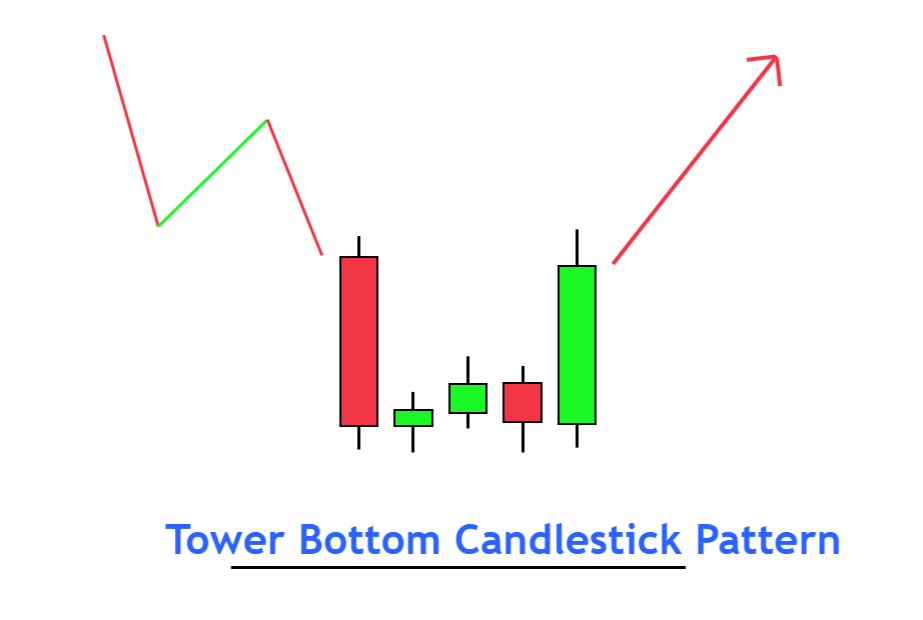

Tower Bottom Pattern:

Tower Bottom Pattern ek technical analysis ka pattern hai jo market mein trend reversal ko darust karta hai. Yeh pattern market mein aane wale bearish trend ke badalne ka ishara hota hai aur bullish movement ka signal deta hai.

Pechan (Identification):

- Extended Downtrend: Pehle, market mein lambi downtrend hona chahiye.

- Three Candles Formation:

- First Candle (Bearish): Ek lambi bearish candle aati hai.

- Second Candle (Bullish): Doosri candle, pehli candle ke upper range ke andar open hoti hai lekin closing pehli candle ke lower range ke andar hoti hai.

- Third Candle (Bullish): Teesri candle ki opening pehli do candles ke closing prices ke beech hoti hai aur phir tezi se upar jaati hai, indicating a bullish reversal.

Tawajju (Attention): Jab Tower Bottom Pattern dekha jata hai, toh important hai ke traders market ke overall context ko samajhain. Doosre technical indicators aur market ki conditions ko bhi madde nazar rakhein.

Tijarat (Trading): Agar Tower Bottom Pattern ko sahi taur par pehchana jata hai aur teesri candle strong bullish movement ke sath close hoti hai, toh yeh ek bullish trend ka shuru hone ka signal hai. Traders is point par long position le sakte hain.

Hifazati Tadabeer (Precautionary Measures):

- Hamesha doosre technical indicators aur analysis tools ka istemal karein pattern ko confirm karne ke liye.

- Stop-loss orders ka istemal karein taki nuksan se bacha ja sake.

- Market conditions aur overall trend ko madde nazar rakhein.

Tower Bottom Pattern ka istemal karne se pehle, traders ko apne trading plan ko dhyan mein rakhna chahiye aur market ki overall situation ko tajwez karna important hai.

تبصرہ

Расширенный режим Обычный режим