Trade Hanging Man Pattern

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

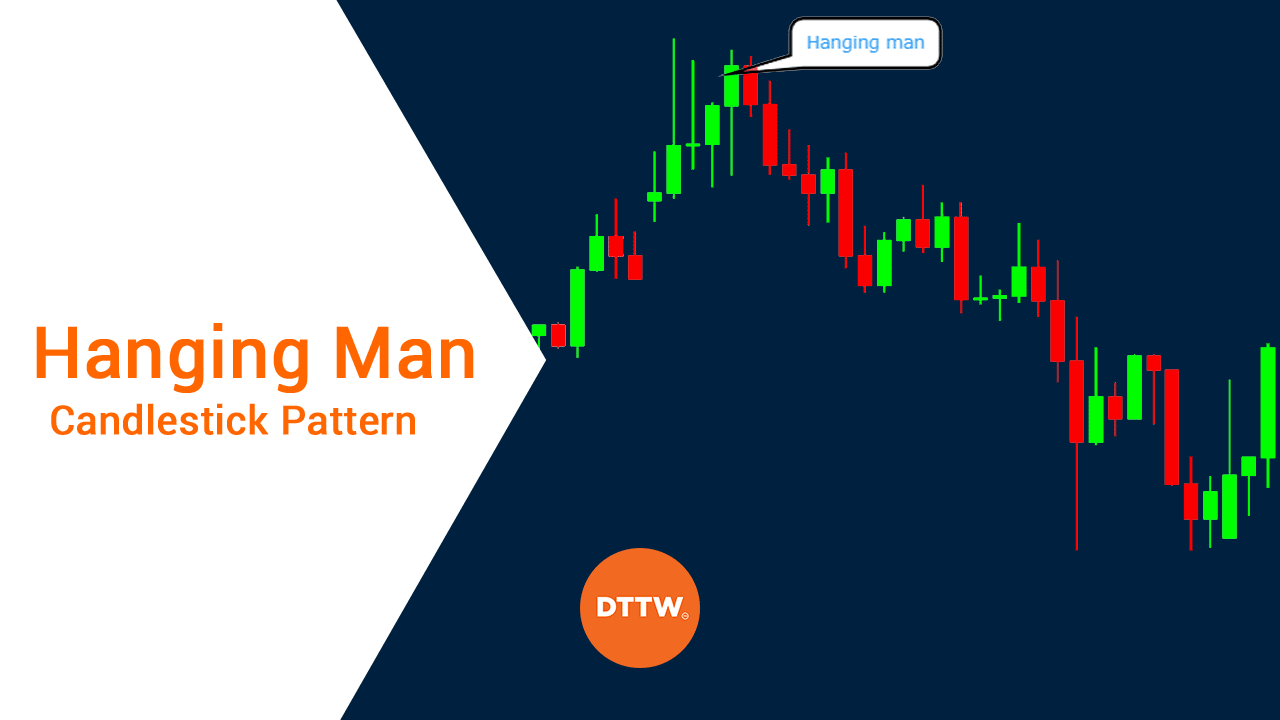

Introduction Hanging man candlestick pattern aik reversal candlestick pattern hota hey taize say chalnay wallay selling pressure ko identify karta hey yeh forex market ka exiting up trend ko indicate karta hey bohut ce forex market mein trader es ko buy kar saktay hein yeh forex market mein bohut say shorka kay zarey say paish keya ja sakta hey market aik bar apni boland tareen level par pohnch jate hey jes ke winning say bulls ka wazan bear say zyada hota hey GBP/USD chart mein es ka analysis keya ja sakta hey jo keh forex market mein baray paimanay par selling pressure ko identify karte hey oper ke taraf trend oper zahair hona dekhai dayta hey Hanging Man candlestick pattern ka Pehchan Hanging man candlestick pattern ka estamal short trade mein keya jata hey kunkeh yeh forex market mein long baray paimanay par selling pressure ko identify karte hey Hanging Man candlestick pattern haqeqat mein imtahan kay bad forex chart par bad ke activities ko zahair karta hey or forex market kay short period mein trend line nechay ke taraf break ho jate hey nechay ke taraf long period trend jare kay tor par daikha jata hey aik or mumkana entry ke level trade mein enter ho sakta hey aik bar jab forex market hanging man ke lower level kocross kar jate hey Trade with Hanging Man Pattern forex market kay long period mein tend jare ko indicate karnay kay ley candlestick ke formation ko daikhna zaroore hota hey forex market mein kai time frae ka analysis kar kay estamal keya jata hey daily or weekly time frame ka estamal kartay hovay hum forex market mein hum es pattern daikh saken gay takeh forex market long period kese bhe side mein movement kar sakte ho es kay bad forex trade mein mesale entry point ka analysis daikh saktay hein chotay time frame H4 or 2H ka estammal kar kay analysis kar kay market mein entry le jate hey Identify long term trend forex market mein hanging man candlestick pattern par trade karnay kay ley humen market mein long entry kay ley daikhna chihay or long trend ka analysis karna chihay mesale entry point ke talash ap ko forex market mein aik mesale entry ka point ka dayna chihay hanging man candlestick short trade signal frahm karta hey Forex market supporting signal hanging man candlestick pattern forex market mein supporting signal frahm karta hey RSI s bat ke confirmation kayley estamal hota hey 20 den SMA or 50 SMA say barah gay hey hanging man short term mein up trend kay oper wallay hesay mein dekhai dayte hey Fibonacci retracement level close ho jate hey trade place forex