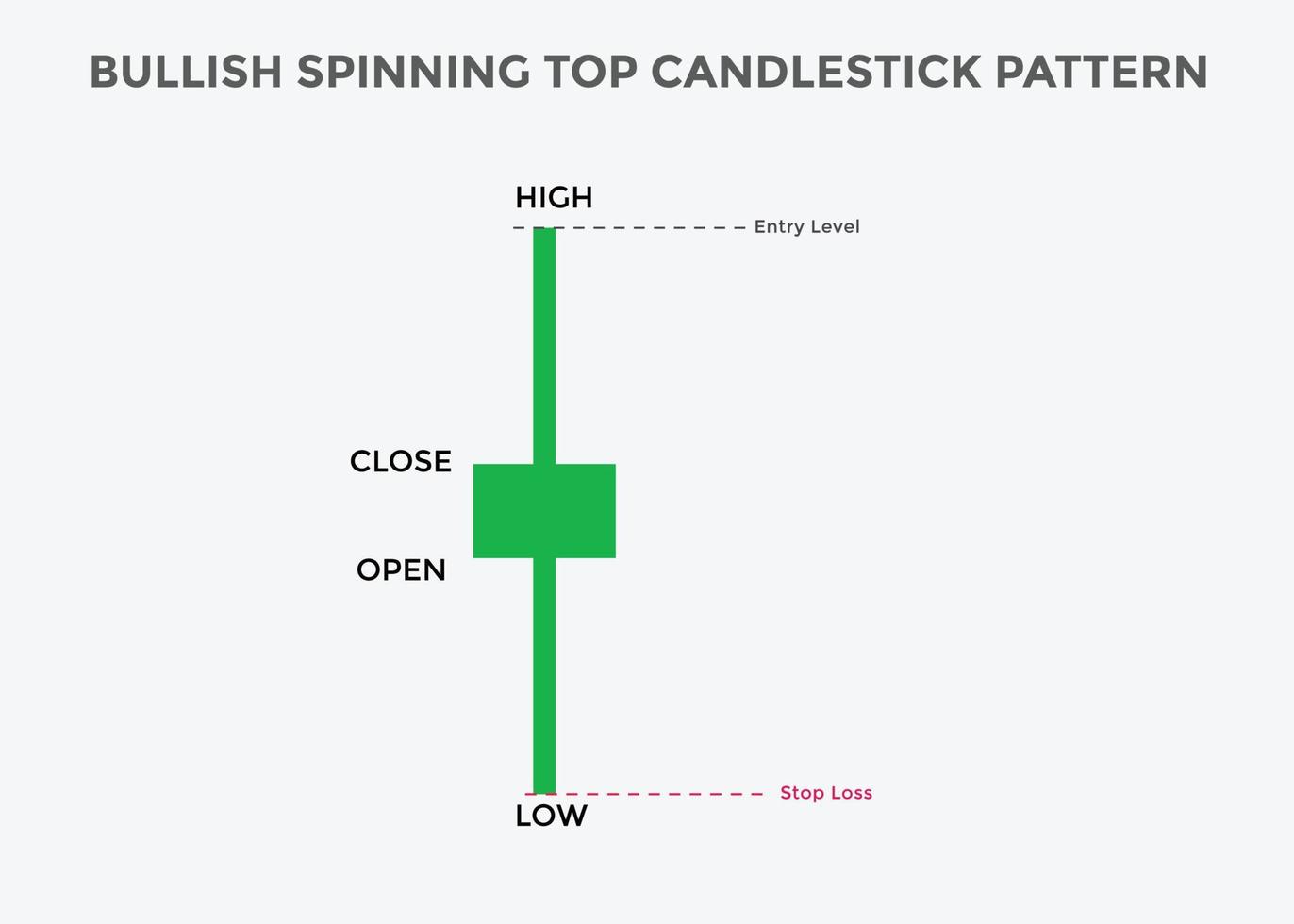

Introduction Assalamu alaikum ummid Karti hun ke Forex ke tamam member se khairiyat se honge bhai aur bahanon aaj ham aapke sath ek topic share karne ja rahe hain use topic ka naam hai spinning top candlestick pattern yeh bahut hi khas topic Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke bare mein janenge utna jyada fayda hasil karenge yah topic maine bahut mushkil se aap logon ke liye dhundha tha ki main aap logon ke sath is topic ko share kar sakun aap ise kuchh fayda kar sake aapko bhi chahie ki aap hamare sath naye topic share kijiye Taki ham bhi kuchh fayda milkar saken is topic se dekhen samjhe aur padhiye hamari post ko pura padhne se aapko bahut jyada fayda hoga to ham is topic ke bare mein batchit karte hain shukriya Characteristics of the duck pattern Is pattern mein, candle ki body bohot chhoti hoti hai aur iski dono taraf wicks bari hoti hain. Market mein kisi bhi trend ke doran, sting candle ki body bohot chhoti hoti hai, lekin uski wicks lambi hoti hain, to you spinning wheel pattern ban jata hai. Bullish and Bearish Spinning Top Patterns There is a pattern of ko samajhne ke liye, aham hai ke iske to hote hain variations: bull spinner aur bear spinner. Bull spinning wheel pattern jab ban jata hai, to ye batata hai ke market mein bearish trend khatam hone ka indication hai aur bullish trend shuru hone wala hai. Jabke bear spinner pattern stab form hota hai, to mark karta hai ke market mein bull trend khatam hone ka option hai aur bear trend shuru hone wala hai. Confirmation and analysis Spinning top candlestick pattern ke signal ko confirm karne ke liye, traders ko market ke saath saath dusre technical indicators bhi use karne hote hain. Iske saath hi, market sentiment ko samajhne ke liye volume aur trend lines ka bhi sahara liya jata hai. Effective use of the rotating vertex pattern Is the pattern ka sahi se istemal karne se, traders ko price reversals aur trend changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, traders ko candlestick patterns aur technical analysis to fundamentals ko samajhna zaroori hai. Market mein risk management aur apni business strategy ko thik tarike se implement karna bhi mahatvapurn hai. Conclusion In conclusion, spinner candlestick pattern market ki movement aur price direction to changes ko samajhne ke liye ek important tool hai. Lekin iska sahi istemal karne ke liye, traders ko acchi tarah se samajh lena chahiye ke iske signals ko kaise interpret karna hai aur market ke saath saath dusre technical indicators ka bhi sahara lena hoga. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Spinning Top, yaani "Ghomnay Wala Top," ek candlestick pattern hai jo forex trading mein istemal hota hai. Is pattern ki madad se market mein mushkilat ya behtari ka pata lagaya jata hai. Planning Identification : Ghomnay Wala Top (Spinning Top) candlestick pattern ka matlab hota hai ke market mein mansuba bandi mein mushkilat aa sakti hain. Is pattern ki nishandahi ka maqsad ye hota hai ke kis taraf market ja sakta hai. Body and Shadows: Ghomnay Wala Top candlestick pattern mein candle ki maqoolat (body) choti hoti hai aur chari (shadows) dono taraf barabar lambi hoti hain. Yani candle ka darmiyan hissa maqoolat se kam hota hai. Market Indication: Agar Ghomnay Wala Top upar ya neeche dekhai de to ye market ki taraf ishara hai ke current trend mein rukawat aa sakti hai. Agar trend pehle se hi upar ya neeche ja raha ho to ye is trend ki rukawat bhi ho sakti hai. Planing identification Explanation: Agar Ghomnay Wala Top uptrend ke baad dekhai de, to ye indicate kar sakta hai ke buyers ke hoslaat kam ho rahe hain aur selling pressure barh raha hai. Isi tarah, agar ye downtrend ke baad dekhai de, to ye dikh sakta hai ke sellers ke hoslaat kam ho rahe hain aur buying pressure barh raha hai. Planing Resistance: Ghomnay Wala Top pattern ka matlab ye nahi ke market zaroor rukna hai, balkay ye ek soorat hai jahan market mein tawanai kam ho sakti hai. Traders ko mazeed information hasil karne ke liye dusre indicators aur price patterns ka bhi tazkira karna chahiye. Indication Verfiy: Ghomnay Wala Top pattern ko confirm karne ke liye, traders ko dusre technical tools aur indicators ka istemal karna chahiye jaise ke trend lines, moving averages, ya RSI. Conculsion: Ghomnay Wala Top candlestick pattern forex trading mein ek ahem tajarba hai. Iski madad se traders market ki mansuba bandi ko samajh sakte hain, lekin is pattern ko confirm karne ke liye mazeed tools aur analysis ki zaroorat hoti hai. Is pattern ke istemal se pehle, traders ko is field ki mazeed maloomat hasil karni chahiye. -

