What is Harmonic Price Chart Pattern in Forex Trading?

Forex trading mein kai tarah ke price chart patterns hotay hain jo traders ko market movement samajhne aur trades plan karne mein madad dete hain. In patterns mein se ek "Harmonic Price Chart Pattern" hai jo kaafi unique aur powerful samjha jata hai. Yeh pattern advanced technical analysis ka hissa hai aur accurate trading signals generate karne mein help karta hai.

Harmonic Patterns Kya Hote Hain?

Harmonic patterns ka basic concept Fibonacci retracement levels par mabni hota hai. Yeh patterns market ke highs aur lows ko follow karte hue ek certain geometric shape banate hain. Harmonic patterns ka kaam yeh hota hai ke yeh market ke reversal points ko pehchante hain, jahan par price apna trend badalne wali hoti hai. In patterns ko samajhna aur unhe theek se apply karna ek important skill hai.

Famous Harmonic Patterns

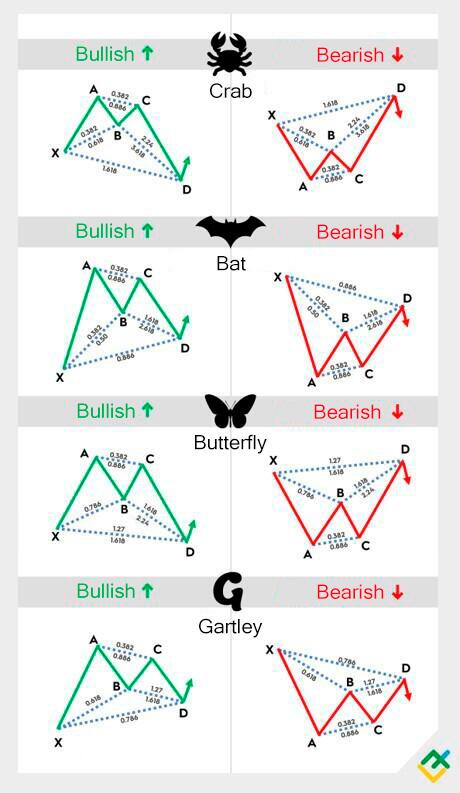

Harmonic patterns ki kai types hain lekin kuch mashhoor aur zyada use hone wale patterns mein "Gartley", "Bat", "Crab", "Butterfly" aur "Shark" shamil hain. Har pattern ka apna ek structure hota hai jo market ke price action ko follow karta hai aur Fibonacci levels ke through define hota hai. Yeh levels market ke turning points ko pinpoint karte hain jahan se price reversal ya continuation ho sakta hai.

1. Gartley Pattern: Yeh pattern ek bullish ya bearish signal generate karta hai aur uske five points X, A, B, C, aur D hotay hain.

2. Bat Pattern: Yeh bhi similar hai lekin ismein Fibonacci retracement thoda different hota hai.

3. Crab aur Butterfly Patterns: Yeh extreme market moves ko pehchante hain jahan major trend reversal expect kiya jata hai.

Harmonic Patterns ka Use

Traders in patterns ko identify karte hue, unki perfect formation ko dekhte hain. Jab ek harmonic pattern complete hota hai to yeh signal deta hai ke market ab apna trend change karne wali hai. Is technique ke through traders ko entry aur exit points ka acha idea mil jata hai jo ke profitable trades karne mein help karta hai.

Conclusion

Harmonic price chart patterns ek advanced tool hain jo accurate signals provide karte hain. In patterns ko samajhne ke liye Fibonacci retracement levels ka acha knowledge zaroori hai. Agar sahi tareeqe se use kiya jaye to yeh patterns aapki trading strategy ko kaafi improve kar sakte hain aur better trade decisions lene mein madadgar sabit hote hain.

Forex trading mein kai tarah ke price chart patterns hotay hain jo traders ko market movement samajhne aur trades plan karne mein madad dete hain. In patterns mein se ek "Harmonic Price Chart Pattern" hai jo kaafi unique aur powerful samjha jata hai. Yeh pattern advanced technical analysis ka hissa hai aur accurate trading signals generate karne mein help karta hai.

Harmonic Patterns Kya Hote Hain?

Harmonic patterns ka basic concept Fibonacci retracement levels par mabni hota hai. Yeh patterns market ke highs aur lows ko follow karte hue ek certain geometric shape banate hain. Harmonic patterns ka kaam yeh hota hai ke yeh market ke reversal points ko pehchante hain, jahan par price apna trend badalne wali hoti hai. In patterns ko samajhna aur unhe theek se apply karna ek important skill hai.

Famous Harmonic Patterns

Harmonic patterns ki kai types hain lekin kuch mashhoor aur zyada use hone wale patterns mein "Gartley", "Bat", "Crab", "Butterfly" aur "Shark" shamil hain. Har pattern ka apna ek structure hota hai jo market ke price action ko follow karta hai aur Fibonacci levels ke through define hota hai. Yeh levels market ke turning points ko pinpoint karte hain jahan se price reversal ya continuation ho sakta hai.

1. Gartley Pattern: Yeh pattern ek bullish ya bearish signal generate karta hai aur uske five points X, A, B, C, aur D hotay hain.

2. Bat Pattern: Yeh bhi similar hai lekin ismein Fibonacci retracement thoda different hota hai.

3. Crab aur Butterfly Patterns: Yeh extreme market moves ko pehchante hain jahan major trend reversal expect kiya jata hai.

Harmonic Patterns ka Use

Traders in patterns ko identify karte hue, unki perfect formation ko dekhte hain. Jab ek harmonic pattern complete hota hai to yeh signal deta hai ke market ab apna trend change karne wali hai. Is technique ke through traders ko entry aur exit points ka acha idea mil jata hai jo ke profitable trades karne mein help karta hai.

Conclusion

Harmonic price chart patterns ek advanced tool hain jo accurate signals provide karte hain. In patterns ko samajhne ke liye Fibonacci retracement levels ka acha knowledge zaroori hai. Agar sahi tareeqe se use kiya jaye to yeh patterns aapki trading strategy ko kaafi improve kar sakte hain aur better trade decisions lene mein madadgar sabit hote hain.

تبصرہ

Расширенный режим Обычный режим