Introduction:-

Aslam u alaikum,

Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Continuation patterns murawaja rujhan ki simt tijarat karne ke liye indraaj ki sazgaar satah paish kar satke hain. tasalsul ke patteren ke sath trading ke baray mein mazeed jan-nay ke liye parhte rahen, aur –apne takneeki tajzia mein shaamil karne ke liye behtareen mandi aur taizi ke farmishnz.

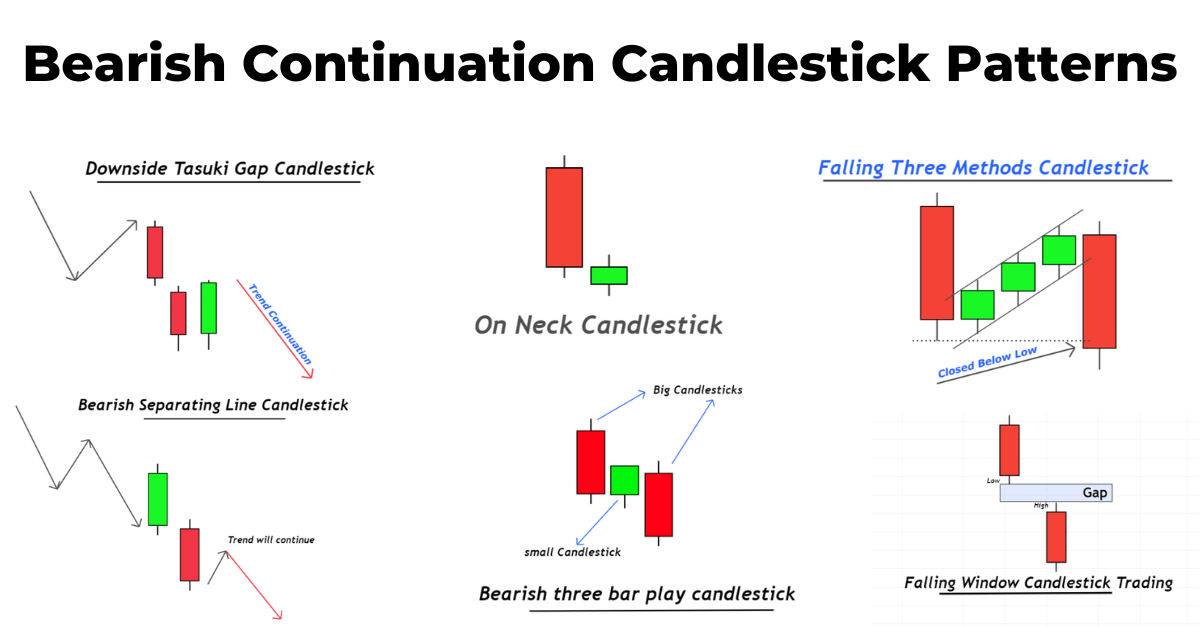

What is Continuation Pattern?

Continuation patterns qabil shanakht chart patteren hain jo asal rujhan ki simt mein jari rakhnay se pehlay earzi istehkaam ki muddat ki nishandahi karte hain. side consolidation ways price movement ki shakal mein zahir hota hai. patteren –apne aap ko consolidation zone ke mazboot break out par mukammal karta hai, jis ke nateejay mein pichlle rujhan ko jari rakha jata hai. tasalsul ke namoonay aam tor par mukhtasir se darmiyani muddat tak chaltay hain.

Bullish Continuation pattern

Bullish Continuation ke patteren oopri rujhan ke darmiyan mein zahir hotay hain aur aasani se pehchane ja satke hain. ahem taizi ke tasalsul ke namoonay zail mein muta-arif karaye gaye hain.

Aik Ascending Triangle patteren aik mazbooti ka namona hai jo darmiyani rujhan mein hota hai aur aam tor par mojooda rujhan ke tasalsul ka ishara deta hai. patteren do converging trained lines ( flat upper trained line aur barhti hui nichli trained line ) ko khech kar tashkeel diya jata hai, kyunkay qeemat earzi tor par aik taraf ki simt mein jati hai .

Aik Bullish Pennant patteren aik tasalsul ke chart ka patteren hai jo security ko aik barri, achanak oopar ki taraf harkat ka tajurbah karne ke baad zahir hota hai. yeh mukhtasir istehkaam ki muddat ke douran tayyar hota hai, is se pehlay ke qeemat isi ibtidayi raftaar ke sath rujhan ki simt mein agay barhay.

Bullish flag patteren taajiron ke liye aik behtareen namona hai. dhamaka khaiz harkatein aksar bail ke jhanday se wabasta hoti hain kyunkay yeh taiz ibtidayi harkat ko earzi mohlat faraham karti hai. bail ka Flag aur Pennant patteren aik hi halaat mein zahir hota hai ( qeemat mein taiz aur achanak tabdeeli ) taham bail jhanda ziyada purkashish indraaj ki satah paish kar sakta hai .

Trading Continuation Pattern

Continuation patterns mustaqbil ki qeematon ki naqal o harkat ke achay isharay hotay hain, bashart e kay tajir darj zail tajaweez par amal karen :

Aslam u alaikum,

Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Continuation patterns murawaja rujhan ki simt tijarat karne ke liye indraaj ki sazgaar satah paish kar satke hain. tasalsul ke patteren ke sath trading ke baray mein mazeed jan-nay ke liye parhte rahen, aur –apne takneeki tajzia mein shaamil karne ke liye behtareen mandi aur taizi ke farmishnz.

What is Continuation Pattern?

Continuation patterns qabil shanakht chart patteren hain jo asal rujhan ki simt mein jari rakhnay se pehlay earzi istehkaam ki muddat ki nishandahi karte hain. side consolidation ways price movement ki shakal mein zahir hota hai. patteren –apne aap ko consolidation zone ke mazboot break out par mukammal karta hai, jis ke nateejay mein pichlle rujhan ko jari rakha jata hai. tasalsul ke namoonay aam tor par mukhtasir se darmiyani muddat tak chaltay hain.

Bullish Continuation pattern

Bullish Continuation ke patteren oopri rujhan ke darmiyan mein zahir hotay hain aur aasani se pehchane ja satke hain. ahem taizi ke tasalsul ke namoonay zail mein muta-arif karaye gaye hain.

- Ascending Triangle

Aik Ascending Triangle patteren aik mazbooti ka namona hai jo darmiyani rujhan mein hota hai aur aam tor par mojooda rujhan ke tasalsul ka ishara deta hai. patteren do converging trained lines ( flat upper trained line aur barhti hui nichli trained line ) ko khech kar tashkeel diya jata hai, kyunkay qeemat earzi tor par aik taraf ki simt mein jati hai .

- Bullish Pennant

Aik Bullish Pennant patteren aik tasalsul ke chart ka patteren hai jo security ko aik barri, achanak oopar ki taraf harkat ka tajurbah karne ke baad zahir hota hai. yeh mukhtasir istehkaam ki muddat ke douran tayyar hota hai, is se pehlay ke qeemat isi ibtidayi raftaar ke sath rujhan ki simt mein agay barhay.

- Bullish Flag

Bullish flag patteren taajiron ke liye aik behtareen namona hai. dhamaka khaiz harkatein aksar bail ke jhanday se wabasta hoti hain kyunkay yeh taiz ibtidayi harkat ko earzi mohlat faraham karti hai. bail ka Flag aur Pennant patteren aik hi halaat mein zahir hota hai ( qeemat mein taiz aur achanak tabdeeli ) taham bail jhanda ziyada purkashish indraaj ki satah paish kar sakta hai .

Trading Continuation Pattern

Continuation patterns mustaqbil ki qeematon ki naqal o harkat ke achay isharay hotay hain, bashart e kay tajir darj zail tajaweez par amal karen :

- Qeemat ke mustahkam honay se pehlay rujhan ki simt ki nishandahi karen .

- Is baat ki nishandahi karne ke liye trained lines ka istemaal karen ke kon sa tasalsul ka namona tayyar ho raha hai .

- Continuation patterns ki kamyabi ke sath shanakht karne ke baad, inaam ke tanasub ke liye misbet khatray par amal karte hue munasib stops aur hudood tay karen .

- Tajir daakhil honay se pehlay rujhan ki simt mein mazboot break out ka intzaar kar satke hain. mazeed bar-aan, taajiron ko ghalat break out se bachanay ke liye sakht stap rakhnay par ghhor karna chahiye aur agar market sazgaar harkat karti hai to is stap ko track karen. istemaal karne ke liye is aur rissk managment ki deegar hikmat amlyon par ghhor karen.

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns2_2-bdc113cc9d874d31bac6a730cd897bf8.png)

تبصرہ

Расширенный режим Обычный режим