Trend Lines trading strategy in forex Guide and Information.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Trend Lines trading strategy. Forex trading mein, trend lines trading strategy ek aisa tarika hai jismein traders trend lines ka istemal karte hain. Trend lines ka matlab hota hai kisi bhi security ya currency ke price movement ka graphical representation. Trend lines ko traders istemal karte hain taaki woh price movement ke trends ko samajh sake aur apne trades ko sahi samay par enter aur exit kar sake. How to find Trends. Trend lines trading strategy mein, trend lines ki tareef bahut important hai. Trend lines ko traders istemal karte hain taaki woh price ke movement ke trends ko samajh sake. Trend lines ek straight line hoti hai jo price movement ke chart par draw ki jati hai. Trend lines ka istemal karne se traders ko market ki direction aur trend ka pata chalta hai. Trend lines trading strategy mein, trend lines ka istemal karna bahut important hai. Trend lines ko traders istemal karte hain taaki woh market ki direction aur trend ko samajh sake. Trend lines ka istemal karne ke liye traders ko price movement ke chart par trend lines draw karna hota hai. Jab trend lines draw ho jate hain to traders ko market ki direction aur trend ka pata chalta hai. Trend Lines Trading Strategy Working. Trend lines trading strategy mein, traders trend lines ka istemal karke trading karte hain. Trend lines ki trading strategy ka matlab hota hai ki traders trend lines ki madad se market ki direction aur trend ko samajhte hain aur phir us direction mein trading karte hain. Agar market uptrend mein hai to traders buy trades ko enter karte hain jab price trend line ko cross karta hai. Aur agar market downtrend mein hai to traders sell trades ko enter karte hain jab price trend line ko cross karta hai. Trend lines ki trading strategy ka istemal karne se traders apne trades ko sahi samay par enter aur exit kar sakte hain aur profit earn kar sakte hain. Main Facts. Trend lines trading strategy forex trading mein ek bahut hi important strategy hai. Trend lines ka istemal karke traders market ki direction aur trend ko samajhte hain aur phir us direction mein trading karte hain. Trend lines ki trading strategy ka istemal karne se traders apne trades ko sahi samay par enter aur exit kar sakte hain aur profit earn kar sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Trend Line

Trend line ek seedhi line hai jo kam se kam do points ko jorta hai aur mustaqbil mein aik support ya resistance ki line ke taur par kaam karti hai. Trend lines upward trend mein significant lows ko jorti hain aur downward trend mein significant highs ko jorti hain, jis se dynamic resistance paida hoti hai. Is maamlay mein, dynamic resistance ka matlab hai ke waqt ke saath saath support ya resistance ke qeemat bhi tabdeel hoti hai. Misal ke taur par, uptrend mein, support ki level waqt ke saath barhti hai. Downtrend mein, resistance ki level waqt ke saath kam hoti hai.

Trend line traders ke liye aik ahem tool hai jo ke price action ko samajhne aur future price movements ke bare mein anaylze karne mein madadgar hota hai. Trend lines aksar trading decisions ke liye critical hote hain aur traders inhein istemal karte hain taake woh market trends ke sath chalte rahein.

Trend Line Ki Ahmiyat

Trend line ki ahmiyat samajhne ke liye, pehle yeh samajhna zaroori hai ke market trends kya hote hain. Market trends ka matlab hota hai ke kisi trading asset ki keemat mein aik muddat ke doraan hone wale tabdeelion ka aik aam aur constant rukh hota hai. Yeh rukh ya to bullish hota hai, jahan asset ki keemat barhti hai, ya phir bearish hota hai, jahan asset ki keemat girti hai.

Trend lines traders ko yeh samjhne mein madadgar hoti hain ke market kis rukh mein ja raha hai. Yeh aik visual tool hoti hain jo ke trading charts par banai jati hain aur trading asset ke prices ko connect karti hain. Jab koi trading asset trend line ko touch karta hai ya usse cross karta hai, to yeh ek important signal deta hai ke market ka trend kis rukh mein ja raha hai.

