Dynamics Momentum Index.

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

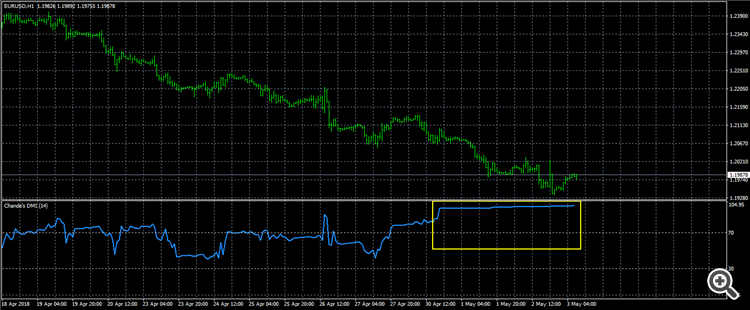

"Dynamics Momentum Index" Dynamics Momentum Index, ya DMI, ek aham technical indicator hai jo market analysis mein istemal hota hai. Ye takneek tijarat ke maidaan mein trend aur taqat ko daryaft karne mein madadgar sabit hoti hai. DMI, traders aur investors ko achi tarah se samajhne aur muqablay ke liye tayyar hone mein madad deti hai. DMI, trend direction aur strength ko samajhne ke liye ek prashikshit tool hai. Ye market mein maujood tezi aur mandi ke trend ko zahir karta hai. DMI ek set of indicators mein se bana hota hai, jis mein "Positive Directional Indicator (+DI)" aur "Negative Directional Indicator (-DI)" shaamil hote hain. Ye dono indicators price movement aur range ki tafseelat se joda jata hai. Kaise Kaam Karta Hai: DMI, trend strength aur momentum ko anaaj ke khet mein hawale deti hai. +DI aur -DI dono hi indicators price movement aur range ko daryaft karte hain aur phir unhe combine kar ke "Average Directional Index (ADX)" hasil karte hain. ADX, trend ki taqat aur mazbooti ko zahir karta hai, jo traders ko samajhne mein madad karta hai ke kis tarah market move kar raha hai. Importance of DMI: DMI traders aur investors ke liye ahem hai kyun ke iska istemal trend aur taqat ko samajhne mein hota hai. Ye indicator aksar "overbought" aur "oversold" conditions ko pehchanna aur samajhne mein madad deta hai. Iske zariye traders price movement ko zyada behtareen tareekay se samajh sakte hain aur munafa kamane ke liye behtar faislay le sakte hain. Conclusion: "Dynamics Momentum Index" (DMI) ek powerful tool hai jo trend aur taqat ko samajhne mein traders aur investors ki madad karta hai. Iska istemal kar ke, tijarat mein hissa lenay walay shakhs trend ko zyada behtareen tareekay se samajh sakte hain aur munafa kamane ke liye sahi raaste par chal sakte hain. Is takneek ka ilm hasil karna tijarat mein kaamyaabi ki taraf ek ahem qadam hai.

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Introduction: Forex mein Dynamics Momentum Index (DMI) ek technical indicator hai jo traders ko market ki trend aur momentum ko samajhne mein madad deta hai. DMI ko trend-following indicator bhi kaha jata hai, kyunki iska istemal khaas karke trends aur unke momentum ko identify karne ke liye hota hai. DMI, Welles Wilder ne develop kiya tha, jo ki ek prasiddh technical analyst the. Iska upyog traders ko ye pata lagane mein madad karta hai ki market upar ya niche ja raha hai aur uski velocity kya hai. Formation: DMI, do principal lines se mil kar banta hai: Positive Directional Index (DI+) aur Negative Directional Index (DI-). Ye dono lines trend ki strength aur direction ko darshate hain. In dono lines ka combination DMI ko taiyar karta hai. Ye lines usually ek dusre ke saath dikhai dete hain aur ek range mein hote hain, jo 0 se 100 tak jati hai. Agar DI+ DI- ko upar se cross karta hai, toh yeh ek bullish signal ho sakta hai, jabki agar DI- DI+ ko upar se cross kare, toh yeh bearish signal ho sakta hai. Istemaal: DMI ka istemaal karke traders market trends aur unke momentum ko samajhne mein saksham hote hain. Is indicator ki madad se woh ye pata laga sakte hain ki market upar ya niche ja raha hai aur usmein kitna momentum hai. DMI ka istemaal karte samay traders ko in signals par dhyan dena chahiye: 1. **Trend Confirmation:** DMI traders ko existing trend ko confirm karne mein madad karta hai. Agar DI+ DI- ko upar se cross karta hai aur DI+ higher levels mein hai, toh yeh uptrend ki tasdeek kar sakta hai. 2. **Trend Reversals:** Agar DI- DI+ ko upar se cross karta hai aur DI- higher levels mein hai, toh yeh downtrend ki sambhavna ko darshata hai. 3. **DMI Crossovers:** DI+ aur DI- ke crossovers se traders ko entry aur exit points ka pata lag sakta hai. 4. **Market Momentum:** DMI ki madad se traders ko market momentum ka andaza lag sakta hai. High DI+ aur DI- levels strong trends aur momentum ko darshate hain. Advantages: 1. **Trend Identification:** DMI traders ko trend ki pehchaan karne mein madad karta hai, jisse woh sahi samay par trade kar sakte hain. 2. **Entry aur Exit Points:** DMI crossovers traders ko entry aur exit points ka nirdharan karne mein sahayak hota hai. 3. **Risk Management:** DMI se traders apne trades ko better tarike se manage kar sakte hain, kyunki woh market ke momentum ko samajhte hain. 4. **Confidence:** DMI ke signals ka istemaal karke traders apne decisions par adhik vishwas rakhte hain, kyun ki unka technical analysis support milta hai. Ikhtitam: To conclude, Dynamics Momentum Index (DMI) ek mahatvapurnn technical indicator hai jo traders ko market trends aur momentum ko samajhne mein madad deta hai. Iske istemaal se traders ko trend identification, entry-exit points ka pata lagta hai aur risk management mein madad milti hai. DMI ka sahi tarah se istemaal karke traders apne trading decisions ko sudhar sakte hain aur unka trading approach mazboot ho sakta hai. -

#4 Collapse

Dynamic Momemtum Indeks Indikator kia hota hy, Introduction forex market mein kamiyabi hasil karne ke liye, behtar maashi faislon ko samajhna aur unka istemal karna zaroori hai. Is maqam par, tijarat karne walon ke liye anay wale halat aur maashi soorat-e-haal ko qabu karne ka zariya hai jo "Dinamik Momemtum Indeks Indikator" ke naam se jana jata hai. Yeh ek tijarti tijarat ke liye intehai ahem aur moassar tool hai jo maaloomati systemon aur tijarati munazamaton mein istemal hota hai. Dynamic Momemtum Indeks Indikator ki tafseeli Wazahat Dynamic Momemtum Indeks Indikator (DMI) ek technical analysis tool hai jo tijarati tijarat ke maamlat mein istemal hota hai. Yeh ek trend-following indicator hai jo tijarat mein anay wale trends aur unki taqat ko zahir karta hai. Iska maqsad tijarat karne walon ko sahi waqt par tijarati maqasid ki taraf rukhne mein madad karna hai.DMI, tijarat karne walon ko asas tijarti dhaar mein taza tabdeeliyon ko pehchane aur in tabdeeliyon ka faida uthane mein madad deta hai. Yeh indicator price aur volume ki bunyad par kaam karta hai aur tijarat karne walon ko samjhne mein madad karta hai ke kis tarah ke maashi harkat darust ho sakti hain. DMI Ke Components kia hoty hain DMI do mukhtalif components se milkar tashkil pata hai: Positive Directional Indicator (+DI) aur Negative Directional Indicator (-DI). Yeh dono indicators trend ki rukh aur taqat ko zahir karte hain. +DI, upar ki taraf move karne wale prices ke liye hai jabkay -DI, neeche ki taraf move karne wale prices ke liye hai.Iske sath hi, DMI ke andar ek "ADX" (Average Directional Index) bhi hota hai jo trend ki taqat ko zahir karta hai. Agar ADX ki value barh rahi hai to iska matlab hai ke trend strong hai, jabke agar ADX ki value ghat rahi hai to trend kamzor hai. DMI Ka Trading main Istemal DMI ko istemal karke tijarat karne walon ko tijarti trends aur unki taqat ke bare mein maloomat milti hai. Agar +DI -DI se ziada hai, to iska matlab hai ke uptrend (upar ki taraf ki rukh) hai. Agar -DI +DI se ziada hai, to downtrend (neeche ki taraf ki rukh) hai. Jab dono indicators aapas mein mukhalif rukh dikhate hain, to sideways trend (aik taraf se dusri taraf ki rukh) ho sakti hai.Iske ilawa, ADX ki value bhi tijarati trends ki taqat ko zahir karte hue istemal hoti hai. ADX ki value 25 se ziada ho to trend strong hai aur tijarat karne walon ko samjhne mein madad deta hai ke market mein kis tarah ke maashi harkat mumkin hain. DMI ko kaisy istemal kia jata hy DMI tijarat karne walon ko tijarati maqasid ki taraf rukhne mein madad deta hai. Agar trend strong hai to tijarat karne walon ko zyada confidence hota hai apne faislon par.Sideways Trends Ki Pehchan:** DMI tijarat karne walon ko sideways trends ki pehchan karne mein bhi madad deta hai. Is tarah ke trends mein tijarat karne ki tarika mukhtalif hota hai.Tijarti tijarat mein kamiyabi hasil karne ke liye, technical analysis tools ka istemal zaroori hai aur Dinamik Momemtum Indeks Indikator (DMI) aik aham zariya hai. Yeh indicator tijarati trends aur unki taqat ki pehchan karne mein madad deta hai aur tijarat karne walon ko sahi faislon par guzishta harkat ko samjhne mein madad karta hai. Iske istemal se tijarat karne walon ko market ke maashi halat aur soorat-e-haal ka behtar andaza ho sakta hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

DYNAMIC MOMENTUM INDEX DEFINITION Dynamic Momentum index ek technical indicator hai Jo is baat ka determine karne ke liye use Hota Hai Ki Aaya Koi asset overbought hai or over sold hai iska use trending aur range wali markets Mein trade signals Paida Karne ke liye Kiya jata hai is artical Mein dynamic Momentum index ko Kabhi kabhar Ko akhteyar Karke DMI kahan jaega lekin is ka directional Momentum index DMI ke sath confuse nahin karna chahie trader ko is Baat per Gaur karne ki tarkeeb Di Jaati Hai Ke asset range hai ya trending trade signal ko filter karne mein help mil sake analysis ki Digar form Jaise price action fundamental analysis ya other technical indicator bhi tajweez kiye Jaate Hain AgarCha indicator RSI se kam lag hain phir Bhi Kuchh waqffa hai trade signal Aane Se Pahle hi price pahle hi numaya Taur per chal sakti hai iska mean yeh hai kya signal chart per good Dikhai De sakta hai:max_bytes(150000):strip_icc()/dotdash_INV-final-Dynamic-Momentum-Index-May-2021-01-be5133bb72a34ab1916280b71cb03125.jpg) UNDERSTANDING DYNSMIC MOMENTOM INDEX trader especially vah log jo primarily Taur per equity market mein involved Hain DMI ka use is baat ka determine karne ke liye kar sakte hain ki trending ya range bound market mein retracement kab Apne end Per Kareeb hai dynamic Momentum index relative index similar hai donon Ke Darmiyan mein difference yah Hai Ke RSI Apne hisab Kitab mein time ki ek MukarRa number usually 14 ka use karta hai Jab Ke dynamic Momentum index different time periods ko volatility ki change ke Taur per use karta hai ammtaur per 5 aur 30 Ke Darmiyan

UNDERSTANDING DYNSMIC MOMENTOM INDEX trader especially vah log jo primarily Taur per equity market mein involved Hain DMI ka use is baat ka determine karne ke liye kar sakte hain ki trending ya range bound market mein retracement kab Apne end Per Kareeb hai dynamic Momentum index relative index similar hai donon Ke Darmiyan mein difference yah Hai Ke RSI Apne hisab Kitab mein time ki ek MukarRa number usually 14 ka use karta hai Jab Ke dynamic Momentum index different time periods ko volatility ki change ke Taur per use karta hai ammtaur per 5 aur 30 Ke Darmiyan  HOW TO USE DYNAMIC MOMENTOM IN TRADING Dynamic Momentum index ko ISI Tarah use Kiya Ja sakta hai Jaise Kisi dusre momentum indicator including RSI stochastic etc indicator sarf ke provided in Put ki buniyad per behave Karega yah understood ki need hai ke Ek ghair mustahkam market mein indicator price ke liye zyada sensitivity Hota Hai Jab Ke quiet intervals main price ki sensitivity kam Ho Jaati Hai yah is indicator ko use karne ka Samjha Jaane wala advantage hai

HOW TO USE DYNAMIC MOMENTOM IN TRADING Dynamic Momentum index ko ISI Tarah use Kiya Ja sakta hai Jaise Kisi dusre momentum indicator including RSI stochastic etc indicator sarf ke provided in Put ki buniyad per behave Karega yah understood ki need hai ke Ek ghair mustahkam market mein indicator price ke liye zyada sensitivity Hota Hai Jab Ke quiet intervals main price ki sensitivity kam Ho Jaati Hai yah is indicator ko use karne ka Samjha Jaane wala advantage hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:31 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим