Long lower candlestick pattern trading

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

LONG LOWER CANDLESTICK PATTERN TRADING INTRODUCTION Long Lower Candlestick Pattern trading ek aham technical analysis tool hai jo traders istemal karte hain tijarat ke faislon aur trends ko samajhne ke liye. Is pattern mein ek lambi neeche ki candle ko dekha jata hai jo market mein bearish (girawat) trend ko darust karti hai. CANDLESTICK PATTERN FORMATION Long Lower Candlestick Pattern mein aik candle hoti hai jo do hisson mein taqseem hoti hai: BODY Candle ki moti hissa hai jo opening aur closing prices ko darust karta hai. LOWER WICK Candle ki lambi patli hissa jo lowest price ko darust karta hai. TECHNICAL ANALYSIS OF THE PATTERN Long Lower Candlestick Pattern jab market mein dikhayi deta hai, to yeh ishara karta hai ke buyers initially market mein powerful thay lekin phir sellers ne control hasil kiya aur market girne laga. Iska result hota hai ke candle ki closing price, opening price se kafi neeche hoti hai aur candle ki neeche wick bhi lambi hoti hai. Long Lower Candlestick Pattern ko dekh kar traders samajhte hain ke market mein bearish sentiment yaani ke girawat ka mahaul hai. Yeh pattern market mein reversals ya trend changes ko indicate karta hai. Isay dekhte hue traders girawat mein positions le sakte hain ya apni existing positions ko band kar sakte hain. LONG LOWER CANDLESTICK PATTERN SIGNIFICANT FACTS Long Lower Candlestick Pattern ko dusre technical indicators aur analysis ke saath mila kar istemal kiya jata hai. Yeh sirf ek signal hai aur isay confirm karne ke liye doosre technical tools jaise ke moving averages, RSI, ya support aur resistance levels ka bhi istemal hota hai.Mehnat aur practice ke baad, traders Long Lower Candlestick Pattern aur uske sath milne wale indicators ko istemal karke behtar faislen le sakte hain aur tijarat mein kamiyabi haasil kar sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Lower Candlestick Pattern Details. Candlestick patterns are widely used in technical analysis by traders and investors to predict market trends and identify potential trading opportunities. One such pattern is the lower candlestick pattern, which can be used to identify a possible reversal in a downtrend. In this article, we will discuss the lower candlestick pattern trading in Roman Urdu. A lower candlestick pattern is formed when the opening price of a candlestick is higher than its closing price, and the candlestick has a long lower shadow or wick. This pattern indicates that the bears are in control of the market, and the prices may continue to decline. How to Trade the Lower Candlestick Pattern? Traders and investors can use the lower candlestick pattern to identify potential trading opportunities in the following ways: 1. Entry: Traders can enter a short position when the lower candlestick pattern is formed after a prolonged uptrend. This indicates that the bulls are losing control, and the bears are taking over. 2. Stop loss: Traders should place a stop loss above the high of the lower candlestick pattern to limit their losses in case the trend reverses. 3. Target: Traders can set their target by measuring the height of the lower candlestick pattern and subtracting it from the entry point. This gives them an idea of how much the prices may decline. 4. Confirmation: Traders should confirm the lower candlestick pattern with other technical indicators such as moving averages, RSI, and MACD to increase the accuracy of their trading signals. Risk Management: The lower candlestick pattern is a powerful tool for traders and investors to identify potential trading opportunities in a downtrend. However, it should be used in conjunction with other technical indicators and proper risk management to maximize profits and minimize losses. -