Trend Line Kaise Banai Jati Hai

Trend line banane ke liye aap ko trading chart par kam az kam do points ko connect karna hota hai. Agar market upward trend mein hai, to trend line significant low points ko connect karti hai. Agar market downward trend mein hai, to trend line significant high points ko jorti hai.

Uptrend line ki slope musbat hoti hai aur do ya is se zyada low points ko jorne se banti hai. Dusra low pehle low se ooncha hona chahiye taa ke line ki slope musbat ho. Ye bullish trendlines ishara deti hain ke financial markets ke assets ki keemat barh rahi hai aur is trend ke musbat jari rehne ka imkaan hai. Uptrend line banane ke liye, aap ko do ya is se zyada low points ko connect karna hota hai. Lekin, yad rahe ke dusra low pehle low se ooncha hona chahiye. Is se trend line ki slope musbat hoti hai. Yeh slope traders ko batati hai ke market bullish hai aur asset ki keemat barh rahi hai.

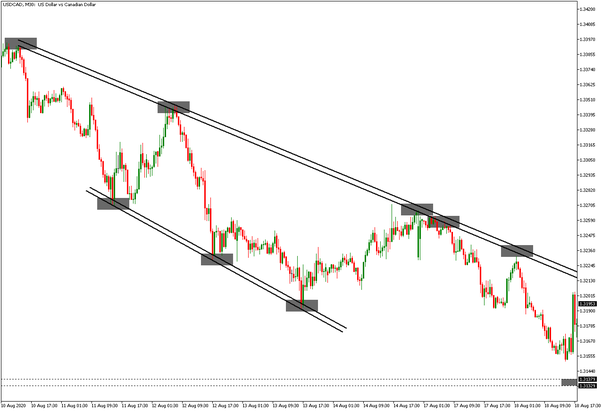

Downtrend line ki slope manfi hoti hai aur aik currency pair ke do ya is se zyada high points ko jorne se banti hai. Dusra high pehle high se kam hona chahiye taa ke line ki slope manfi ho. Uptrends ke mukhalif, ye bearish trendlines ishara deti hain ke financial instrument ki keemat gir rahi hai aur trend line jari rehne ke doran girne jari rahegi. Downtrend line banane ke liye, aap ko do ya is se zyada high points ko connect karna hota hai. Lekin, dusra high pehle high se kam hona chahiye. Is se trend line ki slope manfi hoti hai. Yeh slope traders ko signal deti hai ke market bearish hai aur asset ki keemat girti ja rahi hai.

Sideways line woh horizontal keemat ka bewaqoofana andaz hai jo tab paida hota hai jab supply aur demand ke taqat takreeban barabar hoti hai. Yaani, asset eqaum mein barabar hawaas ke liye ek support aur resistance level ki talash mein hota hai aur dono parallel trendlines ke darmiyan trade hoti hai. Ye trendline strategy range trading ke naam se bhi jaani jaati hai. Sideways trend mein keemat aik tang band mein move karti hai, na to ooper ki taraf jaati hai aur na he neechay.

Trend Line Aur Sideways Trend

Market trends sirf uptrend aur downtrend se mehdood nahi hotay. Kabhi-kabhi market aik horizontal band mein move karti hai jise hum sideways trend kehte hain. Sideways trend tab hota hai jab supply aur demand ke forces takreeban barabar hote hain. Is doran asset ki keemat mein kisi clear direction mein kisi bari tabdeeli nahi hoti.

Sideways trend mein, keemat aik mukhlis band mein move karti hai, na ooper ki taraf jaati hai aur na he neechay. Is trend mein traders ko asset ke keemat ke darmiyan kisi aik support aur resistance level ki talash hoti hai aur woh in dono parallel trendlines ke darmiyan trade karte hain. Is strategy ko range trading ke naam se bhi jana jata hai.

