Market chocking pricemarket mein dabao dar qeemat ka izhar kisi currency pair ki qeemat ko batata hai jis mein us currency pair ki supply aur demand puri tarah barabari mein hoti hai. Iska matlab hai ke market mein kharidne walay aur bechne walay dono barabar ki tadad mein hain, aur koi bhi doosri qeemat par trade karne ko tayyar nahi hai. Market chocking price ko equilibrium price ya fair value bhi kaha jata hai. Market chocking price ka concept forex traders ke liye ahem hai kyunki ye unhe samajhne mein madad karta hai ke ek currency pair ki asal qeemat kya hai aur unhe inform kiya jata hai trading decisions ke liye. Jab ek currency pair apni market chocking price par trade hota hai, to iska matlab hai ke iski qeemat par koi bhi asli ya takneeki factor asar nahi daal raha, aur yeh puri tarah supply aur demand ke zariye chal raha hai.

Importance of Market Chocking Price

Market chocking price forex traders ke liye ahem hai kyunki ye unhe ek currency pair ki asli qeemat ko pehchanne mein madad karta hai. Ye qeemat maqami aur siyasi factors par mabni hoti hai jo supply aur demand ko asar daalte hain, jese ke interest rates, inflation, economic growth, political stability, aur geopolitical events. Jab ek currency pair apni market chocking price par trade hota hai, to iska matlab hai ke in tamam factors ko pehle se market mein shamil kar liya gaya hai, aur kisi bhi doosre qeemat par trade karne ke liye koi tayyar nahi hai.

Lekin jab ek currency pair apni market chocking price se oopar ya neeche trade hota hai, to iska matlab hai ke iski qeemat par koi doosre factor asar daal raha hai. Is tarah ke maamlay mein, traders is information ka istemal karke currency pair ki manzil ke iraday se faida utha sakte hain. Misal ke tor par, agar ek currency pair apni market chocking price se neeche trade kar raha hai kisi negative economic news ya siyasi be-sukooni ki wajah se, to traders ye umid kar sakte hain ke currency pair mein izafah hoga jab investors us currency mein suraksha talash karenge. Ulta, agar ek currency pair apni market chocking price se oopar trade kar raha hai kisi positive economic news ya siyasi mustiqlalti ki wajah se, to traders ye umid kar sakte hain ke currency pair mein girawat hogi jab investors kisi aur jagah zyada munafa kamane ki talash mein honge.

Determining Market Chocking Price

Ek currency pair ki market chocking price ko taayun karne ke liye, iske fundamental aur technical factors ko analyze karna zaroori hai. Fundamental analysis mein economic aur siyasi data ki study shamil hai jisse pata chale ke kaise ye supply aur demand ko asar daalte hain. Misal ke tor par, ek mulk mein ziada interest rates se bahar ka investement attract ho sakta hai aur us mulk ki currency ki demand badh sakti hai. Technical analysis mein, historical price data ki study ki jati hai taake future price movements ko predict kiya ja sake. Misal ke tor par, agar ek currency pair mein waqt ke sath higher lows bante ja rahe hain, to iska matlub hai ke us currency ki demand mein izafah ho sakta hai.

Fundamental analysis ke zariye ek currency pair ki market chocking price taayun karne ke liye, traders economic indicators jese ke gross domestic product (GDP), inflation rate, interest rate differential (IRD), balance of payments (BOP), aur current account balance (CAB) ka istemal kar sakte hain. Ye indicators traders ko madad karte hain ke wo samajh sake ke economic factors supply aur demand ko kaise asar daalte hain.

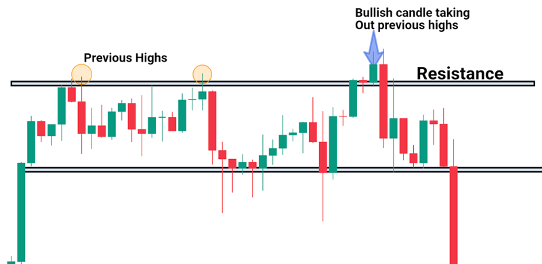

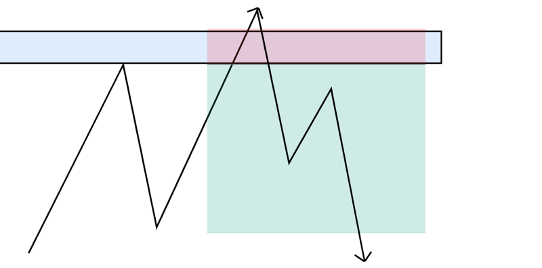

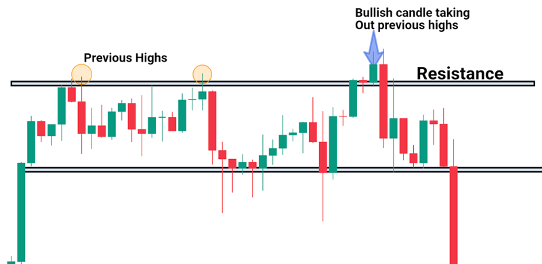

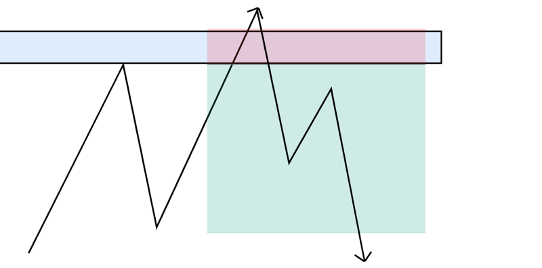

Technical analysis ke zariye market chocking price ko taayun karne ke liye, traders chart patterns ka istemal kar sakte hain jese ke support levels, resistance levels, trend lines, moving averages, Bollinger Bands, Relative Strength Index, MACD, Fibonacci retracements, pivot points, candlestick pattern, Ichimoku Cloud,Inverted Head & Shoulders patterns , Hanging Man patterns, Doji patterns, Spinning Top patterns, Engulfing patterns, Piercing Line patterns, Hammer patterns. Ye chart patterns traders ko trends, reversals, support and resistance levels, momentum indicators, volatility indicators, potential profit targets/stop losses, entry/exit signals tay karnay mein madad karte hain jin par historical price data par mabni hoti hai.

Importance of Market Chocking Price

Market chocking price forex traders ke liye ahem hai kyunki ye unhe ek currency pair ki asli qeemat ko pehchanne mein madad karta hai. Ye qeemat maqami aur siyasi factors par mabni hoti hai jo supply aur demand ko asar daalte hain, jese ke interest rates, inflation, economic growth, political stability, aur geopolitical events. Jab ek currency pair apni market chocking price par trade hota hai, to iska matlab hai ke in tamam factors ko pehle se market mein shamil kar liya gaya hai, aur kisi bhi doosre qeemat par trade karne ke liye koi tayyar nahi hai.

Lekin jab ek currency pair apni market chocking price se oopar ya neeche trade hota hai, to iska matlab hai ke iski qeemat par koi doosre factor asar daal raha hai. Is tarah ke maamlay mein, traders is information ka istemal karke currency pair ki manzil ke iraday se faida utha sakte hain. Misal ke tor par, agar ek currency pair apni market chocking price se neeche trade kar raha hai kisi negative economic news ya siyasi be-sukooni ki wajah se, to traders ye umid kar sakte hain ke currency pair mein izafah hoga jab investors us currency mein suraksha talash karenge. Ulta, agar ek currency pair apni market chocking price se oopar trade kar raha hai kisi positive economic news ya siyasi mustiqlalti ki wajah se, to traders ye umid kar sakte hain ke currency pair mein girawat hogi jab investors kisi aur jagah zyada munafa kamane ki talash mein honge.

Determining Market Chocking Price

Ek currency pair ki market chocking price ko taayun karne ke liye, iske fundamental aur technical factors ko analyze karna zaroori hai. Fundamental analysis mein economic aur siyasi data ki study shamil hai jisse pata chale ke kaise ye supply aur demand ko asar daalte hain. Misal ke tor par, ek mulk mein ziada interest rates se bahar ka investement attract ho sakta hai aur us mulk ki currency ki demand badh sakti hai. Technical analysis mein, historical price data ki study ki jati hai taake future price movements ko predict kiya ja sake. Misal ke tor par, agar ek currency pair mein waqt ke sath higher lows bante ja rahe hain, to iska matlub hai ke us currency ki demand mein izafah ho sakta hai.

Fundamental analysis ke zariye ek currency pair ki market chocking price taayun karne ke liye, traders economic indicators jese ke gross domestic product (GDP), inflation rate, interest rate differential (IRD), balance of payments (BOP), aur current account balance (CAB) ka istemal kar sakte hain. Ye indicators traders ko madad karte hain ke wo samajh sake ke economic factors supply aur demand ko kaise asar daalte hain.

- GDP: Zyada GDP taqatwar arzi nizaam ki taraqqi aur kisi mulk ke maal aur khidmat ki ziada darkhwast ka ishara karta hai, jo ke us mulk ki currency ki ziada darkhwast ka sabab banta hai.

- Inflation rate: Zyada inflation rate ishara karta hai ke production ke izafay se mutasir hokar istehqaqat mein izafa aur istehqaqat mein kami hone se aam logon ke purchasing power mein kami aayegi, jis se mulk ke maal aur khidmat ki kam darkhwast hoti hai aur us mulk ki currency ki bhi kam darkhwast hoti hai.

- Interest rate differential (IRD): Do mulkon mein interest rates ke farq ka asar un mulkon ke darmiyan muddad ki istemal mein hota hai. Zyada interest rates bahar se zyada foreign investment ko akarshit karte hain aur us mulk ki currency ki darkhwast ko izafa karte hain.

- Balance of payments (BOP): BOP mulk ki izat aur manzil mein farq ka andaza lagata hai. A positive BOP izafay se exports ke mutabiq imports mein farq ko darust karta hai aur us mulk ki currency ki izafay se darkhwast ko izafa karta hai. A negative BOP izafay se imports ke mutabiq exports mein farq ko darust nahi karta hai aur us mulk ki currency ki kam darkhwast ko izafa karta hai.

- Current account balance (CAB): CAB mulk ki tamam exports aur goods aur services ke imports ke darmiyan farq ko nazar andaz karta hai. A positive CAB mulk ke maal aur khidmat ki ziada darkhwast ka ishara karta hai aur us mulk ki currency ki ziada darkhwast ka sabab banta hai. A negative CAB mulk ke maal aur khidmat ki kam darkhwast ka ishara karta hai aur us mulk ki currency ki kam darkhwast ka sabab banta hai.

Technical analysis ke zariye market chocking price ko taayun karne ke liye, traders chart patterns ka istemal kar sakte hain jese ke support levels, resistance levels, trend lines, moving averages, Bollinger Bands, Relative Strength Index, MACD, Fibonacci retracements, pivot points, candlestick pattern, Ichimoku Cloud,Inverted Head & Shoulders patterns , Hanging Man patterns, Doji patterns, Spinning Top patterns, Engulfing patterns, Piercing Line patterns, Hammer patterns. Ye chart patterns traders ko trends, reversals, support and resistance levels, momentum indicators, volatility indicators, potential profit targets/stop losses, entry/exit signals tay karnay mein madad karte hain jin par historical price data par mabni hoti hai.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Choppy-Market_Feb_2021-01-d1a35e704e4e49ed9a36456352dfd30a.jpg)

تبصرہ

Расширенный режим Обычный режим