Slippage forex market mein aam baat hai, aur is ke asarat ko samajhna traders ke liye bohot zaroori hai. Slippage wo farq hai jo trade ki umeed ki gayi keemat aur trade ka haqeeqi execution price mein hota hai. Dusre alfaz mein, yeh wo farq hai jo maqsad ki gayi entry ya exit keemat aur trade fill hone wali keemat mein hota hai. Slippage kisi bhi maali market mein ho sakti hai, lekin forex mein iski aksar hoti hai kyun ke yeh aik baihis market hai aur yeh 24 ghantay rozana chalti hai.

Causes of Slippage

Impact of Slippage on Trades

Strategies to Manage Slippage

Causes of Slippage

- Market Volatility: Slippage zyada tar buland market volatility ke doran hoti hai. Yeh is liye kyun ke tezi se badalne wale prices ki wajah se orders ko maqsad ki gayi keemat par execute karna mushkil ho jata hai.

- Liquidity Gaps: Liquidity wo cheez hai jis mein kisi asset ko khareed ya bechay bina uske keemat par asar nahi hota. Low liquidity ke doran, jese ke bade economic releases ya market mein gaps ke doran, orders ko maqsad ki gayi keemat par fill karnay ke liye kafi participants nahi hotay, jo slippage ka sabab banta hai.

- Order Size: Baray order sizes ko zyada slippage ho sakti hai. Agar trader ne bada order diya hai, toh market mein us order ko maqsad ki gayi keemat par pura fill karna mushkil ho sakta hai, jiski wajah se slippage hoti hai.

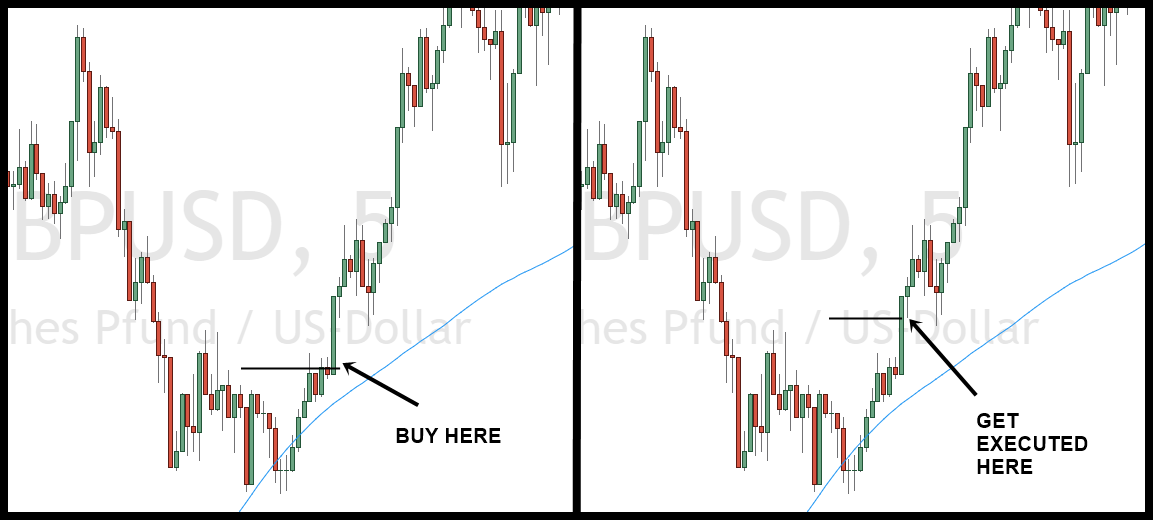

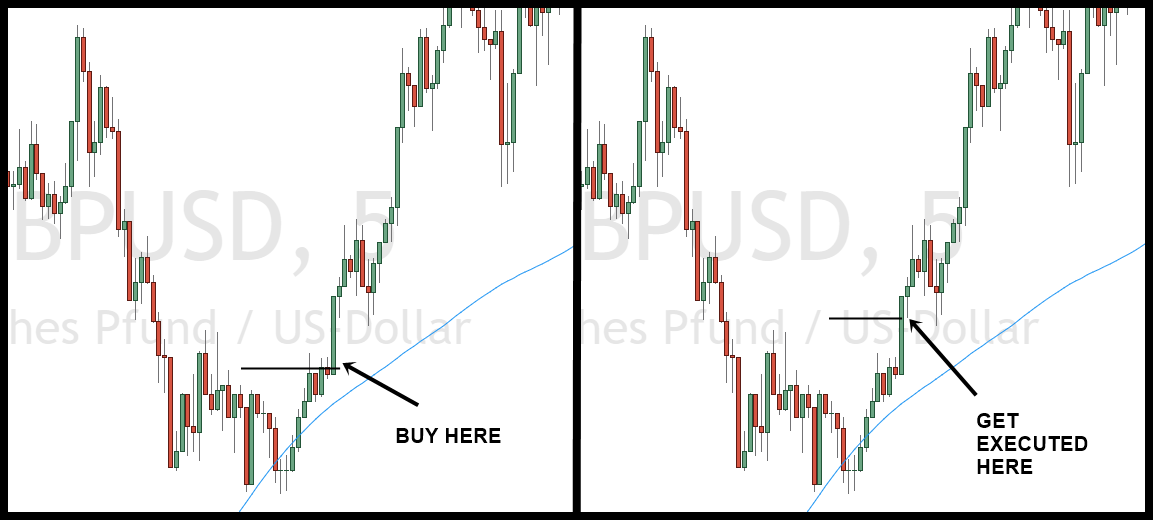

- Market Execution: Slippage market orders ke sath zyada hoti hai as compared to limit orders. Market orders market ke behtareen maujooda keemat par execute hote hain, aur agar order place karne aur execute karne ke darmiyan mein sudden price change ho jaye, toh slippage ho sakti hai.

- Requotes: Buland volatility ke doran, brokers orders ko maqsad ki gayi keemat par execute nahi kar saktay. Iss halat mein, broker naya price offer karta hai, jo ke pehle request ki gayi keemat se kam ho sakti hai, jisse slippage hoti hai.

Impact of Slippage on Trades

- Increased Costs: Slippage trading ke liye transaction costs ko barha sakti hai, khas kar agar traders frequent ya bade positions ke sath trading kar rahe hain. Maqsad ki gayi aur haqeeqi execution prices ke darmiyan ka farq, trade ka overall cost mein hissa banata hai.

- Unintended Losses or Gains: Traders ko slippage ki wajah se be maqsad nuqsaan ya faida ho sakta hai. For example, agar kisi trader ke pass stop-loss order hai toh woh dekhe ga ke order uske maqsad ki gayi keemat se kam price par execute hua hai, jisse expected se zyada nuqsaan ho.

- Reduced Profitability: Slippage trading strategy ka overall munafa asar daal sakti hai. Agar slippage consistently trades ke liye behtar prices na de, toh woh waqt ke sath sath munafa ko bhi ghata sakti hai.

- Slippage in Both Directions: Yeh zaroori hai ke slippage buying aur selling dono directions mein ho sakti hai. Traders ko entry karne ke waqt bhi aur exit karne ke waqt bhi slippage ka samna karna pad sakta hai, jo potential munafa aur nuqsaan dono par asar daal sakti hai.

Strategies to Manage Slippage

- Use Limit Orders: Slippage ka asar kam karne ka aik tariqa yeh hai ke market orders ke bajaye limit orders ka istemal karein. Limit orders mein trader specify karta hai ke woh trade kis maximum price par (sell order ke liye) ya minimum price par (buy order ke liye) karna chahta hai. Haan, limit orders hamesha fill nahi hote, lekin woh trade ko execute karne ke liye price par control rakhtay hain.

- Monitor Economic Events: Traders ko major economic events aur news releases ka khayal rakhna chahiye jo market volatility ko barha saktay hain. Economic calendar ko monitor karke, traders market ke buland volatility ke doran trading se bach saktay hain, aur slippage ka asar kam kar saktay hain.

- Choose Liquid Pairs: Zyada liquid currency pairs mein trading karne se slippage kam ho sakti hai. Major currency pairs jese ke EUR/USD aur USD/JPY, exotic ya kam trade hone wale pairs se zyada liquidity mein mubtala hotay hain.

- Adjust Position Sizes: Traders apne position sizes ko slippage ke hisaab se adjust kar saktay hain. Chhote position sizes ki wajah se slippage bade positions ke muqablay mein kam ho sakti hai, khas kar agar market illiquid hai.

- Use Stop-Limit Orders: Stop-limit order stop aur limit orders dono ka mixture hai. Isme trader specify karta hai ke trade ko trigger karne ke liye konsi price hogi aur trade ko execute karne ke liye konsi price chahiye. Yeh traders ko order ki execution par zyada control deta hai.

تبصرہ

Расширенный режим Обычный режим