Sideways trends traders ke liye challenging ho saktay hain, lekin agar inhein theek tareeqay se istemal kiya jaye to yeh sab se boring lekin inaam dene wala trendline analysis method ho sakta hai.

Sideways trend trading strategy ke mutabiq, experienced traders asset ko tab bechte hain jab ke price resistance lines ke qareeb hoti hai aur asset ko tab khareedte hain jab price horizontal support line ko chuti hai. Agar trend line chart par kisi time frame par ooper ya neechay breakout hota hai, to yeh ek naya trend reversal hota hai aur stop loss order kisi bhi sideways line par set ki jati hai.

Lekin, aap ko yaad rakhna hoga ke jab aap trendline breakouts trade karte hain, to yeh aik significant risk hota hai kyun ke bohat si jhootay breakouts hotay hain. Is masle ko hal karne ke liye, bohat se traders pehli candlestick ka intezar karte hain aur phir trade mein dakhil hote hain.

Trading

Trend lines trading decisions ke liye aik powerful tool hote hain. Inka istemal market trends ko samajhne aur price movements ke predictions ke liye hota hai. Yeh traders ko market ka mood aur possible future price changes ke bare mein aik behtareen andaza deti hain.

Trend lines ki madad se traders support aur resistance levels ko pehchan sakte hain. Support level ek aisi level hoti hai jahan se asset ki keemat ke barhne ka aik potential chance hota hai. Jab asset ki keemat support level ko touch karti hai, to woh bounce back kar sakti hai.

Aksar traders buy positions enter karte hain jab asset ki keemat support level ko touch karti hai. Unka target hota hai ke asset ki keemat support level se upar ja kar resistance level tak pohunchay. Isi tarah se, resistance level ek aisi level hoti hai jahan se asset ki keemat ke girne ka potential chance hota hai. Jab asset ki keemat resistance level ko touch karti hai, to woh gir sakti hai. Aksar traders sell positions enter karte hain jab asset ki keemat resistance level ko touch karti hai.

Trend Lines Ke Kuch Ahem Nuksanat

Trend lines trading mein ahem role ada karti hain, lekin traders ko yaad rakhna hoga ke kisi bhi strategy ya tool ke apne nuksanat hote hain. Yeh kuch trend lines ke nuksanat hain:

- False Breakouts:

Trend lines kabhi-kabhi false breakouts dikhate hain, yaani ke jab price trend line ko cross karta hai, to woh actual trend ke against move karta hai. Aise scenarios mein traders ko loss ho sakta hai. - Multiple Trends:

Markets mein kabhi-kabhi multiple trends hoti hain. Aik time frame par aap ek trend line dekh sakte hain lekin doosre time frame par woh trend different ho sakti hai. Aise situations mein traders ko confusion ho sakti hai. - Subjectivity:

Trend lines banana mein kuch subjectivity hoti hai. Alag traders alag trend lines draw kar sakte hain, isiliye yeh aik trading tool hai jise samjhne aur sahi tareeqay se istemal karne mein practice chahiye. - Timeframes:

Trend lines different timeframes par alag dikh sakti hain. Chota time frame par banai gayi trend line, jaise ke 15-minute chart par, jyada short-term trends ko represent karegi jab ke bara time frame par banai gayi trend line, jaise ke daily chart par, zyada long-term trends ko represent karegi.

Trend Line Trading Tips

Trend lines istemal karte waqt, yeh tips yaad rakhne mein madadgar ho sakti hain:

- Multiple Timeframes:

Multiple timeframes par trend lines dekhen. Alag alag timeframes par bani trend lines se aap ko overall picture mil sakti hai. - Confirm with Other Indicators:

Trend lines ko doosri indicators ke saath confirm karen, jaise ke moving averages, oscillators, ya price patterns. Is se aap ko trading decisions mein aur bhi confidence hoga.

- Practice on Demo Account:

Trend line trading ko demo account par practice karen. Demo account aap ko bina real money invest kiye trading strategies test karne ka mauqa deti hai. - Risk Management:

Stop-loss orders ka istemal karke apna risk management karen. Agar trend line ke breakout ke baad market against trend move karta hai, to aap ka nuksan kam ho sakta hai.

