Shooting Star Candlestick Pattern

Introductions

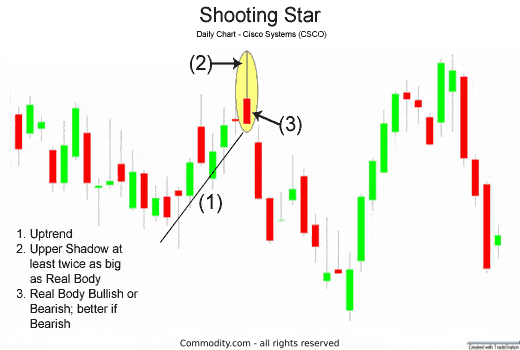

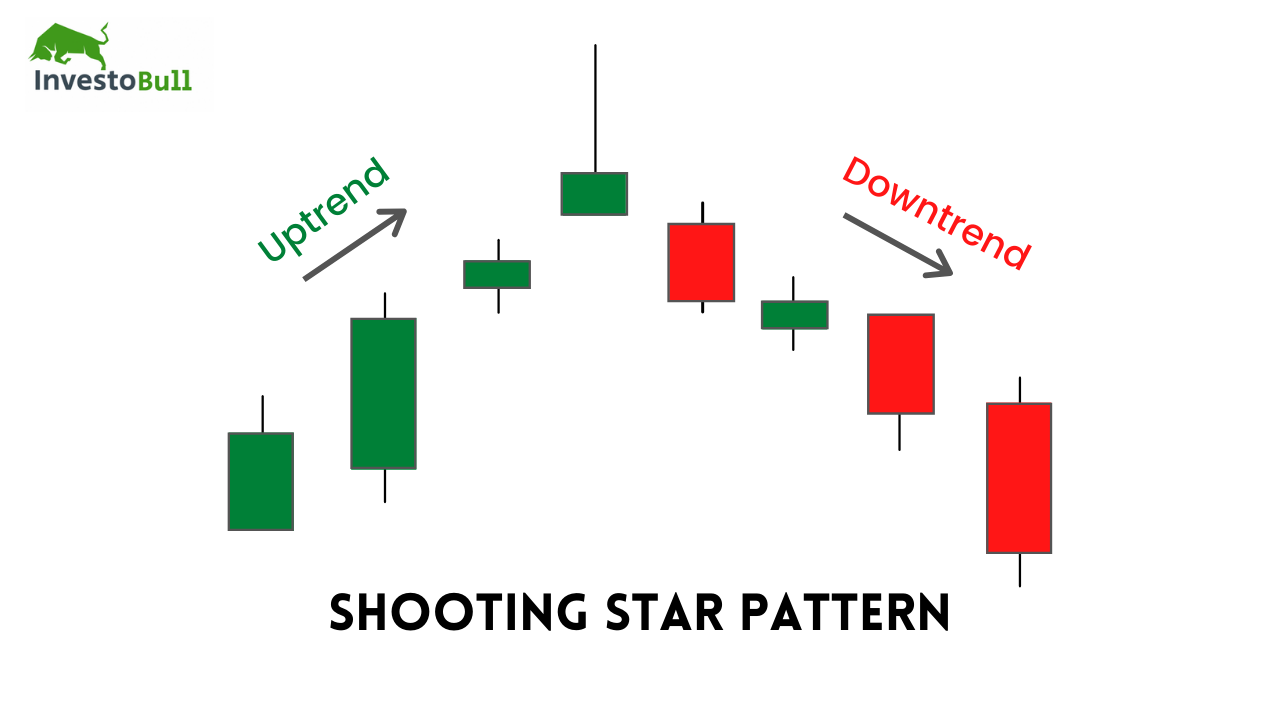

Shooting Star candlestick pattern ek technical analysis ka hissa hai jo kisi bhi market ki price action ko analyze karne mein istemal hota hai. Ye pattern aam tor par uptrend ke doraan dekha jata hai aur future trend ka hint deta hai. Is pattern ko pehli baar Japan mein develop kiya gaya tha aur ab ye global trading community mein popular hai.Shooting Star ek single candlestick pattern hai jo usually uptrend ke akhir mein nazar aata hai. Iski tareef karte hue, ismein ek lambi upper shadow (sar) hoti hai jo candle ke neechay ki taraf choti body se milti hai. Yeh choti body upward movement ko darust karta hai. Upper shadow ki lambai body ki lambai se ziada hoti hai aur iski wajah se iska naam "Shooting Star" hai, kyun ke ye ek star ki tarah lagta hai jo asmaan mein chamak raha hota hai.

Possible Losses

Shooting Star candlestick pattern traders ko potential reversals ka signal deta hai, lekin sirf is pattern ki mawjudgi par pura bharosa nahi karna chahiye. Kuch nuqsanat is tarah hain.

Implementation

Shooting Star pattern ka istemal karne ke liye traders ko kuch steps follow karne chahiye.

Introductions

Shooting Star candlestick pattern ek technical analysis ka hissa hai jo kisi bhi market ki price action ko analyze karne mein istemal hota hai. Ye pattern aam tor par uptrend ke doraan dekha jata hai aur future trend ka hint deta hai. Is pattern ko pehli baar Japan mein develop kiya gaya tha aur ab ye global trading community mein popular hai.Shooting Star ek single candlestick pattern hai jo usually uptrend ke akhir mein nazar aata hai. Iski tareef karte hue, ismein ek lambi upper shadow (sar) hoti hai jo candle ke neechay ki taraf choti body se milti hai. Yeh choti body upward movement ko darust karta hai. Upper shadow ki lambai body ki lambai se ziada hoti hai aur iski wajah se iska naam "Shooting Star" hai, kyun ke ye ek star ki tarah lagta hai jo asmaan mein chamak raha hota hai.

Possible Losses

Shooting Star candlestick pattern traders ko potential reversals ka signal deta hai, lekin sirf is pattern ki mawjudgi par pura bharosa nahi karna chahiye. Kuch nuqsanat is tarah hain.

- False Signals: Kabhi kabhi Shooting Star pattern galat signals bhi de sakta hai. Market conditions aur dusre technical indicators ko bhi madde nazar rakhte hue is pattern ka istemal karna zaroori hai.

- Confirmation Ki Zarurat: Shooting Star pattern ko confirm karne ke liye traders ko doosre technical indicators aur price action ko bhi dekhna chahiye. Agar doosre indicators bhi reversal ki nishandahi kar rahe hain, toh iska matlab Shooting Star ka signal strong hai.

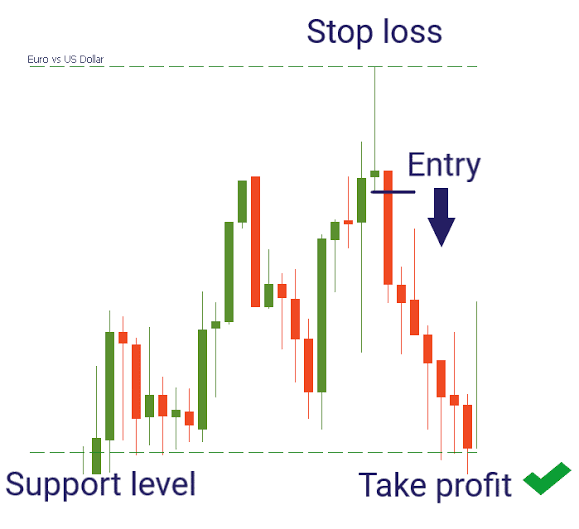

- Stop Loss: Is pattern ko samajhne ke baad, traders ko apne trades ke liye stop loss ka istemal karna chahiye. Stop loss ke istemal se nuqsanat ko control kiya ja sakta hai agar trade ulta chala gaya.

Implementation

Shooting Star pattern ka istemal karne ke liye traders ko kuch steps follow karne chahiye.

- Identification: Sab se pehle, traders ko Shooting Star pattern ko identify karna hota hai. Iske liye candlestick charts ka istemal hota hai, jahan par ek lambi upper shadow ke saath ek choti body nazar aati hai.

- Confirmation: Ek baar pattern identify kar liya gaya hai, traders ko iski confirmation ke liye doosre technical indicators ka istemal karna chahiye. Masalan, RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) jaise indicators ka istemal kiya ja sakta hai.

- Entry Point: Jab pattern aur confirmation dono mil gaye hain, traders ko entry point decide karna hota hai. Ye entry point unhein batata hai ke kis level par trade ki entry leni chahiye.

- Risk Management: Trading mein risk management ka bohot ahem kirdar hota hai. Isliye, har trade ke liye stop loss aur profit target tay kiye jate hain taake nuqsanat ko control kiya ja sake.

تبصرہ

Расширенный режим Обычный режим