Bullish Thrusting Line Pattern in Forex Trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

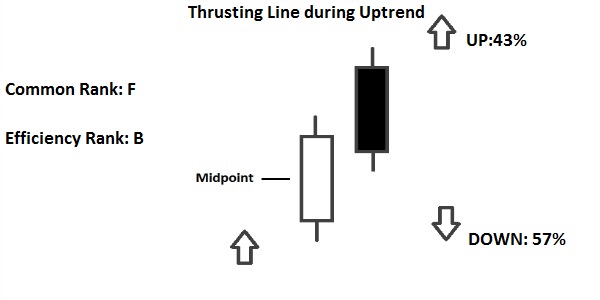

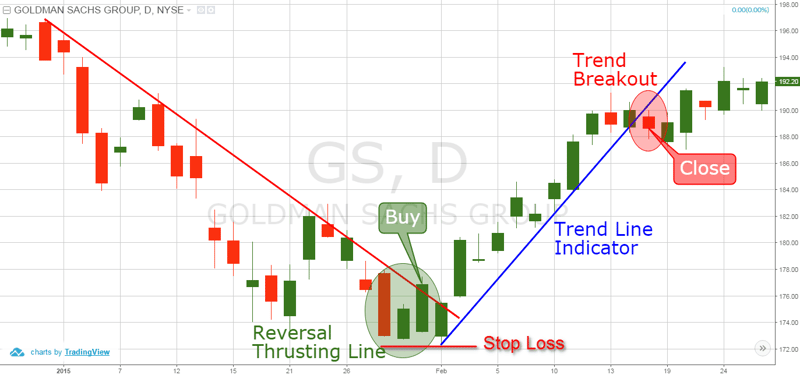

Bullish Thrusting Line Pattern Takneeki tajzia aik maqbool tijarti tareeqa car hai jo market ke rujhanaat ki shanakht aur tijarti faislay karne ke liye charts aur takneeki isharay istemaal karta hai. Chart pattern takneeki tajzia ke kaleedi tools mein se aik hain, aur bullish thrusting line pattern un sab se aam aur qabil aetmaad pattern mein se aik hai jisay traders market mein mumkina taizi ke ulat phair ki nishandahi karne ke liye istemaal karte hain. Is article mein, hum taizi se thrusting line pattern, is ki khususiyaat, aur is ki muaser tareeqay se tijarat karne ke tareeqa ko talaash karen ge. Bullish Thrusting Line Pattern Kya Hai ? bullish thrusting line pattern taizi ke tasalsul ka pattern hai jo is waqt bantaa hai jab kisi asasay ki qeemat pichlle din ki kam qeemat se neechay khulti hai lekin pichlle din ke mid point ke oopar band hojati hai. Is pattern ki khasusiyat aik lambi bullish candlestick se hai jo pichlle din ki mandi wali candlestick se guzarti hai, jo is baat ki nishandahi karti hai ke kharidaron ne market ka control sambhaal liya hai aur imkaan hai ke woh qeemat ko mazeed agay berhate rahen ge. Bullish Thrusting Line Pattern Ki Khususiyaat : Pichlle din ki kam qeemat se neechay iftitahi qeemat : bullish thrusting line pattern ki khasusiyat aik ibtidayi qeemat hai jo pichlle din ki kam qeemat se neechay hai. Yeh is baat ki nishandahi karta hai ke baichnay walay abhi bhi market par control mein hain aur qeemat kam ho sakti hai. Long Bullish Candlestick : bullish thrusting line pattern ki khasusiyat aik lambi bullish candlestick se hoti hai jo pichlle din ke kam se neechay khulti hai lekin pichlle din ke mid point ke oopar band hoti hai. Is se zahir hota hai ke kharidaron ne market ka control sambhaal liya hai aur imkaan hai ke woh qeemat ko mazeed berhate rahen ge. Bearish Candlestick Pattern Se Pehlay : bullish thrusting line pattern se pehlay bearish candlestick hota hai, jo is baat ki nishandahi karta hai ke pattern ki tashkeel se pehlay baichnay walay market par control mein thay. Bearish candlestick pattern ke liye aik point of references ke tor par kaam karti hai aur is baat ki tasdeeq karne mein madad karti hai ke yeh ulat pattern ke bajaye tasalsul ka pattern hai. Pattern Ki Tashkeel Ke Douran Hajam Mein Izafah : Jaisay jaisay taizi se thrusting line pattern bantaa hai, hajam aam tor par barhta hai. Is se zahir hota hai ke tajir asasay mein dilchaspi le rahay hain aur yeh ke kharidari ka kaafi dabao hai. Taham, yeh tasdeeq karna zaroori hai ke hajam ost tijarti hajam se numaya tor par ziyada hai, kyunkay is se pattern ki tasdeeq mein madad millti hai. Bullish Thrusting Line Pattern Ki Tijarat : Pattern Ki Shanakht Karen : bullish thrusting line pattern ko trade karne ka pehla qadam chart par pattern ki shanakht karna hai. Aik lambi bullish candlestick talaash karen jo pichlle din ki kam se neechay khulti hai lekin pichlle din ke mid point ke oopar band hoti hai, aur is se pehlay aik bearish candlestick hoti hai. Pattern Ki Tasdeeq Karen : pattern ki shanakht hojane ke baad, is baat ki tasdeeq karen ke yeh taizi se chalne wala line pattern hai. pattern ki tashkeel ke douran hajam mein izafah talaash karen, aur tasdeeq karen ke candle stick ost tijarti had se numaya tor par barri hai. pattern ki tasdeeq is baat ki jaanch karkay bhi ki ja sakti hai ke aaya pattern ban'nay ke baad bhi qeemat barhti jarahi hai. Aik Lambi Position Darj Karen : pattern ki tasdeeq honay ke baad, jab qeemat taizi candlestick ki oonchai se oopar toot jaye to aik lambi position darj karen. –apne khatray ko mehdood karne ke liye bullish candlestick ke neechay stap las rakhen. Hadaf ki qeemat is satah par muqarrar ki jani chahiye jo ke bearish candlestick ke nichale hissay aur bullish candle stick ki oonchai ke darmiyan faaslay ke barabar ho, jo break out point se oopar ki taraf paish ki gayi ho. Apni Tijarat Ka Intizam Karen : Kisi bhi tijarti hikmat e amli ki terhan, yeh zaroori hai ke aap apni tijarat ko ahthyat se munazzam karen. Qeemat ki karwai par nazar rakhen, aur agar qeemat aap ke khilaaf hoti hai to tijarat se bahar niklny ke liye tayyar rahen. Jaisay jaisay qeemat aap ke haq mein jati hai, –apne stap nuqsaan ko oopar le jayen, taakay munafe ko band kya ja sakay aur –apne khatray ko mehdood kya ja sakay.

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Bullish Thrusting Line Candlestick PatternBullish thrusting line candlestick pattern se traders bearish trend ki same direction me movement ka ishara lete hen. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan se above close hoti hai.Candles FormationBullish thrusting line candlestick pattern pehli din ki candle aik bullish candle hoti hai, lekin dosre din ki candle bearish candle k close prices par hone ki bajaye top gap main open ho kar ussi k midpoint se ooper close hoti hai. Pattern main shamil candles ki formation darjazzel tarah se hoti hai: 1. First Candle: Bullish thrusting line candlestick pattern ki pehli candle aik bullish candle hoti hai, jo prices k top par ya bullish trend ki continuation ka kaam karti hai, q k ye aik real body wali candle hoti hai. Ye candle white ya green color ki candle hoti hai. 2. Second Candle: Bullish thrusting line candlestick pattern ki dosri candle aik real body wali bearish candle hoti hai. Ye candle open pehli candle k top par gap main hoti hai, jab k close pehli candle k darmeyan se above hoti hai. Bearish candle black ya red color main hoti hai, jo k prices k leye bearish trend reversal ki nakam koshash karti hai.ExplanationBullish thrusting line candlestick pattern prices main aksar do dino k darmeyan main banta hai, jiss se market ki same bullish trend main jane ka ishara melta hai. Pattern ki pehli candle k baad dosri candle ussi k closing price par open hone ki bajaye top gap main open ho kar ussi k center se ooper close hoti hai. Normal ye pattern ziada tadad main bante hen, lekin top prices ya bullish trend main banne par ye prices ko bullish trend continuation ka kaam karti hai. Pattern ki pehli candle bullish aur dosri bearish candle hoti hai, jiss ki lazmi real body honi chaheye, jab k dono candles shadow samet ya shadow k bagher ho sakti hai. Pattern main dono candles aik dosre k opposite direction main open hote hen, jab k dosri candle pehli candle k midpoint se above aur close price se below close hoti hai.TradingBullish thrusting line candlestick pattern prices main traders k leye bullish trend continuation ki indication deta hai, jiss par buy ki entry ki jati hai. Pattern k baad aik confirmation candle ka hona zarori hai. Ye candle real body main bearish honi chaheye, jo k dosri candle k top main ban jati hai. Pattern k baad bearish candle banne se pattern trading invalid ho jayega, jab k CCI, RSI indicator aur stochastic oscillator par value above 50 zone main honi chaheye. Pattern ziada reliable na hone ki waja se stop loss ka istemal zarrori hai. Pattern ka Stop Loss pehli candle k bottom ya open price se two pips below par set karen. -

#4 Collapse

INTRODUCTION Dear buddies asalamo alykum kesay hain ap sab umeed hai ap sab tek hon gay aur ap ka trading week bhi acha ja raha ho ga.yeh pattern*aur indicator humari trading main buht important role play karty hain.yeh humain profit delany main buht madad karty hain. hum agr in ki sai tariqay say learning nai krain gay aur in ko fazool samjyn gay to kbi bhi kamyabi humary kadam ni chumy gi aaj hum jis topic per bat krain gay wo hai thrusting pattern.thursting pattren qeemat chart pattren ki aik type hai jisay takneeki tajzia kaar istemaal karte hain.yeh is waqt bantaa hai jab aik lambi black (downword) candlestick kay baad white (upward) candlestick aati hai.white candlestick black candlestick kay qareeb kay oopar band hoti hai,lekin yeh black candlestick kay real body kay midpoint kay opar band nahi hoti hai. UNDERSTANDING BULLISH THRUSTING LINE PATTERN Thrusting pattren ko aam tor par aik bearish continuation pattren samjha jata hai. taham,shawahid batatay hain k woh bullish reversal ka ishara bhi day saktay hain.is liye,thrusting pattren ko dusray trading signals kay sath mil kar istemaal kiya jata hai.aik zor dainay wala pattern aik lambi black candlestick hai jis kay baad aik white candlestick hoti hai jo black candlestick kay real body kay midpoint kay qareeb band hoti hai.pattren ko aik continuation pattren kay tor par kaam karny kay baray main socha jata hai,lekin haqeeqat main,yeh taqriban half time reversal pattren kay tor par kaam karta hai.thrusting patteren kafi aam hain,zaroori nahi k is kay natijay main qeemat barhay, aur deegar types k shawahid kay sath mil kar sab say ziyada mufeed hotay hain.aik thrusting pattern is waqt hota hai jab aik black candlestick kay baad white candlestick aati hai.white candlestick ka distance kam hota hai,lekin phir yeh black candlestick kay real body kay midpoint kay qareeb period ko band kar deta hai.Thrusting patteren ki umomi definitiin yeh hai k yeh qeematon main kami kay baad mudakhlat karny ki bulls ki koshisho ki akkasi karta hai.black candlestick ke mid point kay opar white candlestick kay thrusting main nakami say pata chalta hai k bulls main bearish kay trend ko reverse karne ki taaqat ki kami hai.is liye,kuch ka khayaal hai k thrusting pattren nichay k trend kay continuation ko zahir karta hai kyunckay bull aakhir kaar apni really ki koshish khatam kar dain gay. -

#5 Collapse

WHAT IS BULLISH THRUSTING LINE PATTERN : Bullish thrusting line ak type hoti ha thrusting line pattern ke jo ya bullish thrusting line pattern ha ya huma market ka chart ma lower ke traf downtrend ke traf dakhna ko mil jata ha or jo ya bullish thrusting line pattern ha ya market ma is downtrend ka lower ma banta ha or ya downtrend ka lower ma ban kar market ka downtrend ko end kar da ga or ya downtrend ko end karta hua stock ke price ko lower sa higher ke traf la kar jana ka kam karay ga or ya jo bullish thrusting line pattern hota ha ya market ma lower ke traf downtrend ka lower ma lower two candles ka sath mip kar bana ho ga or ya downtrend ka lower ma banta hua market ke price ko upwards ke traf push kar raha ho ga. Jab ya bullish thrusting line pattern banay ga to ya lower ke traf support level ka near ma bana ho ga or ya pattern support level ka near ma banta hau stock ke price ko higher ke traf push kar raha ho ga or ya jo bullish thrusting line pattern ho ga ya lower ma two opposite candles ka sath mil kar bana ho ga or jo ya bearish thrusting line pattern ho ga ya is pattern ja opposite ma higher ke traf uptrend ma banay ga or ya bearish thrusting line pattern higher ke traf ban kar stock ke price ko lower ke traf reversal kar raha ho ga. FORMATION OF BULLISH THRUSTING LINE PATTERN : Bullish thrusting line pattern ke jo ya formation hoti ha ya market ma downtrend ka traf ho ge or jo ya bullish thrusting line pattern ho ga ya do candles ka sath mil kar bana ho ga or jo ya bullish thrusting line pattern ho ga ya lower ke traf banay ga to is pattern sa phalay stock ke price lower ke traf ja rahi ho ge or market ke price lower ke janab jati hoi strong downtrend ko bana rahi ho ge or ya jo bullish thrusting line pattern ho ga is ke jo first candle ho ge ya ak long real body bullish ke candle ho ge or ya jo first candle ho ge ya downtrend ka lower sa open ho kar stock ke price ko lower ma la kar jay ge or jo ya first candle ho ge ya long red ya black colour ki ho ge or ya market ko lower ma la ja kar lower ma close ho ge or jo ya first candle ho ge ya jasa hi lower ma close ho ge to market ma ak huma gap dakhna ko mil jay ga or jo ya gap ho ga ya long lower ka gao ho ga jo ka first candle ka lower sa open ho kar market ko lower ma la kar jay ga or jo ya second candle ho ge ya long real bidy bullish ke candle ho ge ya market ma long lower gap ka low sa open ho kar stock ke price ko upwards ke traf reversal karna ka kam karay ge or ya jo second candle ho ge ya green ya white colour ki ho ge or ya market ko is pattern ke first candle ka lower point tak reversal kar ka lay ge or market ka higher jana ka kam karay ge.

