How to use correlation to trade forex?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

How to use correlation to trade forex? Correlation currencyartbat aik shmaryati pemana hai ke kis terhan do mutaghirat ka aik dosray se talluq hai. artbat ka jitna ziyada hoga, woh itnay hi qareeb se munsalik hon ge. aik misbet artbat ka matlab hai ke do ki qadren aik hi simt mein harkat karti hain, aik manfi artbat ka matlab hai ke woh mukhalif simtao mein harkat karte hain. forex marketon mein, artbat ka istemaal is baat ki pishin goi karne ke liye kya jata hai ke kon se currency jore ki shrhin mil kar agay barh sakti hain. manfi tor par baahum marboot krnsyon ko bhi peking ke maqasid ke liye istemaal kya ja sakta hai. How to use in forex tradingcurrency ke joron ke bahami inhisaar ki wajah ko dekhna aasaan hai : agar aap bartanwi libra ko japani yan ( gbp / jpy jora ) ke muqablay mein trade kar rahay hain, misaal ke tor par, aap asal mein tijarat kar rahay gbp / usd aur usd / jpy joron ka; lehaza, gbp / jpy ka kisi had tak kisi aik se talluq hona chahiye agar yeh dono deegar currency jore nah hon. taham, krnsyon ke darmiyan bahami inhisaar je saada haqeeqat se ziyada hai ke woh jore mein hain. jab to me ke kuch jore mil kar harkat karen ge, dosray to me ke jore mukhalif simtao mein harkat kar satke hain, jo ziyada paicheeda quwatoon ka nateeja hai. sab se pehlay, woh aap ko do pozishnon mein daakhil honay se bachney mein madad kar satke hain jo aik dosray ko mansookh kar dete hain, misaal ke tor par, yeh jaan kar ke eur / usd aur usd / chf taqreewaq simta % 100 % muk mein harkat karte hain, aap dekhen ge ke taweel eur / usd aur lambay usd / chf ka port folyo hona wohi hai jaisa ke amli tor par koi position nahi hai —q Keh , jaisa ke artbat zahir karta hai, jab eur / usd release, USD / chf sale with guzray ga. Diversificationdoosri taraf, taweel eur / usd aur taweel aud / usd ya nzd / usd ka ineqad aik hi position par dugna honay ke mutradif hai kyunkay artbatat itnay mazboot hain. tanawu par ghhor karne ka aik aur Ansar hai. chunkay eur / usd aur aud / usd ka bahami talluq riwayati tor par 100% misbet nahi hai, is liye tajir un do joron ko –apne khatray ko kuch had tak mtnoa bananay ke liye istemaal kar satke hain aurdihtazyar bunyraka hain. misaal ke tor par, usd par mandi ka nuqta nazar zahir karne ke liye, tajir, eur / usd ke do laat kharidne ke bajaye, eur / usd ka aik laat aur aud / usd ka aik laat khareed sakta hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Correlation

