AOA

Introduction

Friends kya haal hai aapke ummid karta hun aap sab khairiyat se Honge Aaj Jis topic ko Ham discuss Karenge aur main aapke sath Apne knowledge ko share Karunga vah Hai hanging man candlestick pattern market ke trading chart per vaise to different type ke pattern create Hote rahte hain jinmen se Kuchh Aise pattern hai ki Jab Bhi create hote hain to Uske bad market ke direction Mein hoti hai agar Hamen Aise pattern mein se koi sa bhi pattern mil jaaye to use per Ham trade enter Karke short time mein acchi profit Hasil kar sakte hain Jis Tarah market ke chart Mein create hone wala Kuchh famous karykram Hai Jis Tarah morning and evening star pattern hai triangle pattern create hone ke bad market ki momaji fix hoti hai Aise pattern Mein Ek hanging man can understand pattern bhi hai agar Ham isko identify karna aur is per trading karna understand kar len To Ham bahut Achcha profit Hasil kar sakte hain to Chalte Hain is pattern ko understand karne ke liye

Details hanging man candle stick pattern

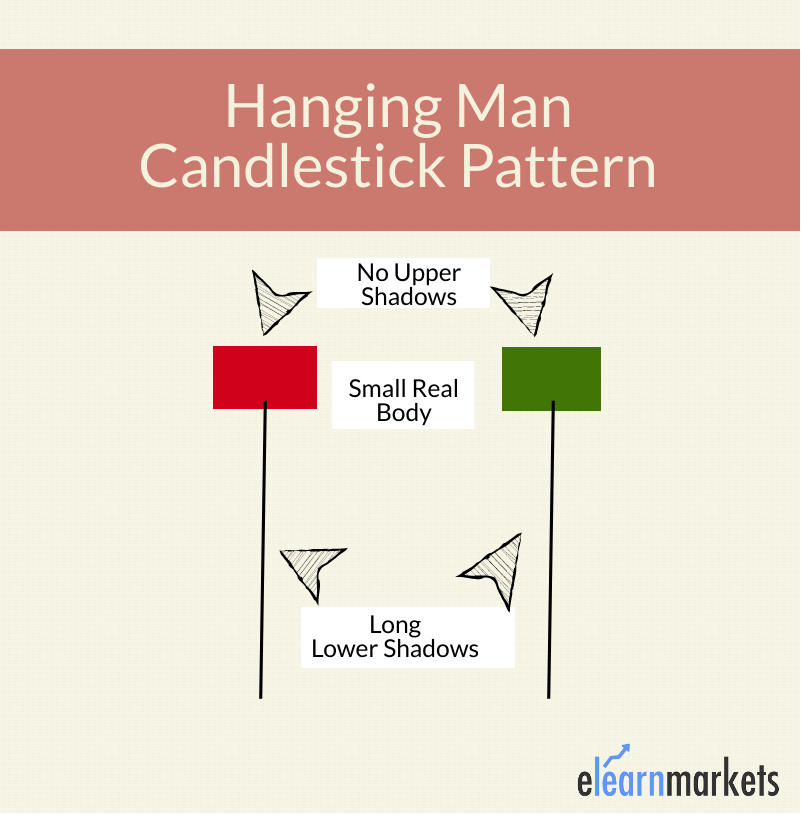

Hanging men candlestick pattern a bullish trend reversal pattern Hai is pattern Mein first candle Small real body ki bullish ya bearish candle banti hai Jiska lower wick long hota hai aur upper wick small ya zero hota hai yah candle fansi per Latke hue aadami Ki Tarah lagti hai isliye is pattern ka naam hanging man candlestick pattern Rakha Gaya Hai yah pattern currency aur commodities ke price chart Mein bullish trend ke top per ya resistance level ke kareeb banta hai is pattern ke bad price bahut fast move down karti hai market ke Trend bullish Mein Hota Hai create hone ke bad change hokar totally down trend Ho Jaate Hain aur mukmmal Sell Mein moment hone Lagti Hai sem time per Ham mein Sel ki trade enter kar sakte hain

Trading with hanging man candlestick pattern

Hanging man candlestick pattern ke complete change ke bad new candle ke open hone per traders ko Sell ki trade enter Karni chahie Kyunki sem time to market long move Karti Hai Lekin Kanye Kanye sem pattern na bhi move down Nahin Karte Jo Kabhi Kabhi hota hai lekin Aksar sem pattern ke create hone ke bad market down move karti hai Jis per Sell mein open ki jaane wali trade mein bahut Achcha profit Hasil ho sakta hai lekin Fir Bhi Hamen apni trade ko secure karne ke liye stop loss Jarur use karna chahie aur take profit ko next support level per spot Karen Agar Baz O qat pattern Kisi bhi vajah Se Na mukmmal Ho To Move opposite direction Mein Ho To Hamara stop loss kam se kam ho aur ham stop loss take profit Hamen Jyada loss hone se secure Karte Hain

Introduction

Friends kya haal hai aapke ummid karta hun aap sab khairiyat se Honge Aaj Jis topic ko Ham discuss Karenge aur main aapke sath Apne knowledge ko share Karunga vah Hai hanging man candlestick pattern market ke trading chart per vaise to different type ke pattern create Hote rahte hain jinmen se Kuchh Aise pattern hai ki Jab Bhi create hote hain to Uske bad market ke direction Mein hoti hai agar Hamen Aise pattern mein se koi sa bhi pattern mil jaaye to use per Ham trade enter Karke short time mein acchi profit Hasil kar sakte hain Jis Tarah market ke chart Mein create hone wala Kuchh famous karykram Hai Jis Tarah morning and evening star pattern hai triangle pattern create hone ke bad market ki momaji fix hoti hai Aise pattern Mein Ek hanging man can understand pattern bhi hai agar Ham isko identify karna aur is per trading karna understand kar len To Ham bahut Achcha profit Hasil kar sakte hain to Chalte Hain is pattern ko understand karne ke liye

Details hanging man candle stick pattern

Hanging men candlestick pattern a bullish trend reversal pattern Hai is pattern Mein first candle Small real body ki bullish ya bearish candle banti hai Jiska lower wick long hota hai aur upper wick small ya zero hota hai yah candle fansi per Latke hue aadami Ki Tarah lagti hai isliye is pattern ka naam hanging man candlestick pattern Rakha Gaya Hai yah pattern currency aur commodities ke price chart Mein bullish trend ke top per ya resistance level ke kareeb banta hai is pattern ke bad price bahut fast move down karti hai market ke Trend bullish Mein Hota Hai create hone ke bad change hokar totally down trend Ho Jaate Hain aur mukmmal Sell Mein moment hone Lagti Hai sem time per Ham mein Sel ki trade enter kar sakte hain

Trading with hanging man candlestick pattern

Hanging man candlestick pattern ke complete change ke bad new candle ke open hone per traders ko Sell ki trade enter Karni chahie Kyunki sem time to market long move Karti Hai Lekin Kanye Kanye sem pattern na bhi move down Nahin Karte Jo Kabhi Kabhi hota hai lekin Aksar sem pattern ke create hone ke bad market down move karti hai Jis per Sell mein open ki jaane wali trade mein bahut Achcha profit Hasil ho sakta hai lekin Fir Bhi Hamen apni trade ko secure karne ke liye stop loss Jarur use karna chahie aur take profit ko next support level per spot Karen Agar Baz O qat pattern Kisi bhi vajah Se Na mukmmal Ho To Move opposite direction Mein Ho To Hamara stop loss kam se kam ho aur ham stop loss take profit Hamen Jyada loss hone se secure Karte Hain

تبصرہ

Расширенный режим Обычный режим