DEFINITION AND IDENTIFICATION OF INVERTED HAMMER PATTERN IN FOREX:

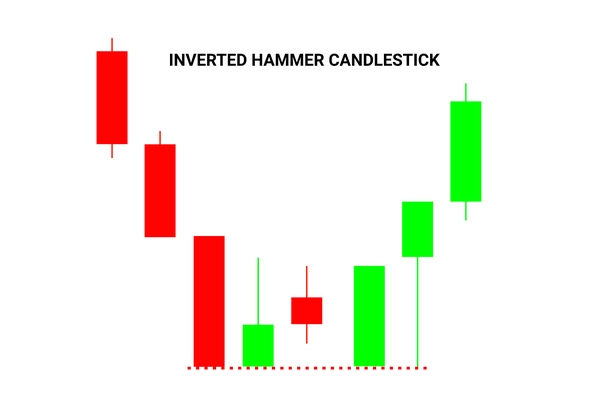

Inverted hammer pattern ek bullish candlestick pattern hai jo forex market mein traders ko taqatwar maloomaat faraham kar sakta hai, joh potential reversals ke baare mein bata sakti hai. Is pattern ki tashkeel tab hoti hai jab open, high aur close prices ek dusre ke qareeb hote hain, lekin low price dusre teeno prices se kafi kam hoti hai. Candlestick ek ulta ghoda jaisa dikhta hai, isliye iska naam aesa hai. Traders aksar is pattern ki talash downtrend ke baad karte hain, kyunki isse ye pata chalta hai ke ek bullish reversal hone ki sambhavna ho sakti hai. Inverted hammer pattern ki pehchan karne ke liye, traders ek chote real body ko candlestick ke upari hisse mein dekhte hain, sath hi sath, ek lambi lower shadow bhi hoti hai. Lower shadow ki length kam se kam real body ki length ka do guna honi chahiye. Ye pattern darshata hai ke buyers ne trading session mein price ko upar le jane mein kamiyabi hasil ki hai, lekin woh significant selling pressure se zarrr kaar aatay hain, jiski wajah se price apne opening level ke qareeb close hoti hai.

INTERPRETATION AND SIGNIFICANCE OF INVERTED HAMMER PATTERN:

Inverted hammer pattern forex traders ke liye qeemti asaar rakhta hai. Isse ye samjha jata hai ke shuru mein market mein bears price ko neeche daba rahe they, lekin phir bulls ne aakar price ko upar le jane mein kamiyab rahe. Lamba lower shadow is baat ka ishara hai ke neeche ke prices ko sakht rok tok ka jawab dia gaya, aur candlestick ke open aur close upar ki taraf ishara karte hain ke buying pressure tha. Traders aksar is pattern ko ek potential reversal signal ke roop mein samjhte hain, jis ka matlab hai ke market sentiment bearish se bullish ki taraf shift ho sakti hai. Lekin dhyan dena zaruri hai ke inverted hammer pattern ko isolation mein nahi, lekin market ki overall trend aur digar technical indicators ki context mein dekha jana chahiye.

CONFIRMATION AND ENTRY STRATEGIES FOR INVERTED HAMMER PATTERN:

Jabki inverted hammer pattern khud mein bullish asaraat rakhta hai, traders aksar tasdeek ka intezar karte hain trade ma mein dakhil hone se pehle. Tasdeek bullish candlestick pattern ya phir kisi significant resistance level ke upar break aur close hone ki shakal mein ho sakti hai. Aur ek tasdeek tool jo traders istemal karte hain, woh volume hoti hai. Ideal tareeqa yeh hai ke traders inverted hammer pattern ke tashkeel hone ke doran buying volume mein izafa dekhein, jo buyers ki taraf se ziada conviction ka ishaara karein. Inverted hammer pattern ki tasdeek ke baad entry strategies mein shaamil ho sakti hai next candle ke opening mein long trade enter karna ya phir pullback ka intezar karna aur faida-mand price level pe dakhil ho jana.

STOP LOSS PLACEMENT AND PROFIT TARGETS FOR INVERTED HAMMER PATTERN:

Risk ko control karne ke liye, traders typically apne stop loss ko inverted hammer pattern ke low se neeche rakhte hain. Ye buffer providekarta hai agar pattern galat ho jaaye aur price ghatne ki taraf jari rakhe. Stop loss ki placement trader ke risk tolerance aur currency pair ki volatility par depend karti hai. Profit targets various technical analysis tools jaise support and resistance levels, Fibonacci retracement levels, ya previous swing highs par based kiye ja sakte hain. Kuch traders trailing stops ka bhi istemal karte hain taki price unki taraf move hone par unki profit lock ki ja sake.

LIMITATIONS AND CONSIDERATIONS OF INVERTED HAMMER PATTERN:

Inverted hammer pattern ek powerful reversal signal ho sakta hai, lekin traders ko iske limitations ka bhi dhyan dena chahiye aur trading decisions lene se pehle dusre factors ko bhi consider karna chahiye. Pehle toh, inverted hammer pattern overall market trend aur dusre technical indicators ke saath analyze kiya jana chahiye taki market dynamics ka achhe se samajh aa sake. Dusra, false signals ho sakte hain, khas kar agar pattern dusre confirming factors dwara support nahi kiya gaya ho. Ant mein, ye samajhna zaruri hai ki candlestick patterns foolproof nahi hote aur trading decisions ke liye sirf in par rely nahi kiya jana chahiye. Traders ko in patterns ko ek broader trading strategy ka hissa samajhna chahiye, jismein risk management techniques aur dusre technical analysis tools shamil hote hain.

Inverted hammer pattern ek bullish candlestick pattern hai jo forex market mein traders ko taqatwar maloomaat faraham kar sakta hai, joh potential reversals ke baare mein bata sakti hai. Is pattern ki tashkeel tab hoti hai jab open, high aur close prices ek dusre ke qareeb hote hain, lekin low price dusre teeno prices se kafi kam hoti hai. Candlestick ek ulta ghoda jaisa dikhta hai, isliye iska naam aesa hai. Traders aksar is pattern ki talash downtrend ke baad karte hain, kyunki isse ye pata chalta hai ke ek bullish reversal hone ki sambhavna ho sakti hai. Inverted hammer pattern ki pehchan karne ke liye, traders ek chote real body ko candlestick ke upari hisse mein dekhte hain, sath hi sath, ek lambi lower shadow bhi hoti hai. Lower shadow ki length kam se kam real body ki length ka do guna honi chahiye. Ye pattern darshata hai ke buyers ne trading session mein price ko upar le jane mein kamiyabi hasil ki hai, lekin woh significant selling pressure se zarrr kaar aatay hain, jiski wajah se price apne opening level ke qareeb close hoti hai.

INTERPRETATION AND SIGNIFICANCE OF INVERTED HAMMER PATTERN:

Inverted hammer pattern forex traders ke liye qeemti asaar rakhta hai. Isse ye samjha jata hai ke shuru mein market mein bears price ko neeche daba rahe they, lekin phir bulls ne aakar price ko upar le jane mein kamiyab rahe. Lamba lower shadow is baat ka ishara hai ke neeche ke prices ko sakht rok tok ka jawab dia gaya, aur candlestick ke open aur close upar ki taraf ishara karte hain ke buying pressure tha. Traders aksar is pattern ko ek potential reversal signal ke roop mein samjhte hain, jis ka matlab hai ke market sentiment bearish se bullish ki taraf shift ho sakti hai. Lekin dhyan dena zaruri hai ke inverted hammer pattern ko isolation mein nahi, lekin market ki overall trend aur digar technical indicators ki context mein dekha jana chahiye.

CONFIRMATION AND ENTRY STRATEGIES FOR INVERTED HAMMER PATTERN:

Jabki inverted hammer pattern khud mein bullish asaraat rakhta hai, traders aksar tasdeek ka intezar karte hain trade ma mein dakhil hone se pehle. Tasdeek bullish candlestick pattern ya phir kisi significant resistance level ke upar break aur close hone ki shakal mein ho sakti hai. Aur ek tasdeek tool jo traders istemal karte hain, woh volume hoti hai. Ideal tareeqa yeh hai ke traders inverted hammer pattern ke tashkeel hone ke doran buying volume mein izafa dekhein, jo buyers ki taraf se ziada conviction ka ishaara karein. Inverted hammer pattern ki tasdeek ke baad entry strategies mein shaamil ho sakti hai next candle ke opening mein long trade enter karna ya phir pullback ka intezar karna aur faida-mand price level pe dakhil ho jana.

STOP LOSS PLACEMENT AND PROFIT TARGETS FOR INVERTED HAMMER PATTERN:

Risk ko control karne ke liye, traders typically apne stop loss ko inverted hammer pattern ke low se neeche rakhte hain. Ye buffer providekarta hai agar pattern galat ho jaaye aur price ghatne ki taraf jari rakhe. Stop loss ki placement trader ke risk tolerance aur currency pair ki volatility par depend karti hai. Profit targets various technical analysis tools jaise support and resistance levels, Fibonacci retracement levels, ya previous swing highs par based kiye ja sakte hain. Kuch traders trailing stops ka bhi istemal karte hain taki price unki taraf move hone par unki profit lock ki ja sake.

LIMITATIONS AND CONSIDERATIONS OF INVERTED HAMMER PATTERN:

Inverted hammer pattern ek powerful reversal signal ho sakta hai, lekin traders ko iske limitations ka bhi dhyan dena chahiye aur trading decisions lene se pehle dusre factors ko bhi consider karna chahiye. Pehle toh, inverted hammer pattern overall market trend aur dusre technical indicators ke saath analyze kiya jana chahiye taki market dynamics ka achhe se samajh aa sake. Dusra, false signals ho sakte hain, khas kar agar pattern dusre confirming factors dwara support nahi kiya gaya ho. Ant mein, ye samajhna zaruri hai ki candlestick patterns foolproof nahi hote aur trading decisions ke liye sirf in par rely nahi kiya jana chahiye. Traders ko in patterns ko ek broader trading strategy ka hissa samajhna chahiye, jismein risk management techniques aur dusre technical analysis tools shamil hote hain.

تبصرہ

Расширенный режим Обычный режим