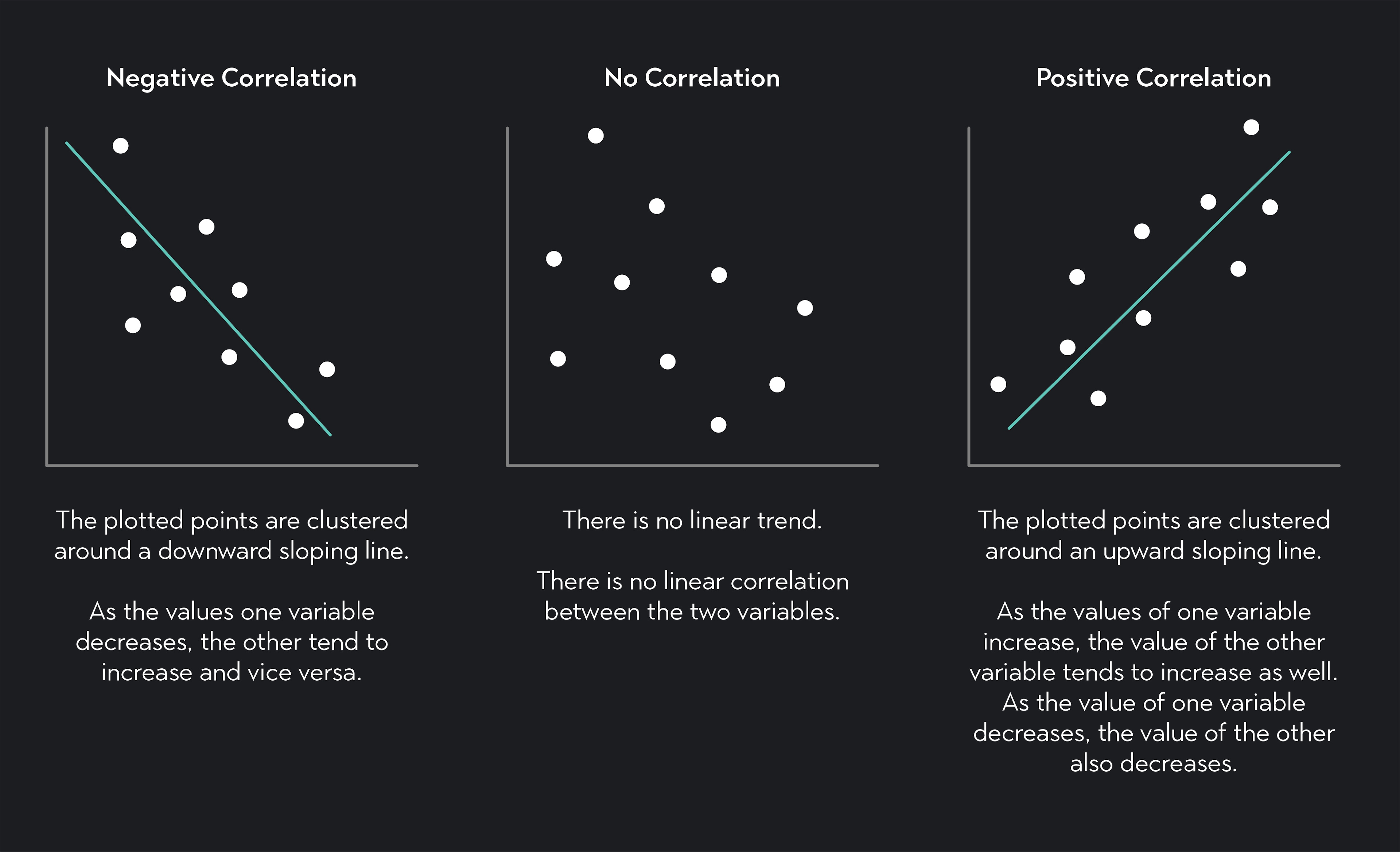

"Correlation" forex trading mein aham kirdar ada karta hai, jo currency pairs ke darmiyan ta'alluqat mein qeemati idaray farahem karta hai. Correlations ko samajh kar aur tajziya kar ke, traders zyada malumat hasil kar ke apne faislay ko behtar banane aur apna risk mawafiq taur par manzoor karne mein madad hasil kar sakte hain. Forex trading mein, correlation do ya zyada currency pairs ke darmiyan istatisti ta'alluqat ko darust karti hai. Yeh un pairs ke price movements ke darmiyan ta'alluqat ka darja nap karti hai. Correlations ko tajziya kar ke, traders currency pairs ke rawaiye mein daakhil ho sakte hain aur hosla afza faislay karne mein madad hasil kar sakte hain.

Correlation coefficient, jise aksar "r" ke nishan se darust kiya jata hai, -1 se +1 tak ki range mein hota hai. Ek musbat correlation (0 se +1 tak) batati hai ke do currency pairs aksar ek hi raaste mein chalte hain. Misal ke tor par, agar currency pair A ki qeemat barhti hai, to currency pair B ki bhi tend hoti hai barhne ki taraf. Wahi, manfi correlation (0 se -1 tak) yeh ishara karta hai ke dono pairs ulte raaste mein hain. Agar currency pair A ki qeemat barhti hai, to currency pair B ki tend hoti hai kam hone ki taraf.