market mein hanging man kay lower point mein aik entry point ko talash karna chihay ager forex market mein bearish ka trend hota hey to ap ko price action nechay atte hove hey to ap forex market mein short trade mein entry ka eshara frahm karte hey risk management ap ko forex market mein hamaisha positive risk o reward kaim karna chihay ap forex market kay account ka total hesa kese bhe risk kay ley day saktay apni trade kam say kam 2% tak ka risk layna chihay takeh ager market ap kay against chal bhe jay to ap ka zyada loss na ho sakay ap ka account bhe safe rahay

bhali kay badlay bhali

bhali kay badlay bhali

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hanging Man Pattern

Forex trading mein chart analysis ka ek ahem hissa Hanging Man pattern hai. Ye ek bearish reversal pattern hai jo ke market trend ke ulte hone ki taraf ishara karta hai. Hanging Man pattern ko samajhna forex traders ke liye zaroori hai taake woh sahi waqt par apne trading decisions ko improve kar sakein.

Tareef Aur Treeqay

Hanging Man pattern ek candlestick pattern hai jo ke bearish reversal ko darust karta hai. Ye pattern aksar uptrend ke doran dekha jata hai aur ye ek potential reversal signal hai. Hanging Man pattern ek single candlestick se banta hai jo ke neeche di gayi characteristics ko dikhata hai.

• Lambi shadow (ya tail) upper side par

• Choti body, ideally upper side par

• Lambi ya kuch lambi shadow lower side par

Hanging Man pattern ko pehchanne ka tareeqa simple hai, lekin iski sahi fehrist mein practice aur experience ki zarurat hoti hai.

Kaise Kaam Karta Hai?

Jab Hanging Man pattern market mein dikhai deta hai, ye ek reversal ki possibility ko darust karta hai. Agar ye pattern ek uptrend ke doran dikhai deta hai, to ye bearish reversal ki possibility ko darust karta hai. Hanging Man pattern ki body upper side par hoti hai, jo ke bullish sentiment ko indicate karti hai. Magar iski lambi shadow upper side par, aur lambi ya kuch lambi shadow lower side par, bearish pressure ko darust karta hai.

Trading Strategies

Hanging Man pattern ko samajhne ke baad, traders iska istemal kar ke apni trading strategies ko improve kar sakte hain. Kuch strategies neeche di gayi hain.

Confirmation ke liye wait karein

Hanging Man pattern ko ek confirmatory signal ke tor par istemal karne se pehle, traders ko doosri confirmatory signals ka intezar karna chahiye jaise ke doji pattern ya bearish engulfing pattern.

Stop loss aur take profit levels set karein

Hanging Man pattern ko dekhte hue, traders apne stop loss aur take profit levels ko set kar sakte hain, taake unka loss minimize ho sake aur profit maximise ho sake.

