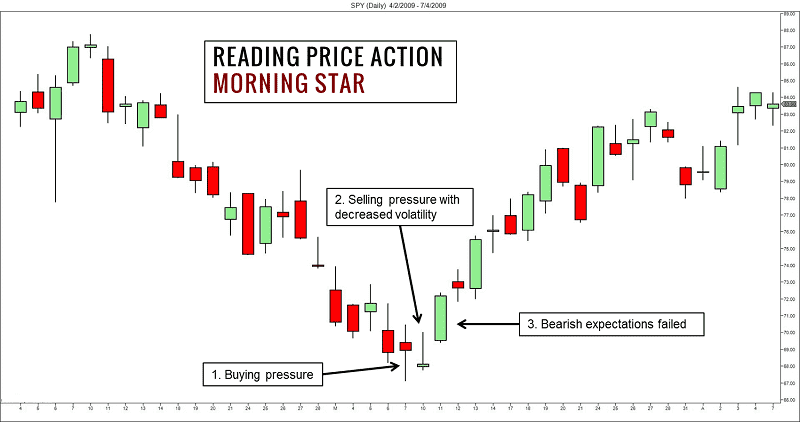

Morning Star candlestick pattern ek bullish reversal pattern hai jo chart analysis mein use hota hai. Yeh pattern commonly ek downtrend ke baad dikhai deta hai aur bullish trend ke shuruaat ko darshata hai.

Morning Star pattern teen consecutive candlesticks se bana hota hai:

- Bullish Candle: Pehli candlestick ek downtrend ki completion ko represent karta hai. Is candlestick ka size aur strength kitni bhi ho sakti hai.

- Doji or Small-bodied Candle: Dusri candlestick usually ek small body ya doji hoti hai. Iska matlab hai ki bulls aur bears ke beech ek saman balance hai. Yeh indicate karta hai ki market confusion mein hai.

- Bullish Candle: Teesri candlestick, jo ki pehli candlestick ke neeche close hoti hai, bulls ka strong comeback darshata hai aur uptrend ka indication deta hai.

Morning Star pattern ko confirm karne ke liye, traders ko dekhna hota hai ki yeh pattern ek strong support level ke paas form hua hai. Agar yeh pattern ek support level ke paas dikhai de, toh iska significance aur bhi badh jaata hai.

Yeh pattern jab dekha jaaye, woh usually ek bullish reversal ke liye indicative hai, aur traders ko potential buying opportunities ka signal deta hai. Lekin, jaise har technical pattern mein hota hai, is pattern ki bhi confirmation ke liye doosre technical indicators aur price action ko consider karna important hota hai.

Pichle mahinay, mazhabi, siyasi aur muashi muddon par zor diya gaya, khaas kar Pakistan aur India ke darmiyan tehzeebi mamlaat ko le kar. Duniya bhar mein shadiyon, ajaraid, aur raqabat ke dawao mein izafa hua hai. Sports ki duniya mein bhi naye taqreerat aur tabdeeliyan dekhi gayi hain.

Bachon ki taleem aur unki sehat ke hawale se global initiatives ki taraf is saal bhi tezi rahi hai. Khaas taur par, Covid-19 ke dore mein bachon ke liye online taleem aur tibbi adab par zor diya gaya.

تبصرہ

Расширенный режим Обычный режим