FORMATION OF BULLISH THRUSTING LINE PATTERN : Bullish thrusting line pattern ke jo ya formation hoti ha ya market ma downtrend ka traf ho ge or jo ya bullish thrusting line pattern ho ga ya do candles ka sath mil kar bana ho ga or jo ya bullish thrusting line pattern ho ga ya lower ke traf banay ga to is pattern sa phalay stock ke price lower ke traf ja rahi ho ge or market ke price lower ke janab jati hoi strong downtrend ko bana rahi ho ge or ya jo bullish thrusting line pattern ho ga is ke jo first candle ho ge ya ak long real body bullish ke candle ho ge or ya jo first candle ho ge ya downtrend ka lower sa open ho kar stock ke price ko lower ma la kar jay ge or jo ya first candle ho ge ya long red ya black colour ki ho ge or ya market ko lower ma la ja kar lower ma close ho ge or jo ya first candle ho ge ya jasa hi lower ma close ho ge to market ma ak huma gap dakhna ko mil jay ga or jo ya gap ho ga ya long lower ka gao ho ga jo ka first candle ka lower sa open ho kar market ko lower ma la kar jay ga or jo ya second candle ho ge ya long real bidy bullish ke candle ho ge ya market ma long lower gap ka low sa open ho kar stock ke price ko upwards ke traf reversal karna ka kam karay ge or ya jo second candle ho ge ya green ya white colour ki ho ge or ya market ko is pattern ke first candle ka lower point tak reversal kar ka lay ge or market ka higher jana ka kam karay ge.  TRADING WITH BULLISH THRUSTING LINE PATTERN : Is bullish thrusting line pattern ma traders ko stock ke price ka higher ke janab reversal ho kar ana ka signal mil raha ho ga or ya jo bullish thrusting line pattern ho ga is pattern sa phalay market ma bear ka control ho ga or jo ya bear ho ga ya stock ke price ko lower sa ke traf la kar ja raha ho ga or jo ya bear ho ga ya sharply market ko downward ma la jata hua lower ke traf strong downtrend ko bana raha ho ga or jo ya bullish thursting line pattern ho ga is pattern ke jo first candle banay ge ya bhi market ma bear ka control sa bani ho ge or is ma jo ya bear ho ga ya stock ko lower ma la ja raha ho ga or jo is pattern ke first candle ka bad lower ke traf gap ay ga ya bhi is bear ka control sa bana ho ga or ya market jo lower ma la jay ga or jasa hi is bullish thrusting line pattern ke second candle open ho ge to market ma jo bear ka control ho ga ya completely lost ho jay ga or market ma full bull ka control a jay ga or jo ya bull ho ga ya sharply market ko higher ke traf reversal kar ka jana ka signal da raha ho ga or traders is bullish thrusting line candlestick pattern ke jo second candle ho ge is ka higher sa long term buy ke trade ko enter karay ga or is ka jo stop loss ho ga is ko traders is pattern ke second candle ka lower ma place karay ga.

TRADING WITH BULLISH THRUSTING LINE PATTERN : Is bullish thrusting line pattern ma traders ko stock ke price ka higher ke janab reversal ho kar ana ka signal mil raha ho ga or ya jo bullish thrusting line pattern ho ga is pattern sa phalay market ma bear ka control ho ga or jo ya bear ho ga ya stock ke price ko lower sa ke traf la kar ja raha ho ga or jo ya bear ho ga ya sharply market ko downward ma la jata hua lower ke traf strong downtrend ko bana raha ho ga or jo ya bullish thursting line pattern ho ga is pattern ke jo first candle banay ge ya bhi market ma bear ka control sa bani ho ge or is ma jo ya bear ho ga ya stock ko lower ma la ja raha ho ga or jo is pattern ke first candle ka bad lower ke traf gap ay ga ya bhi is bear ka control sa bana ho ga or ya market jo lower ma la jay ga or jasa hi is bullish thrusting line pattern ke second candle open ho ge to market ma jo bear ka control ho ga ya completely lost ho jay ga or market ma full bull ka control a jay ga or jo ya bull ho ga ya sharply market ko higher ke traf reversal kar ka jana ka signal da raha ho ga or traders is bullish thrusting line candlestick pattern ke jo second candle ho ge is ka higher sa long term buy ke trade ko enter karay ga or is ka jo stop loss ho ga is ko traders is pattern ke second candle ka lower ma place karay ga.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

or aik aisa tool ha jis ko traders market kay reversals ko detect karnay kay liay use kartay hain, yeh indicator Donald Dorsey nay create kia, yeh market ki volatility ki study kay liay use kia jata hay, jab mass index aik certain point say above aur below move karta hay to iska matlab hota kay market ka trend change honay wala hay, boht saray technical tool ki tarha ye daily chart kay liay banaya gia hay, Usage of Mass Index indicator:Traders kisi pair ka mass index calculate karnay kay liay nine days periods exponential moving average ko use kartay hain aur phir iski average lay li jati hay, yeh indicator originally daily charts kay liay bana hay laikin traders isko kisi bhi time frame ma use kar saktay hain, mass Index indicator certain period ma pairs ki low aur high prices kay darmian difference ko examine karta ha, jab indicator particular level say up move kar kay phir drop hota hay to yeh is baat ki indication hoti ha kay ab trend reversal honay wala hay Process to calculate Mass Index Indicator:

Generally traders mass index calculate karnay kay liay four steps use kartay hain, first step main kisi bhi time ki low aur high prices kay difference ka nine-day exponential moving average calculate kartay hain, phir 2nd step main previous calculate kiay gay nine-day moving average ka dobara moving average calculate kia jata ha, 3rd step main pehlay step say hasil honay walay EMA ko second step sa hasil honay walay EMA say divide kartay hain aur 4th step main in hasil honay wali values ko add kar laitay hain, Important aspects of Mass Index indicator in trading:

Mass index ka best use isko price action kay sath use karna ha, indicator market ki daily high aur low range ko measure karta ha aur market turn ko high accuracy kay sath predict karta ha, aik price chart par market kay turning points spot karna mushkil hota ha laikin is reversal indicator say hum top aur bottoms ko select kar saktay hain, is indicator ko other technical tool kay sath conjuction main use karna chaiay, technical indicator jaisa kay candlestick pattern, fundamental analysis better use kiay jatay hain aur trader ko false signal say protect kartay hain.

- Mentions 0

-

سا0 like

-

#7 Collapse

Bullish Thrusting Line pattern ek bullish reversal pattern hai, jismein bearish trend ko follow karne wali ek candlestick ki body bullish trend wali dusri candlestick ki body ko partially engulf karti hai. Is pattern ko traders apne trading strategy mein use karke trend reversal ka prediction kar sakte hain aur apne trades ki success rate ko increase kar sakte hain. Yeh pattern do mumasil mumashakilon se banta hai aur price chart pe spot kiya ja sakta hai. Agar is pattern ke baad price levels continue uptrend direction mein move karte hain, to iska matlab hai ki bullish trend confirm ho chuki hai aur traders apne trades ko accordingly adjust kar sakte hain. Bullish Thrusting Line pattern ko identify karne ke liye, traders ko kuch parameters ko follow karna hota hai. Ek bearish candlestick ke baad bullish candlestick hona chahiye. Bearish candlestick ki body bullish candlestick ki body ko partially engulf karni chahiye. Bullish candlestick ka close level bearish candlestick ke close level se above hona chahiye. Bullish Thrusting Line pattern ka formation bearish trend ke baad hota hai, jisse traders trend reversal ka prediction kar sakte hain. Is pattern easy to identify hai aur traders isko apne trading strategy mein integrate kar sakte hain. Bullish Thrusting Line pattern ka use karke traders apne trades ki success rate ko increase kar sakte hain. Is pattern ka formation partially engulf hone ke basis pe hota hai, jisse traders bullish trend ka confirmation le sakte hain aur apne trades ko accordingly adjust kar sakte hain.:max_bytes(150000):strip_icc()/thrustingline-3dae63be51b14255b22ae0e228a3e84f.jpg) Bullish Thrusting Line pattern doosre technical indicators ke saath use kiya ja sakta hai. Traders is pattern ki confirmation ke liye doosre technical indicators jaise ki moving averages, support aur resistance levels ka bhi analysis karte hain. Iske saath hi, Bullish Thrusting Line pattern ko candlestick patterns ke saath combine kiya ja sakta hai, jaise ki Hammer pattern, Morning Star pattern aur Doji pattern. Candlestick patterns ka use karke traders apne trades ki success rate ko aur bhi increase kar sakte hain. Lekin Bullish Thrusting Line pattern bhi false signals generate kar sakta hai aur traders ko iski sahi analysis ke liye apne knowledge aur experience ka use karna chahiye. False signals ko identify karne ke liye traders doosre technical indicators ka bhi use karte hain. Iske saath hi, traders ko Bullish Thrusting Line pattern ki sahi interpretation karne ke liye market conditions ka bhi analysis karna chahiye. Market conditions ko analyse karne ke liye traders ko price levels, volume levels aur volatility levels ka bhi analysis karna hota hai.

Bullish Thrusting Line pattern doosre technical indicators ke saath use kiya ja sakta hai. Traders is pattern ki confirmation ke liye doosre technical indicators jaise ki moving averages, support aur resistance levels ka bhi analysis karte hain. Iske saath hi, Bullish Thrusting Line pattern ko candlestick patterns ke saath combine kiya ja sakta hai, jaise ki Hammer pattern, Morning Star pattern aur Doji pattern. Candlestick patterns ka use karke traders apne trades ki success rate ko aur bhi increase kar sakte hain. Lekin Bullish Thrusting Line pattern bhi false signals generate kar sakta hai aur traders ko iski sahi analysis ke liye apne knowledge aur experience ka use karna chahiye. False signals ko identify karne ke liye traders doosre technical indicators ka bhi use karte hain. Iske saath hi, traders ko Bullish Thrusting Line pattern ki sahi interpretation karne ke liye market conditions ka bhi analysis karna chahiye. Market conditions ko analyse karne ke liye traders ko price levels, volume levels aur volatility levels ka bhi analysis karna hota hai.  Bullish Thrusting Line pattern ka use karke traders apne trades ki success rate ko increase kar sakte hain. Is pattern ka use karke traders trend reversal ka prediction kar sakte hain aur apne trades ko accordingly adjust kar sakte hain. Bullish Thrusting Line pattern doosre technical indicators ke saath use kiya ja sakta hai, jisse traders ki trades ki accuracy aur bhi increase ho sakti hai. Iske saath hi, traders ko Bullish Thrusting Line pattern ke limitations ka bhi dhyan rakhna chahiye jaise ki false signals aur market conditions ka analysis karna chahiye. False signals ko identify karne ke liye traders ko doosre technical indicators ka bhi use karna chahiye. Traders ko Bullish Thrusting Line pattern ki sahi interpretation ke liye market conditions ka bhi analysis karna chahiye. Market conditions ko analyse karne ke liye traders ko price levels, volume levels aur volatility levels ka bhi analysis karna hota hai. Iske saath hi, traders ko Bullish Thrusting Line pattern ke limitations ka bhi dhyan rakhna chahiye.Bullish Thrusting Line pattern ka use karke traders ko risks ka bhi dhyan rakhna chahiye. Agar is pattern ka formation sahi nahi hota hai, to false signals generate ho sakte hain aur traders ke trades ko negative impact padh sakta hai. Iske saath hi, traders ko market conditions ko bhi analyse karna chahiye, kyunki market volatility aur price levels ka impact Bullish Thrusting Line pattern ke accuracy pe padta hai. Traders ko Bullish Thrusting Line pattern ka use karne se pehle market conditions ko analyze karne aur apne trading strategy ko accordingly adjust karne ki jarurat hai.

Bullish Thrusting Line pattern ka use karke traders apne trades ki success rate ko increase kar sakte hain. Is pattern ka use karke traders trend reversal ka prediction kar sakte hain aur apne trades ko accordingly adjust kar sakte hain. Bullish Thrusting Line pattern doosre technical indicators ke saath use kiya ja sakta hai, jisse traders ki trades ki accuracy aur bhi increase ho sakti hai. Iske saath hi, traders ko Bullish Thrusting Line pattern ke limitations ka bhi dhyan rakhna chahiye jaise ki false signals aur market conditions ka analysis karna chahiye. False signals ko identify karne ke liye traders ko doosre technical indicators ka bhi use karna chahiye. Traders ko Bullish Thrusting Line pattern ki sahi interpretation ke liye market conditions ka bhi analysis karna chahiye. Market conditions ko analyse karne ke liye traders ko price levels, volume levels aur volatility levels ka bhi analysis karna hota hai. Iske saath hi, traders ko Bullish Thrusting Line pattern ke limitations ka bhi dhyan rakhna chahiye.Bullish Thrusting Line pattern ka use karke traders ko risks ka bhi dhyan rakhna chahiye. Agar is pattern ka formation sahi nahi hota hai, to false signals generate ho sakte hain aur traders ke trades ko negative impact padh sakta hai. Iske saath hi, traders ko market conditions ko bhi analyse karna chahiye, kyunki market volatility aur price levels ka impact Bullish Thrusting Line pattern ke accuracy pe padta hai. Traders ko Bullish Thrusting Line pattern ka use karne se pehle market conditions ko analyze karne aur apne trading strategy ko accordingly adjust karne ki jarurat hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Mentions 0

-

سا0 like

-

#8 Collapse

Bullish Thrusting Line pattern kya hy ???? candlestick pattern se traders bearish trend ki same direction me movement ka ishara lete hen. Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down ho rahi hoti hai. Pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, bullish candle aik normal real body wali white candle hoti hai.yeh humain profit delany main buht madad karty hain. hum agr in ki sai tariqay say learning nai krain gay aur in ko fazool samjyn gay to kbi bhi kamyabi humary kadam ni chumy gi aaj hum jis topic per bat krain gay wo hai thrusting pattern.thursting pattren qeemat chart pattren ki aik type hai jisay takneeki tajzia kaar istemaal karte hain. Bullish Thrusting Line Pattern ki identification kasy hoti hy???? candlestick pattern prices main aksar do dino k darmeyan main banta hai, jiss se market ki same bullish trend main jane ka ishara melta hai. Pattern ki pehli candle k baad dosri candle ussi k closing price par open hone ki bajaye top gap main open ho kar ussi k center se ooper close hoti hai. Normal ye pattern ziada tadad main bante hen, lekin top prices ya bullish trend main banne par ye prices ko bullish trend continuation ka kaam karti hai. Pattern ki pehli candle bullish aur dosri bearish candle hoti hai, jiss ki lazmi real body honi chaheye, jab k dono candles shadow samet ya shadow k bagher ho sakti hai. Pattern main dono candles aik dosre k opposite direction main open hote hen,Bullish thrusting line candlestick pattern ki pehli candle aik bullish candle hoti hai, jo prices k top par ya bullish trend ki continuation ka kaam karti hai, q k ye aik real body wali candle hoti hai.Bullish thrusting line candlestick pattern ki dosri candle aik real body wali bearish candle hoti hai. Ye candle open pehli candle k top par gap main hoti hai, jab k close pehli candle k darmeyan se above hoti hai.

Bullish Thrusting Line Pattern ki identification kasy hoti hy???? candlestick pattern prices main aksar do dino k darmeyan main banta hai, jiss se market ki same bullish trend main jane ka ishara melta hai. Pattern ki pehli candle k baad dosri candle ussi k closing price par open hone ki bajaye top gap main open ho kar ussi k center se ooper close hoti hai. Normal ye pattern ziada tadad main bante hen, lekin top prices ya bullish trend main banne par ye prices ko bullish trend continuation ka kaam karti hai. Pattern ki pehli candle bullish aur dosri bearish candle hoti hai, jiss ki lazmi real body honi chaheye, jab k dono candles shadow samet ya shadow k bagher ho sakti hai. Pattern main dono candles aik dosre k opposite direction main open hote hen,Bullish thrusting line candlestick pattern ki pehli candle aik bullish candle hoti hai, jo prices k top par ya bullish trend ki continuation ka kaam karti hai, q k ye aik real body wali candle hoti hai.Bullish thrusting line candlestick pattern ki dosri candle aik real body wali bearish candle hoti hai. Ye candle open pehli candle k top par gap main hoti hai, jab k close pehli candle k darmeyan se above hoti hai.  Treading ki imprtant information candlestick pattern prices main traders k leye bullish trend continuation ki indication deta hai, jiss par buy ki entry ki jati hai. Pattern k baad aik confirmation candle ka hona zarori hai. Ye candle real body main bearish honi chaheye, jo k dosri candle k top main ban jati hai. Pattern k baad bearish candle banne se pattern trading invalid ho jayega, jab k CCI, RSI indicator aur stochastic oscillator par value above 50 zone main honi chaheye. Pattern ziada reliable na hone ki waja se stop loss ka istemal zarrori hai.

Treading ki imprtant information candlestick pattern prices main traders k leye bullish trend continuation ki indication deta hai, jiss par buy ki entry ki jati hai. Pattern k baad aik confirmation candle ka hona zarori hai. Ye candle real body main bearish honi chaheye, jo k dosri candle k top main ban jati hai. Pattern k baad bearish candle banne se pattern trading invalid ho jayega, jab k CCI, RSI indicator aur stochastic oscillator par value above 50 zone main honi chaheye. Pattern ziada reliable na hone ki waja se stop loss ka istemal zarrori hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

ummid krti hu.ap sab kharyat sa hogy.aur achy sa kam kar rhy hogy.my dear ap market ma jb bi kam karty hai.to ap ko chaiye k ap pehly demo account pa ka kary tak k ap ko samj ah sakgy.jb tak ap k pas expersive ni hoga.to ap kamajb ni ho sakty.as liye ap ko pehly market ko achy tariky sa samj lana chaiye.tak k ap achy sa kam kary.aur achi trading kar sakgy.aur acha profit ear kar sakgy. Hanging candlestick pattern: My dear Friend ab hum hanging candle stick k bary ma baat karty hai.candlestick pattern usually uptrend ke baad aati hai aur price action ko downward trend mein convert karti hai. Hanging Man candlestick pattern ki shape ek vertical line aur iske neeche ek small body wala candle hota hai. Iske bottom mein ek small shadow hota hai, jo ki hanging man ki shape ke tarah dikhayi deta hai. Hanging Man candlestick ka color usually white ya green hota hai, lekin iski color se koi farak nahi padhta, kyunke iske liye candlestick ki shape aur size hi sabse ahem hai.Hanging Man candlestick ka signal bearish reversal ka hota hai, yani uptrend ke baad market mein reversal hone ka signal deta hai. Iska matlab hai ki price action ab downward trend mein convert ho sakta hai.hum as ko hanging candlestick kehty hai.Hanging candlestick ki pechan: My dear Friend ab hum hanging candlestick ki pechan ki baat karrty hai.Hanging Man candlestick pattern ka signal aur strong aur valid mana ja sakta hai. Hanging Man candlestick pattern ka signal aur strong hone ke ilawa, traders ko iske trade entry aur exit ke liye bhi kuch zaroori points ya strategies ka use karna chahiye. Iske liye, stop loss orders ka use karna chahiye, taaki traders ko market ke unpredictable movements ke saath deal karna na pade. Iske saath hi, traders ko apni trades ko baraksar monitor karna chahiye aur apne trading strategy ke according apni trades ko manage karna chahiye.Hanging Man candlestick pattern ka use aur analysis karna forex trading mein ek important skill hai, kyunke iska use traders ko market trends aur movements ke baare mein important information provide karta hai. Iske ilawa, traders ko candlestick patterns aur technical indicators ke knowledge aur experience ka hona bhi zaroori hai, taaki woh Hanging Man candlestick pattern aur dusre candlestick patterns aur indicators ko baraksar analyze aur use kar sakein. Hanging Man candlestick pattern ko recognize karna forex traders ke liye important skill hai, kyunke iske signal se traders ko market movements aur trends ke baare mein important information mil sakti hai.asko bi tumi hanging candlestick keh sakty hai.

Fomission: My dear Friend ab hum explain karty hai.hanging man achi trha sy kam kry ga our jo next candle banti h agar vo hanging man k gap open ho close k neechy open hoti h tu zaida axha hota his sy hm ko aik confirmation milti h k ab hm ko market mn dehan dena h agar apko chart per Hanging man banti dekhai dy tu jo agar next candle gap mn open hui h tu ap ko trading krny k liay hanging man k high k oper stop loss lagna h our selling karni h our jab tk market mn trend badlny wala signal na mily tb tk ap nyapni position k sath khary rehna h our agar apko trend change wala koi signal mil jae tu ap ko foran profit book kar lena chay.Hanging Man candlestick pattern ki shape ek vertical line aur iske neeche ek small body wala candle hota hai. Iske bottom mein ek small shadow hota hai, jo ki hanging man ki shape ke tarah dikhayi deta hai. Hanging Man candlestick ka color usually white ya green hota hai, lekin iski color se koi farak nahi padhta, kyunke iske liye candlestick ki shape aur size hi sabse ahem hai. Hanging Man candlestick pattern ko identify karne ke ilawa traders ko iske surrounding price action aur indicators ko bhi observe karna zaroori hai. Agar iske surrounding candlestick patterns aur indicators bhi bearish trend ka signal de rahe hain.kyunke iske signal se traders ko bearish reversal ka signal milta hai aur woh apni trades ko manage aur adjust kar sakte hain. Iske alawa, traders ko candlestick patterns aur technical indicators ke knowledge aur experience ka hona bhi zaroori hai.as liye hum as ko hanging candlestick bi kehty hai.

-

#10 Collapse

DEFINITION OF BULLISH THRUSTING LINE PATTREN...!!! Asslamoalaikum dear sir I hope aap sab khariyat sy hoon gy Forex tradings marketing and BULLISH thrusting line candlestick pattern se traders bearish trend ki same direction me movement ka ishara lete Hei Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhna ki bohut hi ziada zarorat Bullish thrusting line candlestick pattern hamen strongly ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trend main continue hoga. Aam tawar par ye pattren do dino k darmeyane hese me ziada bante hen jab market ki movement normal up down Pattern do candles par mushtamil jiss ki pehli candle aik bullish candle aik normal real body wali white candle hoti hai. Bullish candle k baad aik bearish candle prices k top par gap main open ho kar ussi k real body k darmeyan gap hota Hai jo CANDL ko destructive karta Hai.. UNDERSTANDING...&& Dear members BULLISH THRUSTING line candlestick pattern prices main aksar do dino k darmeyan main bnay jaty hen jiss se market ki same bullish trend main jane ka ishara melta hai. Pattern ki pehli candle k baad dosri candle ussi k closing price par open hone ki bajaye top gap main open ho kar ussi k center se ooper close hoti hai. Normal ye pattern ziada tadad lekin top prices ya bullish trend main banne par ye prices ko bullish trend continuation ka kaam krty han PATTERN ki pehli candle bullish aur dosri bearish candle jiss ki lazmi real body dono candles shadow samet ya shadow k bagher ho sakti hai. Pattern main dono candles aik dosre k opposite direction main open hote HEI candle pehli candle k midpoint se above aur close price se below close hoti hai... TECHNICAL POINTS OF TRADINGS..** Dear friends BULLISH THRUSTING line candlestick pattern eik Trending pay work karta Hai our Bullish thrusting line candlestick pattern prices main traders k leye bullish trend continuation ki indication deta jiss par buy ki entry ki jati hai. Pattern k baad aik confirmation candle ka hona zarori Ye candle real body main bearish honi jo k dosri candle k top main Pattern k baad bearish candle banne se pattern trading invalid ho indicator aur stochastic oscillator par value above 50 zone main honi chaheye. Pattern ziada reliable na hone ki waja se stop loss ka istemal zarrori Hai.. -

#11 Collapse

INTRODUCTION OF BULLISH THRUSTING LINE PATTREN...!!!Asslam o Alaikum..!!! sir Mn umid Karta Hon ap sab khariyat sy hon gy Forex tradings marketings and BULLISHNESS THRUSTING line candlestick pattern se traders Bearish trend ki same direction me movement ka ishara lete Hei Ye pattren bohut hi ziada bante hen aur is ko sahi mano me samajhna ki bohut hi ziada zarorat Bullish thrustings line candlestick pattern hamen stronglys ishara deti hai k market ka maojoda trend downtrend ki bajaye same bullish trends main continue hoga. Aam tawar par ye pattren do dino k darmeyane here me ziada bante hen jab market ki movement's normal up down Pattern do Candles par mushtamil jiss ki pehli candle aik bullish candle aik normal real body wali white candle hoti hai. Bullish Candlestick's k baad aik bearish candle prices k Top par gap main opening ho kar ussi k real body k darmeyan gap hota hyUNDERSTANDING THE BULLESH THRUSTING LINE PATTERN..!!! Dear all Member's BULLISHNESS THRUSTINGS line candlestick pattern prices main aksar do dino k darmeian main bnay jaty hen jiss se market ki same bullish TRENDS main jane ka ishara melta hai. Pattern ki pehli candle k baad dosri candle ussi k closing price par open hone ki bajaye top Gap main open ho kar ussi k center se ooper close hoti hai. Normal ye PATTERN ziada tadad lekin top prices ya bullish trend main banne par ye prices ko bullish trend continuation ka kaam krty han PATTERNED ki pehli candle bullish aur dosri bearish candle jiss ki lazmi real body dono Candlesticks shadow samet ya shadow k bagher ho sakti hai. Patterns main dono Candles aik dosre k opposites direction main open hoti hyTECHNICAL POINT OF TRADING STRADGY..!!! Friends BULLISHNESS THRUSTING line candles PATTERN eik Trending pay working karta Hai our Bullishness thrusting line candlestick pattern prices main traders k leye bullishs TREND continuation ki indication deta jiss par buy ki Entry ki jati hai. Pattern k baad aik confirmation Candlesticks ka hona zarori Ye candle real body main bearish honi jo k dosri candle k top main PATTERN k baad bearish candle banne se pattern trading invalid ho indicators aur stochastic oscillators par value above 50 zone main honi Chahhaye -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Pushing Line Example in Forex ExchangingBullish Pushing Line Example Takneeki tajzia aik maqbool tijarti tareeqa vehicle hai jo market ke rujhanaat ki shanakht aur tijarti faislay karne ke liye diagrams aur takneeki isharay istemaal karta hai. Outline design takneeki tajzia ke kaleedi devices mein se aik hain, aur bullish pushing line design un sab se aam aur qabil aetmaad design mein se aik hai jisay brokers market mein mumkina taizi ke ulat phair ki nishandahi karne ke liye istemaal karte hain. Is article mein, murmur taizi se pushing line design, is ki khususiyaat, aur is ki muaser tareeqay se tijarat karne ke tareeqa ko talaash karen ge. Bullish Pushing Line Example Kya Hai ? bullish pushing line design taizi ke tasalsul ka design hai jo is waqt bantaa hai hit kisi asasay ki qeemat pichlle noise ki kam qeemat se neechay khulti hai lekin pichlle racket ke mid point ke oopar band hojati hai. Is design ki khasusiyat aik lambi bullish candle se hai jo pichlle noise ki mandi wali candle se guzarti hai, jo is baat ki nishandahi karti hai ke kharidaron ne market ka control sambhaal liya hai aur imkaan hai ke woh qeemat ko mazeed agay berhate rahen ge.Bullish Pushing Line Example Ki Khususiyaat :

Pichlle noise ki kam qeemat se neechay iftitahi qeemat : bullish pushing line design ki khasusiyat aik ibtidayi qeemat hai jo pichlle noise ki kam qeemat se neechay hai. Yeh is baat ki nishandahi karta hai ke baichnay walay abhi bhi market standard control mein hain aur qeemat kam ho sakti hai. Long Bullish Candle : bullish pushing line design ki khasusiyat aik lambi bullish candle se hoti hai jo pichlle racket ke kam se neechay khulti hai lekin pichlle clamor ke mid point ke oopar band hoti hai. Is se zahir hota hai ke kharidaron ne market ka control sambhaal liya hai aur imkaan hai ke woh qeemat ko mazeed berhate rahen ge. Negative Candle Example Se Pehlay : bullish pushing line design se pehlay negative candle hota hai, jo is baat ki nishandahi karta hai ke design ki tashkeel se pehlay baichnay walay market standard control mein thay. Negative candle design ke liye aik point of references ke peak standard kaam karti hai aur is baat ki tasdeeq karne mein madad karti hai ke yeh ulat design ke bajaye tasalsul ka design hai. Design Ki Tashkeel Ke Douran Hajam Mein Izafah : Jaisay taizi se pushing line design bantaa hai, hajam aam peak standard barhta hai. Is se zahir hota hai ke tajir asasay mein dilchaspi le rahay hain aur yeh ke kharidari ka kaafi dabao hai. Taham, yeh tasdeeq karna zaroori hai ke hajam ost tijarti hajam se numaya peak standard ziyada hai, kyunkay is se design ki tasdeeq mein madad millti hai. Bullish Pushing Line Example Ki Tijarat : Design Ki Shanakht Karen : bullish pushing line design ko exchange karne ka pehla qadam graph standard example ki shanakht karna hai. Aik lambi bullish candle talaash karen jo pichlle clamor ki kam se neechay khulti hai lekin pichlle commotion ke mid point ke oopar band hoti hai, aur is se pehlay aik negative candle hoti hai. Design Ki Tasdeeq Karen : design ki shanakht hojane ke baad, is baat ki tasdeeq karen ke yeh taizi se chalne wala line design hai. design ki tashkeel ke douran hajam mein izafah talaash karen, aur tasdeeq karen ke candle ost tijarti had se numaya peak standard barri hai. design ki tasdeeq is baat ki jaanch karkay bhi ki ja sakti hai ke aaya design ban'nay ke baad bhi qeemat barhti jarahi hai. Aik Lambi Position Darj Karen : design ki tasdeeq honay ke baad, poke qeemat taizi candle ki oonchai se oopar honk jaye to aik lambi position darj karen. - apne khatray ko mehdood karne ke liye bullish candle ke neechay stap las rakhen. Hadaf ki qeemat is satah standard muqarrar ki jani chahiye jo ke negative candle ke nichale hissay aur bullish candle ki oonchai ke darmiyan faaslay ke barabar ho, jo break out point se oopar ki taraf paish ki gayi ho. Apni Tijarat Ka Intizam Karen : Kisi bhi tijarti hikmat e amli ki terhan, yeh zaroori hai ke aap apni tijarat ko ahthyat se munazzam karen. Qeemat ki karwai standard nazar rakhen, aur agar qeemat aap ke khilaaf hoti hai to tijarat se bahar niklny ke liye tayyar rahen. Jaisay qeemat aap ke haq mein jati hai, - apne stap nuqsaan ko oopar le jayen, taakay munafe ko band kya ja sakay aur - apne khatray ko mehdood kya ja sakay. Re: Bullish Pushing Line Example in Forex Exchanging Assalamu Alaikum Dosto! Bullish Pushing Line Candle Example

Bullish pushing line candle design se brokers negative pattern ki same bearing me development ka ishara lete hen. Ye pattren bohut howdy ziada bante hen aur is ko sahi mano me samajhne ki bohut hello ziada zarorat hai. Bullish pushing line candle design hamen emphatically ishara deti hai k market ka maojoda pattern downtrend ki bajaye same bullish pattern primary proceed hoga. Aam tawar standard ye pattren do dino k darmeyane hese me ziada bante hen poke market ki development ordinary up down ho rahi hoti hai. Design do candles standard mushtamil hota hai, jiss ki pehli light aik bullish candle hoti hai, bullish flame aik typical genuine body wali white candle hoti hai. Bullish light k baad aik negative candle costs k top standard hole principal open ho kar ussi k genuine body k darmeyan se above close hoti hai. Name: pushing design green-red-round-bullish-continuation-japanese-candle twofold examples 2642.jpg Perspectives: 24 Size: 17.7 KB Candles Development Bullish pushing line candle design pehli racket ki light aik bullish flame hoti hai, lekin dosre noise ki candle negative candle k close costs standard sharpen ki bajaye top hole primary open ho kar ussi k midpoint se ooper close hoti hai. Design fundamental shamil candles ki development darjazzel tarah se hoti hai: 1. First Flame: Bullish pushing line candle design ki pehli light aik bullish candle hoti hai, jo costs k top standard ya bullish pattern ki continuation ka kaam karti hai, q k ye aik genuine body wali candle hoti hai. Ye flame white ya green variety ki candle hoti hai.2. Second Candle: Bullish pushing line candle design ki dosri light aik genuine body wali negative flame hoti hai. Ye flame open pehli candle k top standard hole primary hoti hai, hit k close pehli candle k darmeyan se above hoti hai. Negative flame dark ya red variety fundamental hoti hai, jo k costs k leye negative pattern inversion ki nakam koshash karti hai. Clarification Bullish pushing line candle design costs fundamental aksar do dino k darmeyan principal banta hai, jiss se market ki same bullish pattern primary jane ka ishara melta hai. Design ki pehli candle k baad dosri light ussi k shutting cost standard open sharpen ki bajaye top hole principal open ho kar ussi k focus se ooper close hoti hai. Ordinary ye design ziada tadad primary bante hen, lekin top costs ya bullish pattern fundamental banne standard ye costs ko bullish pattern continuation ka kaam karti hai. Design ki pehli flame bullish aur dosri negative light hoti hai, jiss ki lazmi genuine body honi chaheye, poke k dono candles shadow samet ya shadow k bagher ho sakti hai. Design primary dono candles aik dosre k inverse heading fundamental open hote hen, poke k dosri candle pehli light k midpoint se above aur close cost se beneath close hoti hai. Exchanging Bullish pushing line candle design costs fundamental brokers k leye bullish pattern continuation ki sign deta hai, jiss standard purchase ki section ki jati hai. Design k baad aik affirmation light ka hona zarori hai. Ye light genuine body fundamental negative honi chaheye, jo k dosri flame k top principal boycott jati hai. Design k baad negative candle banne se design exchanging invalid ho jayega, punch k CCI, RSI pointer aur stochastic oscillator standard worth over 50 zone primary honi chaheye. Design ziada dependable na sharpen ki waja se stop misfortune ka istemal zarrori hai. Design ka Stop Misfortune pehli candle k base ya open cost se two pips less than impressive set karen.

-

#13 Collapse

Bullish Pushing Line design ek bullish inversion design hai, jismein negative pattern ko follow karne wali ek candle ki body bullish pattern wali dusri candle ki body ko to some degree immerse karti hai. Is design ko dealers apne exchanging system mein use karke pattern inversion ka expectation kar sakte hain aur apne exchanges ki achievement rate ko increment kar sakte hain. Yeh design do mumasil mumashakilon se banta hai aur cost outline pe spot kiya ja sakta hai. Agar is design ke baad cost levels proceed upturn heading mein move karte hain, to iska matlab hai ki bullish pattern affirm ho chuki hai aur merchants apne exchanges ko as needs be change kar sakte hain. Bullish Pushing Line design ko recognize karne ke liye, dealers ko kuch boundaries ko follow karna hota hai. Ek negative candle ke baad bullish candle hona chahiye. Negative candle ki body bullish candle ki body ko somewhat immerse karni chahiye. Bullish candle ka close level negative candle ke close level se above hona chahiye. Bullish Pushing Line design ka development negative pattern ke baad hota hai,exchanges ki achievement rate ko increment kar sakte hain. Is design ka arrangement to some extent overwhelm sharpen ke premise pe hota hai, jisse merchants bullish pattern ka affirmation le sakte hain aur apne exchanges ko as needs be change kar sakte hain.Bullish Pushing Line design doosre specialized pointers ke saath use kiya ja sakta hai. Merchants is design ki affirmation ke liye doosre specialized pointers jaise ki moving midpoints, support aur obstruction levels ka bhi examination karte hain. Iske saath greetings, Bullish Pushing Line design ko candle designs ke saath join kiya ja sakta hai, jaise ki Mallet design, Morning Star design aur Doji design. Candle designs ka use karke merchants apne exchanges ki achievement rate ko aur bhi increment kar sakte hain. Lekin Bullish Pushing Line design bhi bogus signs create kar sakta hai aur merchants ko iski sahi investigation ke liye apne information aur experience ka use karna chahiye. Bogus signs ko recognize karne ke liye dealers doosre specialized markers ka bhi use karte hain. Iske saath hey, dealers ko Bullish Pushing Line design ki sahi translation karne ke liye economic situations ka bhi investigation karna chahiye.

jisse merchants pattern inversion ka expectation kar sakte hain. Is design simple to recognize hai aur brokers isko apne exchanging methodology mein coordinate kar sakte hain. Bullish Pushing Line design ka use karke merchants apne 1. First Flame: Bullish pushing line candle design ki pehli light aik bullish candle hoti hai, jo costs k top standard ya bullish pattern ki continuation ka kaam karti hai, q k ye aik genuine body wali candle hoti hai. Ye light white ya green variety ki candle hoti hai. 2. Second Candle: Bullish pushing line candle design ki dosri flame aik genuine body wali negative light hoti hai. Ye flame open pehli candle k top standard hole principal hoti hai, poke k close pehli light k darmeyan se above hoti hai. Negative flame dark ya red variety principal hoti hai, jo k costs k leye negative pattern inversion ki nakam koshash karti hai. Clarification Bullish pushing line candle design costs principal aksar do dino k darmeyan fundamental banta hai, jiss se market ki same bullish pattern primary jane ka ishara melta hai. Design ki pehli light k baad dosri flame ussi k shutting cost standard open sharpen ki bajaye top hole fundamental open ho kar ussi k focus se ooper close hoti hai. Typical ye design ziada tadad fundamental bante hen, lekin top costs ya bullish pattern primary banne standard ye costs ko bullish pattern continuation ka kaam karti hai. Design ki pehli flame bullish aur dosri negative candle hoti hai, jiss ki lazmi genuine body honi chaheye, poke k dono candles shadow samet ya shadow k bagher ho sakti hai. Design primary dono candles aik dosre k inverse course principal open hote hen, poke k dosri flame pehli candle k midpoint se above aur close cost se underneath close hoti hai. Economic situations ko dissect karne ke liye brokers ko cost levels, volume levels aur unpredictability levels ka bhi investigation karna hota hai.Bullish Pushing Line design ka use karke dealers apne exchanges ki achievement rate ko increment kar sakte hain. Is design ka use karke merchants pattern inversion ka expectation kar sakte hain aur apne exchanges ko as needs be change kar sakte hain. Bullish Pushing Line design doosre specialized markers ke saath use kiya ja sakta hai, jisse brokers ki exchanges ki precision aur bhi increment ho sakti hai. Iske saath hey, dealers ko Bullish Pushing Line design ke impediments ka bhi dhyan rakhna chahiye jaise ki misleading signs aur economic situations ka examination karna chahiye. Bogus signs ko distinguish karne ke liye brokers ko doosre specialized markers ka bhi use karna chahiye. Merchants ko Bullish Pushing Line design ki sahi understanding ke liye economic situations ka bhi examination karna chahiye. Economic situations ko dissect karne ke liye brokers ko cost levels, volume levels aur unpredictability levels ka bhi investigation karna hota hai. Iske saath greetings, brokers ko Bullish Pushing Line design ke constraints ka bhi dhyan rakhna chahiye.Bullish Pushing Line design ka use karke merchants ko gambles with ka bhi dhyan rakhna chahiye. Agar is design ka development sahi nahi hota hai, to bogus signs create ho sakte hain aur dealers ke exchanges ko adverse consequence padh sakta hai. Iske saath greetings, merchants ko economic situations ko bhi break down karna chahiye, kyunki market instability aur cost levels ka influence Bullish Pushing Line design ke exactness pe padta hai. Brokers ko Bullish Pushing Line design ka use karne se pehle economic situations ko examine karne aur apne exchanging methodology ko in like manner change karne ki jarurat hai

.[IMG][/IMG]

-

#14 Collapse

Bullish Thrusting Line Candlestick PatternBearish trend me movement ka ishara lete hen traders bullish thrusting line candlestick pattern. In addition, is ko sahi mano me samajhne ki bohut hi ziada zarorat hai. Ye pattren bohut hi ziada bante hen. Strong evidence that the bullish trend will continue can be seen in the market's maojoda downtrend and the bullish thrusting line candlestick pattern. When the market moves normally up and down, Aam Tawar Par ye pattren do dino k darmeyane hese me ziada bante hen. jiss ki pehli candle is a bullish candle, and a bullish candle is a normal actual body wali white candle, according to the pattern of candles, which is in Tamil. Bullish candle with bad aik bearish candle prices with top par gap main open ho kar ussi with genuine body and above close hoti hai. Bullish Thrusting Line Pattern ki identification kasy hoti hy??? A COMPREHENSION Bearish momentum is expected to continue after the thrusting pattren, according to the chart. Shawahid batatay hain with regard to the bullish reversal's occurrence today. Thrusting pattren's dusray trading signals have been shown to be effective in the past. As per the Zor Dainay pattern, the black candlestick is the genuine body, the midway, and the qareeb band are the white candlestick is the bad candlestick, and the black candlestick is the lambi candlestick. Haqeeqat main, yeh taqriban half time reversal pattren kay tor par kaam karta hai, pattren ko aik continuation pattren kay tor par kaam karny kay baray main socha jata hai. Deegar kinds' shawahid kay sath mil kar sab say ziyada mufeed hotay hain, aur thrusting patternen kafi aam hain, zaroori nahi k is kay natijay main qeemat barhay. Aik's thrusting pattern is seen when aik's black candlestick is next to a bad white candlestick. When compared to the black candlestick, which has the genuine body, midpoint, and qareeb period's band, the white candlestick's distance is greater. Bulls' ki koshisho ki akkasi karta hai, thrusting patteren ki umomi definitiin yeh hai, qeematon main kami kay baad mudakhlat karny. Bulls and bears both have bearish negative trends that are about to reverse, as shown by the black candlestick's midpoint and the white candlestick's pushing main nakami say pata chalta hai. Bull aakhir kaar apni genuinely ki koshish khatam kar dain gay, is liye,kuch ka khayaal hai k thrusting pattren nichay k trend kay continuation ko zahir karta hai.

Bullish Thrusting Line Pattern ki identification kasy hoti hy??? A COMPREHENSION Bearish momentum is expected to continue after the thrusting pattren, according to the chart. Shawahid batatay hain with regard to the bullish reversal's occurrence today. Thrusting pattren's dusray trading signals have been shown to be effective in the past. As per the Zor Dainay pattern, the black candlestick is the genuine body, the midway, and the qareeb band are the white candlestick is the bad candlestick, and the black candlestick is the lambi candlestick. Haqeeqat main, yeh taqriban half time reversal pattren kay tor par kaam karta hai, pattren ko aik continuation pattren kay tor par kaam karny kay baray main socha jata hai. Deegar kinds' shawahid kay sath mil kar sab say ziyada mufeed hotay hain, aur thrusting patternen kafi aam hain, zaroori nahi k is kay natijay main qeemat barhay. Aik's thrusting pattern is seen when aik's black candlestick is next to a bad white candlestick. When compared to the black candlestick, which has the genuine body, midpoint, and qareeb period's band, the white candlestick's distance is greater. Bulls' ki koshisho ki akkasi karta hai, thrusting patteren ki umomi definitiin yeh hai, qeematon main kami kay baad mudakhlat karny. Bulls and bears both have bearish negative trends that are about to reverse, as shown by the black candlestick's midpoint and the white candlestick's pushing main nakami say pata chalta hai. Bull aakhir kaar apni genuinely ki koshish khatam kar dain gay, is liye,kuch ka khayaal hai k thrusting pattren nichay k trend kay continuation ko zahir karta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Intrdouction Takneeki tajzia aik maqbool tijarti tareeqa vehicle hai jo market ke rujhanaat ki shanakht aur tijarti faislay karne ke liye diagrams aur takneeki isharay istemaal karta hai. Diagram design takneeki tajzia ke kaleedi instruments mein se aik hain, aur bullish pushing line design un sab se aam aur qabil aetmaad design mein se aik hai jisay merchants market mein mumkina taizi ke ulat phair ki nishandahi karne ke liye istemaal karte hain. Is article mein, murmur taizi se pushing line design, is ki khususiyaat, aur is ki muaser tareeqay se tijarat karne ke tareeqa ko talaash karen ge. Clarification Bullish pushing line candle design costs fundamental aksar do dino k darmeyan primary banta hai, jiss se market ki same bullish pattern principal jane ka ishara melta hai. Design ki pehli candle k baad dosri light ussi k shutting cost standard open sharpen ki bajaye top hole primary open ho kar ussi k focus se ooper close hoti hai. Ordinary ye design ziada tadad fundamental bante hen, lekin top costs ya bullish pattern primary banne standard ye costs ko bullish pattern continuation ka kaam karti hai. Design ki pehli flame bullish aur dosri negative light hoti hai, jiss ki lazmi genuine body honi chaheye, hit k dono candles shadow samet ya shadow k bagher ho sakti hai. Design primary dono candles aik dosre k inverse bearing fundamental open hote hen, hit k dosri candle pehli flame k midpoint se above aur close cost se underneath close hoti hai. Exchanging Bullish pushing line candle design costs fundamental merchants k leye bullish pattern continuation ki sign deta hai, jiss standard purchase ki passage ki jati hai. Design k baad aik affirmation light ka hona zarori hai. Ye light genuine body principal negative honi chaheye, jo k dosri candle k top fundamental boycott jati hai. Design k baad negative light banne se design exchanging invalid ho jayega, punch k CCI, RSI marker aur stochastic oscillator standard worth over 50 zone fundamental honi chaheye. Design ziada solid na sharpen ki waja se stop misfortune ka istemal zarrori hai. Design ka Stop Misfortune pehli candle k base ya open cost se two pips worse than average set karen.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:43 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим