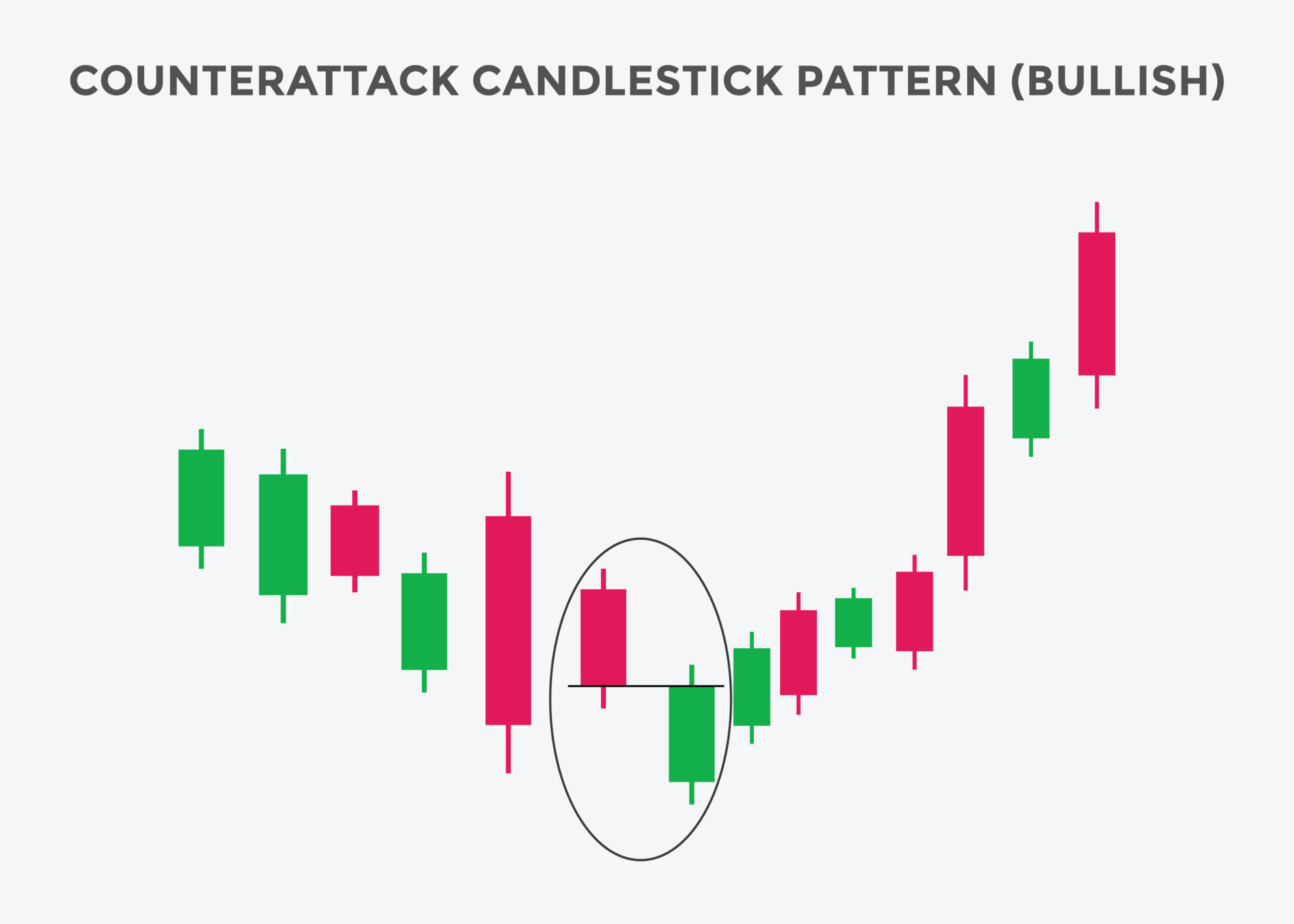

"Bullish Counterattack" ek candlestick pattern hai jo bearish trend ke baad appear hota hai aur bullish reversal signal deta hai. Ye pattern do candlesticks se form hota hai:

- First Candle: Ye ek bearish candle hoti hai jo downtrend ke doran form hoti hai. Is candle ki range usually kaafi large hoti hai aur market bears ke control mein hota hai.

- Second Candle: Ye bullish candle hoti hai jo pehle bearish candle ki range ke andar hi form hoti hai. Yeh candle pehle bearish candle ke neeche open hoti hai aur usi range ke andar close hoti hai, indicating ke bears ne control nahi maintain kiya aur bulls ne market ko recover kiya hai.

"Bullish Counterattack" pattern ko dekh kar traders expect karte hain ke bearish trend weaken ho raha hai aur ab bullish momentum start ho sakta hai. Is pattern kaafi strong nahi hota, lekin agar doosre technical indicators aur price analysis ke saath combine kiya jaye, toh yeh ek potential reversal signal provide kar sakta hai. Is pattern ka significance increase hota hai agar yeh strong support level ya koi doosra bullish indicator ke saath appear hota hai.

Traders is pattern ko dekh kar long positions enter karte hain ya existing short positions ko cover karte hain, lekin yeh sirf ek signal hai aur individually use nahi kiya ja sakta. Iske saath-saath market conditions aur doosre technical analysis tools ka use kiya jaana chahiye for better decision making.

ap ko is ma yah smjhna ho ga ka ham is ma jo bhi apko knowlwdsge detay hain zarori ni hai ka vh wesa ho ham apnay points say ek ek cheez clear kartay hain takay ap smjha sakain ham har jaga ap ka sath kharay rahain gay ap ki support chyea ap na har mamlay ko achay sa hal karna ha takay ham jeet sakain win kar sakain

تبصرہ

Расширенный режим Обычный режим