- Continuously Learn:

Trading ek dynamic field hai aur market conditions change hoti rehti hain. Isliye hamesha seekhte rahein aur apne trading skills ko improve karte rahein.

Aam taur par, is trading strategy ke mutabiq, experienced traders asset ko tab bechte hain jab ke keemat resistance lines ke qareeb hoti hai aur asset ko tab khareedte hain jab ke horizontal support line ko chuti hai. Agar trendline chart par kisi time frame par ooper ya neechay breakout hota hai, to yeh aik naya trend reversal hota hai aur stop loss order kisi bhi sideways line par set ki jati hai. Lekin, aap ko yaad rakhna hoga ke jab aap trendline breakouts trade karte hain, to yeh aik significant risk hota hai kyun ke bohat si jhootay breakouts hotay hain. Is masle ko hal karne ke liye, bohat se traders pehli candlestick ka intezar karte hain aur phir trade mein dakhil hote hain.

- False Breakouts:

-

#4 Collapse

Assalamu Alaikum Dosto!

Trend Line

Trend line ek seedhi line hai jo kam se kam do points ko jorta hai aur mustaqbil mein aik support ya resistance ki line ke taur par kaam karti hai. Trend lines upward trend mein significant lows ko jorti hain aur downward trend mein significant highs ko jorti hain, jis se dynamic resistance paida hoti hai. Is maamlay mein, dynamic resistance ka matlab hai ke waqt ke saath saath support ya resistance ke qeemat bhi tabdeel hoti hai. Misal ke taur par, uptrend mein, support ki level waqt ke saath barhti hai. Downtrend mein, resistance ki level waqt ke saath kam hoti hai.

Trend line traders ke liye aik ahem tool hai jo ke price action ko samajhne aur future price movements ke bare mein anaylze karne mein madadgar hota hai. Trend lines aksar trading decisions ke liye critical hote hain aur traders inhein istemal karte hain taake woh market trends ke sath chalte rahein.

Trend Line Ki Ahmiyat

Trend line ki ahmiyat samajhne ke liye, pehle yeh samajhna zaroori hai ke market trends kya hote hain. Market trends ka matlab hota hai ke kisi trading asset ki keemat mein aik muddat ke doraan hone wale tabdeelion ka aik aam aur constant rukh hota hai. Yeh rukh ya to bullish hota hai, jahan asset ki keemat barhti hai, ya phir bearish hota hai, jahan asset ki keemat girti hai.

Trend lines traders ko yeh samjhne mein madadgar hoti hain ke market kis rukh mein ja raha hai. Yeh aik visual tool hoti hain jo ke trading charts par banai jati hain aur trading asset ke prices ko connect karti hain. Jab koi trading asset trend line ko touch karta hai ya usse cross karta hai, to yeh ek important signal deta hai ke market ka trend kis rukh mein ja raha hai.

Trend Line Kaise Banai Jati Hai

Trend line banane ke liye aap ko trading chart par kam az kam do points ko connect karna hota hai. Agar market upward trend mein hai, to trend line significant low points ko connect karti hai. Agar market downward trend mein hai, to trend line significant high points ko jorti hai.

Uptrend line ki slope musbat hoti hai aur do ya is se zyada low points ko jorne se banti hai. Dusra low pehle low se ooncha hona chahiye taa ke line ki slope musbat ho. Ye bullish trendlines ishara deti hain ke financial markets ke assets ki keemat barh rahi hai aur is trend ke musbat jari rehne ka imkaan hai. Uptrend line banane ke liye, aap ko do ya is se zyada low points ko connect karna hota hai. Lekin, yad rahe ke dusra low pehle low se ooncha hona chahiye. Is se trend line ki slope musbat hoti hai. Yeh slope traders ko batati hai ke market bullish hai aur asset ki keemat barh rahi hai.

Downtrend line ki slope manfi hoti hai aur aik currency pair ke do ya is se zyada high points ko jorne se banti hai. Dusra high pehle high se kam hona chahiye taa ke line ki slope manfi ho. Uptrends ke mukhalif, ye bearish trendlines ishara deti hain ke financial instrument ki keemat gir rahi hai aur trend line jari rehne ke doran girne jari rahegi. Downtrend line banane ke liye, aap ko do ya is se zyada high points ko connect karna hota hai. Lekin, dusra high pehle high se kam hona chahiye. Is se trend line ki slope manfi hoti hai. Yeh slope traders ko signal deti hai ke market bearish hai aur asset ki keemat girti ja rahi hai.

Sideways line woh horizontal keemat ka bewaqoofana andaz hai jo tab paida hota hai jab supply aur demand ke taqat takreeban barabar hoti hai. Yaani, asset eqaum mein barabar hawaas ke liye ek support aur resistance level ki talash mein hota hai aur dono parallel trendlines ke darmiyan trade hoti hai. Ye trendline strategy range trading ke naam se bhi jaani jaati hai. Sideways trend mein keemat aik tang band mein move karti hai, na to ooper ki taraf jaati hai aur na he neechay.

Trend Line Aur Sideways Trend

Market trends sirf uptrend aur downtrend se mehdood nahi hotay. Kabhi-kabhi market aik horizontal band mein move karti hai jise hum sideways trend kehte hain. Sideways trend tab hota hai jab supply aur demand ke forces takreeban barabar hote hain. Is doran asset ki keemat mein kisi clear direction mein kisi bari tabdeeli nahi hoti.

Sideways trend mein, keemat aik mukhlis band mein move karti hai, na ooper ki taraf jaati hai aur na he neechay. Is trend mein traders ko asset ke keemat ke darmiyan kisi aik support aur resistance level ki talash hoti hai aur woh in dono parallel trendlines ke darmiyan trade karte hain. Is strategy ko range trading ke naam se bhi jana jata hai.

Sideways trends traders ke liye challenging ho saktay hain, lekin agar inhein theek tareeqay se istemal kiya jaye to yeh sab se boring lekin inaam dene wala trendline analysis method ho sakta hai.

Sideways trend trading strategy ke mutabiq, experienced traders asset ko tab bechte hain jab ke price resistance lines ke qareeb hoti hai aur asset ko tab khareedte hain jab price horizontal support line ko chuti hai. Agar trend line chart par kisi time frame par ooper ya neechay breakout hota hai, to yeh ek naya trend reversal hota hai aur stop loss order kisi bhi sideways line par set ki jati hai.

Lekin, aap ko yaad rakhna hoga ke jab aap trendline breakouts trade karte hain, to yeh aik significant risk hota hai kyun ke bohat si jhootay breakouts hotay hain. Is masle ko hal karne ke liye, bohat se traders pehli candlestick ka intezar karte hain aur phir trade mein dakhil hote hain.

Trading

Trend lines trading decisions ke liye aik powerful tool hote hain. Inka istemal market trends ko samajhne aur price movements ke predictions ke liye hota hai. Yeh traders ko market ka mood aur possible future price changes ke bare mein aik behtareen andaza deti hain.

Trend lines ki madad se traders support aur resistance levels ko pehchan sakte hain. Support level ek aisi level hoti hai jahan se asset ki keemat ke barhne ka aik potential chance hota hai. Jab asset ki keemat support level ko touch karti hai, to woh bounce back kar sakti hai.

Aksar traders buy positions enter karte hain jab asset ki keemat support level ko touch karti hai. Unka target hota hai ke asset ki keemat support level se upar ja kar resistance level tak pohunchay. Isi tarah se, resistance level ek aisi level hoti hai jahan se asset ki keemat ke girne ka potential chance hota hai. Jab asset ki keemat resistance level ko touch karti hai, to woh gir sakti hai. Aksar traders sell positions enter karte hain jab asset ki keemat resistance level ko touch karti hai.

Trend Lines Ke Kuch Ahem Nuksanat

Trend lines trading mein ahem role ada karti hain, lekin traders ko yaad rakhna hoga ke kisi bhi strategy ya tool ke apne nuksanat hote hain. Yeh kuch trend lines ke nuksanat hain:

- False Breakouts:

Trend lines kabhi-kabhi false breakouts dikhate hain, yaani ke jab price trend line ko cross karta hai, to woh actual trend ke against move karta hai. Aise scenarios mein traders ko loss ho sakta hai. - Multiple Trends:

Markets mein kabhi-kabhi multiple trends hoti hain. Aik time frame par aap ek trend line dekh sakte hain lekin doosre time frame par woh trend different ho sakti hai. Aise situations mein traders ko confusion ho sakti hai. - Subjectivity:

Trend lines banana mein kuch subjectivity hoti hai. Alag traders alag trend lines draw kar sakte hain, isiliye yeh aik trading tool hai jise samjhne aur sahi tareeqay se istemal karne mein practice chahiye. - Timeframes:

Trend lines different timeframes par alag dikh sakti hain. Chota time frame par banai gayi trend line, jaise ke 15-minute chart par, jyada short-term trends ko represent karegi jab ke bara time frame par banai gayi trend line, jaise ke daily chart par, zyada long-term trends ko represent karegi.

Trend Line Trading Tips

Trend lines istemal karte waqt, yeh tips yaad rakhne mein madadgar ho sakti hain:

- Multiple Timeframes:

Multiple timeframes par trend lines dekhen. Alag alag timeframes par bani trend lines se aap ko overall picture mil sakti hai. - Confirm with Other Indicators:

Trend lines ko doosri indicators ke saath confirm karen, jaise ke moving averages, oscillators, ya price patterns. Is se aap ko trading decisions mein aur bhi confidence hoga.

- Practice on Demo Account:

Trend line trading ko demo account par practice karen. Demo account aap ko bina real money invest kiye trading strategies test karne ka mauqa deti hai. - Risk Management:

Stop-loss orders ka istemal karke apna risk management karen. Agar trend line ke breakout ke baad market against trend move karta hai, to aap ka nuksan kam ho sakta hai.

- Continuously Learn:

Trading ek dynamic field hai aur market conditions change hoti rehti hain. Isliye hamesha seekhte rahein aur apne trading skills ko improve karte rahein.

Aam taur par, is trading strategy ke mutabiq, experienced traders asset ko tab bechte hain jab ke keemat resistance lines ke qareeb hoti hai aur asset ko tab khareedte hain jab ke horizontal support line ko chuti hai. Agar trendline chart par kisi time frame par ooper ya neechay breakout hota hai, to yeh aik naya trend reversal hota hai aur stop loss order kisi bhi sideways line par set ki jati hai. Lekin, aap ko yaad rakhna hoga ke jab aap trendline breakouts trade karte hain, to yeh aik significant risk hota hai kyun ke bohat si jhootay breakouts hotay hain. Is masle ko hal karne ke liye, bohat se traders pehli candlestick ka intezar karte hain aur phir trade mein dakhil hote hain.

- CL

- Mentions 0

-

سا0 like

- False Breakouts:

-

#5 Collapse

TREND LINES TRADING STRATEGY IN FOREX GUIDE AND INFORMATION

Trend lines probably forex trading mein technical analysis ki sabse common form hai unfortunately se zyadatar forex trader inhen correctly tarike se nahin khinchte hain trend line ko market ke mutabik banane ki try Nahin karte hain bajay Iske ke dusre way se voh probably sabse zyada istemal Sudha peoples mein se ek hai Agar correctly tarike se khincha Jaaye to vah Kisi dusre method Ki Tarah accurate ho sakte hain yeh ek ascending trend line ke Taur per known hai Inki sabse basic form mein sabse easily se identifiable support areas Valleys ke nichle Hisse ke sath Ek up trend line khinch Jaati Hai down trend Mein trend ki line easily say identify able resistance areas peaks ke upri Hisse ke Sath khinchi Jaati Hai ise descending trend line ke Taur per Jante Hain

TYPE OF TREND LINE

1down trend lower high 2 sideways ka trend ranging 3up trend higher low trend Ki ye 3 types hai horizontal support aur resistance level Ki Tarah trend lines jitni bar Janchi Jaati Hai voh stronger hoti hain Ek valid trend line Banane mein least two bottom ya tops Lagte Hain lakin trend lines ki confirm karne mein teen Lagte Hain s importantly Baat market Mein fit hone per forcing Karke kabhi bhi train lines not ever draw aap jitne steeper line draw utna hi less reliable hoga aur uske break ka likely utna hi zyada hoga

WHAT IS A TREND LINE AND HOW DOES IT WORK YOU KNOW

Support aur resistance aapke chart per horizontal areas Hain joke ke potential buying and selling ke pressure ko show Karte Hain aur trend line ke liye bhi same hi hai sabse pahle yeh suchte hain ke aapni trend line kaise na khechen Yahan Ek bed Misal hai clearly yah raddi ki tokri hai aapko Idea Nahin Hai To carefully listen sirf important swing points per focus Marcus Karen aur Baki everything ko ignore Karen come is come two major swing points ko connect Karen adjust Karen Taki aapko zyada Se Jyada Touches mile Chahe voh body ho ya wick

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trande line ki pahchan ,

Sab se pehle, aapko market mein current trend ko pehchan'na hoga. Agar market upar ja raha hai, to aap "uptrend" mein hain, aur agar neeche ja raha hai, to aap "downtrend" mein hain Trend Lines trading strategy ke bare mein tafseel se batasakta hoon. Trend Lines trading strategy forex market mein aik aham aur asaan tareeqa hai taakay aap trends ko samajh saken aur trading decisions le saken. Yeh strategy aam taur par is tarah kaam karti hai,,

Trande lines drwa krain,

Trend Lines ko draw karne ke liye, aapko market ki high points ko connect karna hoga agar uptrend mein hain, ya market ki low points ko connect karna hoga agar downtrend mein hain. Yeh line aapko trend ki direction dikhayegi Trend Lines trading strategy ke bare mein tafseel se batane ki koshish karunga. Forex mein Trend Lines ek aham technical analysis tool hote hain. Inka istemal market ke trends ko samajhne aur trading decisions lene ke liye kiya jata hai.

Trande line confirmation,

Trend Lines ko aik ya do aur price points se confirm karen. Agar price trend line ko do dafa cross karta hai, to yeh aapko strong signal deta hai Pehle to aapko current price chart par trend lines draw karni hoti hain. Uptrend ke liye, aap line ko low se high direction mein draw karenge, jabki downtrend ke liye high se low direction mein draw karenge.

Entry point tay krain,

Jab aap trend lines ke saath confirm kar lein ke aap sahi trend mein hain, to entry points tay karen. Aksar traders price reversals ya pullbacks ko wait karte hain entry ke liye Jab price trend line ko break karta hai, tab yah ek mukhya signal ho sakta hai. Uptrend ke dauran, breakout upar ki taraf hota hai, jabki downtrend mein, breakout niche ki taraf hota hai.

Stop loss & take profit set krain ,,

Hamesha stop-loss aur take-profit levels set karen taaki aap risk management kar saken Hamesha apne trading positions ke liye risk management ka istemal karen. Stop-loss aur take-profit orders set karein, taaki aap nuksan se bach sakte hain.

Trade monitoring ,,

Apni trades ko monitor karte rahein aur market conditions ke mutabiq apne stop-loss aur take-profit levels ko adjust karte rahein trend Lines trading strategy ek powerful tool ho sakti hai lekin yaad rahe ke market mein risk hota hai, isliye hamesha risk management ko yaad rakhein. Is strategy ko demo account par practice karke, aur experience hasil karke hi live trading mein istemal karen.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:22 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим