What is Pipe Top pattern

Pin bar candlestick pattern and it's types

candlestick pattern it's types

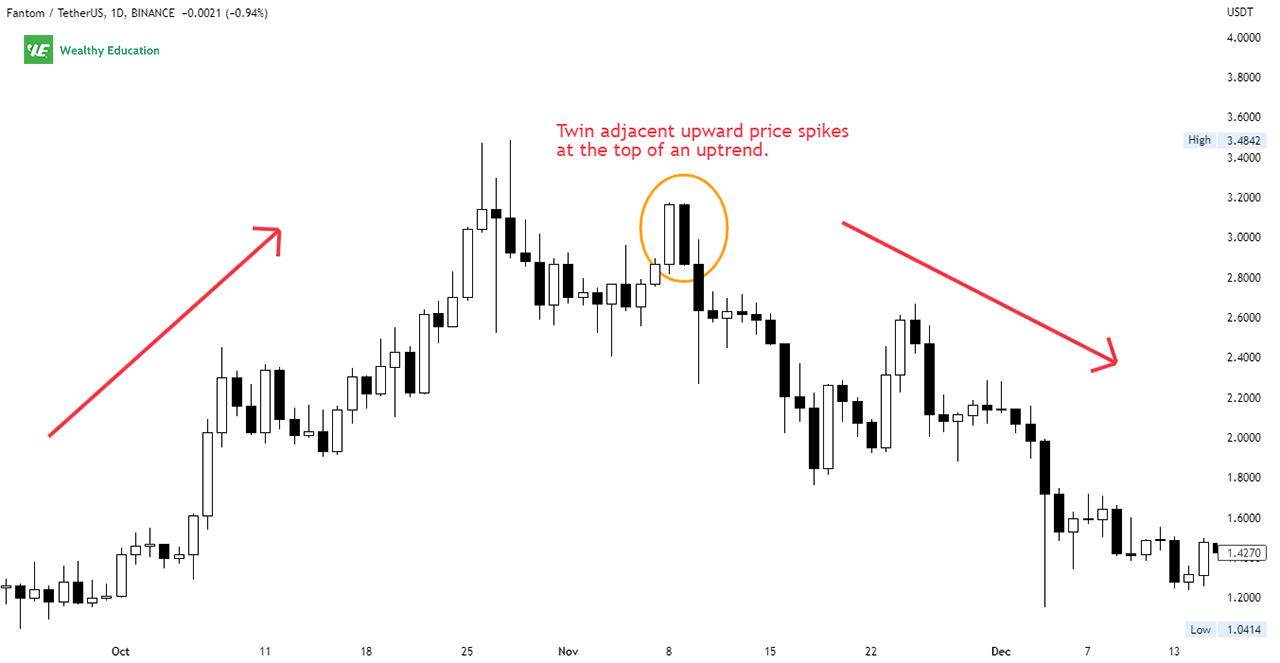

candlesticks ka trading main bahut important role ha es lye inko smjhna lazmi ha or aj ki post maij hum important candle stick pattern ko study karen gy jo pipe top or pipe bottom pattern ha ye aik bearish reversal pattern ha or ye bullish trend k end main banta ha es k bad market main trend reverse hota ha or market bearish jati ha es lye es pattern main hamen achi sell ki entry mil jati ha.

How it is formed pattern main aik bullish candle estrha close hoti ha k us k opr shadow ni hota ya phr mamoli sa shadow hota ha or opr complete body hoti ha jb k es k bad aik bearish candle banti ha or ye candle bullish candle ki 70% body k equal hoti ha es bearish candle k opar bhi koe shadow n hota ya ohr mamooli shadow hota ha es trha aik bearish or aik bullish candle mil k top bnati hain jsko pipe top kaha jata ha.

How to trade it

Dear members es pattern main 2nd bearish candle k close hony k bad hum sell ki trade le skty hain or es main hmara stop loss pipe top k opr hota ha jb k profit target next support hoti ha.

What is Pipe Bottom Pattern

dear member ye aik bullish reversal pattern ha or ye bearish trend k end main banta ha. Es main phly aik beaus candle estraha ki close hoti ha k us k nechy shadow ya to blkul n hota ya bht mamoli hota ha or es k bad next candle bullish banti ha or es k nechy bhi shadow na hony k brabr hota ha.es trha 2 bearish or bullis candles ml k bottom bnati hain jsko pipe bottom kaha jata ha.

How to trade it[/SIZE][/SIZE][/B]

bearish candle k close hony k bad es main hum buy ki trade lety hain or hmara stop loss pipe bottom sw nechy hota ha jb k profit target next resistance tk hota ha.

Pin bar candlestick pattern and it's types

candlestick pattern it's types

candlesticks ka trading main bahut important role ha es lye inko smjhna lazmi ha or aj ki post maij hum important candle stick pattern ko study karen gy jo pipe top or pipe bottom pattern ha ye aik bearish reversal pattern ha or ye bullish trend k end main banta ha es k bad market main trend reverse hota ha or market bearish jati ha es lye es pattern main hamen achi sell ki entry mil jati ha.

How it is formed pattern main aik bullish candle estrha close hoti ha k us k opr shadow ni hota ya phr mamoli sa shadow hota ha or opr complete body hoti ha jb k es k bad aik bearish candle banti ha or ye candle bullish candle ki 70% body k equal hoti ha es bearish candle k opar bhi koe shadow n hota ya ohr mamooli shadow hota ha es trha aik bearish or aik bullish candle mil k top bnati hain jsko pipe top kaha jata ha.

How to trade it

Dear members es pattern main 2nd bearish candle k close hony k bad hum sell ki trade le skty hain or es main hmara stop loss pipe top k opr hota ha jb k profit target next support hoti ha.

What is Pipe Bottom Pattern

dear member ye aik bullish reversal pattern ha or ye bearish trend k end main banta ha. Es main phly aik beaus candle estraha ki close hoti ha k us k nechy shadow ya to blkul n hota ya bht mamoli hota ha or es k bad next candle bullish banti ha or es k nechy bhi shadow na hony k brabr hota ha.es trha 2 bearish or bullis candles ml k bottom bnati hain jsko pipe bottom kaha jata ha.

How to trade it[/SIZE][/SIZE][/B]

bearish candle k close hony k bad es main hum buy ki trade lety hain or hmara stop loss pipe bottom sw nechy hota ha jb k profit target next resistance tk hota ha.

تبصرہ

Расширенный режим Обычный режим