Introduction:

forex market mein Dragonfly Doji candlestick patter aik kesam ka candlestick pattern hota hey jes mein prices aik jaice hote hein or forex market mmein open price hote hey or close price be hote hein candlestick tamam time frame aik jaice hote hein es chart pattern mein daily weekly, 1Hours kay chart pattern bhe ho saktay hein

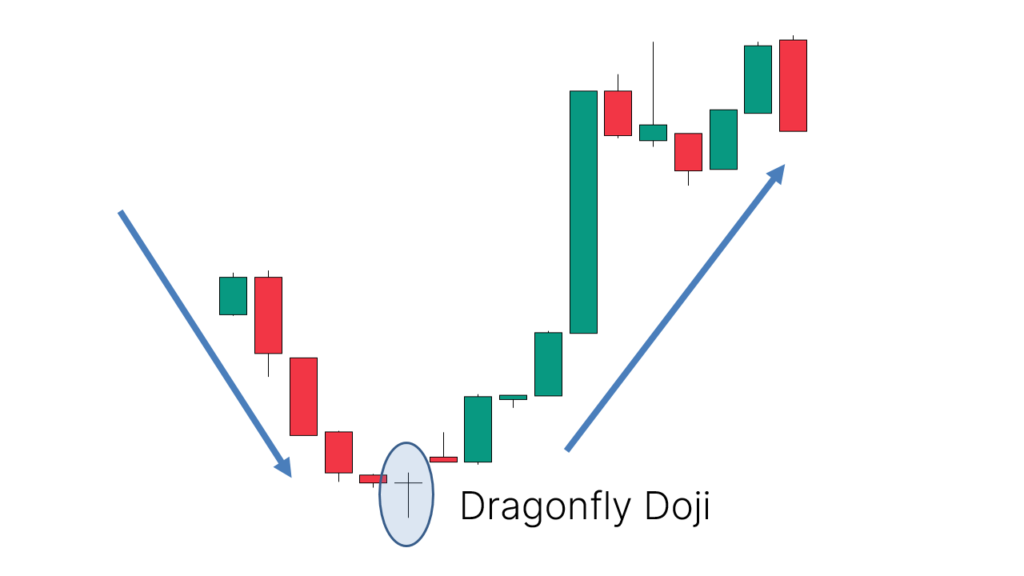

forex market mein dragonfly Doji os time bante hey jab kese assert ke price open hote hey bad mein yeh taize say gerte hey bad mein yeh wapes oper jate hey or es point par close ho jate hey jahan say yeh open hove hote hey

Understanding Dragonfly Doji candlestick pattern :

forex market mein yeh Doji candlestick pattern aik range kay inside mmeiforex tren kayy nechay ke taraf esharay ko indicate karte hey yeh aam tor par es bat ke taraf eshara hota hey keh forex market ke price ke majodah limit inside ke taraf ho jate hey

forex market ka yeh candlestick pattern tamam kesam kay period mein he ho sakta hey jab yeh candlestick pattern daily candlestick pattern mein banta hey or jab yeh weekly candlestick chart pattern mein banta hey to es kamatlab hey yeh hey keh forex stock ai he price par ope hota hey ya phir bad mein close ho jata hey

jaisa keh nechay de gay tasweer mein bhe ap daikh saktay hein keh forex market mein aik long lower shadow ban sakta hey forex market kay kuch moamllat mein market ka upper shadow chota hota hey es ka elawah forex market mein jab candlestick chote hote hey to es ko hammer candlestick ka naam deya jata hey

Dragonfly Doji candlestick up trend mein bhe sakte hey or down trend mein bhe ban sakte hey or es kay elawah forex market mei es ke body chote hote hey to es ko hammer candlestick ka naam deya ja sakta hey

Trading Example Dragonfly Doji:

Dragonfly Doji ke aik ache mesal nechay dey gay chart par he ap daikh saktay hein jo keh EUR/GBP ka chart pair hota hey jaisa keh ap daikh saktay hein keh forex market ke price aik mamol kame kay trend mein he the jo keh forex market ke price ko taize say nechay ke taraf open kar sakte hey bad mein den kay end kay sath he open ho jata hey

dosree mesal USD/ZAR kay chart ke dekhay gay hey jo keh forex market kay pair ko maole say nehay ke taraf lay kar jate hey or pair jare teen candlestick kay sath ger gay the 4th thora sa nechay ke taraf open ho jata hey bad mein jahan par open hota hey wahan parja kar close ho jata hey es pair nay bhe bad mein he mamole sa ochal deya hey

forex market mein Dragonfly Doji candlestick patter aik kesam ka candlestick pattern hota hey jes mein prices aik jaice hote hein or forex market mmein open price hote hey or close price be hote hein candlestick tamam time frame aik jaice hote hein es chart pattern mein daily weekly, 1Hours kay chart pattern bhe ho saktay hein

forex market mein dragonfly Doji os time bante hey jab kese assert ke price open hote hey bad mein yeh taize say gerte hey bad mein yeh wapes oper jate hey or es point par close ho jate hey jahan say yeh open hove hote hey

Understanding Dragonfly Doji candlestick pattern :

forex market mein yeh Doji candlestick pattern aik range kay inside mmeiforex tren kayy nechay ke taraf esharay ko indicate karte hey yeh aam tor par es bat ke taraf eshara hota hey keh forex market ke price ke majodah limit inside ke taraf ho jate hey

forex market ka yeh candlestick pattern tamam kesam kay period mein he ho sakta hey jab yeh candlestick pattern daily candlestick pattern mein banta hey or jab yeh weekly candlestick chart pattern mein banta hey to es kamatlab hey yeh hey keh forex stock ai he price par ope hota hey ya phir bad mein close ho jata hey

jaisa keh nechay de gay tasweer mein bhe ap daikh saktay hein keh forex market mein aik long lower shadow ban sakta hey forex market kay kuch moamllat mein market ka upper shadow chota hota hey es ka elawah forex market mein jab candlestick chote hote hey to es ko hammer candlestick ka naam deya jata hey

Dragonfly Doji candlestick up trend mein bhe sakte hey or down trend mein bhe ban sakte hey or es kay elawah forex market mei es ke body chote hote hey to es ko hammer candlestick ka naam deya ja sakta hey

Trading Example Dragonfly Doji:

Dragonfly Doji ke aik ache mesal nechay dey gay chart par he ap daikh saktay hein jo keh EUR/GBP ka chart pair hota hey jaisa keh ap daikh saktay hein keh forex market ke price aik mamol kame kay trend mein he the jo keh forex market ke price ko taize say nechay ke taraf open kar sakte hey bad mein den kay end kay sath he open ho jata hey

dosree mesal USD/ZAR kay chart ke dekhay gay hey jo keh forex market kay pair ko maole say nehay ke taraf lay kar jate hey or pair jare teen candlestick kay sath ger gay the 4th thora sa nechay ke taraf open ho jata hey bad mein jahan par open hota hey wahan parja kar close ho jata hey es pair nay bhe bad mein he mamole sa ochal deya hey

تبصرہ

Расширенный режим Обычный режим