Financial institutions include various consulting companies, mutual funds, and hedge funds. There are such transnational companies as XEROX, IBM, CrowCork etc.

Non-institutional investors can be of two types non-commercial funds and voluntary associations.

A broker is a company that acts as an intermediary between buyers and sellers. Brokers’ clients are private investors.

Four latest categories often operate through their banks.

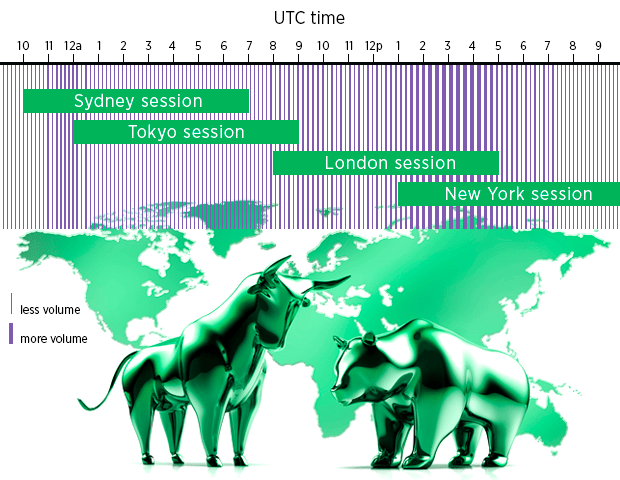

Forex is open from Monday to Friday, excluding holidays when banks in some countries are closed.

Region City Open Close

ASIA Tokyo 03:00 12:00

Hong Kong 04:00 13:00

Singapore 04:00 12:00

EUROPA Frankfurt 09:00 17:00

London 10:00 18:00

AMERICA New York 16:00 24:00

Chicago 17:00 01:00

PACIFIC Wellington 00:00 08:00

Sydney 01:00 09:00

Markets’ behavior greatly differs from one session to another. The US and Asian sessions are notable for aggression and considerable enthusiasm of the market participants, whereas most trading operations are executed during the European session.

The Australian and New Zealand sessions are rather calm as during these hours, only banks of two countries and some financial corporations perform deals.

With the opening of the Asian session, market participants start active trading.

During these hours, the Japanese economic events and the yen determine the market behavior.

At the beginning of the London trading session, fluctuations in the currencies’ prices can be rather sharp.

However, the most interesting events occur at the US session due to the publication of most macroeconomic data and other news. The revealed information has a significant influence on the market expectations and consequently on the currency pairs quotes.

Many traders at the dawn of their career got tangled in the intricacies of financial definitions and wonder whether they can become successful investors and if it is possible to make a living by trading on Forex. In order to give a detailed answer to this question, let us consider the following example which is widely used in business.

In the end of 1983, there was an advertisement placed in Wall Street Journal, Barron and New York Times which read that Richard Dennis is looking for people who want to become traders. The main requirement was to move to Chicago, where the future investors would get a modest salary and a percentage of the profit, while Dennis would teach his trading methods to them.

It is worth saying that the advertisement was extremely important because Richard was known as the “Prince of the Pit” (a pit is a place on the US exchanges where the assets are traded, a specific area). He started to be engaged in trade when he was 17 with the starting trading capital of $1,200. At the age of 25, he made his first million.

So, in 1983, Dennis recruited 14 people from those who expressed their desire and came to him. Among the candidates there were two professional card players, an actor, a security guard, a low-paid bookkeeper, two quite unsuccessful traders, a financial advisor, a fresh school graduate, a woman who worked as an exchange clerk, and even a fantasy game designer. Richard trained them only for two weeks. Then he gave them a trading limit from the budget of his firm and let them trade freely. It was the beginning of the legendary history of the Turtles. All of those people became successful and they started to earn millions.

The Turtles appeared as a result of an argument between two old friends and partners, Richard Dennis and William Eckhardt, who tried to answer the following question:Is it possible to learn trading? William considered trading ability as some sort of a gift, an innate skill. According to him, a trader should have an instinct and a sense of the profit. Meanwhile, Richard shared a different point of view. He linked the success to self-discipline, dedication to learning, and most of all to the use of certain trading methods, which a trader should follow strictly. He was sure that trading skills are limited to a set of rules which can be passed from one successful trader to another. So, the dispute lasted for several years, until they made a one-dollar bet. They decided to carry out an experiment to settle the argument. The partners formed a group of people and tried to teach them everything they knew. Therefore, the two traders were trying to find an answer to their question whether it was possible to learn successful trading. The results of this experiment have been already mentioned to you. It must be said that the story proved two undeniable truths.

Truth No.1. Success in trading is not a gift from above. Every average individual can learn how to trade. It is very important to have the willingness to learning and a good teacher.

Truth No. 2. The secret behind success lies in following a profitable strategy step by step. The sequence is the key factor.

Even if a person does not plan to relate their future profession to financial floors or to become a trader, they still have to know some basics; like what a price trend is, what financial instruments there are, how to hedge currency risks etc. Knowledge plays a huge role and it cannot be overestimated.

Even successful businessmen often wonder how to prevent losses caused by currency fluctuations or how to develop a hedging strategy and so on.

This video tutorial will teach you how to make well-thought-out decisions on financial markets. You will find out more about the market and efficiency of various trading methods, thus raising your winning chances.

Non-institutional investors can be of two types non-commercial funds and voluntary associations.

A broker is a company that acts as an intermediary between buyers and sellers. Brokers’ clients are private investors.

Four latest categories often operate through their banks.

Forex is open from Monday to Friday, excluding holidays when banks in some countries are closed.

Region City Open Close

ASIA Tokyo 03:00 12:00

Hong Kong 04:00 13:00

Singapore 04:00 12:00

EUROPA Frankfurt 09:00 17:00

London 10:00 18:00

AMERICA New York 16:00 24:00

Chicago 17:00 01:00

PACIFIC Wellington 00:00 08:00

Sydney 01:00 09:00

Markets’ behavior greatly differs from one session to another. The US and Asian sessions are notable for aggression and considerable enthusiasm of the market participants, whereas most trading operations are executed during the European session.

The Australian and New Zealand sessions are rather calm as during these hours, only banks of two countries and some financial corporations perform deals.

With the opening of the Asian session, market participants start active trading.

During these hours, the Japanese economic events and the yen determine the market behavior.

At the beginning of the London trading session, fluctuations in the currencies’ prices can be rather sharp.

However, the most interesting events occur at the US session due to the publication of most macroeconomic data and other news. The revealed information has a significant influence on the market expectations and consequently on the currency pairs quotes.

Many traders at the dawn of their career got tangled in the intricacies of financial definitions and wonder whether they can become successful investors and if it is possible to make a living by trading on Forex. In order to give a detailed answer to this question, let us consider the following example which is widely used in business.

In the end of 1983, there was an advertisement placed in Wall Street Journal, Barron and New York Times which read that Richard Dennis is looking for people who want to become traders. The main requirement was to move to Chicago, where the future investors would get a modest salary and a percentage of the profit, while Dennis would teach his trading methods to them.

It is worth saying that the advertisement was extremely important because Richard was known as the “Prince of the Pit” (a pit is a place on the US exchanges where the assets are traded, a specific area). He started to be engaged in trade when he was 17 with the starting trading capital of $1,200. At the age of 25, he made his first million.

So, in 1983, Dennis recruited 14 people from those who expressed their desire and came to him. Among the candidates there were two professional card players, an actor, a security guard, a low-paid bookkeeper, two quite unsuccessful traders, a financial advisor, a fresh school graduate, a woman who worked as an exchange clerk, and even a fantasy game designer. Richard trained them only for two weeks. Then he gave them a trading limit from the budget of his firm and let them trade freely. It was the beginning of the legendary history of the Turtles. All of those people became successful and they started to earn millions.

The Turtles appeared as a result of an argument between two old friends and partners, Richard Dennis and William Eckhardt, who tried to answer the following question:Is it possible to learn trading? William considered trading ability as some sort of a gift, an innate skill. According to him, a trader should have an instinct and a sense of the profit. Meanwhile, Richard shared a different point of view. He linked the success to self-discipline, dedication to learning, and most of all to the use of certain trading methods, which a trader should follow strictly. He was sure that trading skills are limited to a set of rules which can be passed from one successful trader to another. So, the dispute lasted for several years, until they made a one-dollar bet. They decided to carry out an experiment to settle the argument. The partners formed a group of people and tried to teach them everything they knew. Therefore, the two traders were trying to find an answer to their question whether it was possible to learn successful trading. The results of this experiment have been already mentioned to you. It must be said that the story proved two undeniable truths.

Truth No.1. Success in trading is not a gift from above. Every average individual can learn how to trade. It is very important to have the willingness to learning and a good teacher.

Truth No. 2. The secret behind success lies in following a profitable strategy step by step. The sequence is the key factor.

Even if a person does not plan to relate their future profession to financial floors or to become a trader, they still have to know some basics; like what a price trend is, what financial instruments there are, how to hedge currency risks etc. Knowledge plays a huge role and it cannot be overestimated.

Even successful businessmen often wonder how to prevent losses caused by currency fluctuations or how to develop a hedging strategy and so on.

This video tutorial will teach you how to make well-thought-out decisions on financial markets. You will find out more about the market and efficiency of various trading methods, thus raising your winning chances.

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

تبصرہ

Расширенный режим Обычный режим