Forex trading mein correlations ya to short-term ya long-term ho sakti hain, aur waqt ke sath badal sakti hain. Traders aam taur par correlation analysis ka istemal apne portfolios ko mukhtalif banane aur risk ko kam karne ke liye karte hain. Jis tarah se musbat ya manfi correlations wale currency pairs ko pehchan kar, traders apne positions ko mukhtalif banane aur agar market unke khilaf chalti hai to nuksan ko kam karne ki koshish kar sakte hain.

Yeh zaroori hai ke ye maloomat rakhi jaye ke jabke correlations malumat farahem kar sakti hain, woh akhri marhala nahi hain aur inko doosre tajziya techniques ke sath istemal kiya jana chahiye. Iske alawa, correlations mustaqil nahi hote aur mukhtalif maamlat jaise ke iqtisadi waqiat, market jazbat, ya aalmi maaliyat ki surat-e-haal mein tabdeel ho sakte hain. Is liye, traders ko apne correlation analysis ko taqreeban har waqt monitor aur update karne ki zarurat hai takay woh haalat-e-baazari ko darust se reflect kar sake.

Correlation Coefficient

Correlation coefficient ek istatisti measure hai jo do variables ke darmiyan linear ta'alluqat ki miqdar ko darust karta hai. Isay "r" ke nishan se darust kiya jata hai aur iski range -1 se +1 tak hoti hai.

+1 ke correlation coefficient ko perfect positive correlation darust karta hai, yani ke dono variables aik hi raaste mein chalte hain aur inke darmiyan ta'alluqat strong hote hain. Misal ke tor par, agar variable A ki qeemat barhti hai, to variable B ki bhi proportionally barhti hai.

-1 ke correlation coefficient ko perfect negative correlation batata hai, yani ke dono variables ulte raaste mein hain aur inke darmiyan ta'alluqat strong hoti hain. Is surat mein, agar variable A ki qeemat barhti hai, to variable B ki bhi proportionally kam hoti hai.

0 ke correlation coefficient yeh ishara karta hai ke variables ke darmiyan koi linear ta'alluqat nahi hoti, yani ke aik variable mein tabdili ka koi mustaqil asar nahi hota doosre variable par.

Correlation coefficient ki miqdar ta'alluqat ki taqat ko darust karti hai. Jo values +1 ya -1 ke qareeb hain, woh zyada ta'alluqat ko darust karti hain, jabke values 0 ke qareeb ta'alluqat kam hoti hai.

Ye zaroori hai ke yaad kiya jaye ke correlation coefficient sirf variables ke darmiyan linear ta'alluqat ko napta hai aur non-linear ta'alluqat ko nahi pakad sakta. Iske alawa, correlation causation ko darust nahi karti hai, yani ke do variables ke darmiyan high correlation hone ka matlub nahi hai ke aik variable mein hone wali tabdili doosre variable mein tabdili ko jama kar rahi hai.

Forex Correlation Pairs

Forex trading mein, currency pairs mukhtalif correlations ko dikhate hain, jo ke tajaweez ki teen qisam mein darust kiye ja sakte hain: musbat correlation, manfi correlation, aur be-ta'alluqat. Yahan kuch aam dekhe gaye forex correlation pairs hain:- Positive Correlation:

- EUR/USD aur GBP/USD: Ye pairs aksar strong musbat correlation dikhate hain kyun ke ye dono major currency pairs hain aur inke prices ko Eurozone aur United States ki iqtisadi malumat asar andaz hoti hai.

- AUD/USD aur NZD/USD: Australian dollar aur New Zealand dollar dono commodity currencies hain, aur inke exchange rates aksar is wajah se musbat correlation dikhate hain ke inki qareebi geographi aur mawafiq iqtisadi talluqat ki wajah se.

- Negative Correlation:

- USD/JPY aur EUR/JPY: Japanese yen ko aik safe-haven currency samjha jata hai, aur jab market mein risk se bachne ki zarurat hoti hai, to USD/JPY aur EUR/JPY dono kamzor ho jate hain, jiski wajah se inke darmiyan manfi correlation hoti hai.

- USD/JPY aur Gold: Sona bhi aik safe-haven asset hai, aur jab market mein uncertainty hoti hai, to investors aksar USD/JPY aur sona dono ki taraf rujoo karte hain, jiski wajah se inke darmiyan manfi correlation hoti hai.

- No Correlation:

- USD/CHF aur GBP/JPY: Ye pairs aksar kisi khaas ta'alluqat ko dikhate nahi hain kyun ke inme mukhtalif major currencies shamil hain jo apne apne iqtisadi factors se asar hoti hain.

- USD/CAD aur EUR/GBP: Isi tarah, ye pairs aksar kam correlation dikhate hain kyun ke inme mukhtalif currency combinations shamil hain jo apni apni iqtisadi factors ke zariye asar andaz hoti hain.

Yaad rahe ke currency pairs ke darmiyan correlations mustaqil nahi hote aur waqt ke sath tabdeel ho sakte hain. Traders ko apne correlation analysis ko mustaqil tor par monitor aur update karne ki zarurat hoti hai takay woh haalat-e-baazari ko darust se reflect kar sake.

Currency Correlation Strategies Ke Examples

Yahaan kuch currency correlation strategies ke udaaharan hain jo forex trading mein traders istemaal kar sakte hain:- Hedging Strategy: Traders apne positions ko hedge karne ke liye currency correlation ka istemaal kar sakte hain. Misal ke tor par, agar ek trader EUR/USD mein long position hold kar raha hai (umeed hai ke yeh barhegi), lekin usne dekha hai ke EUR/USD aur USD/CHF ke darmiyan strong negative correlation hai, to woh USD/CHF mein short position lekar apna risk hedge kar sakta hai. Agar EUR/USD uski initial position ke khilaf chali jati hai, to short USD/CHF position ke faide se nuksan ko kam ya khatam kar sakta hai.

- Diversification Strategy: Currency correlation traders ko apne portfolios ko mukhtalif banane mein madadgar ho sakti hai. Kam ya manfi correlations wale currency pairs ko pehchan kar, traders apna risk mukhtalif currency pairs mein baant kar kam kar sakte hain. Misal ke tor par, agar ek trader EUR/USD par bullish hai, to woh EUR/USD ke sath manfi correlation wale pairs jaise USD/JPY ya USD/CHF ko bhi shamil karke apni positions ko mukhtalif banane mein madad le sakta hai.

- Correlation Breakout Strategy: Traders woh waqt dekh sakte hain jab do currency pairs ke darmiyan correlation norm se zyada badal jata hai. Jab strong correlation toot jata hai, to is mein trading ke mauqe pesh aate hain. Misal ke tor par, agar EUR/USD aur GBP/USD ke darmiyan aik historical tor par musbat correlation kamzor ho jata hai ya manfi ho jata hai, to trader dono pairs par opposite positions le sakte hain, umeed hai ke woh phir apni maamooli correlation par laut jayenge.

- Carry Trade Strategy: Carry trade mein, low-interest-rate currency se udhaar lekar high-interest-rate currency mein invest karna shamil hota hai taake interest rate ka farq hasil kiya ja sake. Correlation analysis traders ko carry trades ke liye currency pairs ka chayan karne mein madad kar sakti hai. Misal ke tor par, agar trader musbat correlation wale currency pairs pehchan leta hai aur ek pair par carry trade implement karta hai, to woh overexposure se bachne ke liye correlated pairs par carry trades avoid karke apna risk kam kar sakta hai.

Ye sirf kuch currency correlation strategies ke udaaharan hain, aur trader ki risk tolerance, time horizon, aur market conditions ke mutabiq aur bhi tajaweezat aur tabdiliyan ho sakti hain. Zaroori hai ke kisi bhi strategy ko live trading mein lagoo karne se pehle uski thorough backtesting aur tajaweez ki jaye, aur waqtan-fa-waqt correlation ko monitor karna bhi zaroori hai kyun ke yeh waqt ke sath tabdeel ho sakti hai.

Trading

Forex correlation pairs ko mawafiq taur par trade karne ke liye, aap in steps ko follow kar sakte hain:- InstaForex par live trading account kholen ya demo account istemaal karen: Aik maqbool forex broker chunen aur trading shuru karne ke liye aik account kholen. Agar aap forex trading mein naya hain, to tajurba hasil karne aur samajhne ke liye demo account istemaal karna bhi consider karen.

- Market research karen: Currency pairs aur unke movements par asar dalne wale factors ke baray mein apni malumat ko barhayein. Apne aap ko iqtisadi indicators, central bank policies, siyasi waqiat, aur doosre maamoolat se mutassir hone wale factors se maqool karen.

- Currency correlation strategy chunen: Currency correlations par mabni apni khaas strategy ko tay karen. Hedging, pairs trading, ya apne approach mein commodity correlations shamil karne jaise options mein se koi bhi choose karen. Behtareen hai ke aap apni trading plan tayar karen jisme aapki strategy, dakhli aur kharij criteria, risk management guidelines, aur profit targets shamil hon.

- Risk management tools ka istemaal karen: Apne broker dwara farahem kiye gaye risk management tools ka faida uthayen, jaise ke stop-loss aur take-profit orders. Yeh tools aapko predefined levels set karne mein madad karte hain jin par aapki trades automatically band ho jati hain. Yaad rakhen ke jabke yeh tools risk ko kam karte hain, woh market gaps ya slippage ke khilaf puri suraksha nahi farahem kar sakti.

- Apni trade ko execute karen: Correlations aur doosre maamoolat ki tajziya ke mutabiq faisla karen ke aap kis currency pair ko khareedna chahte hain ya bechna chahte hain. Apni trades ke liye dakhli aur kharij points ka tay karen, support aur resistance levels, technical indicators, aur market conditions ka bhi madah karen. Apne trading platform ke zariye apni trade implement karen, apne trading plan ko follow karte hue.

Yaad rahe, forex correlation trading mein correlations ko hamesha monitor karna zaroori hai kyun ke yeh waqt ke sath tabdeel ho sakti hain. Market conditions aur tabdili hone wale correlation patterns ke mutabiq apni trading strategy ko baar baar tajwez aur adjust karen. Iske alawa, hamesha sahi risk management ka amal karen aur kabhi bhi itna risk na uthayen jitna aap afford kar sakte hain.

Conclusion

Correlation analysis forex traders ke liye ek taqatwar tool hai jo unke faislay ko behtar banane aur risk ko manage karne mein madad karta hai. Currency pairs ke darmiyan ta'alluqat ko study karke, traders hedging, diversification, breakout trading, aur carry trades ke liye mauqay pa sakte hain. Lekin yaad rahe ke correlations mustaqil nahi hote aur waqt ke sath tabdeel ho sakte hain, is liye strategies ko baar baar monitor aur adjust karna zaroori hai. Forex traders jo correlation analysis ko apne trading approach mein shamil karte hain, woh market dynamics ko gehraai se samajh sakte hain aur apne trading outcomes ko behtar bana sakte hain.

- Positive Correlation:

-

#4 Collapse

Forex Trading Mein Correlation":":":"

Forex trading mein correlation ek important concept hai. Correlation ka matlab hota hai ki do ya zyada currencies ya assets ke movement mein kaisi relation hai. Agar do currencies ya assets ke beech mein strong positive correlation hai, toh jab ek ki value badhti hai, doosre ki value bhi generally badhti hai. Aur agar negative correlation hai, toh ek ki value badhti hai toh doosre ki ghat ti hai.

Yeh information traders ke liye valuable hoti hai, kyun ki agar woh ek currency pair trade kar rahe hain jo doosri currency pair se strongly correlated hai, toh unhein ek ki movement se doosri ki movement ka expectation bhi ho sakta hai. Isse risk management aur trading strategies develop karne mein madad milti hai.

Forex Trading Mein Correlation Ko Uses ":":":"

Forex trading mein correlation ke kai uses hote hain:- Risk Management: Correlation ko samajh kar traders apne portfolio ko diversify kar sakte hain. Agar kisi currency pair ya asset ka price ghat raha hai, toh correlated currency pair ya asset mein badhne ki sambhavna hoti hai. Isse overall portfolio ke risk ko kam kiya ja sakta hai.

- Trading Strategies: Correlation analysis se traders trading strategies develop karte hain. Agar do currencies ya assets ke beech mein strong negative correlation hai, toh traders ek long position aur doosri short position le sakte hain, taki ek ki price badhti hai toh doosri ki price ghat ti hai.

- Market Sentiment: Correlation analysis market sentiment ko samajhne mein madad karta hai. Agar kisi currency pair ka strong positive correlation hai kisi particular market event ke saath, toh traders us event ke impacts ko dusri correlated currencies ya assets ke movement se samajh sakte hain.

- Hedging: Correlation analysis hedging ke liye bhi important hai. Traders apne open positions ko hedge karne ke liye correlated assets ka use karte hain. Agar kisi currency pair par long position hai aur uska correlated pair par short position liya gaya hai, toh overall risk kam ho sakta hai.

- Portfolio Optimization: Correlation analysis se traders apne portfolio ko optimize kar sakte hain. Agar do assets ke beech mein low correlation hai, toh unhein portfolio mein add karke diversification increase ki ja sakti hai.

-

#5 Collapse

### Forex Trading Mein Correlation Ka Istemaal

Forex trading mein correlation ek valuable tool hai jo traders ko do ya zyada currency pairs ke price movements ke beech ke relationship ko samajhne mein madad karta hai. Correlation ko use karke, traders potential trading opportunities identify kar sakte hain aur risk management ko improve kar sakte hain. Aaiye, correlation ko detail mein samjhte hain aur forex trading mein uska istemaal discuss karte hain:

**1. Correlation Ki Pehchaan:**

Correlation do ya zyada variables ke beech ke relationship ko measure karta hai. Forex trading mein, ye measure karta hai ke do currency pairs kis had tak ek dusre ke price movements ko follow karte hain. Correlation coefficient -1 se 1 ke range mein hota hai:

- **+1:** Perfect positive correlation, matlab do currency pairs hamesha ek direction mein move karte hain.

- **-1:** Perfect negative correlation, matlab do currency pairs hamesha opposite direction mein move karte hain.

- **0:** No correlation, matlab do currency pairs ke movements independent hain.

**2. Positive Correlation:**

Jab do currency pairs positive correlation dikhate hain, to ye indicate karta hai ke jab ek pair ki value barhti hai, to dusre pair ki value bhi barhti hai. Example: EUR/USD aur GBP/USD aksar positive correlation dikhate hain kyun ke dono pairs USD ke against hain aur European currencies hain.

**3. Negative Correlation:**

Jab do currency pairs negative correlation dikhate hain, to ye indicate karta hai ke jab ek pair ki value barhti hai, to dusre pair ki value girti hai. Example: EUR/USD aur USD/JPY negative correlation dikhate hain kyun ke USD ek pair mein base currency aur dusre mein quote currency hai.

**4. Correlation Matrix:**

Traders correlation matrix ka use karke different currency pairs ke beech ke correlations ko analyze kar sakte hain. Correlation matrix ek table hota hai jo various currency pairs ke correlation coefficients ko show karta hai. Isse traders ko quickly identify karne mein madad milti hai ke kaunse pairs positive ya negative correlation dikhate hain.

**5. Trading Strategy:**

- **Hedging:** Correlation ko hedging ke liye use kar sakte hain. Agar trader EUR/USD mein long position hold karta hai, to negative correlation pair (jaise ke USD/CHF) mein short position open karke risk ko hedge kar sakta hai.

- **Diversification:** Correlation ko diversification ke liye use kar sakte hain. High positive correlation pairs mein multiple positions hold karne se risk concentration badh sakta hai. Isliye, low correlation pairs mein positions open karke portfolio ko diversify kar sakte hain.

- **Confirmation:** Correlation ko trade confirmation ke liye use kar sakte hain. Agar trader EUR/USD mein bullish signal dekhta hai, to positive correlation pair (jaise ke GBP/USD) mein similar bullish signal dekhkar confirmation le sakta hai.

**6. Risk Management:**

Effective risk management ke liye correlation analysis zaroori hai. High correlation pairs mein multiple positions hold karne se exposure aur risk badh sakta hai. Correlation analysis karke traders apne trades ko better manage kar sakte hain aur risk ko control mein rakh sakte hain.

**7. Tools Aur Resources:**

Market mein multiple tools aur resources available hain jo real-time correlation data provide karte hain. Websites aur trading platforms par correlation calculators aur matrixes available hain jo traders ko quick analysis aur decision making mein madad karte hain.

**Conclusion:**

Forex trading mein correlation ka istemaal ek powerful technique hai jo traders ko market dynamics ko samajhne aur informed trading decisions lene mein madad karta hai. Correlation analysis se traders apne portfolio ko diversify kar sakte hain, risk ko manage kar sakte hain, aur potential trading opportunities ko identify kar sakte hain. Proper understanding aur strategic application ke sath, correlation ko effective trading strategy mein integrate kiya ja sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Mein Correlation Ka Istemaal: Ek Mukhtasir Jaiza

Muqaddama

Forex trading mein correlation ek powerful tool hai jo traders ko different currency pairs ke darmiyan relationship ko samajhne mein madad deti hai. Ye approach aapko trading decisions ko optimize karne aur risk management ko improve karne mein madadgar hoti hai. Is article mein hum forex trading mein correlation ka istimaal karne ka tareeqa briefly explain karenge.

Correlation Kya Hai?

Correlation ek statistical measure hai jo do variables ke darmiyan relationship ko depict karta hai. Forex trading mein, correlation ka matlab hai do currency pairs ke price movements ka ek dosray ke sath kis tarah se related hona. Correlation ki value -1 se 1 tak hoti hai:- +1: Perfect positive correlation - Do currency pairs hamesha ek hi direction mein move karte hain.

- -1: Perfect negative correlation - Do currency pairs hamesha opposite direction mein move karte hain.

- 0: No correlation - Do currency pairs ke movements mein koi specific relationship nahi hota.

Correlation Matrix Ka Istemaal- Correlation Matrix: Correlation matrix ek table hota hai jo different currency pairs ke darmiyan correlations ko show karta hai. Ye matrix aapko quickly ye dekhne mein madad karta hai ke kaunse currency pairs ek dosray ke sath positively ya negatively correlated hain.

- Correlation Indicators: Kai trading platforms correlation indicators provide karte hain jo real-time correlation values ko calculate karte hain. Ye indicators aapko current market conditions ke mutabiq correlations ko track karne mein madad karte hain.

Correlation Ko Use Karne Ka Tareeqa- Diversification: Positive correlation ko samajhne se aap apne portfolio ko diversify kar sakte hain. For example, agar aap EUR/USD aur GBP/USD dono pairs mein trade kar rahe hain, toh ye dono pairs highly correlated hain. Isliye, diversification ke liye aapko aise pairs choose karne chahiye jo kam correlated ya negatively correlated hon.

- Hedging: Negative correlation ko samajhne se aap hedging strategies use kar sakte hain. For example, agar aap EUR/USD mein long position le rahe hain, toh aap USD/CHF mein short position le sakte hain taake potential losses ko mitigate kar sakein kyunki ye pairs usually negatively correlated hain.

- Confirmation: Correlation ko use karke aap apne trade signals ko confirm kar sakte hain. For example, agar aapko EUR/USD mein buy signal mil raha hai aur GBP/USD bhi upward move kar raha hai, toh ye positive correlation ko indicate karta hai aur aapke trade signal ko confirm karta hai.

Risk Management:- Exposure Control: Correlation ko samajhne se aap apne risk exposure ko control kar sakte hain. Highly correlated pairs mein simultaneously trade karne se avoid karein taake aapka risk zyada na ho.

- Position Sizing: Correlation ko madad nazar rakhte hue aap apne position sizes ko adjust kar sakte hain. Aise pairs mein jahan correlation high ho, wahan position size ko chhota rakhna better hota hai taake risk manage ho sake.

Conclusion

Forex trading mein correlation ka sahi istimaal aapko trading decisions ko optimize karne aur risk management ko improve karne mein madadgar ho sakta hai. Correlation matrix aur indicators ko use karke aap different currency pairs ke relationships ko samajh sakte hain aur apni trading strategies ko accordingly adjust kar sakte hain. Har trader ke liye zaroori hai ke wo correlation ko apni trading strategy ka hissa banaye aur isse maximum faida uthaye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:57 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим