Re: Arbitrage trading

pure exchange

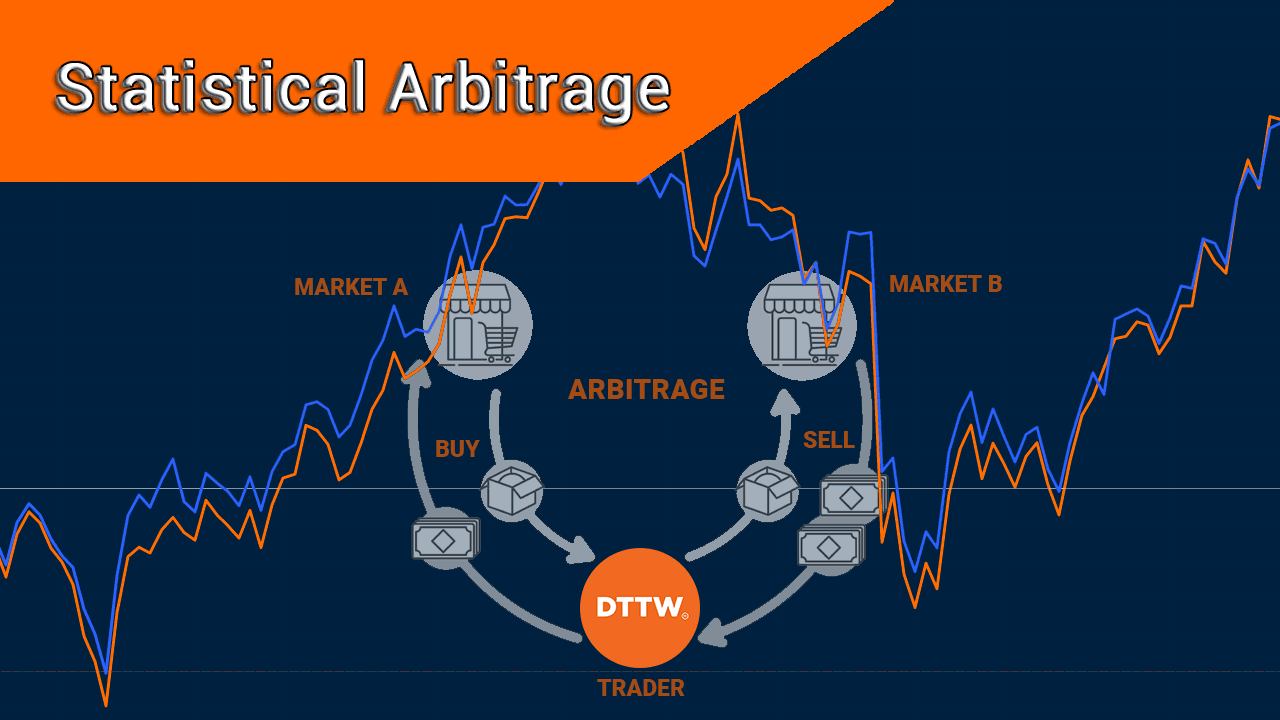

Qeemat ke distinction se faida uthany ke liye istemaal kiye jane wali procedures mein se aik ko forex triangle exchange kaha jata hai exchange foreli cash mein tabdeel kar diya jata hai, yaad delana ke jaisay howdy doosri exchanging hoti hai hor merchant peril hai benefit mein jo je kaam se haasil hota x matches ke kaam karne ke tareeqay ko behtar pinnacle standard samajhney ke liye dealers ko pehle is ki bunyadi batein sekhne chahiye, poke koi broker kisi khaas money ke pair ki exchanging karta hai to iska matlab hai ke a movement kar raha hai aik pair khareedna aur dosra bechna ye baat zehen mein rakhen ke forex ke pair je terhan likhay gaye hain ke dono cash ka aik dosray se taluq hai, model ke peak pair euro/usd cash pair usd mein euro ki aik kha ki qader ko zahir card hai. unfamiliar money ke triangle exchange ke muamlay mein aik broker forex market mein 3 mukhtalif monetary forms ki qeematon ke farq se mauqa se faida uthany mein invlove hai, aik aur wazahat mein je hikmat-e-amli ke liye cash 3 exchanges ki pehli zaroorat hai ke badlay doosri money ka teesri money ke badlay aur teesri cash ko wapas pehhai jo is waqt hota hai punch market cross swapping scale aur inferred cross conversion standard aik dosray ke sath munsalik nahi hotay hain.

Intervention WORK

Aamtaur for a huge monetary foundation ki jaaneb se work Karte Hain ismein aamtaur na Kafi sum ki tijarat Shamil hoti hai aur Iske Pesh Karda opportunity between two seconds ki distinguished aur ine per intihai nafis programming ke zriye hey Amal Kiya Ja sakta hai internet business ke aruj ke sath Jo ek second ke Ek part ke andar tijarti request ko Anjam De sakta hai Jo Ke discretion Tijarat ke exchange ke cost se Chhota Hota Hai Kyunki is opportunity ki maloomat karne aur Tijarat ko Anjam dene ke liye Aham vasal ki zarurat hoti hai

Intervention DECENTRALIZED Trade

Decentralized digital currency resources ki cost ka tayun karne ke liye ek different technique istamal Karte Hain ek robotized market producer framework ke Taur per Jana jata Hai Yahan request framework ke Bajaye Jahan purchasers and venders matched ko ek kas cost aur sum for crypto resource ke Tijarat karne ke liye Ek Sath Milaya jata hai decentralized liquidity supports trade for assembly Karta Hain har crypto exchanging pair ke liye Ek Alyda Pool banana zaruri hai Aisa karne ka matlab Ek Aise Amal ke zarie benefit Kamana hai jismein bahut kam aur risk Na Ho is procedure ke exposed mein dusri bari Baat yah hai ke aapko exchange Tijarat start karne se pahle ek dear Arrangement ke sath proficient financial backer

pure exchange

Qeemat ke distinction se faida uthany ke liye istemaal kiye jane wali procedures mein se aik ko forex triangle exchange kaha jata hai exchange foreli cash mein tabdeel kar diya jata hai, yaad delana ke jaisay howdy doosri exchanging hoti hai hor merchant peril hai benefit mein jo je kaam se haasil hota x matches ke kaam karne ke tareeqay ko behtar pinnacle standard samajhney ke liye dealers ko pehle is ki bunyadi batein sekhne chahiye, poke koi broker kisi khaas money ke pair ki exchanging karta hai to iska matlab hai ke a movement kar raha hai aik pair khareedna aur dosra bechna ye baat zehen mein rakhen ke forex ke pair je terhan likhay gaye hain ke dono cash ka aik dosray se taluq hai, model ke peak pair euro/usd cash pair usd mein euro ki aik kha ki qader ko zahir card hai. unfamiliar money ke triangle exchange ke muamlay mein aik broker forex market mein 3 mukhtalif monetary forms ki qeematon ke farq se mauqa se faida uthany mein invlove hai, aik aur wazahat mein je hikmat-e-amli ke liye cash 3 exchanges ki pehli zaroorat hai ke badlay doosri money ka teesri money ke badlay aur teesri cash ko wapas pehhai jo is waqt hota hai punch market cross swapping scale aur inferred cross conversion standard aik dosray ke sath munsalik nahi hotay hain.

Intervention WORK

Aamtaur for a huge monetary foundation ki jaaneb se work Karte Hain ismein aamtaur na Kafi sum ki tijarat Shamil hoti hai aur Iske Pesh Karda opportunity between two seconds ki distinguished aur ine per intihai nafis programming ke zriye hey Amal Kiya Ja sakta hai internet business ke aruj ke sath Jo ek second ke Ek part ke andar tijarti request ko Anjam De sakta hai Jo Ke discretion Tijarat ke exchange ke cost se Chhota Hota Hai Kyunki is opportunity ki maloomat karne aur Tijarat ko Anjam dene ke liye Aham vasal ki zarurat hoti hai

Intervention DECENTRALIZED Trade

Decentralized digital currency resources ki cost ka tayun karne ke liye ek different technique istamal Karte Hain ek robotized market producer framework ke Taur per Jana jata Hai Yahan request framework ke Bajaye Jahan purchasers and venders matched ko ek kas cost aur sum for crypto resource ke Tijarat karne ke liye Ek Sath Milaya jata hai decentralized liquidity supports trade for assembly Karta Hain har crypto exchanging pair ke liye Ek Alyda Pool banana zaruri hai Aisa karne ka matlab Ek Aise Amal ke zarie benefit Kamana hai jismein bahut kam aur risk Na Ho is procedure ke exposed mein dusri bari Baat yah hai ke aapko exchange Tijarat start karne se pahle ek dear Arrangement ke sath proficient financial backer

:max_bytes(150000):strip_icc():format(webp)/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

تبصرہ

Расширенный режим Обычный режим