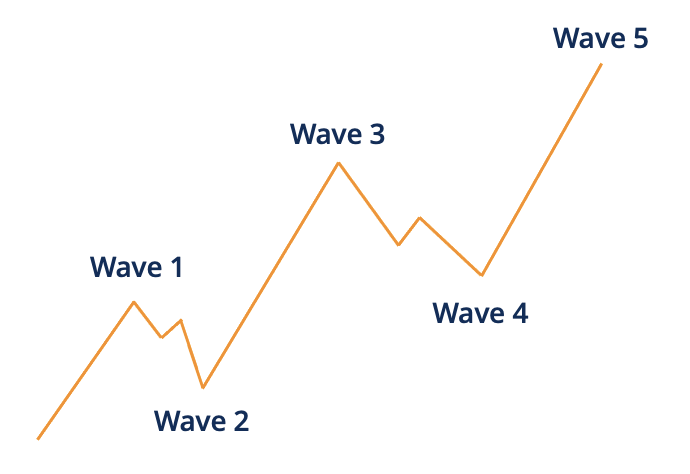

Forex mein impulsive waves trading formula ek aisa tareeqa hai jis se traders trading kar sakte hain aur market ke upar control rakh sakte hain. Is formula mein impulsive waves ka use kiya jata hai jis se traders market trend ko samajh sakte hain aur trading ke liye behtar decisions le sakte hain.is me ap upper level tk trading kr skty hen.

Analyze system

Impulsive waves trading formula ka use karne ke liye traders ko market ke trends aur price patterns ko analyze karna hota hai. Is formula mein traders ko market ke uptrend aur downtrend ke beech mein differentiate karna hota hai aur phir unhe trading ke liye use karna hota hai.is me apko pattern k bary me pta hna chaye k khan graph positive chl rha aur khan negative positive nishan profit show krta h.

Formula engage

Impulsive waves trading formula ka use karne ke liye traders ko market ke liye ek plan banana hota hai jis mein unhe trading ke liye entry aur exit points ko decide karna hota hai. Is formula mein traders ko market ke volatility aur risk ko bhi analyze karna hota hai.is me ap aik plan bna kr kam krty hen aur aik side ay shrun ho ker aagy jaty hen.

Conclusion

Impulsive waves trading formula ek effective trading tool h

تبصرہ

Расширенный режим Обычный режим