Assalam ualikum kise ho ap sab log me bilkul thek or khariyat se ho or umeed karta ho ke ap sab log bhi bilkul thek or khariyat se ho ge aj is thread me apko

me Pakistan forex trading me divergence ki importance ke bare me btao ga or me umeed karta ho ke jo information me apse share karo ga wo ap sab ke

Knowledge Or experience me zaror izafa kare ge or agar ap mere is thread pe amal karte he to ak ache Trader ban sakte he ak or bat jo me apko btana

Chahta ho ke agar Ham Pakistan forex forum pe apni pori mhenat or himmat se kM karte he or apna ziyada se xiyada time bhi Pakistan forex forum pe he

Guzarte he to ham ak ache or kamyab Trader ban sakte he or bhot sare paise bhi kama sakte he isliye hme yha pe apni pori mhenat or himmat se karna

Chahye.

What is Divergence?

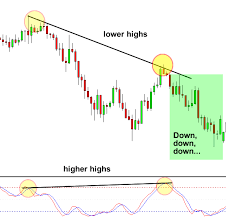

chunkay rujhanaat qeematon ke aik silsilay par mushtamil hotay hain, is liye raftaar rujhan ki taaqat ka andaza laganay mein kaleedi kirdaar ada karti hai. is terhan, yeh janna zaroori hai ke rujhan kab sust ho raha hai. kam raftaar hamesha ulat ka baais nahi banti, lekin yeh is baat ka ishara deti hai ke kuch badal raha hai, aur rujhan mazboot ya rivers ho sakta hai. qeemat ki raftaar se morad qeemat ki simt aur wusat hai. qeematon ke jhoolon ka mawazna karne se taajiron ko qeemat ki raftaar ke baray mein baseerat haasil karne mein madad millti hai. yahan, hum qeemat ki raftaar ka andaza laganay ke tareeqa par aik nazar dalain ge aur aap ko deikhein ge ke raftaar mein kya farq aap ko rujhan ki simt ke baray mein bta sakta hai .

Key Takeaways;

qeemat ki raftaar ko qaleel mudti qeemat ke jhoolon ki lambai se mapa jata hai khari dhalwan aur qeematon ka aik taweel jhool mazboot raftaar ki numaindagi karta hai, jab ke kamzor raftaar ko kam dhalwan aur mukhtasir qeemat ke jhool se zahir kya jata hai. raftaar ke isharay mein rishta daar taaqat ka asharih, aur tabdeeli ki sharah shaamil hai. inhiraf isharay ke darmiyan ikhtilaaf tijarti intizam ke liye barray mzmrat ho sakta hai .

me Pakistan forex trading me divergence ki importance ke bare me btao ga or me umeed karta ho ke jo information me apse share karo ga wo ap sab ke

Knowledge Or experience me zaror izafa kare ge or agar ap mere is thread pe amal karte he to ak ache Trader ban sakte he ak or bat jo me apko btana

Chahta ho ke agar Ham Pakistan forex forum pe apni pori mhenat or himmat se kM karte he or apna ziyada se xiyada time bhi Pakistan forex forum pe he

Guzarte he to ham ak ache or kamyab Trader ban sakte he or bhot sare paise bhi kama sakte he isliye hme yha pe apni pori mhenat or himmat se karna

Chahye.

What is Divergence?

chunkay rujhanaat qeematon ke aik silsilay par mushtamil hotay hain, is liye raftaar rujhan ki taaqat ka andaza laganay mein kaleedi kirdaar ada karti hai. is terhan, yeh janna zaroori hai ke rujhan kab sust ho raha hai. kam raftaar hamesha ulat ka baais nahi banti, lekin yeh is baat ka ishara deti hai ke kuch badal raha hai, aur rujhan mazboot ya rivers ho sakta hai. qeemat ki raftaar se morad qeemat ki simt aur wusat hai. qeematon ke jhoolon ka mawazna karne se taajiron ko qeemat ki raftaar ke baray mein baseerat haasil karne mein madad millti hai. yahan, hum qeemat ki raftaar ka andaza laganay ke tareeqa par aik nazar dalain ge aur aap ko deikhein ge ke raftaar mein kya farq aap ko rujhan ki simt ke baray mein bta sakta hai .

Key Takeaways;

qeemat ki raftaar ko qaleel mudti qeemat ke jhoolon ki lambai se mapa jata hai khari dhalwan aur qeematon ka aik taweel jhool mazboot raftaar ki numaindagi karta hai, jab ke kamzor raftaar ko kam dhalwan aur mukhtasir qeemat ke jhool se zahir kya jata hai. raftaar ke isharay mein rishta daar taaqat ka asharih, aur tabdeeli ki sharah shaamil hai. inhiraf isharay ke darmiyan ikhtilaaf tijarti intizam ke liye barray mzmrat ho sakta hai .

تبصرہ

Расширенный режим Обычный режим