Premium RSI Oscillator Implement Karna

Introduction

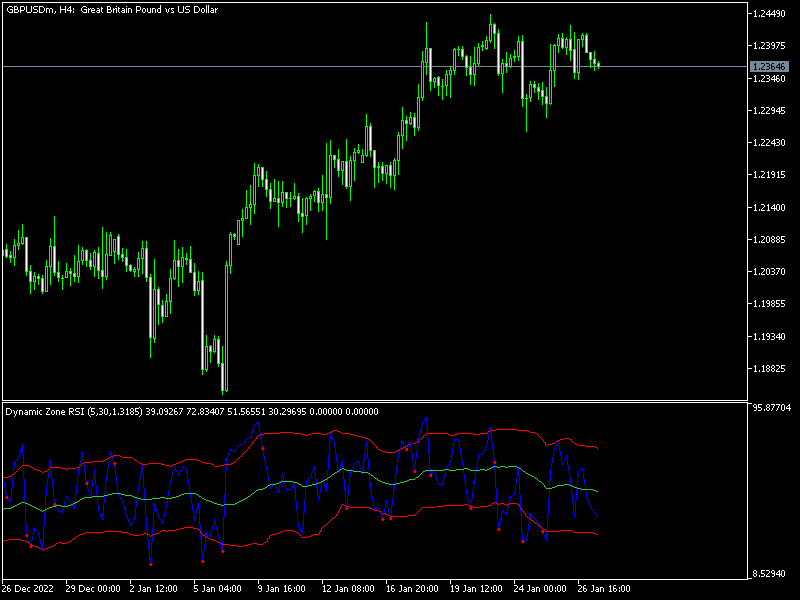

Premium RSI Oscillator ek advanced version hai RSI indicator ka jo technical analysis mein use hota hai. Yeh oscillator investors aur traders ko market ki overbought aur oversold conditions ko better samajhne mein madad karta hai. Is guide mein hum discuss karenge ke kaise aap Premium RSI Oscillator ko apne trading strategy mein implement kar sakte hain.

RSI (Relative Strength Index) Kya Hai?

RSI ek momentum oscillator hai jo 0 se 100 ke beech value assign karta hai. Traditional RSI ki values agar 70 se upar hoon to market overbought condition mein hota hai aur agar 30 se neeche hoon to market oversold condition mein hota hai.

Premium RSI Oscillator Ki Unique Features

Steps to Implement Premium RSI Oscillator

1. Data Collection and Preparation

Sabse pehle aapko accurate aur up-to-date price data collect karna hoga. Aap yeh data kisi reliable financial data provider se le sakte hain. Data ko daily, weekly, ya monthly basis par collect karein.

Example Code (Python):

python

Copy code

import yfinance as yf # Data Collection data = yf.download('AAPL', start='2020-01-01', end='2024-01-01') data = data['Close'] 2.

Calculate Traditional RSI

Traditional RSI ko calculate karne ke liye aap gain aur loss ko determine karte hain aur unka average nikalte hain.

Example Code (Python):

python

Copy code

import numpy as np def calculate_rsi(data, window=14): delta = data.diff() gain = (delta.where(delta > 0, 0)).rolling(window=window).mean() loss = (-delta.where(delta < 0, 0)).rolling(window=window).mean() rs = gain / loss rsi = 100 - (100 / (1 + rs)) return rsi data['RSI'] = calculate_rsi(data)

3. Enhanced Smoothing Techniques

Premium RSI mein advanced smoothing techniques use hoti hain. Exponential Moving Average (EMA) ek common technique hai jo aap use kar sakte hain.

Example Code (Python):

python

Copy code

def ema(data, span): return data.ewm(span=span, adjust=False).mean() data['Smooth_RSI'] = ema(data['RSI'], span=14)

4. Implement Dynamic Thresholds

Dynamic thresholds market volatility ke mutabiq adjust hoti hain. Aap volatility ko measure karne ke liye ATR (Average True Range) use kar sakte hain.

Example Code (Python):

python

Copy code

def calculate_atr(data, window=14): high_low = data['High'] - data['Low'] high_close = np.abs(data['High'] - data['Close'].shift()) low_close = np.abs(data['Low'] - data['Close'].shift()) ranges = pd.concat([high_low, high_close, low_close], axis=1) true_range = np.max(ranges, axis=1) atr = true_range.rolling(window=window).mean() return atr data['ATR'] = calculate_atr(data) data['Upper_Threshold'] = 70 + data['ATR'] data['Lower_Threshold'] = 30 - data['ATR'] 5.

Generate Additional Signals

Premium RSI Oscillator additional signals bhi provide karta hai jo aapke trading decisions ko enhance karte hain. Yeh signals divergence, crossovers, aur overbought/oversold conditions ke through milte hain.

Example Code (Python):

python

Copy code

# Generate Buy/Sell Signals based on Smooth_RSI and Dynamic Thresholds def generate_signals(data): buy_signals = [] sell_signals = [] for i in range(len(data)): if data['Smooth_RSI'][i] < data['Lower_Threshold'][i]: buy_signals.append(data.index[i]) elif data['Smooth_RSI'][i] > data['Upper_Threshold'][i]: sell_signals.append(data.index[i]) return buy_signals, sell_signals buy_signals, sell_signals = generate_signals(data) 6.

Backtesting and Optimization

Kisi bhi trading strategy ko implement karne se pehle uska backtest zaruri hai. Yeh ensure karta hai ke aapki strategy historically profitable hai.

Example Code (Python):

python

Copy code

def backtest_strategy(data, buy_signals, sell_signals): initial_balance = 10000 balance = initial_balance position = 0 # Number of shares for i in range(len(data)): if data.index[i] in buy_signals: position = balance / data['Close'][i] balance = 0 elif data.index[i] in sell_signals and position > 0: balance = position * data['Close'][i] position = 0 if position > 0: balance = position * data['Close'][-1] return balance final_balance = backtest_strategy(data, buy_signals, sell_signals) print(f'Initial Balance: $10000, Final Balance: ${final_balance:.2f}') .

Premium RSI Oscillator ko implement karna thoda complex ho sakta hai lekin agar aap isko theek tarike se samajh lein aur implement karlein to yeh aapki trading strategy ko significantly enhance kar sakta hai. Is guide ke steps ko follow karke aap apni trading efficiency aur profitability ko improve kar sakte hai.

Introduction

Premium RSI Oscillator ek advanced version hai RSI indicator ka jo technical analysis mein use hota hai. Yeh oscillator investors aur traders ko market ki overbought aur oversold conditions ko better samajhne mein madad karta hai. Is guide mein hum discuss karenge ke kaise aap Premium RSI Oscillator ko apne trading strategy mein implement kar sakte hain.

RSI (Relative Strength Index) Kya Hai?

RSI ek momentum oscillator hai jo 0 se 100 ke beech value assign karta hai. Traditional RSI ki values agar 70 se upar hoon to market overbought condition mein hota hai aur agar 30 se neeche hoon to market oversold condition mein hota hai.

Premium RSI Oscillator Ki Unique Features

- Enhanced Smoothing Techniques: Premium RSI mein zyada sophisticated smoothing techniques use hoti hain jo price data ko accurately represent karti hain.

- Dynamic Thresholds: Is oscillator mein dynamic thresholds hoti hain jo market conditions ke mutabiq adjust hoti hain.

- Additional Signals: Yeh oscillator multiple signals generate karta hai jo traditional RSI mein nahi hote.

Steps to Implement Premium RSI Oscillator

1. Data Collection and Preparation

Sabse pehle aapko accurate aur up-to-date price data collect karna hoga. Aap yeh data kisi reliable financial data provider se le sakte hain. Data ko daily, weekly, ya monthly basis par collect karein.

Example Code (Python):

python

Copy code

import yfinance as yf # Data Collection data = yf.download('AAPL', start='2020-01-01', end='2024-01-01') data = data['Close'] 2.

Calculate Traditional RSI

Traditional RSI ko calculate karne ke liye aap gain aur loss ko determine karte hain aur unka average nikalte hain.

Example Code (Python):

python

Copy code

import numpy as np def calculate_rsi(data, window=14): delta = data.diff() gain = (delta.where(delta > 0, 0)).rolling(window=window).mean() loss = (-delta.where(delta < 0, 0)).rolling(window=window).mean() rs = gain / loss rsi = 100 - (100 / (1 + rs)) return rsi data['RSI'] = calculate_rsi(data)

3. Enhanced Smoothing Techniques

Premium RSI mein advanced smoothing techniques use hoti hain. Exponential Moving Average (EMA) ek common technique hai jo aap use kar sakte hain.

Example Code (Python):

python

Copy code

def ema(data, span): return data.ewm(span=span, adjust=False).mean() data['Smooth_RSI'] = ema(data['RSI'], span=14)

4. Implement Dynamic Thresholds

Dynamic thresholds market volatility ke mutabiq adjust hoti hain. Aap volatility ko measure karne ke liye ATR (Average True Range) use kar sakte hain.

Example Code (Python):

python

Copy code

def calculate_atr(data, window=14): high_low = data['High'] - data['Low'] high_close = np.abs(data['High'] - data['Close'].shift()) low_close = np.abs(data['Low'] - data['Close'].shift()) ranges = pd.concat([high_low, high_close, low_close], axis=1) true_range = np.max(ranges, axis=1) atr = true_range.rolling(window=window).mean() return atr data['ATR'] = calculate_atr(data) data['Upper_Threshold'] = 70 + data['ATR'] data['Lower_Threshold'] = 30 - data['ATR'] 5.

Generate Additional Signals

Premium RSI Oscillator additional signals bhi provide karta hai jo aapke trading decisions ko enhance karte hain. Yeh signals divergence, crossovers, aur overbought/oversold conditions ke through milte hain.

Example Code (Python):

python

Copy code

# Generate Buy/Sell Signals based on Smooth_RSI and Dynamic Thresholds def generate_signals(data): buy_signals = [] sell_signals = [] for i in range(len(data)): if data['Smooth_RSI'][i] < data['Lower_Threshold'][i]: buy_signals.append(data.index[i]) elif data['Smooth_RSI'][i] > data['Upper_Threshold'][i]: sell_signals.append(data.index[i]) return buy_signals, sell_signals buy_signals, sell_signals = generate_signals(data) 6.

Backtesting and Optimization

Kisi bhi trading strategy ko implement karne se pehle uska backtest zaruri hai. Yeh ensure karta hai ke aapki strategy historically profitable hai.

Example Code (Python):

python

Copy code

def backtest_strategy(data, buy_signals, sell_signals): initial_balance = 10000 balance = initial_balance position = 0 # Number of shares for i in range(len(data)): if data.index[i] in buy_signals: position = balance / data['Close'][i] balance = 0 elif data.index[i] in sell_signals and position > 0: balance = position * data['Close'][i] position = 0 if position > 0: balance = position * data['Close'][-1] return balance final_balance = backtest_strategy(data, buy_signals, sell_signals) print(f'Initial Balance: $10000, Final Balance: ${final_balance:.2f}') .

Premium RSI Oscillator ko implement karna thoda complex ho sakta hai lekin agar aap isko theek tarike se samajh lein aur implement karlein to yeh aapki trading strategy ko significantly enhance kar sakta hai. Is guide ke steps ko follow karke aap apni trading efficiency aur profitability ko improve kar sakte hai.

تبصرہ

Расширенный режим Обычный режим