#4 Collapse

Introduction Long Lower Candlestick Pattern trading ek technical analysis strategy hai jo forex mein use ki jati hai. Is strategy mein traders long position par enter karte hain jab price action mein long lower candlestick pattern form hoti hai. Long Lower Candlestick Pattern:- Long Lower Candlestick Pattern chart mein ek long red candle hoti hai jiske bottom wale part mein koi wick nahi hota hai. Is pattern ko bearish trend ke indication ke liye use kiya jata hai. Long Lower Candlestick Pattern Trading Strategy: 1. Identify the pattern: Sabse pehle traders ko long lower candlestick pattern ko identify karna hota hai. 2. Confirm the trend: Traders ko trend ko confirm karna hota hai ki trend bearish hai ya nahi. Iske liye traders technical indicators jaise ki Moving Averages, MACD, aur RSI ka use karte hain. 3. Enter the trade: Agar trend bearish hai aur long lower candlestick pattern form ho raha hai to traders long position par enter karte hain. Entry point ko identify karne ke liye traders support aur resistance levels ka use karte hain. 4. Place stop loss: Traders ko stop loss place karna important hota hai kyunki agar price opposite direction mein move karega to unka loss hoga. Stop loss ko identify karne ke liye traders support aur resistance levels, moving averages aur other technical indicators ka use karte hain. 5. Set profit target: Traders ko profit target set karna important hota hai. Iske liye traders support aur resistance levels ka use karte hain. Conclusion: Long Lower Candlestick Pattern trading strategy mein traders price action aur trend ko samajhne ke liye technical indicators ka use karte hain aur long position par enter karte hain jab bearish trend aur long lower candlestick pattern form hota hai. -

#5 Collapse

Long Lower Candlestick Pattern ek aur candlestick pattern hai jo traders ke liye market analysis mein istemal hota hai. Ye pattern market ke trend aur potential reversals ko identify karne mein madadgar hota hai. Is pattern ko samajhne ke liye, hume pehle candlesticks aur unki formations ka concept samajhna zaroori hai.

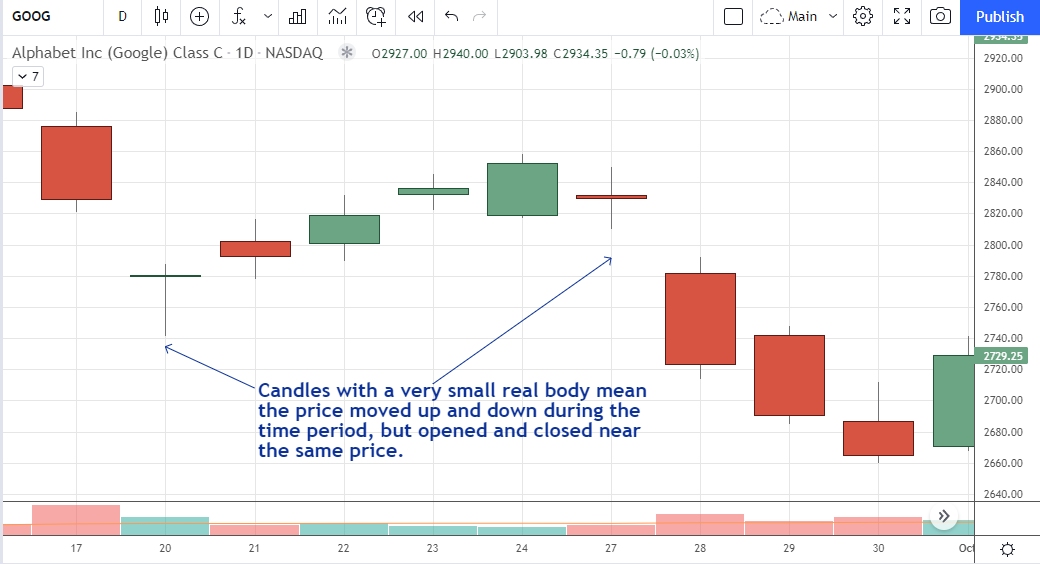

Candlesticks market movement ko represent karte hain. Har ek candlestick ek specific time period ko darust karta hai, jese ke ek din, ek ghanta ya ek hafte. Candlestick patterns ko padh kar, traders market mein hone wale price changes ka anuman lagate hain.

Long Lower Candlestick pattern mein, ek particular candlestick ko dekha jata hai jo neeche ki taraf lamba hota hai. Ye pattern typically ek bearish reversal signal ke roop mein dekha jata hai, matlab ke agar yeh pattern uptrend ke baad form hota hai, toh ye ek potential trend reversal ki indication deta hai.

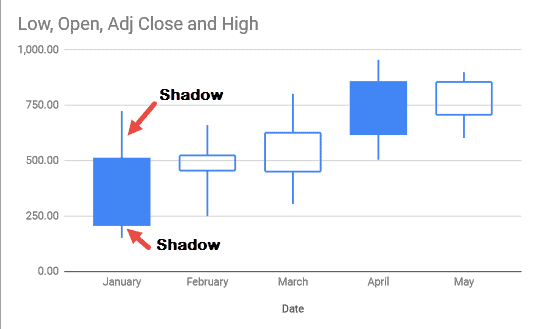

Long Lower Candlestick pattern ko samajhne ke liye, yeh components zaroori hain:- Lambi Candlestick: Ye candlestick neeche ki taraf lamba hota hai aur market mein selling pressure ko represent karta hai. Is candle ki lambai aur chaudiayi ko dekha jata hai. Jyadatar cases mein, is candle ki shadow lambi hoti hai compared to upper shadow.

- Pichli Candlesticks: Is pattern ko samajhne ke liye, traders ko pichli candlesticks ki bhi analysis karni chahiye. Agar long lower candlestick pichli candlesticks ke baad form hota hai, toh iska significance aur impact zyada hota hai.

Long Lower Candlestick pattern ek reversal signal hai, jo market mein potential trend change ko dikhata hai. Agar yeh pattern uptrend ke baad form hota hai, toh ye ek bearish reversal signal hai, matlab ke market mein girawat ki sambhavna hai. Agar yeh pattern downtrend ke baad form hota hai, toh ye ek continuation signal ho sakta hai, matlab ke downtrend jaari hai.

Is pattern ko samajhne aur istemal karne ke liye, traders ko dusre technical indicators aur confirmatory signals ka bhi istemal karna chahiye. Kisi ek pattern par pura bharosa karke trading karna risky ho sakta hai. Long Lower Candlestick pattern ke sath volume, moving averages, aur support/resistance levels jese aur indicators ka istemal karke traders ko apne trading decisions ko validate karna chahiye.

Is pattern ki samajh aur istemal mein practice aur experience ki zaroorat hoti hai. Naye traders ko pehle demo accounts ya small positions ke saath practice karna chahiye, aur jab unhe is pattern ko samajhne aur identify karne mein confidence ho, tabhi real trading shuru karni chahiye.

Long Lower Candlestick pattern ek important tool hai jo traders ko market trends aur potential reversals ke bare mein alert karta hai. Lekin iska istemal karne se pehle thorough analysis aur confirmatory signals ka istemal zaroori hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Long Lower Candlestick Pattern Trading

Forex trading mein candlestick patterns market sentiment aur price movements ko samajhne mein madadgar sabit hote hain. Long Lower candlestick pattern ek aisa pattern hai jo bearish trend ke dauran potential reversal ka signal deta hai. Is pattern ko identify karna aur trade karna aapki trading strategy ko enhance kar sakta hai. Aaj hum Long Lower candlestick pattern ke trading aspects ko detail se samjhenge aur dekhenge ke yeh pattern forex trading mein kis tarah faida mand ho sakta hai.

**1. Long Lower Candlestick Pattern Ki Pehchaan:**

Long Lower candlestick pattern ek specific type ki candlestick hai jo ek significant downward price movement ko indicate karti hai. Is pattern ki pehchaan kuch is tarah hoti hai:

- **Long Lower Shadow:** Is pattern ka sabse prominent feature ek lamba lower shadow hai. Lower shadow candlestick ke body se kaafi zyada lamba hota hai aur yeh indicate karta hai ke price ne ek significant low level ko touch kiya hai.

- **Small Body:** Candlestick ka body chhota hota hai aur yeh closing aur opening price ke beech ka difference dikhata hai. Small body ka hona indicate karta hai ke market ne downward movement ke bawajood closing price ko close range ke paas maintain kiya hai.

**2. Pattern Ki Importance:**

- **Potential Reversal Signal:** Long Lower candlestick pattern bearish trend ke dauran ek potential reversal signal hota hai. Jab price ek downtrend ke dauran lamba lower shadow banati hai, to yeh indicate karta hai ke sellers ki strength kam ho gayi hai aur buyers market ko control le rahe hain.

- **Market Sentiment:** Is pattern ka lamba lower shadow market mein buying pressure ko dikhata hai. Yeh signal hota hai ke market ne lower prices ko absorb kar liya hai aur ab upward movement start ho sakta hai.

- **Confirmation Ki Zaroorat:** Long Lower candlestick pattern ka signal tab tak confirm nahi hota jab tak uske baad ek bullish confirmation candle form nahi hoti. Confirmation candle ek strong buy signal provide karti hai aur reversal ko confirm karti hai.

**3. Trading Strategy:**

- **Pattern Identification:** Long Lower candlestick pattern ko identify karna zaroori hai. Yeh pattern downtrend ke dauran develop hota hai aur ek long lower shadow aur small body se identify kiya jata hai.

- **Entry Point:** Entry point tab consider kiya jata hai jab pattern ke baad ek bullish confirmation candle form hoti hai. Yeh confirmation candle price ke upward movement ko confirm karti hai aur buy signal provide karti hai.

- **Stop-Loss Placement:** Stop-loss ko Long Lower candlestick pattern ke low ke thoda neeche place karna chahiye. Isse aapko market ke sudden reversals se bachne mein madad milegi aur risk management effectively handle hoga.

- **Target Setting:** Target ko set karte waqt, aap previous resistance levels ya technical indicators ka use kar sakte hain. Long Lower candlestick pattern ke baad, price typically resistance levels tak pahunch sakti hai.

**4. Limitations:**

Long Lower candlestick pattern ek valuable tool hai lekin iske bhi limitations hain. Yeh pattern kabhi-kabhi false signals bhi de sakta hai, khas kar agar market context aur additional indicators ko consider nahi kiya jaye. Isliye, pattern ke signals ko confirm karne ke liye other technical tools aur indicators ka use zaroori hai.

**5. Conclusion:**

Long Lower candlestick pattern forex trading mein ek effective tool hai jo bearish trend ke dauran potential bullish reversal signal provide karta hai. Is pattern ko accurately identify karke aur effective trading strategy apply karke, aap market ke potential uptrends ko capitalize kar sakte hain. Lekin, kisi bhi technical pattern ki tarah, Long Lower candlestick pattern ko market context aur additional indicators ke sath validate karna zaroori hai taake aap apne trading decisions ko accurate aur successful bana sakein.

-

#7 Collapse

Long lower candlestick pattern trading mein, ek candlestick chart ka long lower shadow ya wick indicate karta hai ke price ne trading session ke dauran significantly low tak drop kiya tha, lekin session ke end tak price wapas recovery kar gaya. Ye pattern ek bullish signal ho sakta hai, jo batata hai ke buyers ne session ke dauran price ko lower levels se push kar diya.

Ye pattern aksar market ke support level ya oversold condition mein dekha jata hai, jahan se reversal hone ke chances zyada hote hain.

Main Points:

Formation: Ek candlestick jisme chhota body aur lambi lower shadow ho.

Meaning: Market ne niche jane ki koshish ki, lekin buyers ne price wapas push kar diya.

Trading Implication: Ye ek reversal pattern ho sakta hai, jisme downward trend ke baad price upar ja sakta hai.

Is pattern ko samajhne ke liye zaroori hai ke aap confirmation candles ka wait karein aur doosre technical indicators ke saath isse confirm karein.

Long lower candlestick patterns ko mazeed detail mein samajhne ke liye, yeh kuch important aspects hain:

1. Types of Long Lower Candlestick Patterns:

Hammer:

Hammer candlestick ek bullish reversal pattern hota hai, jo downtrend ke end mein banta hai. Isme chhota body hota hai aur lambi lower shadow (wick), jo batata hai ke market ne session ke dauran low price dekha, lekin bulls ne price ko upar push kiya aur close zyada kar diya.

Confirmation: Agli candle agar bullish hoti hai, toh ye pattern strong bullish signal ban sakta hai.

Dragonfly Doji:

Dragonfly Doji mein open, close, aur high prices lagbhag ek hi level par hote hain, lekin lower shadow bohot lambi hoti hai. Ye pattern bhi ek reversal signal ho sakta hai, lekin iske liye confirmation ka intezaar karna zaroori hota hai.

2. Interpretation in Market Context:

Support Levels: Agar long lower candlestick support level ke qareeb ban raha hai, toh iska matlab hai ke buyers support level par strong hain, aur price ko wahan se upar push kar rahe hain.

Oversold Conditions: Jab market oversold hoti hai (jise RSI, stochastic jaise indicators se measure kiya jata hai), tab aise candlestick patterns reversal ke strong signs hote hain.

3. Risk Management:

Stop Loss: Is pattern ko trade karte waqt, stop loss aksar shadow ke lowest point par lagaya jata hai, kyun ke agar price wahan tak phir se aa jaye, toh pattern invalid ho sakta hai.

Position Sizing: Risk ko control mein rakhne ke liye apni position size manage karna zaroori hai. Is pattern ka success rate kabhi kabar context par depend karta hai, isliye zaroori hai ke aap sirf is ek pattern ke upar rely na karein.

4. Confirmation Candles:

Ek long lower candlestick apne aap mein reversal ka perfect signal nahi hota. Isliye aksar traders iske baad ek ya do bullish confirmation candles ka intezaar karte hain. Agar agli candles bhi bullish hoti hain, toh ye confirmation hota hai ke market ab upward trend shuru karne wala hai.

5. Volume:

Volume ka bhi is pattern mein important role hota hai. Agar long lower candlestick ke dauran high volume hoti hai, toh iska matlab hai ke buyers ne significant force ke sath market ko support kiya hai, jo is pattern ko zyada reliable banata hai.

6. Real-Life Application:

Is pattern ka aksar use stocks, forex, aur crypto trading mein kiya jata hai. Jab bhi market me panic selling ho rahi ho aur ek long lower shadow banta hai, toh aksar is baat ka chance hota hai ke market ek short-term low hit kar chuki hai, aur ab reversal aane wala hai.

Summary:

Long lower candlestick patterns, jaise hammer aur dragonfly doji, ek bullish reversal ka signal dete hain, lekin inhe doosre indicators aur market context ke saath use karna zaroori hota hai. Confirmation aur risk management ke baghair is pattern par reliance risky ho sakti hai.

-

#8 Collapse

Long lower candlestick ek candlestick pattern hai jo mostly market mien bullish reversal ko signal karta hai. Is pattern ka matlab yeh hota hai ke price ne ek point par niche ki taraf zyada pressure face kiya, lekin buyers ne us pressure ko handle karte hue price ko wapas upar push kiya, aur day ya period ke end tak price close ho gaya. Yeh pattern trading ke liye bohat important signal ban sakta hai jab price ek specific level par bottom form kar raha ho.

Long lower candlestick tab banata hai jab opening price aur closing price ke darmiyan zyada farq na ho, magar low point bohat zyada ho. Is ka matlab hai ke trading period ke doran price ne bottom hit kiya lekin wapas recover ho gaya. Yeh cheez ek bullish reversal signal kar sakti hai, kyun ke buyers ne sellers ko overpower kiya aur price ko niche se upar le aaye.

Jab long lower candlestick ko identify karte hain, traders ko kuch factors ka dhyan rakhna chahiye. Pehla factor yeh hai ke market ka trend pehle se downtrend ho. Agar market already downward direction mein ja raha ho aur phir yeh pattern banay, to yeh reversal ke chances ko barhata hai. Lekin agar yeh pattern ek upward trend ke beech mein form ho, to isko reversal ke liye reliable signal nahi samjha jata.

Doosra factor yeh hai ke candlestick ka shadow ya wick kitna lamba hai. Long lower shadow ka matlab hota hai ke market ne kaafi zyada selling pressure face kiya, lekin end mien buyers ne price ko upar la diya. Yeh buyer strength ka indicator hai jo ke market mein bulls ki wapsi ko show karta hai.

Traders ko is pattern ke sath volume ka analysis bhi karna chahiye. Agar long lower candlestick ke time zyada volume ho, to yeh aur bhi strong signal hota hai ke market mien bullish reversal aanay wala hai. Zyada volume ka matlab hota hai ke market mein interest barh raha hai, aur bohat saare buyers market mein aa rahe hain. Yeh signal karta hai ke price wapas upward trend shuru kar sakti hai.

Long lower candlestick ko kabhi kabhi confirmation ke sath trade karna safe hota hai. Matlab, agar next candlestick bullish ho aur price ko thoda aur upar push kare, to yeh ek aur strong indication hota hai ke trend wapas bullish ho raha hai. Agar bina confirmation ke trade karain, to kabhi kabhi market ek trap ban sakta hai aur price wapas downtrend mein chali jaye.

Trading strategy mien risk management ka hona zaroori hai. Har pattern ke sath ek stop-loss set karna chahiye taake agar market opposite direction mein chali jaye to zyada loss na ho. Long lower candlestick ke case mein, stop-loss ko usually candle ke low point ke neeche set kiya jata hai, kyun ke agar price us level ko dobara touch kare, to market mein bearishness wapas aa sakti hai.

Is pattern ko different time frames par bhi dekha ja sakta hai. Agar aap short-term trading karte hain, to yeh pattern minute ya hourly charts par bhi useful ho sakta hai. Agar long-term investment ke liye dekh rahe hain, to daily ya weekly charts par is pattern ko identify karna helpful hoga. Time frame ka selection aapki trading style par depend karta hai.

Akhir mein, yeh samajhna zaroori hai ke koi bhi candlestick pattern 100% accurate nahi hota. Market unpredictable hai, aur different factors influence karte hain. Is liye, candlestick patterns ko doosri technical indicators ke sath combine karke use karna hamesha behtar hota hai

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Long Lower Candlestick Pattern Trading

Introduction

Long lower candlestick pattern aik ahem technical analysis tool hai jo traders ko market ka trend samajhnay mein madad deta hai. Is pattern ko dekh kar hum market ki support aur demand ko judge kar saktay hain. Yeh pattern zyada tar downtrend market mein dekhne ko milta hai aur ye indication hoti hai ke market ab reversal ki taraf ja sakti hai.

Long Lower Shadow kya hota hai?

Long lower shadow ka matlab hai ke candle ki body ke neeche ek lambi shadow ya tail hoti hai. Yeh tab banta hai jab price session ke dauran kaafi neeche girta hai lekin phir recover karke close hota hai, jo ke bulls ke pressure ko dikhata hai. Yeh shadow market ki strong demand ko represent karti hai aur is baat ka indication deti hai ke buyers ne market ko neeche se uthaya hai.

Is Pattern ka Significance

Jab long lower shadow banti hai, to yeh signal hota hai ke market mein selling ka pressure tha, lekin buyers ne apni position strong ki aur price ko wapas uthaya. Yeh pattern aksar market ke bottom mein dikhai deta hai aur is ka matlab yeh hota hai ke price ab neeche nahi jaane wali, aur market mein reversal aa sakta hai.

Trading Strategy

Is pattern ke saath trading karte waqt sab se pehle yeh dekhna hota hai ke kya yeh downtrend ke baad banta hai. Agar aapko yeh downtrend ke dauran nazar aaye, to iska matlab yeh hai ke market ab reversal ke liye tayyar hai. Aap ek buy position khol saktay hain jab agla candle bullish ho.- Entry Point: Jab long lower shadow ke baad ek bullish candle banti hai, to yeh aapka entry signal ho sakta hai.

- Stop Loss: Apna stop loss aap lower shadow ke neeche lagain, takay agar price wapas neeche aaye to aapka risk limited ho.

- Take Profit: Apna take profit aap resistance levels par ya moving average indicators ke aas-paas set kar saktay hain.

Risk Management

Risk management har trading strategy ka ahem hissa hota hai. Long lower shadow pattern mein bhi risk management zaroori hai. Aapka stop loss hamesha well defined hona chahiye. Risk-reward ratio ko follow karte huye aap apni position ko manage kar saktay hain.

Conclusion

Long lower candlestick pattern aik powerful tool hai jo traders ko market mein potential reversal ka signal deta hai. Is pattern ko samajhna aur is ke mutabiq trading karna profit potential ko barha sakta hai. Lekin yaad rahe, har trade risk ke saath hoti hai, is liye risk management ka khayal rakhna zaroori hai.

-

#10 Collapse

### Long Lower Candlestick Pattern Trading

Long lower candlestick pattern forex trading mein ek aham role ada karta hai. Ye pattern jab market mein major downward movement ke baad emerge hota hai, tab traders isse bullish reversal signal samajhte hain. Is pattern ko identify karne ke liye aapko candles ki shape aur unke placement par nazar rakhni hoti hai.

Long lower candlestick pattern tab banta hai jab ek candlestick ka lower shadow lambe hota hai aur body chhoti hoti hai. Yeh pattern indicate karta hai ke price ne ek waqt ke liye bahut neeche jaa kar phir upar ki taraf move kiya hai. Is pattern ka major focus body aur lower shadow ki length par hota hai. Body chhoti aur lower shadow lambi hoti hai, jo yeh darshata hai ke sellers ne market ko neeche push kiya, lekin buyers ne us momentum ko reverse kar diya aur price ko upar le aaye.

Traders is pattern ko dekh kar kuch important trading decisions lete hain. Sabse pehle, jab aap long lower candlestick pattern dekhen, to confirm karna zaroori hai ke ye ek strong support level ke paas banta hai. Support level ek aisi jagah hoti hai jahan pehle bhi price ne niche jaane ke bawajood bounce back kiya ho. Agar aapka pattern support level ke paas ban raha hai, to yeh bullish reversal ka signal ho sakta hai.

Pattern ke confirmation ke liye, aapko next candlestick ko bhi dekhna chahiye. Agar next candlestick bullish (green) hoti hai aur long lower candlestick ke upar close hoti hai, to isse confirmation milta hai ke market mein buying pressure zyada hai aur price further upar ja sakti hai.

Trading strategy mein, long lower candlestick pattern ko buy signal ke taur par use kiya ja sakta hai. Is pattern ko identify karne ke baad, aap market mein buy order place kar sakte hain, lekin risk management zaroori hai. Stop-loss ko pattern ke neeche set karna chahiye, taake agar market aapke against chale, to aapki losses limited rahein.

In conclusion, long lower candlestick pattern ek powerful tool hai jo traders ko market reversal ke signals provide karta hai. Is pattern ko samajh kar aur uski confirmation ko dekh kar aap apni trading decisions ko enhance kar sakte hain. Lekin hamesha yaad rakhein ke risk management ko apni trading strategy ka ek integral part banayein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Long Lower Candlestick Pattern Trading

Introduction

Trading ke duniya mein, candlestick patterns ka ek aham role hota hai. Ye patterns traders ko market ki mood aur trends samajhne mein madad dete hain. Unmein se ek important pattern hai "Long Lower Candlestick." Ye pattern market ki potential reversal points ko identify karne mein madadgar ho sakta hai. Aaj hum is pattern ke baare mein detail mein baat karenge aur ye seekhenge ke ise trading mein kaise use kiya ja sakta hai.

Long Lower Candlestick Pattern Ka Taaruf

Long lower candlestick pattern ek aise candlestick pattern ko refer karta hai jisme ek candlestick ka lower shadow bohot lamba hota hai. Is candlestick ka body chhota hota hai, aur ye generally ek bearish trend ke dauran nazar aata hai. Jab market mein bearish trend hota hai aur ek candlestick banati hai jisme body ke niche ka shadow bohot lamba hota hai, to ye ek potential reversal signal ho sakta hai.

Is Pattern Ki Pehchaan

Long lower candlestick pattern ko pehchanna bahut aasan hai. Jab aap ek candlestick chart dekhte hain, to is pattern ki pehchaan ke liye following cheezein dekhein:- Lower Shadow: Candlestick ka lower shadow body se lamba hona chahiye. Agar shadow body se kam se kam do guna lamba hai, to ye long lower candlestick pattern ki indication hai.

- Body Size: Candlestick ka body chhota hona chahiye, yaani open aur close ke darmiyan ka difference chhota hona chahiye.

- Trend: Ye pattern typically ek downtrend ke baad hota hai, jahan market ne ek lower shadow ke saath support level ko test kiya hai.

Long lower candlestick pattern trading strategy ko apply karne ke liye kuch key steps hain jo aapko follow karne chahiye:- Confirm Trend Reversal: Long lower candlestick pattern dekh kar aapko market trend ke reversal ko confirm karna hoga. Ye pattern khud hi ek reversal ka signal nahi hota, isliye aapko additional confirmation signals ki zaroorat hoti hai, jaise ki higher volume ya bullish engulfing pattern.

- Entry Point: Jab aapko long lower candlestick pattern mil jaye, to entry point define karne ke liye aapko next candlestick ke movement ko monitor karna hoga. Agar next candlestick bullish hoti hai aur pattern ke above close karti hai, to ye ek buy signal ho sakta hai.

- Stop Loss: Trading mein risk management bohot zaroori hai. Long lower candlestick pattern ke case mein, aap apna stop loss pattern ke neeche rakh sakte hain, taake agar market reverse hota hai, to aapka loss minimize ho sake.

- Target Setting: Target setting ke liye, aap previous swing high ya key resistance levels ko consider kar sakte hain. Iske alawa, aap technical indicators jaise Moving Averages ya Fibonacci retracement levels bhi use kar sakte hain.

Chaliye ek example ke zariye long lower candlestick pattern ko samajhte hain. Maan lijiye aap ek stock chart dekh rahe hain jahan market ek strong bearish trend mein hai. Aapko ek candlestick milti hai jisme lower shadow bohot lamba hai aur body chhoti hai. Iske baad ek bullish candlestick form hoti hai jo previous candlestick ke upar close hoti hai. Ye signal hai ke market ne support level ko test kiya hai aur ab upward movement start ho sakti hai.

Is situation mein, aap buy order place kar sakte hain aur apne stop loss ko long lower candlestick ke neeche set kar sakte hain. Iske baad, aap market ki movement ko closely monitor karenge aur target setting ke zariye apne profit ko maximize karne ki koshish karenge.

Conclusion

Long lower candlestick pattern trading ke liye ek valuable tool hai jo market ke potential reversal points ko identify karne mein madad karta hai. Is pattern ko sahi tarike se use karne ke liye, aapko trend reversal confirmation, entry points, stop loss aur target setting ko dhyan mein rakhna hoga. Proper analysis aur risk management ke saath, ye pattern aapki trading strategy mein ek effective addition ban sakta hai. Trading ke complex world mein, candlestick patterns ko samajhna aur unhe effectively use karna aapke trading decisions ko improve karne mein madadgar ho sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:35 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим