What is Hanging man candlestick?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

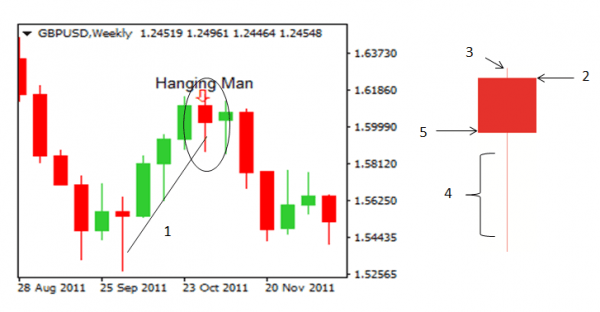

Aj is thread me apko me Pakistan forex trading ke ak bhot he important topic Hanging man candlestick pattern ki importance ke bare me btao ga or me umeed Karta ho ke jo information me apse share Karo ga wo apke knowledge or experience me zaror izafa kare ge. What is Hanging man candlestick? Aik hanging mean candle stick aik up trained ke douran hoti hai aur khabardaar karti hai ke qeematein girna shuru ho sakti hain. mom batii aik chhota sa asli jism, aik lamba nichala saya, aur thora ya koi oopri saya par mushtamil hai. phansi wala aadmi zahir karta hai ke sood farokht honay laga hai. patteren ke durust honay ke liye, latakaye hue aadmi ki pairwi karne wali mom batii ko asasa ki qeemat mein kami dekhna chahiye . Key Takeaway Aik hanging mean aik bearish reversal candle stuck patteren hai jo qeemat mein izafay ke baad hota hai. advance choti ya barri ho sakti hai, lekin kam az kam qeemat ki chand salakhon par mushtamil honi chahiye jo majmoi tor par ziyada ho gi .mom batii ka aik chhota asli jism aur aik lamba nichala saya hona chahiye jo haqeeqi jism se kam az kam dugna size ka ho. oopar ka saya bohat kam ya koi nahi hota. phansi walay aadmi ka band khula sun-hwa oopar ya neechay ho sakta hai, usay sirf khulay ke qareeb hona zaroori hai taakay asli jism chhota ho. tijarti muddat ke kuch hissay ke liye control haasil karen .phansi ka namona sirf aik intibah hai. qeemat ko agli mom batii par kam hona chahiye taakay latakaye hue aadmi ko aik durust ulat patteren banaya jasakay. usay tasdeeq kehte hain .tajir aam tor par taweel tijarat se bahar nikaltay hain ya tasdeeqi mom batii ke douran ya is ke baad mukhtasir tijarat mein daakhil hotay hain, is se pehlay nahi . Understanding Aik latka sun-hwa aadmi khulay ke baad aik barri farokht ki numaindagi karta hai jis se qeemat mein kami waqay hoti hai, lekin phir khredar qeemat ko ibtidayi qeemat ke qareeb wapas dhakel dete hain. tajir latakaye hue aadmi ko is baat ki alamat ke tor par dekhte hain ke bail control khonay lagey hain aur yeh ke asasa jald hi neechay ke rujhan mein daakhil ho sakta hai. latakaye hue aadmi ka namona is waqt hota hai jab qeemat kam az kam chand mom btyon se ziyada barh jati hai. yeh aik barri paish Raft ki zaroorat nahi hai. yeh ho sakta hai, lekin patteren aik barray neechay ke rujhan ke darmiyan aik mukhtasir muddat ke izafay ke andar bhi ho sakta hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC:What is Hanging man candlestick? market mein rujhanaat aur mumkina mourr ki nishandahi karne ke liye candle stick chart aam tor par takneeki tajzia mein istemaal hotay hain. Hanging man candle stick pattern candle stick charting mein sab se ziyada istemaal honay walay patteren mein se aik hai . Hanging man candle stick pattern aik bearish reversal pattern hai jo oopri rujhan ke oopar hota hai. is ki shanakht aik chhootey jism aur lambay nichale saaye se hoti hai. oopri saya aam tor par chhota ya ghair mojood hota hai . EXPLAINATION: Hanging man candle stick pattern ki tashkeel hamein batati hai ke agarchay market din ki oonchai ke qareeb khuli aur band hui, baichnay walay tijarti din ke douran qeematon ko numaya tor par neechay laane mein kamyaab rahay. yeh lambay nichale saaye se zahir hota hai . Hanging man ka chhota jism mom batii ki majmoi range ke oopri range ke qareeb waqay hona chahiye. yeh aik choti safaid ya siyah asli body honi chahiye aur is ki khuli aur qareebi qeemat mein koi khaas farq nahi hona chahiye . Hanging man candle stick pattern market ki simt mein mumkina tabdeeli ke liye aik intibahi alamat hai. is se pata chalta hai ke khredar raftaar kho rahay hain aur baichnay walay is par qabza karne ke liye tayyar ho satke hain . Hanging man patteren ki durustagi ki tasdeeq karne ke liye, yeh zaroori hai ke aglay din izafi bearish signals jaisay ke gape down ya lower close ko talaash karen . majmoi tor par, Hanging man patteren up trindz mein mumkina tabdeelion ki nishandahi karne ke liye aik mufeed tool saabit ho sakta hai. taham, signal ki durustagi ki tasdeeq ke liye usay hamesha deegar ahem takneeki isharay ke sath mil kar istemaal kya jana chahiye . -

#4 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC: What is HANGING MAN CANDLESTICK The hanging man aik maqbool candle stick pattern hai jo aam tor par maliyati mandiyon mein paaya jata hai, jaisay stock, forex aur comudators. yeh aik bearish reversal pattern hai jo aik taweel up trained ke baad bantaa hai aur rujhan ke mumkina ulat jane ka ishara deta hai. is pattern ka naam is ki shakal ke naam par rakha gaya hai, jo aik hanging man se mushabihat rakhta hai jis ke paon is ke neechay latak rahay hain . EXPLAINATION: hanging man pattern is waqt bantaa hai jab aik hi mom batii is waqt banti hai jis mein aik chhota sa jism, aik lamba nichala saya, aur thora ya koi oopri saya hota hai. mom batii ka jism ya to surkh ya sabz ho sakta hai, lekin neechay ka lamba saya ahem hai aur jism ki lambai se kam az kam dugna hona chahiye. oopri saaye ki ghair mojoodgi, ya bohat choti, is baat ki nishandahi karti hai ke belon ne qeemat ko ziyada karne ki koshish ki, lekin nakaam rahay, aur bears ne qeemat ko neechay dhkilte hue qaboo pa liya . hanging man pattern aik mazboot ishara hai ke oopar ka rujhan khatam ho sakta hai aur reechh mazboot ho rahay hain. taham, yeh note karna zaroori hai ke hanging man rujhan ke ulat jane ki zamanat nahi hai, aur taajiron ko hamesha ulat jane ki tasdeeq ke liye dosray isharay istemaal karne chahiye . hanging man pattern ki ahmiyat lambay nichale saaye mein hai, jo is baat ki nishandahi karti hai ke reechh qeemat ko numaya tor par neechay dhakelnay ke qabil thay is se pehlay ke bail usay wapas oopar dhakel saken. is se zahir hota hai ke reechh mazboot ho rahay hain aur qeemat ko mazeed neechay dhakel satke hain. candle stick ka chhota sa jism zahir karta hai ke taajiron ke darmiyan ghair faisla kin hai, aur oopri saaye ki kami is baat ki nishandahi karti hai ke bail control kho rahay hain . taajiron ko hanging man pattern ki tasdeeq ke liye deegar bearish signals, jaisay rsi ya macd par bearish divergence, ya kaleedi support level se neechay waqfa talaash karna chahiye. agar yeh signals mojood hain, to hanging mean pattern mumkina rujhan ke ulat jane ka aik mazboot signal ban jata hai . tajir hanging man pattern ko kayi tareeqon se istemaal kar satke hain. aik tareeqa yeh hai ke usay farokht ke signal ke tor par istemaal kya jaye, jis se yeh zahir hota hai ke yeh taweel pozishnon se bahar niklny aur stock ya asasa ko kam karne par ghhor karne ka waqt ho sakta hai. dosra tareeqa yeh hai ke usay tasdeeqi signal ke tor par istemaal kya jaye, jo is baat ki nishandahi karta hai ke deegar bearish signals durust hain aur rujhan ko tabdeel karne ka imkaan hai . yeh note karna zaroori hai ke hanging man pattern hamesha durust nahi hota hai aur usay dosray takneeki isharay aur tajzia ke sath istemaal kya jana chahiye. taajiron ko bhi ghalat signals se aagah hona chahiye, jahan pattern zahir hota hai, lekin yeh rujhan jari rehta hai, jis se zahir hota hai ke reechh market par control haasil karne ke qabil nahi thay . riwayati hanging man pattern ke ilawa, patteren ki mukhtalif halatain hain jin se taajiron ko aagah hona chahiye. misaal ke tor par, himr pattern hanging mean ka aik taizi se tagayur hai, aur yeh oopri rujhan ke bajaye neechay ke rujhan ke baad bantaa hai. hathora patteren is waqt bantaa hai jab aik wahid shama daan aik chhootey jism, aik lamba nichala saya, aur thora ya koi oopri saaye ke sath bantaa hai. hathoray ke pattern ki ahmiyat lambay nichale saaye mein hai, jo is baat ki nishandahi karta hai ke reechh qeemat ko numaya tor par neechay dhakelnay ke qabil thay is se pehlay ke bail usay peechay dhakel saken. is se zahir hota hai ke bail mazboot ho rahay hain aur qeemat ko mazeed oopar le ja satke hain . hanging man pattern ki aik aur tabdeeli shooting star patteren hai. shooting star patteren aik bearish reversal pattern hai jo aik taweel up trained ke baad bantaa hai aur rujhan ke mumkina ulat jane ka ishara deta hai. shooting star ka namona is waqt bantaa hai jab aik hi mom batii aik chhootey jism ke sath banti hai . -

#5 Collapse

HANGING MAN CANDLESTICK IN FOREX TRAIDING: Hanging Man Ek Candlestick Chart Pattern hai jo technical analysis mein istemaal hota hai. Ye pattern ba'az auqaat bearish trend ke indication ke liye dekha jata hai. Chaliye is pattern ko samjhein. Hanging Man candlestick pattern, Japanese candlestick charts ka ek hissa hai jo stock market analysis mein istemaal hota hai. Is pattern mein ek specific candlestick shape ki formation dikhayi deti hai jo bearish sentiment ki nishani ho sakti hai. FORMATION OF HANGING MAN CANDLESTICK: Hanging Man candlestick pattern mein candlestick ka shape ek lambi body aur ek chhoti upper shadow (sarhad) ke saath hota hai. Candlestick ki body upar wali taraf hoti hai, jabki lower shadow bahut chhoti ya na ke barabar hoti hai. Ye candlestick pattern bullish trend ke baad dikhta hai aur bearish reversal ki possibility batata hai. INTERPRETATION OF HANGING MAN CANDLESTICK: Hanging Man pattern ki interpretation market sentiment aur price action ke sath jodi jati hai. Agar ye pattern uptrend ke baad dikhe, to ye bearish reversal ki nishani ho sakti hai. Ye pattern bullish momentum ki khatam hone aur selling pressure ki shuruat ko darshata hai. Iska matlab hai ke market mein price down jaa sakti hai. KEY CHARACTERISTICS OF HANGING MAN CANDLESTICK PATTERN: Hanging Man candlestick pattern ka kuch important characteristics hain: - Is pattern mein candlestick ki body upar wali taraf hoti hai, jo isko mardana (hanging) appearance deta hai. - Upper shadow (sarhad) chhoti hoti hai ya na ke barabar hoti hai, jabki lower shadow bahut chhoti hoti hai. - Ye pattern uptrend ke baad dikhta hai aur bearish reversal ki indication deta hai. CONFIRMATION OF HANGING MAN CANDLESTICK PATTERN: Hanging Man candlestick pattern ki confirmation ke liye, traders aur investors dusre technical indicators aur price patterns ka istemaal karte hain. Is pattern ko confirm karne ke liye volume, trend lines, aur support/resistance levels ka bhi analysis kiya jata hai. TRAIDING STRATEGY OF HANGING MAN CANDLESTICK PATTERN: Hanging Man candlestick pattern ko trading strategy mein istemaal karne ke liye, traders iski confirmation ke baad sell positions le sakte hain. Stop-loss aur target levels ka bhi sahi tay kar lena zaroori hai. Ye pattern ek bearish reversal ko suggest karta hai, isliye traders sell positions lene ke liye market conditions ko aur bhi confirm karna chahiye.Hanging Man candlestick pattern bearish reversal ke liye ek important signal hai. Is pattern ko samajhna aur sahi tareeqe se interpret karna traders ke liye zaroori hai. Technical analysis ke saath-saath market trends aur dusre indicators ki madad se is pattern ki validity ko confirm karna chahiye, taaki sahi trading decisions liye ja sakein. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Aj is thread me apko me hanging man. Candlestick pattren ke bare me btao ga.aik hanging mean candle stick aik up trained ke douran hoti hai aur khabardaar karti hai ke qeematein girna shuru ho sakti hain. mom batii aik chhota sa asli jism, aik lamba nichala saya, aur thora ya koi oopri saya par mushtamil hai. phansi wala aadmi zahir karta hai ke sood farokht honay laga hai. patteren ke durust honay ke liye, hanging mean ki pairwi karne wali candle ko asasay ki qeemat mein kami dekhni chahiye. aik hang mean aik bearish reversal candle stuck patteren hai jo qeemat ki paishgi ke baad hota hai. advance choti ya barri ho sakti hai, lekin kam az kam qeemat ki chand salakhon par mushtamil honi chahiye jo majmoi tor par ziyada ho gi . -

#7 Collapse

Assalamualaikum ma umeed krta hun k aap sub loog khaireyat sy hon gy or aap subhi ka trading session acha chal raha ho ga. Aaj ka hamara topic hy Hanging man candlestick patterns Chalain us k baay ma agahi hasil krty hain hanging man candle stick patteren takneeki tajzia mein aik ahem chart ki tashkeel hai jo mumkina rujhan ko tabdeel karne ke baray mein baseerat faraham karta hai. yeh aik wahid mom batii ka namona hai jo aik oopri rujhan mein hota hai aur is ki makhsoos shakal latkay hue aadmi se millti hai. is note mein, hum hanging mean candle stuck patteren se wabasta khususiyaat, mzmrat, aur tijarti hikmat amlyon ko talaash karen ge. khususiyaat : 1. shakal : hanging mean patteren aik chhootey jism par mushtamil hota hai, aik lamba nichala saya ( jisay dam bhi kaha jata hai ), aur thora sa ya koi oopri saya nahi hota hai. jism aam tor par candle stick ke oopar hota hai, jo iftitahi aur ikhtitami qeematon ki numaindagi karta hai. 2. rang : kaye hue aadmi candle stuck ka rang itna ahem nahi hai jitna ke is ki shakal. yeh ya to taizi ( sabz ya safaid ) ya bearish ( surkh ya siyah ) ho sakta hai. 3. upper shadow : latkay hue aadmi ka oopri saya bohat kam hota hai, jo is baat ki nishandahi karta hai ke trading session ke douran qeemat ibtidayi ya band honay wali satah se ziyada nahi barhi. 4. zaireen saya : latkay hue aadmi ka lamba nichala saya aam tor par jism ki lambai se kam az kam dugna hota hai. yeh intra session kam ki numaindagi karta hai aur is ka matlab yeh hai ke session ke douran qeematon mein numaya kami waqay hui hai is se pehlay ke khredar qeematon ko wapas dhakelien, jis ke nateejay mein aik choti body bani. 5. zaireen saya : latkay hue aadmi ka lamba nichala saya aam tor par jism ki lambai se kam az kam dugna hota hai. yeh intra session kam ki numaindagi karta hai aur is ka matlab yeh hai ke session ke douran qeematon mein numaya kami waqay hui hai is se pehlay ke khredar qeematon ko wapas dhakelien, jis ke nateejay mein aik choti body bani. mzmrat aur tijarti hikmat e amli : 1. bearish reversal signal : hanging mean candle stuck patteren ko mumkina bearish reversal signal samjha jata hai jab yeh oopri rujhan mein zahir hota hai. is se pata chalta hai ke kharidari ka dabao kamzor ho raha hai aur yeh rujhan bhaap khatam ho sakta hai. tajir is ki tashreeh aik intibahi alamat ke tor par karte hain ke manfi pehlu ki taraf rujhan ka ulat jana qareeb aa sakta hai. 2. tasdeeq : jab ke akailey hanging mean patteren mumkina ulat palat ke baray mein baseerat faraham kar sakta hai, dosray takneeki isharay ya chart patteren se tasdeeq haasil karna bohat zaroori hai. tajir aksar izafi bearish signals talaash karte hain, jaisay ke support level se neechay ka waqfa, ascilators mein bearish divergen ya aas paas ke deegar bearish candle stuck patteren ki zahiri shakal. 3. nuqsaan ko rokna aur rissk managment : kisi bhi tijarti hikmat e amli ki terhan, rissk managment ki munasib taknekoon ka nifaz zaroori hai. tajir aam tor par mumkina ulat phair ki nakami se bachanay ke liye hanging mean candle stick ki oonchai ke oopar stap loss order dete hain. is se nuqsanaat ko mehdood karne mein madad millti hai agar qeemat mutawaqqa ulat phair ke khilaaf jari rehti hai. 4. hajam ke tahaffuzaat : hanging mean patteren se wabasta hajam par tawajah dena zaroori hai. hajam mein izafah patteren ki durustagi ko mazboot karta hai aur rujhan ke ulat jane ke mazboot imkaan ko zahir karta hai. hanging mean candle stick ki tashkeel ke douran market ke shurka ke yaqeen aur shirkat ka andaza laganay ke liye tajir hajam ka tajzia karte hain . 5. time frame : hanging mean patteren ki ahmiyat time frame ke lehaaz se mukhtalif ho sakti hai. chhootey intra day time framoon ke muqablay mein jab yeh taweel time frame, jaisay rozana ya hafta waar chart par hota hai to tajir aksar usay ziyada qabil aetmaad aur taaqatwar samajte hain. 6. mumkina tijarti hikmat e amli : jo tajir hang mean patteren ki nishandahi karte hain woh mandi ki hikmat amlyon ko nafiz karne par ghhor kar satke hain. is mein mojooda positions ko bechna, mukhtasir pozishnon mein daakhil hona, ya poat aapshnz khareedna shaamil ho sakta hai. taham, izafi takneeki tajzia tools ke sath reversal signal ki tasdeeq karna aur tijarat shuru karne se pehlay market ke majmoi tanazur par ghhor karna zaroori hai. aakhir mein, hanging mean candle stuck patteren takneeki tajzia ke liye aik qabil qader tool hai, jo up trindz mein mumkina rujhan ke ulat jane ka ishara deta hai. tajir bakhabar tijarti faislay karne ke liye deegar isharay aur tasdeeqi taknik ke sath is patteren ka istemaal kar satke hain. rissk managment ki munasib hikmat amlyon ko shaamil karkay aur market ke majmoi sayaq o Sabaq par ghhor karte hue, tajir hang mean candle stuck patteren par mabni tijarti hikmat amlyon ki taseer ko barha satke hain . -

#8 Collapse

Assalamualaikum! Umeed hai k ap sb khariyat sy hongy. R apky trading sessions achy jaa rhy hongy. Aj ka hmra discussion topic "What is hanging man candlestick pattern? ". Dekhty hain k ye hmein Kya information deta hai r hmry ilam Mai Kesy ezafa krta hai. Hanging man candlestick Aik hanging man candle stuck oopar ke rujhan ke douran hoti hai aur khabardaar karti hai ke qeematein girna shuru ho sakti hain. mom batii aik chhota sa asli jism, aik lamba nichala saya, aur thora ya koi oopri saya par mushtamil hai. phansi wala aadmi zahir karta hai ke sood k sth farokht honay laga hai. patteren ke durust honay ke liye, latakaye hue aadmi ki pairwi karne wali mom batii ko asasa ki qeemat mein kami dekhna chahiye . Explanation Aik latka sun-hwa aadmi khulay ke baad aik barri farokht ki numaindagi karta hai jis se qeemat mein kami waqay hoti hai, lekin phir khredar qeemat ko ibtidayi qeemat ke qareeb wapas dhakel dete hain. tajir latkay hue aadmi ko is baat ki alamat ke tor par dekhte hain ke bail control khonay lagey hain aur yeh ke asasa jald hi neechay ke rujhan mein daakhil ho sakta hai. hanging mean patteren is waqt hota hai jab qeemat kam az kam chand mom btyon ke liye ziyada barh jati hai. yeh aik barri paish Raft ki zaroorat nahi hai. yeh ho sakta hai, lekin patteren aik qaleel mudti izafay ke andar aik barray neechay ke rujhan ke darmiyan bhi ho sakta hai. latka sun-hwa aadmi" t" ki terhan lagta hai, halaank mom batii ka zahir hona sirf aik warning hai aur zaroori nahi ke amal karne ki koi wajah ho. hanging mean patteren ki tasdeeq nahi hoti jab tak ke qeemat agli muddat ya is ke foran baad gir nah jaye. phansi dainay walay aadmi ke baad, qeemat ko phansi dainay wali mom batii ki onche qeemat se oopar nahi jana chahiye, kyunkay yeh mumkina tor par aik aur qeemat ki paish qadmi ka ishara karta hai. agar qeemat phansi dainay walay shakhs ke baad girty hai, to is se patteren ki tasdeeq hoti hai aur candle stuck ke tajir usay lambi pozishnon se niklny ya mukhtasir position mein daakhil honay ke liye signal ke tor par istemaal karte hain. agar phansi ke aadmi ki tasdeeq honay ke baad aik nai mukhtasir position mein daakhil honay ki soorat mein, aik stap nuqsaan phansi walay aadmi ki mom batii ki oonchai ke oopar rakha ja sakta hai . Limitations Latakaye hue aadmi ki aik had, aur bohat se candle stuck patteren, yeh hai ke tasdeeq ka intzaar karne ke nateejay mein dakhlay ka maqam kharab ho sakta hai. qeemat do adwaar ke andar itni taizi se barh sakti hai ke tijarat se mumkina inaam khatray ka juwaz nahi ban sakta. tijarat ke aaghaz par inaam ki miqdaar ka taayun karna bhi mushkil ho sakta hai kyunkay candle stuck patteren aam tor par munafe ke ahdaaf k hoty faraham nahi karte hain. is ke bajaye, taajiron ko kisi bhi tijarat se bahar niklny ke liye deegar mom btyon ke patteren ya tijarti hikmat e amli istemaal karne ki zaroorat hai jo ke hang mean patteren ke zariye shuru ki gayi ho. is baat ki bhi koi yaqeen dehani nahi hai ke phansi ke aadmi ke ban'nay ke baad qeemat kam ho jaye gi, chahay aik tasdeeqi mom batii ho. yahi wajah hai ke jab aik mukhtasir tijarat shuru ki jati hai to khatray ko control karne ke liye, phansi walay aadmi ke ounchay darjay ke oopar aik stap las rakhnay ki sifarish ki jati hai . -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Aik hanging mean candle stick aik up trained ke douran hoti hai aur khabardaar karti hai ke qeematein girna shuru ho sakti hain. mom batii aik chhota sa asli jism, aik lamba nichala saya, aur thora ya koi oopri saya par mushtamil hai. phansi wala aadmi zahir karta hai ke sood farokht honay laga hai. patteren ke durust honay ke liye, latakaye hue aadmi ki pairwi karne wali mom batii ko asasa ki qeemat mein kami dekhna chahiye . Hanging man candle stick pattern ki tashkeel hamein batati hai ke agarchay market din ki oonchai ke qareeb khuli aur band hui, baichnay walay tijarti din ke douran qeematon ko numaya tor par neechay laane mein kamyaab rahay. yeh lambay nichale saaye se zahir hota hai . hanging man pattern is waqt bantaa hai jab aik hi mom batii is waqt banti hai jis mein aik chhota sa jism, aik lamba nichala saya, aur thora ya koi oopri saya hota hai. mom batii ka jism ya to surkh ya sabz ho sakta hai, lekin neechay ka lamba saya ahem hai aur jism ki lambai se kam az kam dugna hona chahiye. oopri saaye ki ghair mojoodgi, ya bohat choti, is baat ki nishandahi karti hai ke belon ne qeemat ko ziyada karne ki koshish ki, lekin nakaam rahay, aur bears ne qeemat ko neechay dhkilte hue qaboo pa liya . Aik hanging man candle stuck oopar ke rujhan ke douran hoti hai aur khabardaar karti hai ke qeematein girna shuru ho sakti hain. mom batii aik chhota sa asli jism, aik lamba nichala saya, aur thora ya koi oopri saya par mushtamil hai. phansi wala aadmi zahir karta hai ke sood k sth farokht honay laga hai. patteren ke durust honay ke liye, latakaye hue aadmi ki pairwi karne wali mom batii ko asasa ki qeemat mein kami dekhna chahiye .hanging mean patteren se wabasta hajam par tawajah dena zaroori hai. hajam mein izafah patteren ki durustagi ko mazboot karta hai aur rujhan ke ulat jane ke mazboot imkaan ko zahir karta hai. hanging mean candle stick ki tashkeel ke douran market ke shurka ke yaqeen aur shirkat ka andaza laganay ke liye tajir hajam ka tajzia karte hain . -

#10 Collapse

What is Hanging man candlestick? Asslam-O-Alaikum! Dear participants Me ummed kerti hoke ap sb ka foreign exchange buying and selling py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. TOPIC: What is HANGING MAN CANDLESTICK The placing guy aik maqbool candle stick sample hai jo aam tor par maliyati mandiyon mein paaya jata hai, jaisay stock, forex aur comudators. Yeh aik bearish reversal pattern hai jo aik taweel up trained ke baad bantaa hai aur rujhan ke mumkina ulat jane ka ishara deta hai. Is sample ka naam is ki shakal ke naam par rakha gaya hai, jo aik putting man se mushabihat rakhta hai jis ke paon is ke neechay latak rahay hain . EXPLAINATION:putting man pattern is waqt bantaa hai jab aik hello mother batii is waqt banti hai jis mein aik chhota sa jism, aik lamba nichala saya, aur thora ya koi oopri saya hota hai. Mother batii ka jism ya to surkh ya sabz ho sakta hai, lekin neechay ka lamba saya ahem hai aur jism ki lambai se kam az kam dugna hona chahiye. Oopri saaye ki ghair mojoodgi, ya bohat choti, is baat ki nishandahi karti hai ke belon ne qeemat ko ziyada karne ki koshish ki, lekin nakaam rahay, aur bears ne qeemat ko neechay dhkilte hue qaboo pa liya . Putting man sample aik mazboot ishara hai ke oopar ka rujhan khatam ho sakta hai aur reechh mazboot ho rahay hain. Taham, yeh notice karna zaroori hai ke striking man rujhan ke ulat jane ki zamanat nahi hai, aur taajiron ko hamesha ulat jane ki tasdeeq ke liye dosray isharay istemaal karne chahiye . HANGING MAN CANDLESTICK IN FOREX TRAIDING:

Striking guy sample ki ahmiyat lambay nichale saaye mein hai, jo is baat ki nishandahi karti hai ke reechh qeemat ko numaya tor par neechay dhakelnay ke qabil thay is se pehlay ke bail usay wapas oopar dhakel saken. Is se zahir hota hai ke reechh mazboot ho rahay hain aur qeemat ko mazeed neechay dhakel satke hain. Candle stick ka chhota sa jism zahir karta hai ke taajiron ke darmiyan ghair faisla relatives hai, aur oopri saaye ki kami is baat ki nishandahi karti hai ke bail control kho rahay hain . Taajiron ko hanging guy sample ki tasdeeq ke liye deegar bearish signals, jaisay rsi ya macd par bearish divergence, ya kaleedi guide degree se neechay waqfa talaash karna chahiye. Agar yeh indicators mojood hain, to placing suggest sample mumkina rujhan ke ulat jane ka aik mazboot signal ban jata hai . Tajir striking man sample ko kayi tareeqon se istemaal kar satke hain. Aik tareeqa yeh hai ke usay farokht ke sign ke tor par istemaal kya jaye, jis se yeh zahir hota hai ke yeh taweel pozishnon se bahar niklny aur inventory ya asasa ko kam karne par ghhor karne ka waqt ho sakta hai. Dosra tareeqa yeh hai ke usay tasdeeqi signal ke tor par istemaal kya jaye, jo is baat ki nishandahi karta hai ke deegar bearish alerts durust hain aur rujhan ko tabdeel karne ka imkaan hai . Yeh word karna zaroori hai ke placing man pattern hamesha durust nahi hota hai aur usay dosray takneeki isharay aur tajzia ke sath istemaal kya jana chahiye. Taajiron ko bhi ghalat signals se aagah hona chahiye, jahan sample zahir hota hai, lekin yeh rujhan jari rehta hai, jis se zahir hota hai ke reechh market par manipulate haasil karne ke qabil nahi thay . Riwayati hanging man pattern ke ilawa, patteren ki mukhtalif halatain hain jin se taajiron ko aagah hona chahiye. Misaal ke tor par, himr pattern hanging mean ka aik taizi se tagayur hai, aur yeh oopri rujhan ke bajaye neechay ke rujhan ke baad bantaa hai. Hathora patteren is waqt bantaa hai jab aik wahid shama daan aik chhootey jism, aik lamba nichala saya, aur thora ya koi oopri saaye ke sath bantaa hai. Hathoray ke sample ki ahmiyat lambay nichale saaye mein hai, jo is baat ki nishandahi karta hai ke reechh qeemat ko numaya tor par neechay dhakelnay ke qabil thay is se pehlay ke bail usay peechay dhakel saken. Is se zahir hota hai ke bail mazboot ho rahay hain aur qeemat ko mazeed oopar le ja satke hain .

-

#11 Collapse

"Hanging Man Candlestick: A Reversal Signal inside the Stock Market" OVERVIEW: "Hanging guy candlestick" ek technical evaluation tool hai jo stock market aur trading mein istemal hota hai. Ye ek candlestick sample hai jo fee motion aur market sentiment ke baare mein facts deta hai. Hanging guy candlestick bullish trend ke baad ek capability reversal signal hai.Hanging guy candlestick pattern woh candle hota hai jismein price open, excessive, low aur close ranges available hotay hain. Ye pattern typically ek single candle se represented hota hai. Hanging man candlestick sample ko become aware of karne ke liye kuch specific characteristics aur criteria hotay hain. Hanging guy candlestick sample ki pehchaan karne ke liye ek candle chahiye jo neeche diye gaye criteria ko meet karta hai:

Hanging guy candlestick sample ki pehchaan karne ke liye ek candle chahiye jo neeche diye gaye criteria ko meet karta hai:  1. Price open se neeche gap down hota hai.2. Candle ki body hamesha upar ki taraf hoti hai aur lambi hoti hai.3. Neeche wali shadow (ya lower wick) candle ki frame se kam hoti hai aur minimum body ke 2-3 guna ho sakti hai.Four. Upper wick chhoti hoti hai ya bilkul na hoti hai. "Interpreting Hanging Man Candlestick Pattern: Key Characteristics and Usage" Hanging man candlestick sample bearish reversal signal hai, matlab ki yeh ek indicator hai ki market mein bullish fashion khatam ho sakta hai aur bearish trend shuru ho sakta hai. Ye pattern charge ke upar pressure banane wale consumers ki weakness ko imply karta hai.Hanging guy candlestick pattern dekh kar buyers aur investors marketplace route aur fee motion ke baare mein choices lete hain. Is pattern ke incidence ke baad, investors promote positions enter kar sakte hain ya current long positions ko go out kar sakte hain.Lekin striking guy candlestick sample ka use karne se pehle, investors ko aur bhi factors aur signs ko don't forget karna chahiye. Ye ek single candle sample hai, isliye ek unmarried candle se trading selections lena risky ho sakta hai. Is sample ko verify karne ke liye buyers aur investors dusre technical indicators aur charge movement ko bhi dekhte hain.Hanging man candlestick pattern ki accuracy aur reliability rely karti hai ki woh kis context mein appear karti hai. Isliye, investors ko rate trends, aid aur resistance ranges, aur market volatility ko bhi examine karna chahiye.In conclusion, putting man candlestick pattern ek famous technical evaluation device hai jo buyers aur investors ke liye beneficial ho sakti hai. Ye pattern market sentiment aur capability trend reversal ko indicate karti hai. Lekin is sample ka istemal karne se pehle, traders ko aur bhi factors ko recall karna chahiye aur dusre technical signs ka use karna chahiye.

1. Price open se neeche gap down hota hai.2. Candle ki body hamesha upar ki taraf hoti hai aur lambi hoti hai.3. Neeche wali shadow (ya lower wick) candle ki frame se kam hoti hai aur minimum body ke 2-3 guna ho sakti hai.Four. Upper wick chhoti hoti hai ya bilkul na hoti hai. "Interpreting Hanging Man Candlestick Pattern: Key Characteristics and Usage" Hanging man candlestick sample bearish reversal signal hai, matlab ki yeh ek indicator hai ki market mein bullish fashion khatam ho sakta hai aur bearish trend shuru ho sakta hai. Ye pattern charge ke upar pressure banane wale consumers ki weakness ko imply karta hai.Hanging guy candlestick pattern dekh kar buyers aur investors marketplace route aur fee motion ke baare mein choices lete hain. Is pattern ke incidence ke baad, investors promote positions enter kar sakte hain ya current long positions ko go out kar sakte hain.Lekin striking guy candlestick sample ka use karne se pehle, investors ko aur bhi factors aur signs ko don't forget karna chahiye. Ye ek single candle sample hai, isliye ek unmarried candle se trading selections lena risky ho sakta hai. Is sample ko verify karne ke liye buyers aur investors dusre technical indicators aur charge movement ko bhi dekhte hain.Hanging man candlestick pattern ki accuracy aur reliability rely karti hai ki woh kis context mein appear karti hai. Isliye, investors ko rate trends, aid aur resistance ranges, aur market volatility ko bhi examine karna chahiye.In conclusion, putting man candlestick pattern ek famous technical evaluation device hai jo buyers aur investors ke liye beneficial ho sakti hai. Ye pattern market sentiment aur capability trend reversal ko indicate karti hai. Lekin is sample ka istemal karne se pehle, traders ko aur bhi factors ko recall karna chahiye aur dusre technical signs ka use karna chahiye.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Candlestick Chart Pattern hai jo technical analysis mein istemaal hota hai. Ye pattern ba'az auqaat bearish trend ke indication ke liye dekha jata hai. Chaliye is pattern ko samjhein. Hanging Man candlestick pattern, Japanese candlestick charts ka ek hissa hai jo stock market analysis mein istemaal hota hai. Is pattern mein ek specific candlestick shape ki formation dikhayi deti hai jo bearish sentiment ki nishani ho sakti hai.pattern is waqt bantaa hai jab aik hi mom batii is waqt banti hai jis mein aik chhota sa jism, aik lamba nichala saya, aur thora ya koi oopri saya hota hai. mom batii ka jism ya to surkh ya sabz ho sakta hai, lekin neechay ka lamba saya ahem hai aur jism ki lambai se kam az kam dugna hona chahiye. oopri saaye ki ghair mojoodgi, ya bohat choti, is baat ki nishandahi karti hai ke belon ne qeemat ko ziyada karne ki koshish ki, lekin nakaam rahay, aur bears ne qeemat ko neechay dhkilte hue qaboo pa liya . Aik hanging man candle stuck oopar ke rujhan ke douran hoti hai aur khabardaar karti hai ke qeematein girna shuru ho sakti hain. mom batii aik chhota sa asli jism, aik lamba nichala saya, aur thora ya koi oopri saya par mushtamil hai. phansi wala aadmi zahir karta hai ke sood k sth farokht honay laga hai. patteren ke durust honay ke liye, latakaye hue aadmi ki pairwi karne wali mom batii ko asasa ki qeemat mein kami dekhna chahiye .hanging mean patteren se wabasta hajam par tawajah dena zaroori hai. hajam mein izafah patteren ki durustagi ko mazboot karta hai aur rujhan ke ulat jane ke mazboot imkaan ko zahir karta hai. hanging mean candle stick ki tashkeel ke douran market ke shurka ke yaqeen aur shirkat ka andaza laganay ke liye tajir hajam ka tajzia karte hain .

FORMATION OF HANGING MAN CANDLESTICK: Hanging Man candlestick pattern mein candlestick ka shape ek lambi body aur ek chhoti upper shadow (sarhad) ke saath hota hai. Candlestick ki body upar wali taraf hoti hai, jabki lower shadow bahut chhoti ya na ke barabar hoti hai. Ye candlestick pattern bullish trend ke baad dikhta hai aur bearish reversal ki possibility batata hai. INTERPRETATION OF HANGING MAN CANDLESTICK: Hanging Man pattern ki interpretation market sentiment aur price action ke sath jodi jati hai. Agar ye pattern uptrend ke baad dikhe, to ye bearish reversal ki nishani ho sakti hai. Ye pattern bullish momentum ki khatam hone aur selling pressure ki shuruat ko darshata hai. Iska matlab hai ke market mein price down jaa sakti hai.

KEY CHARACTERISTICS OF HANGING MAN CANDLESTICK PATTERN: Hanging Man candlestick pattern ka kuch important characteristics hain: - Is pattern mein candlestick ki body upar wali taraf hoti hai, jo isko mardana (hanging) appearance deta hai. - Upper shadow (sarhad) chhoti hoti hai ya na ke barabar hoti hai, jabki lower shadow bahut chhoti hoti hai. - Ye pattern uptrend ke baad dikhta hai aur bearish reversal ki indication deta hai.

-

#13 Collapse

Introduction Hanging man candle stick aik bht hi popular candle stick h jo trader ko bht zyada khrbdar krta hai k ab qeemto ka girna shoro ho choka h lehaza dehan sy trading krny ki zrort hai ,yeh reversal chart patern k aik candle wala patern hota hai,iski nechy wla candle bht lamba hota hai,or isky opr waly hisy m chota sa body type bna hota hai,yeh thora opr or nichy wick ho bi skta h or ni bi . Explanation Yeh aik ghair mustehkam teezi k rujhanat k sath numaya muzahmti sattah sy aala treen drusgi frahim krta hai. Yeh hanging mam candle stick oper k trend k doraan hoti hai or yeh inform krti h keh qeemtain girna shro krti hain,yeh real candle or sya type body ki trah hota hai,yeh hanging man candle stick yeh zahir krta h k ab trust m izafa ki shrah zyada hony lgi h, trader ko is trah k candle m sabr or analysis krny k bad trade kry to behtr rhy ga .is bat ki bi koi yaqeendehani ni h hanging man candle stick bnny k bad qeematain kam ho jain is bat ki bi koi guarantee ni h k profit bht zyada ho sky,jub trading shro ki jati h to kahtry ko control krny k liay k hanging man stick peh stop loss lgany ki sfarish ki jati hai . -

#14 Collapse

Hanging man candle Aik hanging man flame stuck oopar ke rujhan ke douran hoti hai aur khabardaar karti hai ke qeematein girna shuru ho sakti hain. mother batii aik chhota sa asli jism, aik lamba nichala saya, aur thora ya koi oopri saya standard mushtamil hai. phansi wala aadmi zahir karta hai ke soodk sth farokht honay laga hai. patteren ke durust honay ke liye, latakaye tint aadmi ki pairwi karne wali mother batii ko asasa ki qeemat mein kami dekhna chahiye .Clarification Aik latka sun-hwa aadmi khulay ke baad aik barri farokht ki numaindagi karta hai jis se qeemat mein kami waqay hoti hai, lekin phir khredar qeemat ko ibtidayi qeemat ke qareeb wapas dhakel dete hain. tajir latkay tint aadmi ko is baat ki alamat ke peak standard dekhte hain ke bail control khonay lagey hain aur yeh ke asasa jald hello there neechay ke rujhan mein daakhil ho sakta hai. hanging mean patteren is waqt hota hai hit qeemat kam az kam chand mother btyon ke liye ziyada barh jati hai. yeh aik barri paish Pontoon ki zaroorat nahi hai. yeh ho sakta hai, lekin patteren aik qaleel mudti izafay ke andar aik barray neechay ke rujhan ke darmiyan bhi ho sakta hai. latka sun-hwa aadmi" t" ki terhan lagta hai, halaank mother batii ka zahir hona sirf aik cautioning hai aur zaroori nahi ke amal karne ki koi wajah ho. hanging mean patteren ki tasdeeq nahi hoti punch tak ke qeemat agli muddat ya is ke foran baad gir nah jaye. phansi dainay walay aadmi ke baad, qeemat ko phansi dainay wali mother batii ki onche qeemat se oopar nahi jana chahiye, kyunkay yeh mumkina peak standard aik aur qeemat ki paish qadmi ka ishara karta hai. agar qeemat phansi dainay walay shakhs ke baad girty hai, to is se patteren ki tasdeeq hoti hai aur flame stuck ke tajir usay lambi pozishnon se niklny ya mukhtasir position mein daakhil honay ke liye signal ke pinnacle standard istemaal karte hain. agar phansi ke aadmi ki tasdeeq honay ke baad aik nai mukhtasir position mein daakhil honay ki soorat mein, aik stap nuqsaan phansi walay aadmi ki mother batii ki oonchai ke oopar rakha ja sakta hai . Impediments Latakaye tint aadmi ki aik had, aur bohat se flame stuck patteren, yeh hai ke tasdeeq ka intzaar karne ke nateejay mein dakhlay ka maqam kharab ho sakta hai. qeemat do adwaar ke andar itni taizi se barh sakti hai ke tijarat se mumkina inaam khatray ka juwaz nahi boycott sakta. tijarat ke aaghaz standard inaam ki miqdaar ka taayun karna bhi mushkil ho sakta hai kyunkay candle stuck patteren aam peak standard munafe ke ahdaaf k hoty faraham nahi karte hain. is ke bajaye, taajiron ko kisi bhi tijarat se bahar niklny ke liye deegar mother btyon ke patteren ya tijarti hikmat e amli istemaal karne ki zaroorat hai jo ke hang mean patteren ke zariye shuru ki gayi ho. is baat ki bhi koi yaqeen dehani nahi hai ke phansi ke aadmi ke ban'nay ke baad qeemat kam ho jaye gi, chahay aik tasdeeqi mother batii ho. yahi wajah hai ke poke aik mukhtasir tijarat shuru ki jati hai to khatray ko control karne ke liye, phansi walay aadmi ke ounchay darjay ke oopar aik stap las rakhnay ki sifarish ki jati hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction Hanging man candle stick aik bht hi popular candle stick h jo trader ko bht zyada khrbdar krta hai k ab qeemto ka girna shoro ho choka h lehaza dehan sy trading krny ki zrort hai ,yeh reversal chart patern k aik candle wala patern hota hai,iski nechy wla candle bht lamba hota hai,or isky opr waly hisy m chota sa body type bna hota hai,yeh thora opr or nichy wick ho bi skta h or ni bi . Explanation Yeh aik ghair mustehkam teezi k rujhanat k sath numaya muzahmti sattah sy aala treen drusgi frahim krta hai. Yeh hanging mam candle stick oper k trend k doraan hoti hai or yeh inform krti h keh qeemtain girna shro krti hain,yeh real candle or sya type body ki trah hota hai,yeh hanging man candle stick yeh zahir krta h k ab trust m izafa ki shrah zyada hony lgi h, trader ko is trah k candle m sabr or analysis krny k bad trade kry to behtr rhy ga .is bat ki bi koi yaqeendehani ni h hanging man candle stick bnny k bad qeematain kam ho jain is bat ki bi koi guarantee ni h k profit bht zyada ho sky,jub trading shro ki jati h to kahtry ko control krny k liay k hanging man stick peh stop loss lgany ki sfarish ki jati hai . Hanging man candle stick trader isy trend m tabdeeli k simt m istemal krty hainjaisy hi ueh candle apni speed ko khoony lgta h to yeh market k girny ka ishara deta hai .iska maqsad h potential bearish reversal in the market.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:48 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим