What is bullish mat hold pattern?

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is bullish mat hold pattern? -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

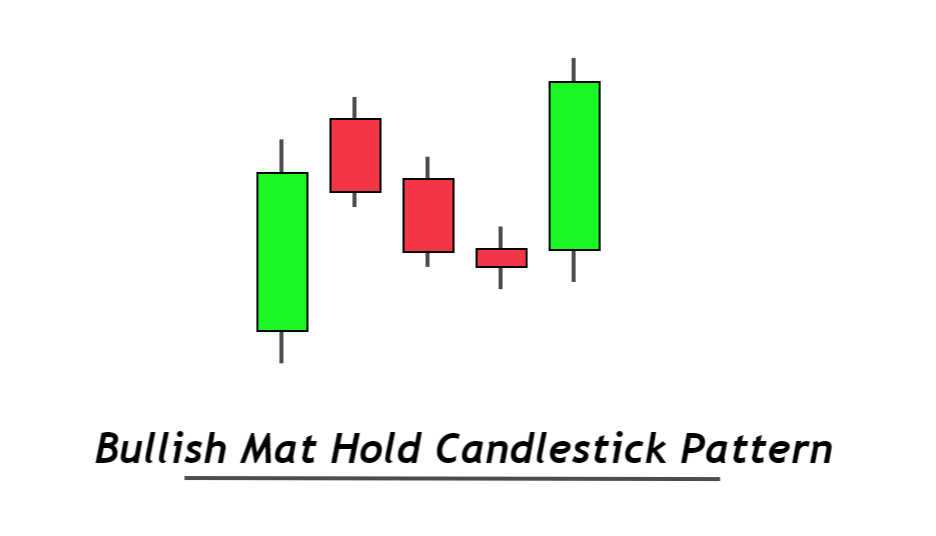

Assalamu Alaikum Dosto!Bullish Mat-Hold Candlestick PatternBullish mat-hold candlestick pattern price chart k top par ya uptrend k dowran bullish trend continuation pattern ka kaam karta hai, jiss k banne k baad prices same apne sabeqa trend ko hi follow karte hen. Candlesticks charts pattern main jitne ziada candles ka istemal kia jata hai, unte hi wo pattern ziada complex bante hen, aur iss ki trading ki techniques dosre sada pattern ki nisbat complex hote hen, lekin ye pattern hamesha sada pattern ki nisbat ziada kamyab rehte hen. Bullish mat-hold candlestick pattern bhi ussi munasibat sada pattern ki nisbat ziada complex pattern hai, jiss main aik waqat panch ya uss se bhi ziada candles hote hen, lekin ye aik kamyab pattern tasawar hota hai.Candles FormationBullish mat-hold candlestick pattern bullish aur bearish candlestick se mel kar banne wala aik bullish trend continuation pattern hai, jo prices ko prices ko upward side par push karti hai, pattern main shamil pehli aur akhari candle bullish jab k darmeyan wali candles bearish hoti hai. Ye pattern aik strong signal deta hai, jiss main candles ki formation darjazzel tarah se hoti hai;- First Candle: Bullish mat-hold candlestick pattern ki pehli candle aik bullish candle hoti hai, jo prices ko upward side par push karti hai. Bullish candle candle aik real body main banti hai, jiss ka close point open price ki nisbat high hota hai.

- Second Candle: Bullish mat-hold candlestick pattern ki dosri candle aik bearish candle hoti hai, ye candle aik small real body main banti hai. Ye candle open pehli candle k baad hoti hai, jab k close ussi ki real body main hoti hai. Ye candle real body main to banti hai, lekin ziada strong reaction nahi deti hai.

- Third Candle: Bullish mat-hold candlestick pattern ki teesri candle bhi aik bearish candle hoti hai, jo k same dosri bearish candle ki tarah small real body main hoti hai. Ye candle prices ko nechay push karti hai, lekin ziada strong real body na hone ki waja se ye bhi pehli candle ki real body main hi banti hai.

- Fourth Candle: Bullish mat-hold candlestick pattern ki fourth candle bhi same dosri aur teesri candle ki tarah aik bearish candle hoti hai, aur same small real body main hoti hai. Ye candle bhi ziada mazboti se prices ko nechay ki taraf push nahi karti hai, jiss se candle ki small real body same other bearish candles ki tarah pehli candle k andar hoti hai.

- Fifth Candle: Bullish mat-hold candlestick pattern ki last ya fifth candle aik strong bullish candle hoti hai, jo k real body main bearish candle se bari aur bullish candle k taqreeban barabar hoti hai. Ye candle bearish trend reversal ki koshash ko nakam bana kar prices ko same sabeqa bullish trend main jari karti hai, jo k bullish trend continuation ka sabab banti hai.

ExplainationBullish mat-hold candlestick pattern price chart par aik strong continuation ka signal deta hai. Ye pattern panch candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, jo k strong real body wali aik bullish candle banti hai. Pattern ki baad main teen small candles hoti hai, jo k pehli candle k real body main banti hai. Ye candles prices ko nechay ki taraf to push karti hai, lekin sellers ki adam-tawajah k bahis prices ko ziada strong nechay nahi le kar jati hai. Pattern ki teeno small candles prices k bullish trend k dowran aik waqfa peda karti hai, jiss k baad aik strong bullish candle banne par prices wapis apne sabeqa bullish trend ko hi follow karna shoro karti hai.TradingBullish mat-hold candlestick pattern aik bullish trend continuation pattern hone ki waja se bullish trend reversal pattern ki nisbat ziada successful rehta hai. Ye pattern newly bullish breakout main banne par prices ko bohut ziada teezi k sath upward le kar jati hai. Pattern par trading karne se pehle aik confirmation candle ka hona zarori hai, jo k bullish candle k top par bullish real body se honi chaheye. Jab k indicator se confirmation lene par ussi ki value midpoint ya darmeyan se above trade kar na zarori hai. Pattern k end par stop loss ka istemal zarori hai. Stop Loss pattern k sab se lower position jo pattern ka support level hota hai, se two pips below set karen. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

INTRUDUCTION OF BULLISH MAT HOLD CANDLICTICK PATTREN'': Members I hope aap sab khariyat sy hoon gy Forex tradings Marketing main apna work dilchapi ky sath work karty hen our eis Pattren ko rujhaan bnany ky liye TRENDLINE ky liye chart bnana mat hold Pattren ky ksm hotu to Hei our eis Pattren ko samjhna eis lazmi hota Hai Bullish mat-hold candlestick pattern price chart k top par ya uptrend k dowran bullish trend continuation pattern ka kaam karta hai, jiss k banne k baad prices same apne sabeqa trend ko hi follow karte hen. Candlesticks charts pattern main jitne ziada candles ka istemal kia jata hai, unte hi wo pattern ziada complex bante hen, aur iss ki trading ki techniques dosre sada pattern ki nisbat complex hote hen, lekin ye pattern hamesha sada pattern ki nisbat ziada kamyab rehte hen. Bullish mat-hold candlestick pattern bhi ussi munasibat sada pattern ki nisbat ziada complex pattern hai, jiss main aik waqat panch ya uss se bhi ziada candles hote hen, lekin ye aik kamyab pattern tasawar karty hen our rujhaan update karty hen our upper position Mei jaty hen.Bullish mat-hold candlestick pattern aik bullish trend continuation pattern hone ki waja se bullish trend reversal pattern ki nisbat ziada successful rehta hai. Ye pattern newly bullish breakout main banne par prices ko bohut ziada teezi k sath upward le kar jati hai. Pattern par trading karne se pehle aik confirmation candle ka hona zarori hai, jo k bullish candle k top par bullish real body se honi chaheye. Jab k indicator se confirmation lene par ussi ki value midpoint ya darmeyan se above trade kar na zarori hai. Pattern k end par stop loss ka istemal zarori haTRADING STRATEGY: Members bullish mat hold pattren ko market Mei ziyada tar sell stop par buying positive par mushtamil kar dety hein our eis ka rujhaan sell par hota Hai our upper position Mei kam CANDL bnaty hei Bullish mat-hold candlestick pattern price chart par aik strong continuation ka signal deta hai. Ye pattern panch candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, jo k strong real body wali aik bullish candle banti hai. Pattern ki baad main teen small candles hoti hai, jo k pehli candle k real body main banti hai. Ye candles prices ko nechay ki taraf to push karti hai, lekin sellers ki adam-tawajah k bahis prices ko ziada strong nechay nahi le kar jati hai. Pattern ki teeno small candles prices k bullish trend k dowran aik waqfa peda karti hai, jiss k baad aik strong bullish candle banne par prices wapis apne sabeqa bullish trend ko hi follow karna shoro karti hai.Bullish mat-hold candlestick pattern ki last ya fifth candle aik strong bullish candle hoti hai, jo k real body main bearish candle se bari aur bullish candle k taqreeban barabar hoti hai. Ye candle bearish trend reversal ki koshash ko nakam bana kar prices ko same sabeqa bullish trend main jari karti hai, jo k bullish trend continuation ka sabab banti hai.Bullish mat-hold candlestick pattern bullish aur bearish candlestick se mel kar banne wala aik bullish trend continuation pattern hai, jo prices ko prices ko upward side par push karti hai, pattern main shamil pehli aur akhari candle bullish jab k darmeyan wali candles bearish hoti hai. Ye pattern aik strong signal deta hai, jiss main candles ki formation darjazzel tarah se samajhna hota Hai.

-

#4 Collapse

What is bullish mat hold pattern? Bullish Mat Hold Pattern, normaly kisi downtrend (jab prices gir rahi hain) ke baad paya jata hai. Yeh pattern market ke future mein prices ke barhnay ki ummed ko ishara karta hai. Bullish Mat Hold Pattern ko pehchane ke liye, niche diye gaye chand indicators ka khayal rakha jata hai:- Pehla Candle: Downtrend mein hota hai aur ek bearish candle hota hai. Iska matlab hai ke prices gir rahi hain.

- Dusra Candle: Yeh ek bullish (upward) candle hota hai. Ismein prices ne pehlay candle ki closing price ko overlap kiya hai, matlab yeh neechay nahi gayi. Isse mat hold kiya jata hai.

- Teesra Candle: Yeh ek aur bullish candle hota hai jo pehlay do candles ko follow karta hai. Iski closing price pehlay do candles ki opening price ke oper hoti hai.

- Chouthi Candle: Yeh bhi ek bullish candle hota hai jo pehlay teen candles ko follow karta hai. Iski closing price teesri candle ki closing price ke oper hoti hai.

-

#5 Collapse

I information About Bullish Mat hold Pattern

Candlesticks charts pattern main jitne ziada candles ka istemal kia jata hai, unte hi wo pattern ziada complex bante hen, aur iss ki trading ki techniques dosre sada pattern ki nisbat complex hote hen, lekin ye pattern hamesha sada pattern ki nisbat ziada kamyab rehte hen. Bullish mat-hold candlestick pattern bhi ussi munasibat sada pattern ki nisbat ziada complex pattern hai, jiss main aik waqat panch ya uss se bhi ziada candles hote hen, lekin ye aik kamyab pattern tasawar karty hen our rujhaan update karty hen our upper position Mei jaty hen.Bullish mat-hold candlestick pattern aik bullish trend continuation pattern hone ki waja se bullish trend reversal pattern ki nisbat ziada successful rehta hai. Ye pattern newly bullish breakout main banne par prices ko bohut ziada teezi k sath upward le kar jati hai. Pattern par trading karne se pehle aik confirmation candle ka hona zarori hai, jo k bullish candle k top par bullish real body se honi chaheye. Jab k indicator se confirmation lene par ussi ki value midpoint ya darmeyan se above trade kar na zarori hai. Pattern k end par stop loss ka istemal zarori ha

Identification and Treading Strategy

bullish mat hold pattren ko market Mei ziyada tar sell stop par buying positive par mushtamil kar dety hein our eis ka rujhaan sell par hota Hai our upper position Mei kam CANDL bnaty hei Bullish mat-hold candlestick pattern price chart par aik strong continuation ka signal deta hai. Ye pattern panch candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, jo k strong real body wali aik bullish candle banti hai. Pattern ki baad main teen small candles hoti hai, jo k pehli candle k real body main banti hai. Ye candles prices ko nechay ki taraf to push karti hai, lekin sellers ki adam-tawajah k bahis prices ko ziada strong nechay nahi le kar jati hai. Pattern ki teeno small candles prices k bullish trend k dowran aik waqfa peda karti hai, jiss k baad aik strong bullish candle banne par prices wapis apne sabeqa bullish trend ko hi follow karna shoro karti hai.Bullish mat-hold candlestick pattern ki last ya fifth candle aik strong bullish candle hoti hai, jo k real body main bearish candle se bari aur bullish candle k taqreeban barabar hoti hai. Ye candle bearish trend reversal ki koshash ko nakam bana kar prices ko same sabeqa bullish trend main jari karti hai, jo k bullish trend continuation ka sabab banti hai -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Bullish Mat Hold" ek candlestick pattern hai jo market analysis mein istemal hota hai. Ye pattern ek bullish reversal pattern ke roop mein aata hai, aur traders ko ye signal deta hai ki market mein potential uptrend hone ke chances hain. Is pattern ko identify karne ke liye kuch specific characteristics hote hain:

Formation:- Bullish Mat Hold pattern ek downtrend ke baad aata hai, jahan market bearish phase mein tha.

- Pehla candlestick ek long red (bearish) candle hota hai, jo downtrend ke continuation ko darust karta hai. Is candlestick ka rang chhota hota hai, lekin uska body lamba hota hai.

- Dusri candlestick ek small green (bullish) candle hoti hai, jo pehle candlestick ke niche ya andar open hoti hai aur close first candlestick ke upper side hoti hai.

- Tisri candlestick ek long green (bullish) candle hota hai, jo second candlestick ke close price ke near open hoti hai aur higher levels par close hoti hai.

Key Characteristics:- Bullish Mat Hold pattern me pehla candlestick bearish sentiment ko darust karta hai, lekin dusri aur tisri candlesticks bullish reversal ko indicate karte hain.

- Dusri candlestick ka small body aur lower side open hota hai, lekin upper side close hota hai.

- Tisri candlestick bullish momentum aur buying interest ko confirm karta hai.

Trading Strategy: Traders Bullish Mat Hold pattern ko trading strategy mein use karte hain. Agar aap Bullish Mat Hold pattern dekhte hain to aap ye steps follow kar sakte hain:- Entry Point: Buy order place karna recommended hota hai jab tisri candlestick close hoti hai, yani jab pattern complete hota hai.

- Stop Loss: Protective stop-loss order set kiya jata hai taki aap risk ko manage kar saken. Stop loss pehli candlestick ke low ke niche rakha jata hai.

- Target: Target price ko pattern ki height ke basis par set kiya jata hai. Yani, pehle aur tisre candlesticks ke price range ko calculate karte hain.

Yad rahe ki Bullish Mat Hold pattern bhi false signals de sakta hai, isliye risk management hamesha priority rehna chahiye. Technical analysis ke saath fundamental analysis bhi combine karke trading decisions liye ja sakte hain.

-

#7 Collapse

FOREX ME BULLISH MAT HOLD:-

Forex market me "bullish mat hold" pattern ek technical analysis pattern hota hai jo price charts par paya jata hai. Ye pattern normally uptrend ke doran develop hota hai aur traders use karte hain taki future price movements ka idea mil sake. Bullish mat hold pattern me kuch key characteristics hote hain:

FOREX ME BULLISH MAT HOLD K CHARACTERISTICS:-

1. **Initial Uptrend:**

Bullish mat hold pattern ek uptrend ke doran develop hota hai, jab price continuously higher highs aur higher lows banata hai.

2. **Bullish Candlestick:**

Pattern ki starting point pe ek strong bullish candle hoti hai. Is candle me price significantly up move karta hai.

3. **Second Candle:**

Dusri candle jo is pattern ka hissa hoti hai, ye pehli candle ke upward movement ke kareeb rehti hai. Isme bhi price up move karta hai, lekin ye pehli candle ke closing price ke around rehti hai ya slightly lower hoti hai.

4. **Third Candle:**

Tisri candle, jo pattern ka confirmation hoti hai, ek bullish candle hoti hai jo pehli candle ke closing price ke upar close hoti hai aur price ka uptrend continue hota hai.

Yadi ye teen candles ek saath mil jaye, to isse ek bullish mat hold pattern complete hota hai, jo indicate karta hai ki uptrend me strong buying pressure hai aur price ka further up move expected hai. Traders in signals ko analyze karke trading decisions lete hain.

Dhyan rahe ki market me kisi bhi pattern ke reliance se pehle, aapko proper risk management aur stop-loss orders ka istemal karna chahiye, kyunki market me price movements unpredictable hote hain aur trading me risk hota hai. Aapko technical analysis patterns ke sath-sath fundamental analysis aur market conditions ka bhi dhyan rakhna chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

"Bullish Mat Hold" ek candlestick pattern hai jo market analysis mein use hota hai aur bullish continuation pattern ko darust karta hai. Is pattern ko recognize karne ke liye kuch specific characteristics hote hain, aur traders is pattern ko price charts par dekhte hain to unhe ye signal milta hai ki current bullish trend continue hone ke chances hain. Aaiye is pattern ki wazahat karain:

Formation:- Bullish Mat Hold pattern ek uptrend ke dauran aata hai, yani market me already ek bullish trend chal raha hota hai.

- Pehla candlestick ek long green (bullish) candle hota hai, jo uptrend ke continuation ko darust karta hai.

- Dusri candlestick ek small red (bearish) candle hoti hai, jo pehle candlestick ke upper side open hoti hai.

- Tisri candlestick ek long green (bullish) candle hota hai, jo dusri candlestick ke upper side open hoti hai aur higher levels par close hoti hai.

Key Characteristics:- Bullish Mat Hold pattern me pehla candlestick uptrend ko indicate karta hai, dusri candlestick short-term bearish sentiment ko dikhata hai, aur tisri candlestick bullish momentum ko confirm karta hai.

- Dusri candlestick ka small body, bearish pressure ko indicate karta hai, lekin tisri candlestick ka strong bullish close pattern ko continue karne ke chances ko darust karta hai.

Trading Strategy: Traders Bullish Mat Hold pattern ko trading strategy mein use karte hain. Agar aap Bullish Mat Hold pattern dekhte hain to aap ye steps follow kar sakte hain:- Entry Point: Buy order place karna recommended hota hai jab tisri candlestick close hoti hai, yani jab pattern complete hota hai aur bullish continuation ko darust karta hai.

- Stop Loss: Protective stop-loss order set kiya jata hai taki aap risk ko manage kar saken. Stop loss pehli candlestick ke low ke niche set kiya jata hai.

- Target: Target price ko previous uptrend ke range ya pattern ki height ke basis par set kiya jata hai.

Yad rahe ki Bullish Mat Hold pattern bhi false signals de sakta hai, isliye risk management hamesha priority rehna chahiye. Technical analysis ke saath fundamental analysis bhi combine karke trading decisions liye ja sakte hain.

https://www.google.com/imgres?imgurl...0QMygEegQIARBI

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:37 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим