Introduction

forex market mein pivot point trading strategy aik kesam ka technical indicator hota hey jo keh forex trade kay zarey anay wale market ke movement ko he identify kar sakta hey or forex market mein price ke level gage kay tor par estamal keya ja sakta hey pivot point indicator ka estamal trend ko identify karnay kay ley estamal keya ja sakta hey es ko forex market mein support or resistance level kay tayon karnay kay ley estamal keya ja sakta hey stop loss take profit or entry or exit kay raston kay ley he estamal keya ja sakta hey

Pivot Point ke calculation

kuch time pehlay tak computer baray paimaay par dasteyab nahi thay lahza market bananay walay or floor trader es bat ka tayon karnay kay ley estamal kartay rehtay hein price sastee bhe ho sakte hey or expensive bhe ho sakte hey mathimatical base par pivot point paida ho saktay hein

forex trader simple tor par high ya low price ko he indicate kar rahay hotay hein end price ko assani say leya jata hey pivot ko taqseem keya jata hey jo keh 3 sayhe keya jata hey

Trading with Pivot Point

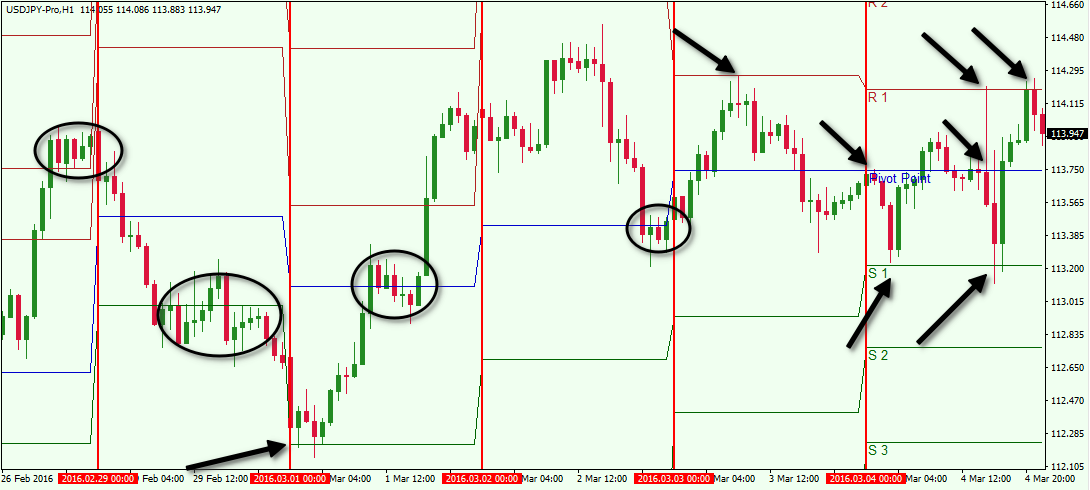

pivot point forex market ke trading mein traditional point kay tor par he estamal keya jata hey forex market mein price ke yeh level stable karte hey jes ka support ya resistance kay sath estamal keyaja sakta hey Pivot Point price ke en level ke bar bar janch kar sakte hey or forex market ke en level ke mazeed janch kar sakte hey

forex trader zyada tar es ko additional kay tor par bhe estamal kar sakte hey candlestick oscillator basic asol kay indicator hotay hein jo keh price action mein market kay trading faislay kar sakte hey pivot kay sath mell kar estamal key ja saktay hein

Pivot Point Swing Trader

aisay trader kay ley jo keh central ya long period keforex market ko tarjeh day saktay hein pivot point kay sath swing trade weekly bhe ho sakte hey or monthly time frame ka estamal bhe ho sakta hey

forex market ka nechay deya geya chart weekly chart he hota hey or yeh bhe wazah hey keh oper ke taraf forex market ka aik trend hota hey jo keh pechlay pivot or resistance kay zarey say break keya ja sakta hey or forex market ke price break honay kay bad zahair ho sakta hey

ab price action mein support level trader ke break honay ja rehe hote hey jo keh forex market ke price kay long entry order ko talash kar saktay hein aik fake breakout ho jata hey jes kay ba forex market reversal ho sakte hey pivot ke level hamaisha price par nahi hote hey yeh aik long time ke swing trade bhe ho sakte hey

forex market mein pivot point trading strategy aik kesam ka technical indicator hota hey jo keh forex trade kay zarey anay wale market ke movement ko he identify kar sakta hey or forex market mein price ke level gage kay tor par estamal keya ja sakta hey pivot point indicator ka estamal trend ko identify karnay kay ley estamal keya ja sakta hey es ko forex market mein support or resistance level kay tayon karnay kay ley estamal keya ja sakta hey stop loss take profit or entry or exit kay raston kay ley he estamal keya ja sakta hey

Pivot Point ke calculation

kuch time pehlay tak computer baray paimaay par dasteyab nahi thay lahza market bananay walay or floor trader es bat ka tayon karnay kay ley estamal kartay rehtay hein price sastee bhe ho sakte hey or expensive bhe ho sakte hey mathimatical base par pivot point paida ho saktay hein

forex trader simple tor par high ya low price ko he indicate kar rahay hotay hein end price ko assani say leya jata hey pivot ko taqseem keya jata hey jo keh 3 sayhe keya jata hey

Trading with Pivot Point

pivot point forex market ke trading mein traditional point kay tor par he estamal keya jata hey forex market mein price ke yeh level stable karte hey jes ka support ya resistance kay sath estamal keyaja sakta hey Pivot Point price ke en level ke bar bar janch kar sakte hey or forex market ke en level ke mazeed janch kar sakte hey

forex trader zyada tar es ko additional kay tor par bhe estamal kar sakte hey candlestick oscillator basic asol kay indicator hotay hein jo keh price action mein market kay trading faislay kar sakte hey pivot kay sath mell kar estamal key ja saktay hein

Pivot Point Swing Trader

aisay trader kay ley jo keh central ya long period keforex market ko tarjeh day saktay hein pivot point kay sath swing trade weekly bhe ho sakte hey or monthly time frame ka estamal bhe ho sakta hey

forex market ka nechay deya geya chart weekly chart he hota hey or yeh bhe wazah hey keh oper ke taraf forex market ka aik trend hota hey jo keh pechlay pivot or resistance kay zarey say break keya ja sakta hey or forex market ke price break honay kay bad zahair ho sakta hey

ab price action mein support level trader ke break honay ja rehe hote hey jo keh forex market ke price kay long entry order ko talash kar saktay hein aik fake breakout ho jata hey jes kay ba forex market reversal ho sakte hey pivot ke level hamaisha price par nahi hote hey yeh aik long time ke swing trade bhe ho sakte hey

تبصرہ

Расширенный режим Обычный режим