Trading Examples

Hanging Man pattern ko samajhna aur uska istemal karne ke liye kuch practical trading examples neeche diye gaye hain

Uptrend ke doran Hanging Man pattern

Agar market uptrend mein hai aur Hanging Man pattern dikhai deta hai, to ye bearish reversal ki possibility ko darust karta hai. Traders is signal ke sath doosri confirmatory signals ka bhi intezar karte hain aur phir selling position enter karte hain.

Downtrend ke doran Hanging Man pattern

Agar market downtrend mein hai aur Hanging Man pattern dikhai deta hai, to ye bearish trend ka further confirmation hai. Traders is signal ke sath doosri confirmatory signals ka bhi intezar karte hain aur phir short selling positions enter karte hain.

-

#4 Collapse

Trade hanging man pattern

Title: Hanging Man Pattern: Ek Eham Stock Market Signal

Introduction: Hanging Man Pattern, ya hamein Urdu mein 'latka hua aadmi' pattern kehte hain, ek ahem stock market signal hai jo traders ke liye kisi bhi naye movement ki shuruaat ka andaza lagane mein madad karta hai. Ye pattern typically ek uptrend ke baad aata hai aur bearish reversal ka sign hota hai. Is article mein, hum Hanging Man Pattern ke bare mein Roman Urdu mein tafseel se baat karenge.

- Hanging Man Pattern Ka Tasavvur:

- Hanging Man Pattern ek single candlestick pattern hai jo ek specific formation ko darust karta hai.

- Iski pehchaan karta hai ek lambi upper shadow aur choti body ke saath, jo ki niche close hoti hai.

- Ye typically ek uptrend ke baad aata hai, jo ke ek bearish reversal ka sign hai.

- Hanging Man Pattern Ka Matlab:

- Hanging Man Pattern ka matlab hota hai ke buyers initially aggressive hote hain, lekin phir sellers dominate karte hain aur price ko neeche kheenchte hain.

- Ye ek psychological shift ko darust karta hai, jahan buyers ki taqat khatam hoti hai aur sellers control lena shuru karte hain.

- Hanging Man Pattern Ki Shuruaat:

- Hanging Man Pattern typically ek uptrend ke baad aata hai.

- Ye ek indication hota hai ke uptrend weak ho raha hai aur market mein reversal ho sakta hai.

- Hanging Man Pattern Ki Tafseel:

- Hanging Man Pattern ek single candlestick se milta hai jo ek specific formation ko represent karta hai.

- Iski body choti hoti hai, aur lambi upper shadow hoti hai, jo niche close hoti hai.

- Yeh ek strong selling pressure ka sign hai, jab ki buyers initially active thay.

- Hanging Man Pattern Ka Istemal:

- Hanging Man Pattern ko confirm karne ke liye, traders dusre technical indicators ka istemal karte hain, jaise ke volume aur support/resistance levels.

- Agar ye pattern high volume ke saath aata hai, toh uska significance aur bhi barh jata hai.

- Hanging Man Pattern Aur Trading Strategies:

- Hanging Man Pattern ka istemal karke traders bearish positions enter karte hain ya existing long positions ko exit karte hain.

- Is pattern ko confirm karne ke liye, traders doji ya bearish confirmation candle ka wait karte hain.

- Hanging Man Pattern Ka Dhyaan:

- Hanging Man Pattern sirf ek signal hai aur uske akele par na bharosa kiya jana chahiye.

- Is pattern ko confirm karne ke liye, dusre technical aur fundamental factors ka bhi tajziya karna zaroori hai.

- Hanging Man Pattern Ki Limitations:

- Hanging Man Pattern ke signals kabhi-kabhi false bhi ho sakte hain.

- Isliye, traders ko is pattern ko samajhne aur uska istemal karne ke liye sahi knowledge aur experience hona chahiye.

Conclusion: Hanging Man Pattern ek ahem stock market signal hai jo traders ko bearish reversal ka indication deta hai. Is pattern ko samajhna aur sahi tareeke se istemal karna, traders ke liye zaroori hai taake woh market movements ko sahi taur par samajh sakein aur munafa kamayen.

- Hanging Man Pattern Ka Tasavvur:

-

#5 Collapse

Trade Hanging Man Pattern: Ek Mufeed Tarika

Trade Hanging Man Pattern ek mufeed tarika hai jise traders istemal karte hain market ke movements ko samajhne ke liye.

1. Introduction to Hanging Man Pattern:

Hanging Man Pattern ek candlestick pattern hai jo bearish reversal signal deta hai. Ye pattern ek single candlestick se banta hai aur uptrend ke end ko indicate karta hai.

Hanging Man Pattern ka naam isiliye hai kyunki ye candlestick market chart par ek hanging man ki tarah dikhta hai, jiska sir upper side mein hota hai aur body neeche ki taraf jhuki hoti hai.

2. Understanding the Hanging Man Candlestick:

Hanging Man candlestick ek single candle hai jo market ke upper wale hisse mein form hota hai. Iska sir upper shadow hota hai jo price ke maximum level ko indicate karta hai, jabki body neeche hoti hai jo closing price ko represent karti hai. Lower shadow ki absence is pattern ko aur bhi prominent banata hai.

Hanging Man candlestick ka size aur shape bhi important hai. Is pattern ka body chhota hota hai aur neeche ki taraf jhuka hota hai, jo ki bearish sentiment ko highlight karta hai.

3. Identifying the Hanging Man Pattern:

Hanging Man ko pehchanne ke liye dekhen jab market upar jata hai aur phir neeche aata hai, lekin closing price near the low hoti hai. Iska matlab hai ke buyers initially market ko push karte hain lekin phir sellers control mein aate hain aur price ko neeche le jaate hain.

Hanging Man pattern ko confirm karne ke liye, traders ko ek candle ke sirf ek hisse (shadow) par focus karna chahiye aur uski body ko ignore karna chahiye.

4. Components of a Hanging Man Candlestick:

Hanging Man candlestick mein upper shadow lambi hoti hai aur lower shadow nahi hoti hai. Upper shadow price ke maximum level ko represent karta hai jabki lower shadow ki absence bearish pressure ko highlight karta hai.

Hanging Man candlestick ka body chhota hota hai aur neeche ke taraf jhuka hota hai, jo ki bearish sentiment ko indicate karta hai.

5. Significance of the Hanging Man Pattern:

Hanging Man Pattern bearish reversal ko indicate karta hai, yani ke uptrend ke end ka signal hai. Ye pattern jab market ke upar form hota hai aur phir price neeche aata hai, to ye ek indication hai ke buyers ka control kamzor ho raha hai aur sellers dominate kar rahe hain.

Is pattern ko samajhna traders ke liye zaroori hai taake woh market ke future direction ka better analysis kar sakein.

6. Psychological Implications of the Hanging Man Pattern:

Hanging Man Pattern ka formation traders ke among uncertainty ko indicate karta hai aur selling pressure ki shuruaat hoti hai. Jab traders is pattern ko dekhte hain, to unmein fear aur caution paida hoti hai aur woh apni positions ko reevaluate karte hain.

Is pattern ke formation ke baad, traders bearish sentiment mein aane lagte hain aur selling pressure ke wajah se market mein downward movement dekhne ko milta hai.

7. Confirmation of the Hanging Man Pattern:

Hanging Man Pattern ko confirm karne ke liye traders ko next candle ka behavior dekhna chahiye. Agar next candle bearish hai aur price neeche ja rahi hai, to ye Hanging Man Pattern ka confirmation hai.

Traders ko sirf Hanging Man candle ka formation par bharosa nahi karna chahiye, balki uske baad wale candles ka bhi dhyan rakhna chahiye taake unhein confirmatory signals mil sakein.

8. Trading Strategies Using the Hanging Man Pattern:

Hanging Man Pattern ka istemal karke traders apni trading strategies ko improve kar sakte hain. Agar Hanging Man Pattern uptrend ke baad form hota hai, to traders short positions enter kar sakte hain ya existing long positions ko close kar sakte hain.

Is pattern ke istemal mein, traders ko stop-loss orders lagana important hai taake agar market unexpected movement karta hai to unka loss minimize ho sake.

9. Risk Management with the Hanging Man Pattern:

Hanging Man Pattern ka istemal karne se pehle traders ko risk management ka dhyan rakhna chahiye. Har trade mein, traders ko apne risk tolerance ke hisab se position size decide karna chahiye aur stop-loss orders lagana chahiye taake losses ko control kiya ja sake.

Hanging Man Pattern ke formation ke baad, traders ko market ke uncertainty ke sath sath potential losses ko bhi consider karna important hai.

10. Examples of Hanging Man Pattern in Real Market Situations:

Haqeeqati market situations mein Hanging Man Pattern ke kuch examples ko dekhte hue iska istemal samajh sakte hain. Jab market mein uptrend ke baad Hanging Man Pattern form hota hai, to traders ko reversal ka potential samajh aata hai aur woh apni strategies ko adjust karte hain.

Real market examples dekh kar traders Hanging Man Pattern ke importance ko aur bhi clearly samajh sakte hain aur iska istemal karke apne trading performance ko improve kar sakte hain.

11. Limitations of the Hanging Man Pattern:

Hanging Man Pattern ke kuch limitations hain jinhe traders ko samajhna zaroori hai. Ye pattern kabhi kabhi false signals generate kar sakta hai, jaise ke market volatility ya choppy conditions mein.

Iske alawa, sirf Hanging Man Pattern par bharosa karke trading karna risky ho sakta hai. Is pattern ko confirm karne ke liye traders ko dusre technical indicators ka bhi istemal karna chahiye.

12. Combining the Hanging Man Pattern with Other Indicators:

Hanging Man Pattern ko dusre indicators ke sath combine karke traders apni analysis ko aur bhi mazboot bana sakte hain. Moving averages, RSI, aur MACD jaise indicators ka istemal karke traders Hanging Man Pattern ke signals ko confirm kar sakte hain.

Is tarah ke multiple confirmatory signals ke sath, traders ko apne decisions par zyada confidence milta hai aur unki trading performance bhi improve hoti hai.

13. Backtesting the Hanging Man Pattern:

Hanging Man Pattern ko backtest karke traders apne trading strategies ko validate kar sakte hain. Historical market data par is pattern ka istemal karke traders apne strategies ka performance analyze kar sakte hain aur potential flaws ko identify kar sakte hain.

Backtesting ke through, traders ko Hanging Man Pattern ke istemal ke pros aur cons ka pata chalta hai aur woh apne strategies ko optimize kar sakte hain.

14. Conclusion:

Hanging Man Pattern ek mufeed tool hai jo traders ko market ke reversals ko samajhne mein madad karta hai. Is pattern ka istemal karke traders apni trading decisions ko improve kar sakte hain aur market ke movements ko better predict kar sakte hain.

Hanging Man Pattern ke importance ko samajhne ke liye thorough analysis aur practical experience ka hona zaroori hai taake traders is pattern ka sahi istemal kar sakein.

15. Final Thoughts on the Hanging Man Pattern:

Aakhir mein, Hanging Man Pattern ke istemal se pehle thorough analysis aur risk management ka dhyan rakhna zaroori hai. Traders ko is pattern ke formation ke baad market ke behavior ko closely monitor karna chahiye aur apni strategies ko adjust karte hue trading decisions leni chahiye. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Market Mein Hanging Man Pattern<><><><>

Forex market mein "Hanging Man" pattern candlestick analysis mein ek prasiddh pattern hai. Yeh bearish reversal pattern hota hai aur typically uptrend ke ant mein dikhta hai. Is pattern mein ek candle hoti hai jo ek lambi upper shadow ke saath hoti hai aur ek chhota body ke saath neeche ki taraf hamesha khatam hoti hai.

"Hanging Man" pattern ko dekh kar traders ka interpretation hota hai ki buyers initially ne prices ko badhaya tha, lekin phir sellers ne control assume kiya aur price ko niche kheecha. Yeh indicate karta hai ki market ka sentiment change ho sakta hai aur bearish reversal hone ki sambhavna hoti hai.

Forex Market Mein Hanging Man Pattern Ke Factors<><><><>

trading decisions lene se pehle market ke broader context ko samajhna zaroori hai. Ismein kuch factors hain jo traders ko dhyan mein rakhne chahiye:- Trend: Hanging Man pattern ko dekhne se pehle overall trend ko samajhna important hai. Agar pattern uptrend ke ant mein aata hai, toh bearish reversal ke chances zyada hote hain. Lekin agar downtrend mein yeh pattern dikhe, toh woh bearish continuation ka indication ho sakta hai.

- Volume: Trading volume ko bhi consider karna important hai. Agar Hanging Man candle ke saath high volume hai, toh reversal ka probability zyada hota hai. Lekin agar volume low hai, toh pattern ka reliability kam ho jata hai.

- Support/Resistance Levels: Agar Hanging Man pattern kisi important support ya resistance level ke paas dikhta hai, toh woh uski significance ko aur bhi badha deta hai. Support level ke neeche ya resistance level ke upar aane par, pattern ka impact aur bhi strong ho sakta hai.

- Confirmation Signals: Sirf ek candlestick pattern par bharosa karne se pehle, traders ko doosre confirmatory signals ka bhi intezar karna chahiye. Jaise ki, doosre bearish indicators ya price action signals jo Hanging Man pattern ko support karte hain.

Is tarah se, Hanging Man pattern ko samajhne ke liye aur saath mein dusre technical analysis tools ka istemal karke, traders apne trading decisions ko improve kar sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

**Hanging Man Pattern Ka Trade Kaise Karein**

Hanging Man pattern ek popular candlestick pattern hai jo price action analysis mein use hota hai. Yeh pattern market reversal ke signals ko indicate karta hai aur traders ko important trading decisions lene mein madad karta hai. Yahan Hanging Man pattern ko trade karne ke liye kuch key points hain jo aapko is pattern ko effectively use karne mein madad karenge:

1. **Hanging Man Pattern Ka Overview**: Hanging Man pattern ek bearish reversal pattern hai jo uptrend ke baad banta hai. Is pattern ka formation ek candlestick ke roop mein hota hai jo market ki upward movement ke baad bearish trend ki possible reversal ko indicate karta hai. Is candlestick ka body chhota aur shadow (wick) bada hota hai jo market ki strong selling pressure ko show karta hai.

2. **Pattern Ki Identification**: Hanging Man pattern tab identify hota hai jab ek candlestick jisme chhoti body aur lambi lower shadow hoti hai, uptrend ke end mein appear hoti hai. Pattern ke formation ke baad, price action ke decline hone ke chances hote hain.

3. **Confirmation Ki Zaroorat**: Hanging Man pattern ko trade karne ke liye, pattern ke confirmation ka intezar zaroori hai. Confirmation tab milti hai jab next candle Hanging Man ke body ke niche close hoti hai, jo pattern ke bearish reversal signal ko confirm karta hai. Is confirmation se aapko trade open karne ka signal milta hai.

4. **Entry Point**: Hanging Man pattern ke confirmation ke baad, aap apni sell position open kar sakte hain. Entry point tab hota hai jab price Hanging Man ke body ke niche close hoti hai aur bearish trend start hota hai.

5. **Stop-Loss Aur Target Setting**: Stop-loss ko Hanging Man pattern ke upper shadow ke thoda upar set karein, taake agar market unexpected movement kare to loss se bacha ja sake. Target price ko previous support levels ya risk-reward ratio ke basis par set karein.

6. **Risk Management**: Risk management ko dhyan mein rakhna zaroori hai. Aapko apne trades ko size aur risk tolerance ke mutabiq manage karna chahiye.

7. **Combine with Other Indicators**: Hanging Man pattern ko dusre technical indicators aur analysis tools ke sath combine karke trading decisions ko enhance kar sakte hain. For example, Moving Averages, RSI, aur MACD ko use karke, aapko additional confirmation aur insights mil sakti hain.

Hanging Man pattern market ke potential reversals ko identify karne mein madadgar hota hai. Is pattern ko accurately identify karke aur proper confirmation ke saath trade karke, aap apni trading strategy ko improve kar sakte hain aur market movements ka behtar faida utha sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:36 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим