Importance of Chart Patterns:

Forex Trading man traders currency pairs aur commodities ki price movements ko smajhna k liye price chart read kerta han Price Chart price k trend, momentum aur patterns man changes ko accurately identify kerta ha Chart Patterns price chart man price ki movement ko track kerna k liye use hona wala most important technical tool ha Traders Currency Pairs aur Commodities ko Buy/Sell k liye in chart pattern pr depend kerta han

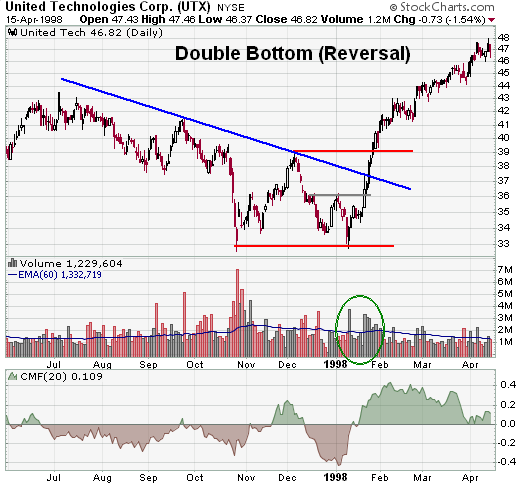

What Is Double Bottom Chart Pattern

Double Bottom Chart Pattern ak trend reversal pattern ha Ye pattern long bearish trend k bottom per support level per banta ha Ye pattern batata ha k sellers price ko nicha la ker jata han lakin power kam hona ki waja sa price ko hold nahe ker pata Sellers is pattern man two time price ko same level tak nicha le ker jata han lakin second bottom k bad jab price hoti ha to pher ak long bullish trend k start hona ki 50% confirmation ho jati ha Final confirmation k liye trader dono bottom k starting point ko ak trend line sa jorta ha. Is trend line ko " Neckline"" kehta han, jab price is neckline ko break kerti ha to trader ko long bullish trend ki 100 % confirmation ho jati ha

Trading With 'Double Chart Pattern

Double Bottom Chart Pattern per trading kerna k liye zarori ha k trader breakout ka wait kara, aur jab price candle ka close ""Neckline"" sa oper de to is sa breakout ki confirmation ho jati ha Lakin trader ko trade k liye price k neckline ko re-test kerna ka wait kerna chaheye Jab price retest kerti ha to is per trader ko ""Buy ki Trade"" active kerni chaheye Stoploss ko last bottom sa nicha place karen aur Take Profit ko neckline aur bottom k dermiyan distance k baraber oper place karen

With Other Technical Indicator

Trade ki mazeed confimation k liye trader is pattern k sath ""Moving Average ya Oscilator"" ko use ker sakta ha Ager trader Relative Strength Index (RSI) use ker raha han to trade ki confirmation k liye zarori ha k is pattern ki formation k doran RSI bullish Divergence de rahe ho

Forex Trading man traders currency pairs aur commodities ki price movements ko smajhna k liye price chart read kerta han Price Chart price k trend, momentum aur patterns man changes ko accurately identify kerta ha Chart Patterns price chart man price ki movement ko track kerna k liye use hona wala most important technical tool ha Traders Currency Pairs aur Commodities ko Buy/Sell k liye in chart pattern pr depend kerta han

What Is Double Bottom Chart Pattern

Double Bottom Chart Pattern ak trend reversal pattern ha Ye pattern long bearish trend k bottom per support level per banta ha Ye pattern batata ha k sellers price ko nicha la ker jata han lakin power kam hona ki waja sa price ko hold nahe ker pata Sellers is pattern man two time price ko same level tak nicha le ker jata han lakin second bottom k bad jab price hoti ha to pher ak long bullish trend k start hona ki 50% confirmation ho jati ha Final confirmation k liye trader dono bottom k starting point ko ak trend line sa jorta ha. Is trend line ko " Neckline"" kehta han, jab price is neckline ko break kerti ha to trader ko long bullish trend ki 100 % confirmation ho jati ha

Trading With 'Double Chart Pattern

Double Bottom Chart Pattern per trading kerna k liye zarori ha k trader breakout ka wait kara, aur jab price candle ka close ""Neckline"" sa oper de to is sa breakout ki confirmation ho jati ha Lakin trader ko trade k liye price k neckline ko re-test kerna ka wait kerna chaheye Jab price retest kerti ha to is per trader ko ""Buy ki Trade"" active kerni chaheye Stoploss ko last bottom sa nicha place karen aur Take Profit ko neckline aur bottom k dermiyan distance k baraber oper place karen

With Other Technical Indicator

Trade ki mazeed confimation k liye trader is pattern k sath ""Moving Average ya Oscilator"" ko use ker sakta ha Ager trader Relative Strength Index (RSI) use ker raha han to trade ki confirmation k liye zarori ha k is pattern ki formation k doran RSI bullish Divergence de rahe ho

تبصرہ

Расширенный режим Обычный режим