#4 Collapse

spinning top candlestick pattern yeh bahut hi khas topic Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke bare mein janenge utna jyada fayda hasil karenge yah topic maine bahut mushkil se aap logon ke liye dhundha tha ki main aap logon ke sath is topic ko share kar sakun aap ise kuchh fayda kar sake aapko bhi chahie ki aap hamare sath naye topic share kijiye Taki ham bhi kuchh fayda milkar saken is topic se dekhen samjhe aur padhiye hamari post ko pura padhne se aapko bahut jyada fayda hoga to ham is topic ke bare mein batchit karte hain shukriya Characteristics of the duck pattern Is pattern mein, candle ki body bohot chhoti hoti hai aur iski dono taraf wicks bari hoti hain. Market mein kisi bhi trend ke doran, sting candle ki body bohot chhoti hoti hai, lekin uski wicks lambi hoti hain, to you spinning wheel pattern ban jata hai.Bullish and Bearish Spinning Top Patterns There is a pattern of ko samajhne ke liye, aham hai ke iske to hote hain variations: bull spinner aur bear spinner. Bull spinning wheel pattern jab ban jata hai, to ye batata hai ke market mein bearish trend khatam hone ka indication hai aur bullish trend shuru hone wala hai. Jabke bear spinner pattern stab form hota hai, to mark karta hai ke market mein bull trend khatam hone ka option hai aur bear trend shuru hone wala hai. Confirmation and analysis Spinning top candlestick pattern ke signal ko confirm karne ke liye, traders ko market ke saath saath dusre technical indicators bhi use karne hote hain. Iske saath hi, market sentiment ko samajhne ke liye volume aur trend lines ka bhi sahara liya jata hai. Effective use of the rotating vertex pattern Is the pattern ka sahi se istemal karne se, traders ko price reversals aur trend changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, traders ko candlestick patterns aur technical analysis to fundamentals ko samajhna zaroori hai. Market mein risk management aur apni business strategy ko thik tarike se implement karna bhi mahatvapurn hai.Spinning Top, yaani "Ghomnay Wala Top," ek candlestick pattern hai jo forex trading mein istemal hota hai. Is pattern ki madad se market mein mushkilat ya behtari ka pata lagaya jata hai.pattern ka sahi se istemal karne se, traders ko price reversals aur trend changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, traders ko candlestick patterns aur technical analysis to fundamentals ko samajhna zaroori hai. Market mein risk management aur apni business strategy ko thik tarike se implement karna bhi mahatvapurn hai. Conclusion In conclusion, spinner candlestick pattern market ki movement aur price direction to changes ko samajhne ke liye ek important tool hai. Lekin iska sahi istemal karne ke liye, traders ko acchi tarah se samajh lena chahiye ke iske signals ko kaise interpret karna hai aur market ke saath saath dusre technical indicators ka bhi sahara lena hoga.

Planning Identification : Ghomnay Wala Top (Spinning Top) candlestick pattern ka matlab hota hai ke market mein mansuba bandi mein mushkilat aa sakti hain. Is pattern ki nishandahi ka maqsad ye hota hai ke kis taraf market ja sakta hai.Ghomnay Wala Top pattern ka matlab ye nahi ke market zaroor rukna hai, balkay ye ek soorat hai jahan market mein tawanai kam ho sakti hai. Traders ko mazeed information hasil karne ke liye dusre indicators aur price patterns ka bhi tazkira karna chahiye.

Indication Verfiy: Ghomnay Wala Top pattern ko confirm karne ke liye, traders ko dusre technical tools aur indicators ka istemal karna chahiye jaise ke trend lines, moving averages, ya RSI. Conculsion: Ghomnay Wala Top candlestick pattern forex trading mein ek ahem tajarba hai. Iski madad se traders market ki mansuba bandi ko samajh sakte hain, lekin is pattern ko confirm karne ke liye mazeed tools aur analysis ki zaroorat hoti hai. Is pattern ke istemal se pehle, traders ko is field ki mazeed maloomat hasil karni chahiye.

-

#5 Collapse

Introduction; candlestick sample yeh bahut hello khas topic Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke bare mein janenge utna jyada fayda hasil karenge yah subject matter maine bahut mushkil se aap logon ke liye dhundha tha ki main aap logon ke sath is topic ko percentage kar sakun aap ise kuchh fayda kar sake aapko bhi chahie ki aap hamare sath naye topic proportion kijiye Taki ham bhi kuchh fayda milkar saken is topic se dekhen samjhe aur padhiye hamari publish ko pura padhne se aapko bahut jyada fayda hoga to ham is topic ke bare mein batchit karte hain.There is a sample of ko samajhne ke liye, aham hai ke iske to hote hain versions: bull spinner aur endure spinner. Bull spinning wheel sample jab ban jata hai, to ye batata hai ke market mein bearish fashion khatam hone ka indication hai aur bullish trend shuru hone wala hai. Jabke endure spinner sample stab shape hota hai, to mark karta hai ke marketplace mein bull trend khatam hone ka alternative hai aur bear trend shuru hone wala hai.The duck pattern; Is pattern mein, candle ki body bohot chhoti hoti hai aur iski dono taraf wicks bari hoti hain. Market mein kisi bhi fashion ke doran, sting candle ki frame bohot chhoti hoti hai, lekin uski wicks lambi hoti hain, to you spinning wheel sample ban jata hai.Spinning pinnacle candlestick pattern ke sign ko confirm karne ke liye, traders ko market ke saath saath dusre technical indicators bhi use karne hote hain. Iske saath hello, market sentiment ko samajhne ke liye extent aur fashion lines ka bhi sahara liya jata hai.Is the pattern ka sahi se istemal karne se, traders ko charge reversals aur trend modifications ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, investors ko candlestick patterns aur technical analysis to basics ko samajhna zaroori hai. Market mein risk control aur apni commercial enterprise approach ko thik tarike se enforce karna bhi mahatvapurn hai. Spinner candlestick sample marketplace ki movement aur charge path to modifications ko samajhne ke liye ek critical device hai. Lekin iska sahi istemal karne ke liye, traders ko acchi tarah se samajh lena chahiye ke iske signals ko kaise interpret karna hai aur marketplace ke saath saath dusre technical signs ka bhi sahara lena hoga. Identification : Spinning Top, yaani "Ghomnay Wala Top," ek candlestick pattern hai jo forex buying and selling mein istemal hota hai. Is sample ki madad se marketplace mein mushkilat ya behtari ka pata lagaya jata hai. Ghomnay Wala Top candlestick pattern ka matlab hota hai ke marketplace mein mansuba bandi mein mushkilat aa sakti hain. Is pattern ki nishandahi ka maqsad ye hota hai ke kis taraf marketplace ja sakta hai.Ghomnay Wala Top candlestick pattern mein candle ki maqoolat choti hoti hai aur chari dono taraf barabar lambi hoti hain. Yani candle ka darmiyan hissa maqoolat se kam hota hai.Pattern forex buying and selling mein ek ahem tajarba hai. Iski madad se investors marketplace ki mansuba bandi ko samajh sakte hain, lekin is pattern ko affirm karne ke liye mazeed gear aur evaluation ki zaroorat hoti hai. Is pattern ke istemal se pehle, investors ko is discipline ki mazeed maloomat hasil karni chahiye.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Ghomnay Wala Top (Spinning Top) candlestick pattern ka matlab hota hai ke market mein mansuba bandi mein mushkilat aa sakti hain. Is pattern ki nishandahi ka maqsad ye hota hai ke kis taraf market ja sakta hai.candlestick pattern ke sign ko confirm karne ke liye, traders ko market ke saath saath dusre technical indicators bhi use karne hote hain. Iske saath hello, market sentiment ko samajhne ke liye extent aur fashion lines ka bhi sahara liya jata hai.Is the pattern ka sahi se istemal karne se, traders ko charge reversals aur trend modifications ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, investors ko candlestick patterns aur technical analysis to basics ko samajhna zaroori hai. Market mein risk control aur apni commercial enterprise approach ko thik tarike se enforce karna bhi mahatvapurn hai. Spinner candlestick sample marketplace ki movement aur charge path to modifications ko samajhne ke liye ek critical device hai. Lekin iska sahi istemal karne ke liye, traders ko acchi tarah se samajh lena chahiye ke iske signals ko kaise interpret karna hai aur marketplace ke saath saath dusre technical signs ka bhi sahara lena hoga. Body and Shadows: Ghomnay Wala Top candlestick pattern mein candle ki maqoolat (body) choti hoti hai aur chari (shadows) dono taraf barabar lambi hoti hain. Yani candle ka darmiyan hissa maqoolat se kam hota hai.Market Indication: Agar Ghomnay Wala Top upar ya neeche dekhai de to ye market ki taraf ishara hai ke current trend mein rukawat aa sakti hai. Agar trend pehle se hi upar ya neeche ja raha ho to ye is trend ki rukawat bhi ho sakti hai.

Planing identification Explanation: Agar Ghomnay Wala Top uptrend ke baad dekhai de, to ye indicate kar sakta hai ke buyers ke hoslaat kam ho rahe hain aur selling pressure barh raha hai. Isi tarah, agar ye downtrend ke baad dekhai de, to ye dikh sakta hai ke sellers ke hoslaat kam ho rahe hain aur buying pressure barh raha hai. Planing Resistance: Ghomnay Wala Top pattern ka matlab ye nahi ke market zaroor rukna hai, balkay ye ek soorat hai jahan market mein tawanai kam ho sakti hai. Traders ko mazeed information hasil karne ke liye dusre indicators aur price patterns ka bhi tazkira karna chahiye.

Indication Verfiy:candlestick sample yeh bahut hello khas topic Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke bare mein janenge utna jyada fayda hasil karenge yah subject matter maine bahut mushkil se aap logon ke liye dhundha tha ki main aap logon ke sath is topic ko percentage kar sakun aap ise kuchh fayda kar sake aapko bhi chahie ki aap hamare sath naye topic proportion kijiye Taki ham bhi kuchh fayda milkar saken is topic se dekhen samjhe aur padhiye hamari publish ko pura padhne se aapko bahut jyada fayda hoga to ham is topic ke bare mein batchit karte hain.There is a sample of ko samajhne ke liye, aham hai ke iske to hote hain versions: bull spinner aur endure spinner. Bull spinning wheel sample jab ban jata hai, to ye batata hai ke market mein bearish fashion khatam hone ka indication hai aur bullish trend shuru hone wala hai. Jabke endure spinner sample stab shape hota hai, to mark karta hai ke marketplace mein bull trend khatam hone ka alternative hai aur bear trend shuru hone wala hai.

Ghomnay Wala Top pattern ko confirm karne ke liye, traders ko dusre technical tools aur indicators ka istemal karna chahiye jaise ke trend lines, moving averages, ya RSI.

-

#7 Collapse

SPINNING TOP CANDLESTICK PATTERN:-"Spinning Top" candlestick pattern ek technical analysis tool hai jo stock market ya financial markets mein istemal hota hai. Yeh pattern usually price reversal ke indications provide karta hai. "Spinning Top" pattern ek single candlestick se bana hota hai aur iska matlab hota hai ki market sentiment indecision ya uncertainty ke aaspaas hai. Is pattern ko candlestick chart par dekhte waqt, iske kuch key characteristics hote hain:SPINNING TOP CANDLESTICK PATTERN K CHARACTICTICS:-Body Size (Badan Ki Size): Spinning Top candle ka body bohot chota hota hai, jisse ki iska open aur close price kareeb ek doosre ke barabar hote hain. Yani, body practically dikhayi nahi deti. Shadows (Upar Nichle Chhale): Is candle ke upper aur lower shadows (chhale) lambi hote hain, jisse ki price movement ka range zahir hota hai. In chhalon ki length, market sentiment ko represent karti hai. Indecision (Sankoch): Spinning Top pattern ek uncertainty ya indecision ka indication deta hai. Yeh batata hai ki buyers aur sellers ke beech mein koi tay nahi ho pa raha hai aur market direction unclear hai.SPINNING TOP CANDLESTICK PATTERN KY KEY POINTS:-Long-Legged Doji: Yeh pattern bhi ek variation hai jisme candle ke upper aur lower shadows (chhale) lambe hote hain, lekin body choti hoti hai. Isse bhi indecision ka indication hota hai, lekin ismein market participants ka confusion aur zyada hota hai. Dragonfly Doji: Is pattern mein candle ka body bilkul nahi hota aur sirf ek lambi bottom shadow hoti hai, jisse ki candle lagta hai jaise ek dragonfly ke jaise ud rahi ho. Yeh pattern price reversal ya trend change ka indication ho sakta hai, lekin confirmatory signals ki zarurat hoti hai. Gravestone Doji: Yeh pattern bhi ek variation hai jisme candle ka body nahi hota aur sirf ek lambi upper shadow hoti hai. Candlestick chart par yeh lagta hai jaise gravestone (kabr) ke jaise dikh rahi ho. Yeh pattern bhi price reversal ya trend change ka sign ho sakta hai. In patterns ke saath-saath, aapko doosre technical analysis tools jaise ki trend lines, moving averages, aur volume analysis bhi istemal karne chahiye. Yeh tools aapko candlestick patterns ke indications ko confirm aur validate karne mein madadgar hote hain.Candlestick patterns ka istemal kar ke traders market direction ko predict karne ki koshish karte hain, lekin yaad rahe ki koi bhi single pattern ya indicator khud hi reliable trading strategy nahi bana sakta. Hamesha thorough research, risk management, aur multiple indicators ki madad se trading decisions lena zaruri hai. -

#8 Collapse

Spinning Top Candle Chart Pattern: Spinning Top candle design ek specialized examination device hai jo securities exchange ya monetary business sectors mein istemal hota hai. Yeh design generally cost inversion ke signs give karta hai. "Turning Top" design ek single candle se bana hota hai aur iska matlab hota hai ki market opinion hesitation ya vulnerability ke aaspaas hai. Is design ko candle diagram standard dekhte waqt, iske kuch key qualities hote hain Yeh design bhi ek variety hai jisme light ke upper aur lower shadows (chhale) lambe hote hain, lekin body choti hoti hai. Isse bhi uncertainty ka sign hota hai, lekin ismein market members ka disarray aur zyada hota hai.Is design mein flame ka body bilkul nahi hota aur sirf ek lambi base shadow hoti hai, jisse ki light lagta hai jaise ek dragonfly ke jaise ud rahi ho. Yeh design cost inversion ya pattern change ka sign ho sakta hai, lekin corroborative signs ki zarurat hoti hai yeh design bhi ek variety hai jisme light ka body nahi hota aur sirf ek lambi upper shadow hoti hai. Candle outline standard yeh lagta hai jaise tombstone (kabr) ke jaise dikh rahi ho. Yeh design bhi cost inversion ya pattern change ka sign ho sakta hai. Designs ke saath, aapko doosre specialized examination devices jaise ki pattern lines, moving midpoints, aur volume investigation bhi istemal karne chahiye. Yeh apparatuses aapko candle designs ke signs ko affirm aur approve karne mein madadgar hote hain.Candlestick designs ka istemal kar ke brokers market bearing ko anticipate karne ki koshish karte hain, lekin yaad rahe ki koi bhi single example ya marker khud hello dependable exchanging methodology nahi bana sakta. Hamesha intensive exploration, risk the board, aur different pointers ki madad se exchanging choices lena zaruri hai.:candlestick test yeh bahut hi khas subject Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke exposed mein janenge utna jyada fayda hasil karenge yah topic maine bahut mushkil se aap logon ke liye dhundha tha ki fundamental aap logon ke sath is point ko rate kar sakun aap ise kuchh fayda kar purpose aapko bhi chahie ki aap hamare sath naye point extent kijiye Taki ham bhi kuchh fayda milkar saken is theme se dekhen samjhe aur padhiye hamari distribute ko pura padhne se aapko bahut jyada fayda hoga to ham is point ke uncovered mein batchit karte hain.There is an example of ko samajhne ke liye, aham hai ke iske to hote hain forms: bull spinner aur persevere through spinner. Bull turning wheel test hit boycott jata hai, to ye batata hai ke market mein negative design khatam sharpen ka sign hai Chart Pattern Types: Candle design ka matlab hota hai ke market mein mansuba bandi mein mushkilat aa sakti hain. Is design ki nishandahi ka maqsad ye hota hai ke kis taraf market ja sakta hai.candlestick design ke sign ko affirm karne ke liye, dealers ko market ke saath dusre specialized pointers bhi use karne hote hain. Iske saath hi, market opinion ko samajhne ke liye degree aur design lines ka bhi sahara liya jata hai.Is the example ka sahi se istemal karne se, merchants ko charge inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, financial backers ko candle designs aur specialized investigation to rudiments ko samajhna zaroori hai. Market mein risk control aur apni business endeavor approach ko thik tarike se uphold karna bhi mahatvapurn hai. Spinner candle test commercial center ki development aur charge way to alterations ko samajhne ke liye ek basic gadget ha

Designs ke saath, aapko doosre specialized examination devices jaise ki pattern lines, moving midpoints, aur volume investigation bhi istemal karne chahiye. Yeh apparatuses aapko candle designs ke signs ko affirm aur approve karne mein madadgar hote hain.Candlestick designs ka istemal kar ke brokers market bearing ko anticipate karne ki koshish karte hain, lekin yaad rahe ki koi bhi single example ya marker khud hello dependable exchanging methodology nahi bana sakta. Hamesha intensive exploration, risk the board, aur different pointers ki madad se exchanging choices lena zaruri hai.:candlestick test yeh bahut hi khas subject Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke exposed mein janenge utna jyada fayda hasil karenge yah topic maine bahut mushkil se aap logon ke liye dhundha tha ki fundamental aap logon ke sath is point ko rate kar sakun aap ise kuchh fayda kar purpose aapko bhi chahie ki aap hamare sath naye point extent kijiye Taki ham bhi kuchh fayda milkar saken is theme se dekhen samjhe aur padhiye hamari distribute ko pura padhne se aapko bahut jyada fayda hoga to ham is point ke uncovered mein batchit karte hain.There is an example of ko samajhne ke liye, aham hai ke iske to hote hain forms: bull spinner aur persevere through spinner. Bull turning wheel test hit boycott jata hai, to ye batata hai ke market mein negative design khatam sharpen ka sign hai Chart Pattern Types: Candle design ka matlab hota hai ke market mein mansuba bandi mein mushkilat aa sakti hain. Is design ki nishandahi ka maqsad ye hota hai ke kis taraf market ja sakta hai.candlestick design ke sign ko affirm karne ke liye, dealers ko market ke saath dusre specialized pointers bhi use karne hote hain. Iske saath hi, market opinion ko samajhne ke liye degree aur design lines ka bhi sahara liya jata hai.Is the example ka sahi se istemal karne se, merchants ko charge inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, financial backers ko candle designs aur specialized investigation to rudiments ko samajhna zaroori hai. Market mein risk control aur apni business endeavor approach ko thik tarike se uphold karna bhi mahatvapurn hai. Spinner candle test commercial center ki development aur charge way to alterations ko samajhne ke liye ek basic gadget ha Turning Top, yaani "Ghomnay Wala Top," ek candle design hai jo forex trading mein istemal hota hai. Is test ki madad se commercial center mein mushkilat ya behtari ka pata lagaya jata hai.Ghomnay Wala Top candle design ka matlab hota hai ke commercial center mein mansuba bandi mein mushkilat aa sakti hain. Is design ki nishandahi ka maqsad ye hota hai ke kis taraf commercial center ja sakta hai.Ghomnay Wala Top candle design mein candle ki maqoolat choti hoti hai aur chari dono taraf barabar lambi hoti hain. Yani candle ka darmiyan hissa maqoolat se kam hota hai.Pattern forex trading mein ek ahem tajarba hai. Iski madad se financial backers commercial center ki mansuba bandi ko samajh sakte hain, lekin is design ko confirm karne ke liye mazeed gear aur assessment ki zaroorat hoti hai. Is design ke istemal se pehle, financial backers ko is discipline ki mazeed maloomat hasil karni chahiye. Trading Explanation: Candle test yeh bahut hi khas theme Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke uncovered mein janenge utna jyada fayda hasil karenge yah topic maine bahut mushkil se aap logon ke liye dhundha tha ki primary aap logon ke sath is subject ko rate kar sakun aap ise kuchh fayda kar purpose aapko bhi chahie ki aap hamare sath naye point extent kijiye Taki ham bhi kuchh fayda milkar saken is theme se dekhen samjhe aur padhiye hamari distribute ko pura padhne se aapko bahut jyada fayda hoga to ham is point ke exposed mein batchit karte hain.There is an example of ko samajhne ke liye, aham hai ke iske to hote hain forms: bull spinner aur persevere through spinner. Bull turning wheel test punch boycott jata hai, to ye batata hai ke market mein negative design khatam sharpen ka sign hai aur bullish pattern shuru sharpen wala hai. Jabke get through spinner test cut shape hota hai, to stamp karta hai ke commercial center mein bull pattern khatam sharpen ka elective ha

Design ka sahi se istemal karne se, brokers ko cost inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, brokers ko candle designs aur specialized examination to essentials ko samajhna zaroori hai. Market mein risk the executives aur apni business technique ko thik tarike se carry out karna bhi mahatvapurn hai.Spinning Top, yaani "Ghomnay Wala Top," ek candle design hai jo forex exchanging mein istemal hota hai. Is design ki madad se market mein mushkilat ya behtari ka pata lagaya jata hai.pattern ka sahi se istemal karne se, brokers ko cost inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, brokers ko candle designs aur specialized investigation to essentials ko samajhna zaroori hai.

Design ka sahi se istemal karne se, brokers ko cost inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, brokers ko candle designs aur specialized examination to essentials ko samajhna zaroori hai. Market mein risk the executives aur apni business technique ko thik tarike se carry out karna bhi mahatvapurn hai.Spinning Top, yaani "Ghomnay Wala Top," ek candle design hai jo forex exchanging mein istemal hota hai. Is design ki madad se market mein mushkilat ya behtari ka pata lagaya jata hai.pattern ka sahi se istemal karne se, brokers ko cost inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, brokers ko candle designs aur specialized investigation to essentials ko samajhna zaroori hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

turning top candle design yeh bahut howdy khas point Hai isko janne ki bahut jyada jarurat hai jitne jyada Office ke uncovered mein janenge utna jyada fayda hasil karenge yah theme maine bahut mushkil se aap logon ke liye dhundha tha ki principal aap logon ke sath is subject ko share kar sakun aap ise kuchh fayda kar purpose aapko bhi chahie ki aap hamare sath naye subject offer kijiye Taki ham bhi kuchh fayda milkar saken is subject se dekhen samjhe aur padhiye hamari post ko pura padhne se aapko bahut jyada fayda hoga to ham is theme ke exposed mein batchit karte hain shukriyaIs design mein, flame ki body bohot chhoti hoti hai aur iski dono taraf wicks bari hoti hain. Market mein kisi bhi pattern ke doran, sting flame ki body bohot chhoti hoti hai, lekin uski wicks lambi hoti hain, to you turning wheel design boycott jata hai. Bullish and Negative Turning Top Examples There is an example of ko samajhne ke liye, aham hai ke iske to hote hain varieties: bull spinner aur bear spinner. Bull turning wheel design punch boycott jata hai, to ye batata hai ke market mein negative pattern khatam sharpen ka sign hai aur bullish pattern shuru sharpen wala hai. Jabke bear spinner design cut structure hota hai, to check karta hai ke market mein bull pattern khatam sharpen ka choice hai aur bear pattern shuru sharpen wala hai. Affirmation and examination Turning top candle design ke signal ko affirm karne ke liye, dealers ko market ke saath dusre specialized pointers bhi use karne hote hain. Iske saath hello there, market feeling ko samajhne ke liye volume aur pattern lines ka bhi sahara liya jata hai. Successful utilization of the pivoting vertex design Is the example ka sahi se istemal karne se, merchants ko cost inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, merchants ko candle designs aur specialized investigation to basics ko samajhna zaroori hai. Market mein risk the executives aur apni business methodology ko thik tarike se carry out karna bhi mahatvapurn hai.Spinning Top, yaani "Ghomnay Wala Top," ek candle design hai jo forex exchanging mein istemal hota hai. Is design ki madad se market mein mushkilat ya behtari ka pata lagaya jata hai.pattern ka sahi se istemal karne se, dealers ko cost inversions aur pattern changes ki pehchan karne mein madad milti hai. Lekin iska istemal karne se pehle, merchants ko candle designs aur specialized examination to basics ko samajhna zaroori hai. Market mein risk the executives aur apni business technique ko thik tarike se carry out karna bhi mahatvapurn hai.All in all, spinner candle design market ki development aur value course to changes ko samajhne ke liye ek significant apparatus hai. Lekin iska sahi istemal karne ke liye, dealers ko acchi tarah se samajh lena chahiye ke iske signals ko kaise decipher karna hai aur market ke saath dusre specialized pointers ka bhi sahara lena hoga. Arranging Distinguishing proof : Ghomnay Wala Top (Turning Top) candle design ka matlab hota hai ke market mein mansuba bandi mein mushkilat aa sakti hain. Is design ki nishandahi ka maqsad ye hota hai ke kis taraf market ja sakta hai.Ghomnay Wala Top example ka matlab ye nahi ke market zaroor rukna hai, balkay ye ek soorat hai jahan market mein tawanai kam ho sakti hai. Dealers ko mazeed data hasil karne ke liye dusre pointers aur cost designs ka bhi tazkira karna chahiye. Sign Verfiy: Ghomnay Wala Top example ko affirm karne ke liye, dealers ko dusre specialized devices aur markers ka istemal karna chahiye jaise ke pattern lines, moving midpoints, ya RSI. Conculsion: Ghomnay Wala Top candle design forex exchanging mein ek ahem tajarba hai. Iski madad se merchants market ki mansuba bandi ko samajh sakte hain, lekin is design ko affirm karne ke liye mazeed instruments aur examination ki zaroorat hoti hai. Is design ke istemal se pehle, merchants ko is field ki mazeed maloomat hasil karni chahiye.

Ghomnay Wala Top example ko affirm karne ke liye, dealers ko dusre specialized devices aur markers ka istemal karna chahiye jaise ke pattern lines, moving midpoints, ya RSI. Conculsion: Ghomnay Wala Top candle design forex exchanging mein ek ahem tajarba hai. Iski madad se merchants market ki mansuba bandi ko samajh sakte hain, lekin is design ko affirm karne ke liye mazeed instruments aur examination ki zaroorat hoti hai. Is design ke istemal se pehle, merchants ko is field ki mazeed maloomat hasil karni chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:27 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим